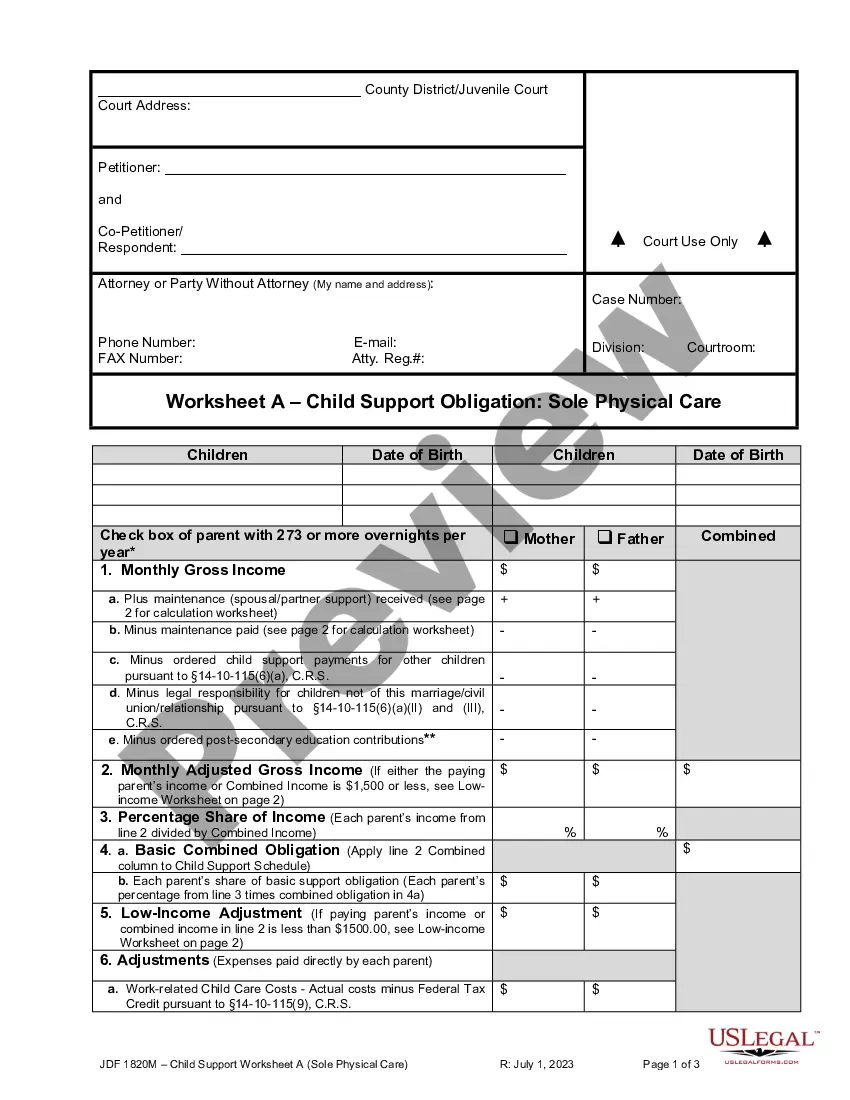

Child Support Worksheet B Colorado With Dependents

Description

How to fill out Colorado Child Support Worksheet B?

Securing a reliable location to acquire the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy. Identifying the correct legal documents requires precision and meticulousness, which is why it is crucial to obtain samples of Child Support Worksheet B Colorado With Dependents solely from credible sources, such as US Legal Forms. An incorrect template can squander your time and postpone your current situation. With US Legal Forms, you can have peace of mind.

You can access and review all the information regarding the document’s applicability and significance for your specific situation and in your region.

Eliminate the stress that comes with legal paperwork. Delve into the vast collection of US Legal Forms to discover legal templates, assess their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to find your template.

- Open the form’s details to verify if it meets the standards of your region.

- Access the form preview, if available, to confirm the form is indeed the one you need.

- Return to the search to locate the correct template if the Child Support Worksheet B Colorado With Dependents does not meet your criteria.

- Once you are confident about the form’s relevance, proceed to download it.

- If you are a registered customer, click Log in to verify your identity and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Select the payment plan that aligns with your requirements.

- Move forward to the registration to finalize your purchase.

- Conclude your purchase by choosing a payment option (credit card or PayPal).

- Select the document format for downloading Child Support Worksheet B Colorado With Dependents.

- After obtaining the form on your device, you can edit it or print it and fill it out by hand.

Form popularity

FAQ

Under Colorado Revised Statutes Section 14-10-115, a parent's adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Income can refer to more than just the wages you earn at your place of employment, however. Income can refer to: Wages.

In cases in which the parties share equal parenting time and have similar incomes the child support calculation could render a result such that neither pays the other any support. A common misconception is that because there is 50/50 parenting time, neither owes child support, which is just not true.

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.

Reality: A new spouse's income usually has no effect on the paying parent's child support obligation. It is the parent of the child who has to pay, not the new spouse. Myth: Child support can not be modified.

Can the court use my wife's income for calculating child support? No. The income of new spouses, or spouses in just a custody case, has no bearing on a child support calculation. However, the cost of a spouse to cover the cost of health insurance for a child may be factored into a child support calculation.