Colorado Child Support Calculator With Overnights

Description

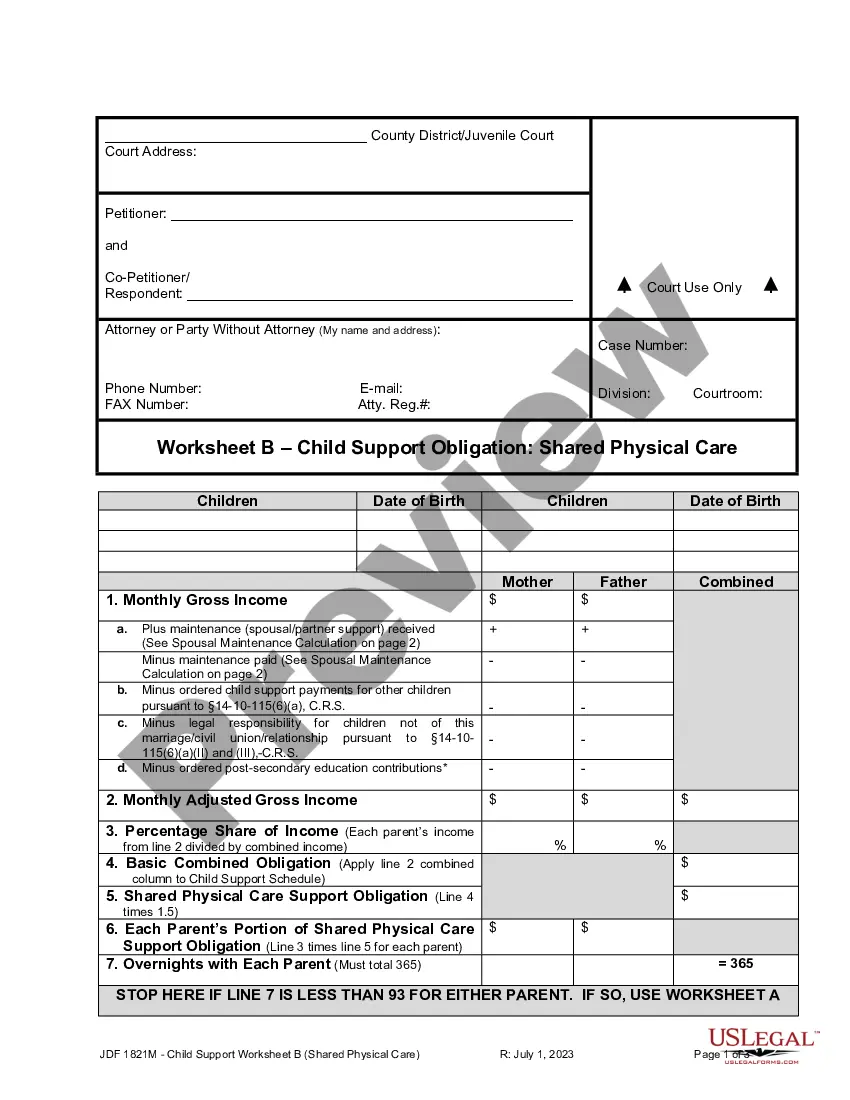

How to fill out Colorado Child Support Worksheet A?

The Colorado Child Support Calculator With Overnights you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and state laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Colorado Child Support Calculator With Overnights will take you just a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it fits your needs. If it does not, use the search bar to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Colorado Child Support Calculator With Overnights (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your paperwork one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.

Generally, overtime is not counted as part of your income for child support unless your employer requires it.

Extraordinary medical expenses must be addressed in child support orders. These expenses are any uninsured medical/dental/mental health expenses over $250 per year per child (the first $250 is considered in the basic child support) and may include the costs of: Dental work (e.g., braces) Physical therapy.

Support with Low Income Parents 14-10-115(7)(a)(II)(D) provides for a minimum support obligation applies unless both parents have at least 93 overnights. The monthly obligation is: $50 for 1 child. $70 for 2 children.

Adjusted gross income, the child support obligation must be capped at twenty percent of the obligor's adjusted gross income. The minimum guideline amount for obligors earning less than $1,500 per month shall not apply when each parent keeps the children more than ninety-two overnights each year.