Trust Account For Law Firm

Description

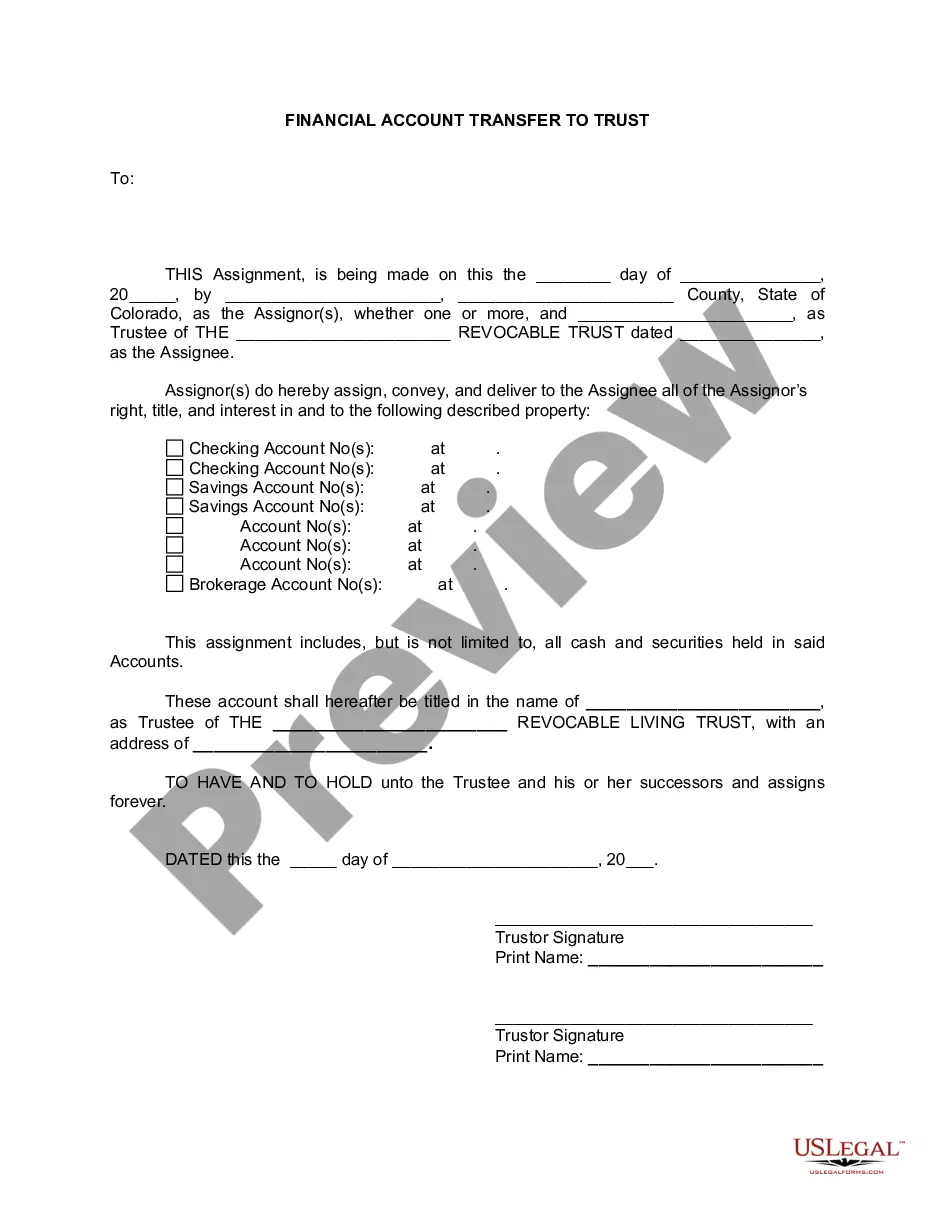

How to fill out Colorado Financial Account Transfer To Living Trust?

- Visit the US Legal Forms website and log in to your account if you're an existing user. Ensure your subscription is active to access the needed forms.

- For new users, start by previewing the form descriptions available in the library. Confirm that the selected form meets your legal jurisdiction's requirements.

- If the form doesn't meet your needs, utilize the search feature to find alternative templates that are suitable.

- Once you have chosen the correct document, click on the Buy Now button. Select your preferred subscription plan and create an account to proceed.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- After the transaction, download the form directly to your device from your account. You can revisit it anytime through the 'My Forms' section.

By following these straightforward steps, you can efficiently obtain the necessary forms for your law firm's trust account. US Legal Forms streamlines the process, empowering legal professionals to focus on their clients rather than paperwork.

Start your journey with US Legal Forms today and ensure your trust account is legally compliant and properly managed.

Form popularity

FAQ

Yes, a law firm can serve as a trustee, provided it meets the legal requirements in your jurisdiction. As a trustee, the firm would oversee the trust account for a law firm, managing and disbursing funds according to the terms of the trust agreement. This can be beneficial for clients who require professional management of their assets and legal matters. However, it is essential to have a clear understanding of the responsibilities and potential conflicts of interest involved.

To file a trust fund, you first need to gather the necessary documentation related to the trust account for a law firm. This includes any relevant agreements, client consents, and identification information. Once you have everything in order, you can proceed to open the trust account with your chosen bank, ensuring it meets all regulatory requirements. You may also want to consult a legal professional or service, like uslegalforms, to streamline this process and ensure compliance with the law.

A trust account for a law firm is a specialized banking account that holds client funds separate from the firm's operating funds. This account ensures that client funds are safeguarded and used only for their intended purpose, such as paying legal fees or costs. Trust accounts help maintain transparency and avoid commingling client funds with the firm's assets. Using a trust account is essential for maintaining client trust and meeting ethical obligations.

The basic bookkeeping of a trust account includes recording all deposits, withdrawals, and transactions as they occur. It is essential to maintain an accurate ledger that reflects the current balance and keeps track of individual client funds. Using an organized approach, alongside a platform like US Legal Forms, can help law firms manage their trust account efficiently and in compliance with regulations.

A common example of a trust account for a law firm is an escrow account used during real estate transactions. In this setup, client funds are held securely until the closing process is finalized, ensuring that all parties meet their obligations. Such accounts facilitate transactions by adding an extra layer of security and trust between clients and attorneys.

To fill out a trust fund, start by gathering all necessary information about the beneficiaries and the assets involved. You'll want to clearly outline how the funds will be managed, distributed, and any conditions tied to the trust. Using a reliable service like US Legal Forms can simplify this process, providing templates specifically for a trust account for law firm needs.

Lawyers keep two separate types of bank accounts to ensure compliance and protect client interests. One account is designated for operating expenses, while the other is a trust account for law firm, managing client funds. This structure prevents any co-mingling of funds, which is essential to maintain trust and accountability. It is a fundamental practice in the legal profession.

No, having two bank accounts is not against the law. In fact, it is often required for legal compliance, especially in law firms. Maintaining separate accounts helps to showcase financial transparency and accountability. A trust account for law firm is a vital component in adhering to these legal standards.

The best type of bank account for a trust is a dedicated trust account specifically designed for holding client funds. These accounts typically offer features such as interest accrual, which can be beneficial for client funds held over time. Additionally, ensure that the bank provides excellent reporting capabilities to help you maintain precise records for your trust account for law firm operations.

To obtain a trust account, reach out to banks or credit unions that specialize in legal trust accounts. You will need to provide documentation, such as your firm's registration and an operating agreement. Once opened, manage the account diligently to ensure it meets the regulatory requirements associated with maintaining a trust account for law firm practices.