Formato Solicitud De Arrendamiento Minerva Withholding Tax

Description

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

Whether for business purposes or for individual matters, everyone has to manage legal situations at some point in their life. Filling out legal documents demands careful attention, starting with choosing the appropriate form template. For example, if you select a wrong edition of a Formato Solicitud De Arrendamiento Minerva Withholding Tax, it will be turned down when you submit it. It is therefore essential to have a trustworthy source of legal papers like US Legal Forms.

If you need to obtain a Formato Solicitud De Arrendamiento Minerva Withholding Tax template, follow these simple steps:

- Get the template you need using the search field or catalog navigation.

- Check out the form’s description to ensure it matches your situation, state, and region.

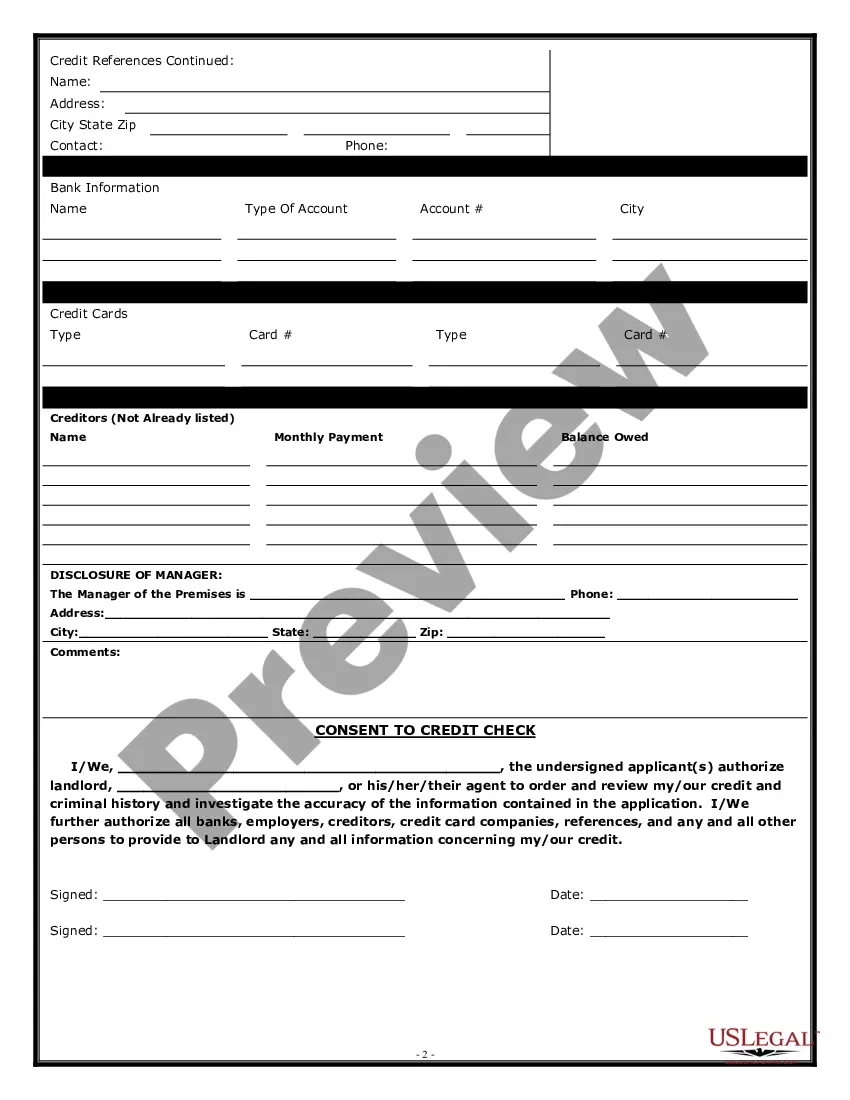

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Formato Solicitud De Arrendamiento Minerva Withholding Tax sample you require.

- Download the template if it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Finish the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Pick the file format you want and download the Formato Solicitud De Arrendamiento Minerva Withholding Tax.

- When it is saved, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the right template across the web. Make use of the library’s easy navigation to get the right form for any occasion.

Form popularity

FAQ

Ohio has a graduated individual income tax, with rates ranging from 2.765 percent to 3.990 percent. There are also jurisdictions that collect local income taxes. Ohio does not have a corporate income tax but does levy a gross receipts tax.

The Village of Minerva Park has a 2% Income Tax, which supports our community infrastructure as well as our police department.

Cities that administer their own taxes on their own form: City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.

Levied in thousands of cities, counties, school districts, and other localities, local income taxes are often used to either lower other taxes (like property taxes) or raise more revenue for local services.

Income Taxes In Ohio, townships do not levy an income tax on residents. If you live and work in a township, you will pay no income tax (assuming your business is not within a Joint Economic Development District). The township's residential taxpayer funding comes generally through property taxes.