Colorado Name Change With Hmrc

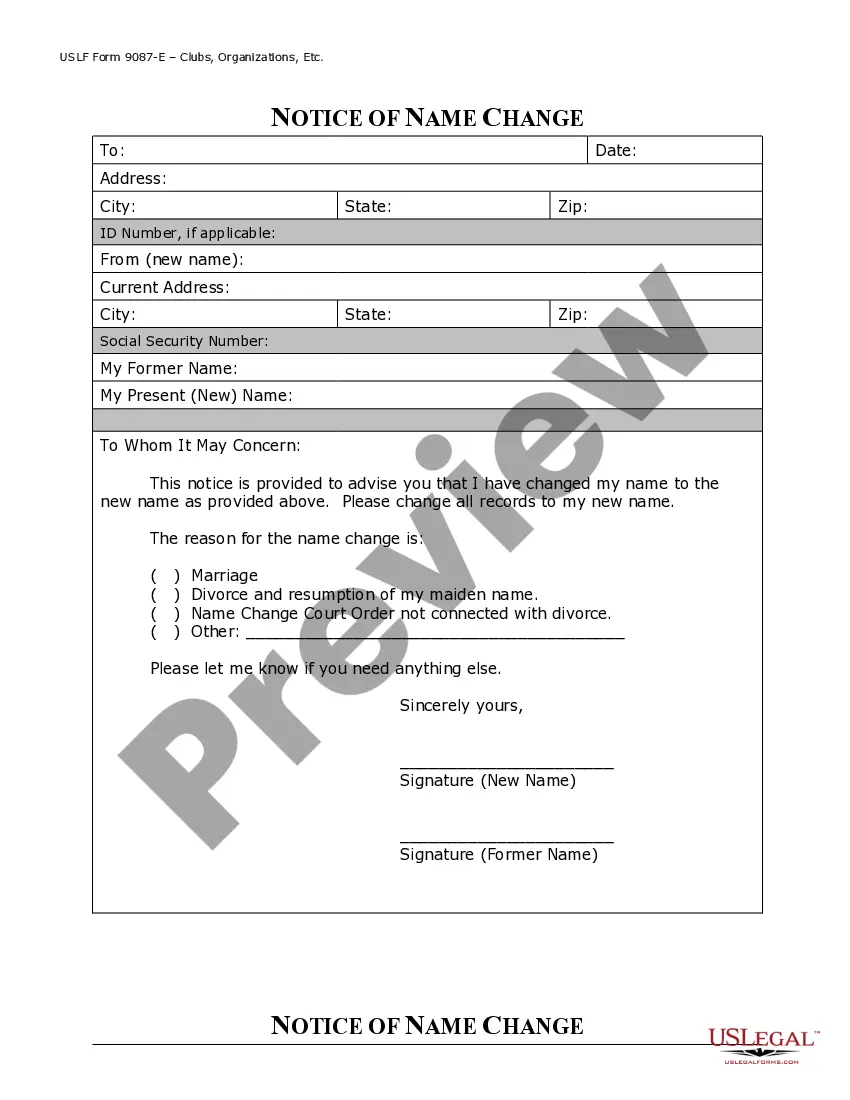

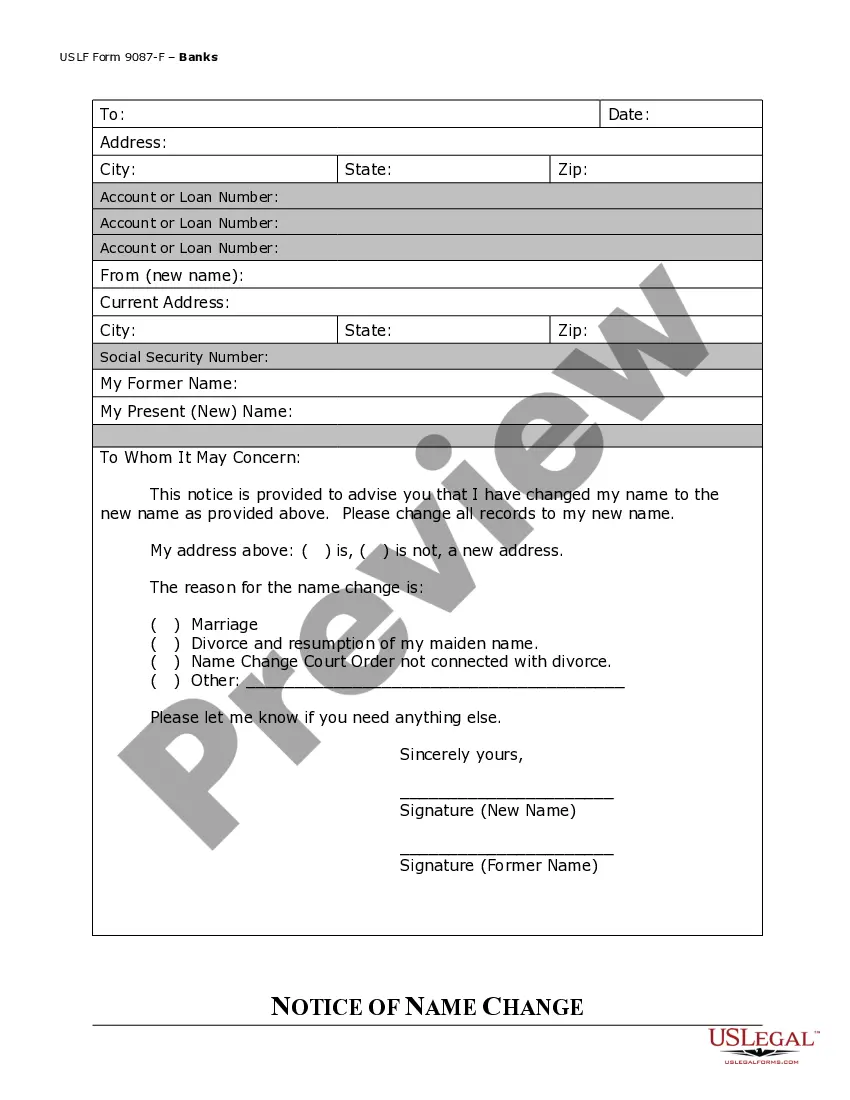

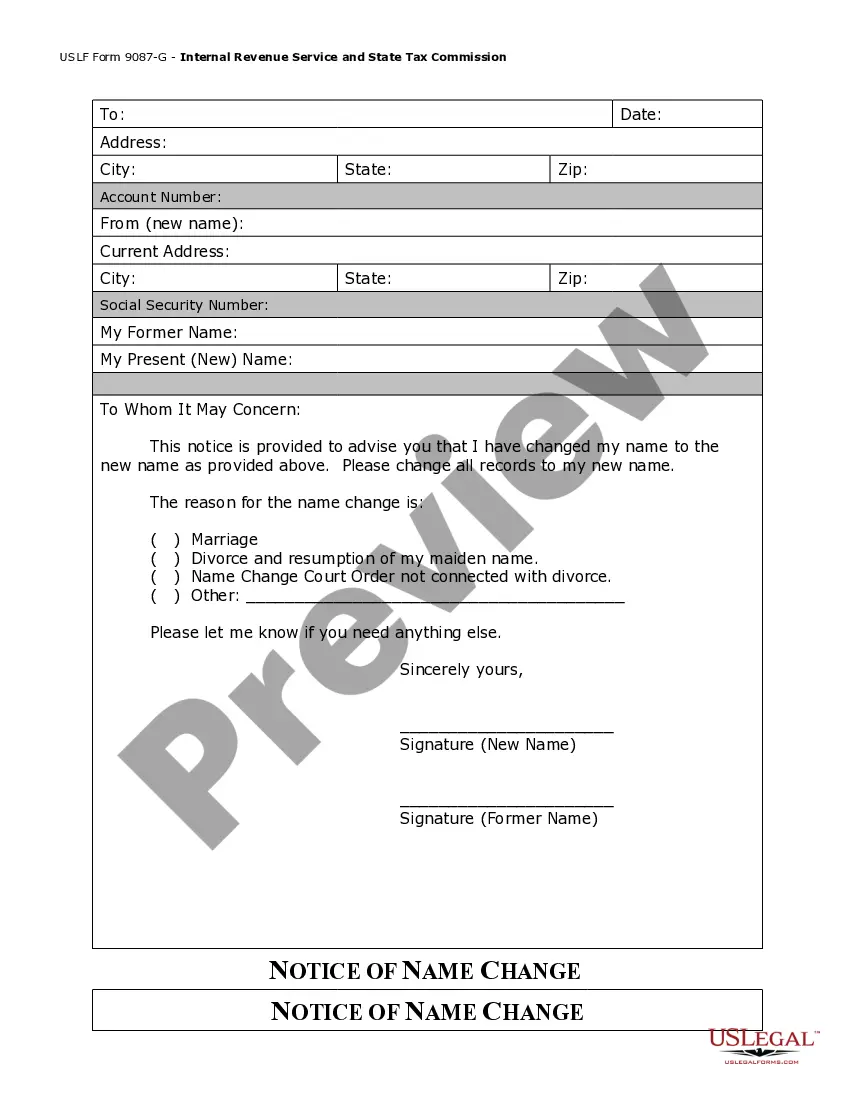

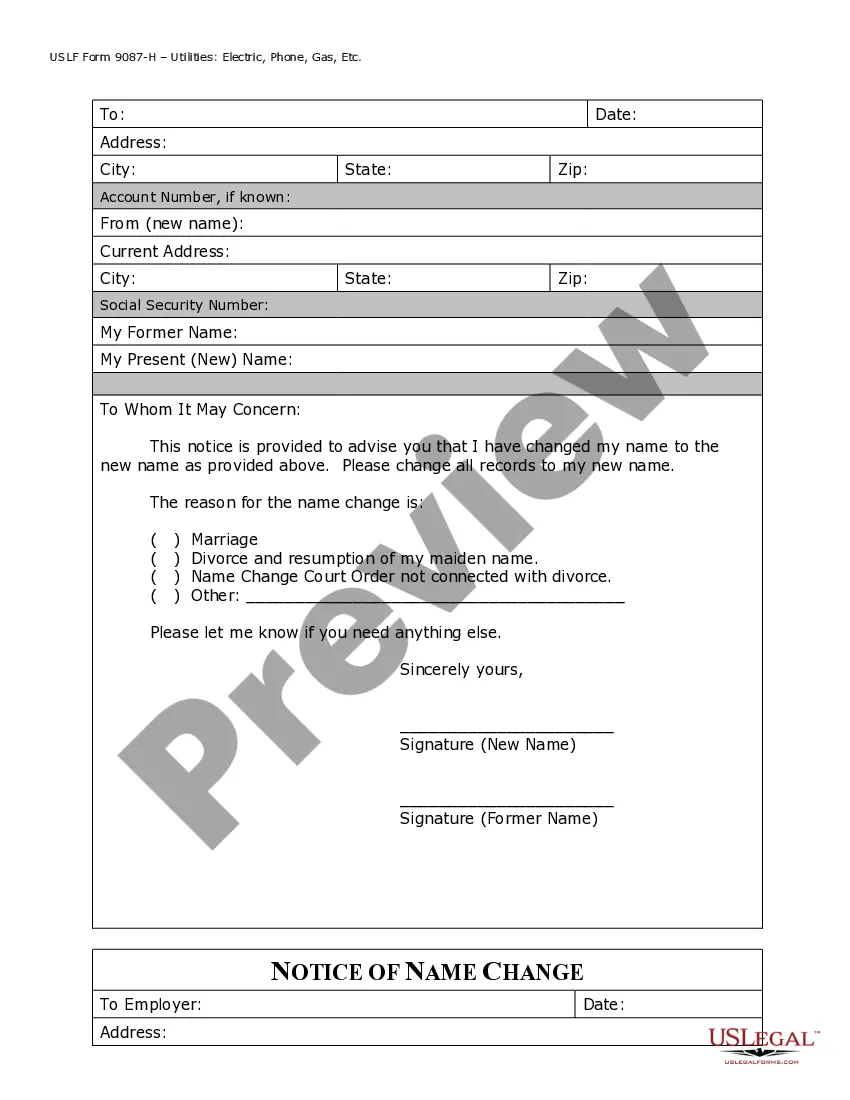

Description

How to fill out Colorado Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Utilizing legal document examples that adhere to federal and state regulations is essential, and the internet provides a plethora of choices.

However, why spend time searching for the appropriate Colorado Name Change With Hmrc template online when the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms is the largest virtual legal repository with over 85,000 fillable documents prepared by attorneys for any business and personal situation.

