Name Change After Marriage For Social Security Card

Description

How to fill out Colorado Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log in to your US Legal Forms account if you are a returning user. Make sure your subscription is active; renew it if necessary.

- Explore the preview mode and form descriptions to select the appropriate name change form suitable for your local jurisdiction.

- Use the Search function to find alternative templates if the initial choice doesn't meet your requirements.

- Proceed to purchase the selected document by clicking on the Buy Now button and selecting your preferred subscription plan.

- Complete your payment securely using a credit card or PayPal, ensuring you can access your document library.

- Download the form to your device from your profile menu to complete it and access it whenever needed.

In conclusion, changing your name after marriage for your Social Security card doesn't have to be complicated. With US Legal Forms, you gain access to a vast selection of forms, expert support, and an easy-to-navigate process.

Start your name change journey today—visit US Legal Forms for all your document needs!

Form popularity

FAQ

If you don't report your marriage to Social Security, you may face several consequences, such as incorrect benefit payments or penalty fines. Additionally, your name may not reflect the change after marriage for social security card, causing confusion down the line. To avoid these issues, it’s best to act quickly and update your records. Services like uslegalforms can assist you with the paperwork needed for a smooth transition.

Yes, failing to report your marriage to Social Security can lead to complications, including delayed benefits or potential legal issues. When you change your name after marriage for social security card, you need to ensure that your marital status is correctly reported. Neglecting this step may result in penalties or loss of benefits. Using a platform like uslegalforms can help you manage these requirements effectively.

The marriage penalty for Social Security refers to the reduced benefits some couples may face when both partners receive retirement benefits. By filing jointly, spouses could end up with a lower overall payout compared to if they filed separately. It's important to understand how a name change after marriage for social security card could impact your situation. Consulting with a legal service like uslegalforms can provide clarity on potential penalties.

Yes, Social Security verifies your marital status when processing a name change after marriage for social security card. This verification helps ensure that your benefits are accurately calculated and assigned. If you change your name after marriage, it's crucial to update your records with Social Security promptly. Using platforms like uslegalforms can simplify this process for you.

If your name does not match your Social Security card, it may lead to complications with taxes and benefits. Mismatches can result in delays, penalties, or even audits from the IRS. Thus, addressing a name change after marriage for your Social Security card promptly is essential to maintain proper documentation.

Yes, the name on your W-2 must match your Social Security card to avoid discrepancies during tax filing. If you've recently undergone a name change after marriage for your Social Security card, ensure your W-2 reflects your new name to prevent issues with the IRS. Keeping all records aligned is vital for your financial health.

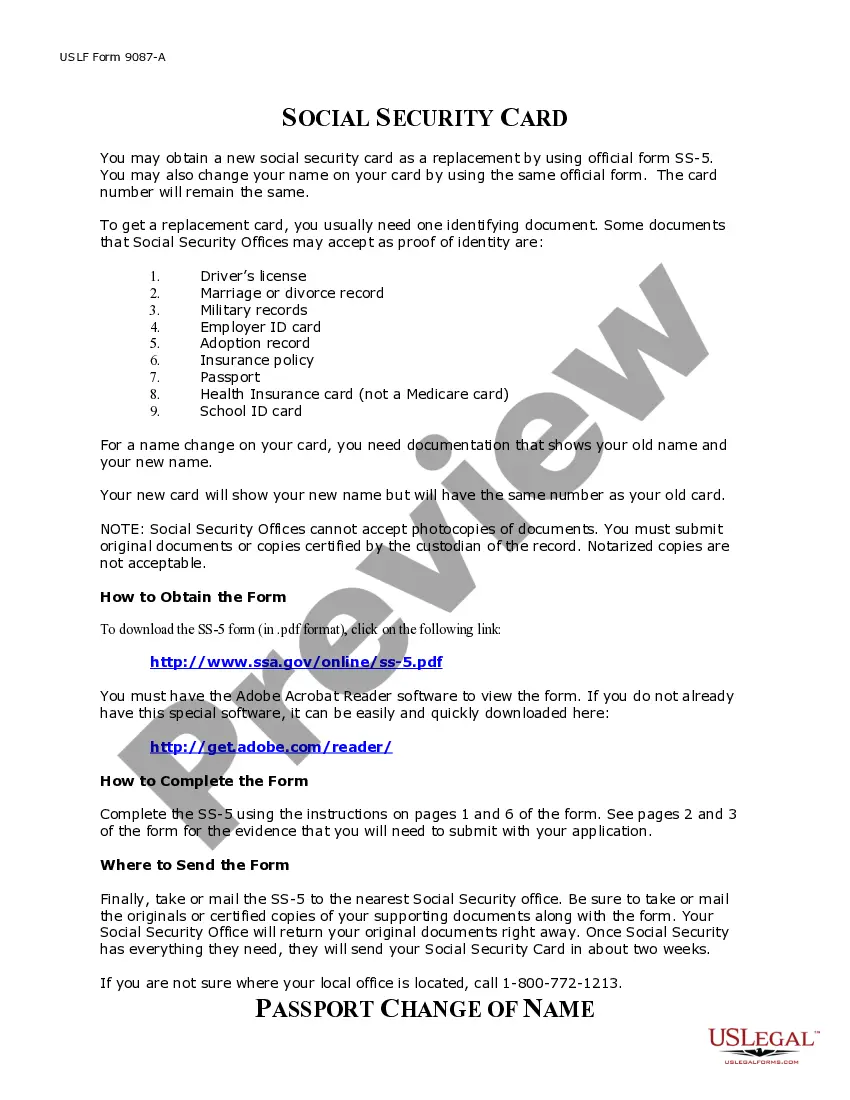

When changing your name on your Social Security card, you will need several key documents. You must present proof of your identity, such as a photo ID, and documentation of your name change, like a marriage certificate. This ensures a smooth transition in your name change after marriage for your Social Security card.

Yes, you typically need your Social Security card to change your name on your driver’s license. Providing this card helps verify your identity and confirms your name change after marriage for your Social Security card. Keep in mind that some states may have additional requirements, so it's wise to check your local DMV's rules.

While you are not legally required to change your Social Security card after marriage, it is highly recommended. Keeping your records consistent can prevent issues with tax filings and benefits in the future. Therefore, pursuing a name change after marriage for your Social Security card is a proactive step to ensure your documents match.

To notify Social Security of your marriage, you need to complete an application for a new Social Security card. This process can usually be done online or in person at your local Social Security office. Ensure you have the necessary documents, such as your marriage certificate, which will support your name change after marriage for your Social Security card.