Solicitud De Arrendamiento Minerva Withholding Tax

Description

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

Finding a reliable source for obtaining the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the necessary legal documents requires accuracy and meticulousness, which is why it’s crucial to source Solicitud De Arrendamiento Minerva Withholding Tax only from trustworthy providers like US Legal Forms.

Eliminate the hassles associated with your legal documents. Explore the extensive US Legal Forms catalog, where you can locate legal templates, evaluate their suitability for your needs, and download them instantly.

- Utilize the library navigation or search bar to find your document.

- Review the form’s details to ensure it aligns with the requirements of your state and locality.

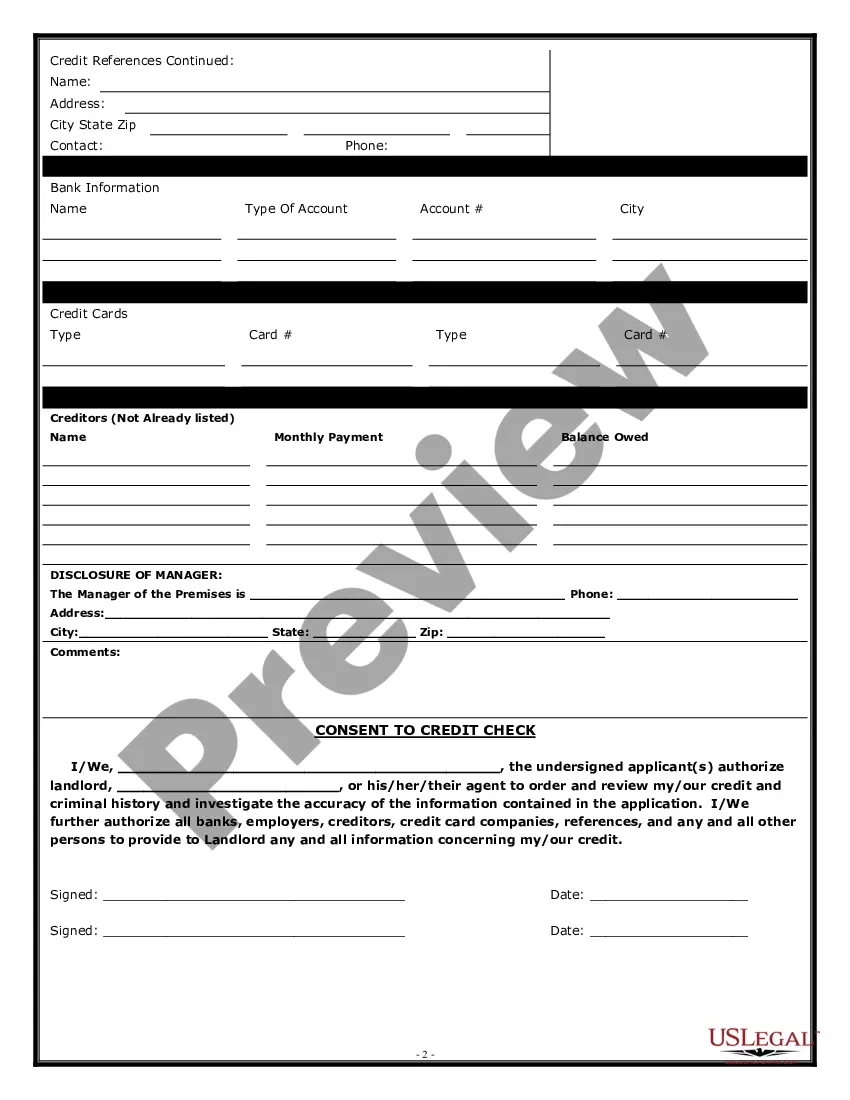

- If available, view the form preview to confirm that it is indeed the document you need.

- Return to the search results and seek the correct document if the Solicitud De Arrendamiento Minerva Withholding Tax does not fulfill your criteria.

- Once you are confident about the document’s suitability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven’t created an account yet, click Buy now to purchase the form.

- Select the pricing option that best suits your needs.

- Complete the registration process to finalize your purchase.

- Conclude your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Solicitud De Arrendamiento Minerva Withholding Tax.

- After obtaining the form on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Income Taxes In Ohio, townships do not levy an income tax on residents. If you live and work in a township, you will pay no income tax (assuming your business is not within a Joint Economic Development District). The township's residential taxpayer funding comes generally through property taxes.

Levied in thousands of cities, counties, school districts, and other localities, local income taxes are often used to either lower other taxes (like property taxes) or raise more revenue for local services.

Ohio has a graduated individual income tax, with rates ranging from 2.765 percent to 3.990 percent. There are also jurisdictions that collect local income taxes. Ohio does not have a corporate income tax but does levy a gross receipts tax.

The Village of Minerva Park has a 2% Income Tax, which supports our community infrastructure as well as our police department.

Cities that administer their own taxes on their own form: City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.