All templates you find through US Legal Forms are reusable. To re-download and complete previously stored documents, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- They are simple to navigate with all documents categorized by state and intended use.

- Our specialists keep abreast of legal modifications, ensuring that your form is always current and compliant when obtaining a Colorado Name Change With Hmrc from our platform.

- Acquiring a Colorado Name Change With Hmrc is straightforward and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample needed in your desired format.

- If you are unfamiliar with our site, follow the steps outlined below.

Form popularity

FAQ

How Do I Amend a Trademark Registration? If your trademark registration is not the subject of a cancellation proceeding, then you can amend your trademark registration by filing a Section 7 Request for Amendment with the USPTO. The Section 7 is an online form that is available on the USPTO's website.

Trademark applications and registrations are public records. Individuals and private companies may use this public information to create third-party access to these records.

U.S. Trademark Law permits amendments to existing trademark registrations, provided that the changes are not a ?material alteration? and do not alter the ?commercial impression? of the trademark.

To change the owner of a federal trademark registration or application, a trademark assignment should be signed and recorded with the USPTO. A trademark assignment is a document signed by the original owner (?assignor?) that transfers ownership of the trademark to a new owner (?assignee?).

Is There Such a Thing as Free Trademark Registration? No. To register a trademark, you must pay a non-refundable government filing fee to the United States Patent and Trademark Office (?USPTO?).