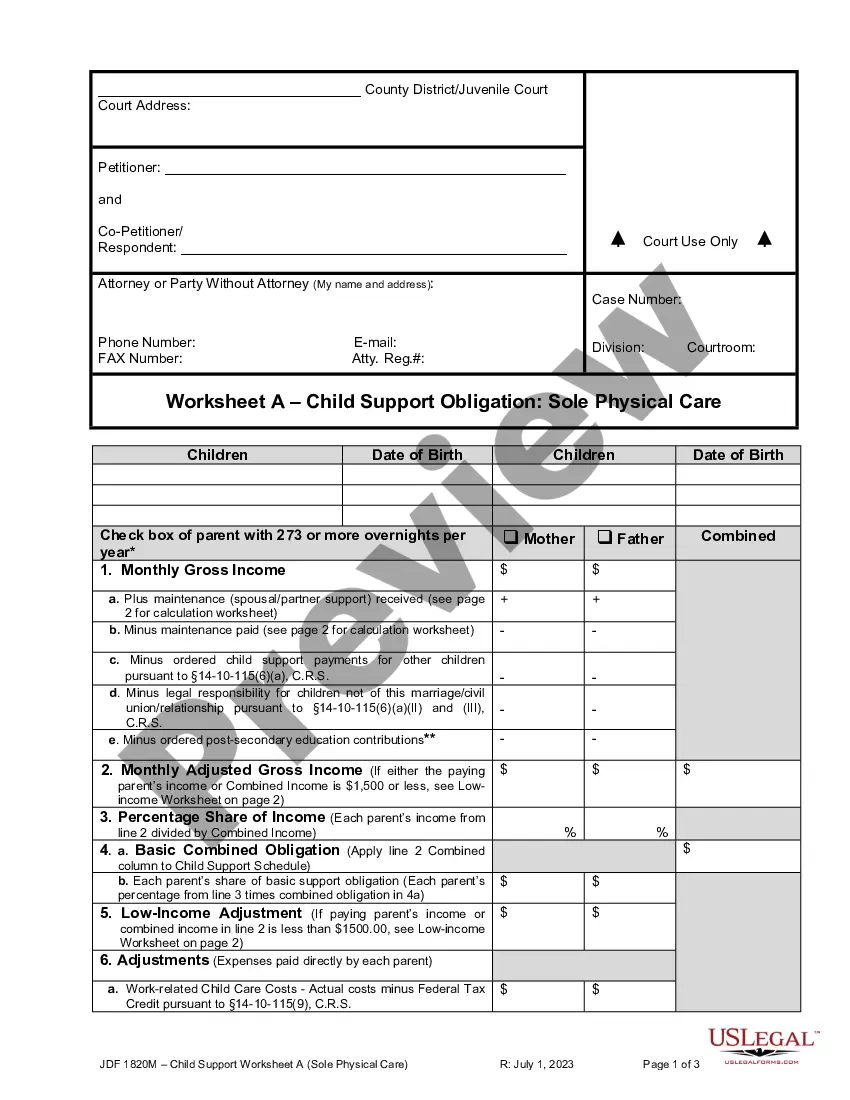

Worksheet B Child Support Colorado Withholding

Description

How to fill out Colorado Child Support Worksheet B?

Drafting legal documents from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating Worksheet B Child Support Colorado Withholding or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of over 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Worksheet B Child Support Colorado Withholding. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the catalog. But before jumping directly to downloading Worksheet B Child Support Colorado Withholding, follow these tips:

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Worksheet B Child Support Colorado Withholding.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us today and turn form completion into something simple and streamlined!

Form popularity

FAQ

From Disposable Earnings, child support either takes the full amount for the Frequency or up to 65%. For child support with court ordered health insurance, Disposable Earnings excludes the amount of the employee's health insurance.

Ing to Colorado child support law, COL. REV. STAT. §14-10-115, the amount of child support owed is calculated by applying a percentage (roughly 20% for one child and an additional 10% for each additional child) of the parents' combined gross income to their child's needs.

Under Colorado Revised Statutes Section 14-10-115, a parent's adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Income can refer to more than just the wages you earn at your place of employment, however. Income can refer to: Wages.

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.

Gross income (before taxes) of both parents. The child's income (if any) Number of overnights the child spends with each parent. Expenses, including health insurance and daycare.