Formato Solicitud De Arrendamiento Minerva Withholding

Description

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

Whether for business purposes or for individual affairs, everyone has to handle legal situations sooner or later in their life. Filling out legal documents demands careful attention, starting with picking the right form template. For example, when you select a wrong edition of a Formato Solicitud De Arrendamiento Minerva Withholding, it will be rejected once you submit it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you need to obtain a Formato Solicitud De Arrendamiento Minerva Withholding template, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it suits your situation, state, and county.

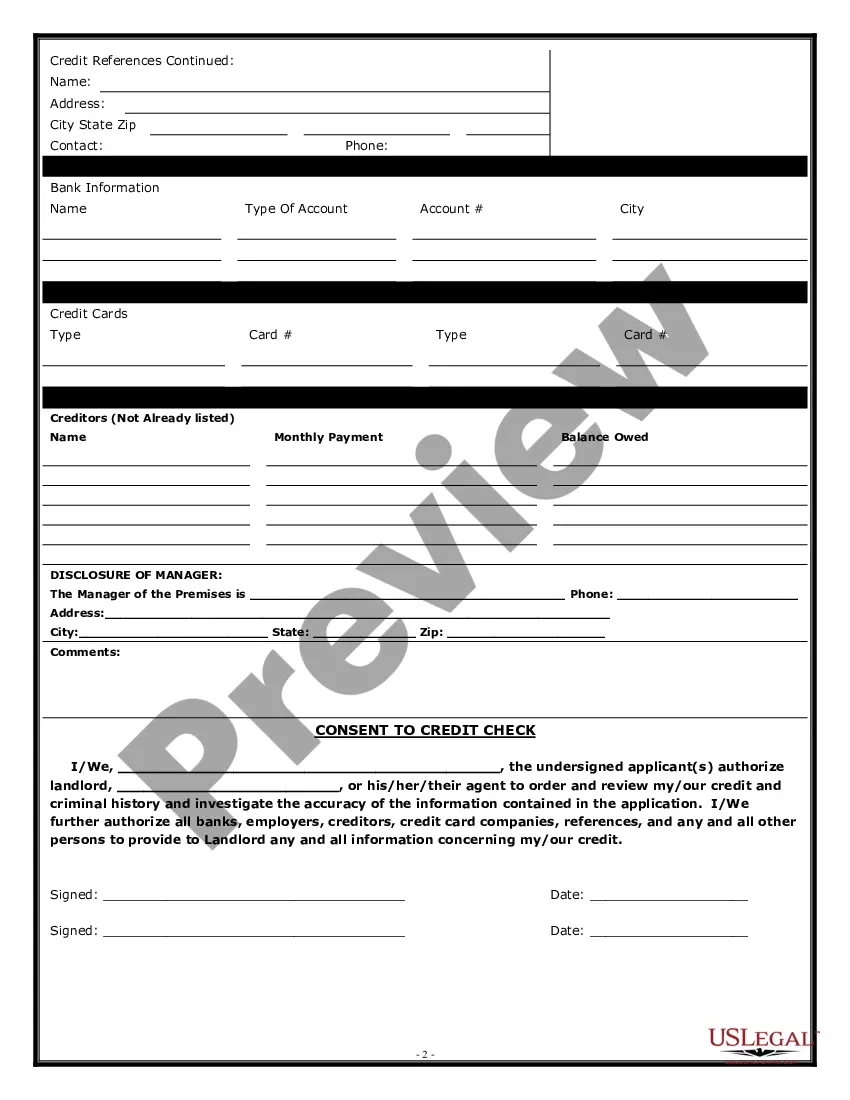

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to locate the Formato Solicitud De Arrendamiento Minerva Withholding sample you need.

- Download the template when it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Formato Solicitud De Arrendamiento Minerva Withholding.

- When it is downloaded, you can complete the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the internet. Take advantage of the library’s straightforward navigation to find the right template for any occasion.

Form popularity

FAQ

Como llenar un contrato de arrendamiento con fiador: Paso a paso Lugar y fecha. Debe definir cuando y donde se revisara el documento para su firma. Datos personales. ... Informacion sobre la propiedad. ... Responsabilidades del avalista. ... Duracion. ... Valor y revision del alquiler. ... Valor de la fianza. ... Firma.

Las siguientes son las partes basicas que debe contener el acuerdo, en especial si deseas obtener ingresos por arrendamiento de un terreno: Especificaciones del terreno. ... Duracion del contrato. ... Aspectos legales que implica el contrato: Derechos y obligaciones de los involucrados. ... Montos a pagar. ... Clausulas especiales.

El contrato de arrendamiento sencillo debe incluir la siguiente informacion: ¿Que y quien va rentar? Descripcion detallada del inmueble. Clausulas indispensables. Clausulas adicionales. Garantia para el cumplimiento de las obligaciones.

Tambien llamado contrato de alquiler, estos formularios son prueba de que tanto el inquilino como el propietario llegaron a un acuerdo y estan de acuerdo. Un formulario de contrato de arrendamiento de alquiler sera util para obtener informacion para la proteccion de ambas partes.

¿Que debe contener el contrato? Fecha en la que se redacta, fecha de entrega del inmueble y terminacion del contrato. Nombre y la identificacion de las partes. Datos de la casa para arrendar. Precio, forma de pago, fechas y medio de pago. Paragrafo en el que se especifiquen las obligaciones de las partes.