File Lien For Nonpayment

Description

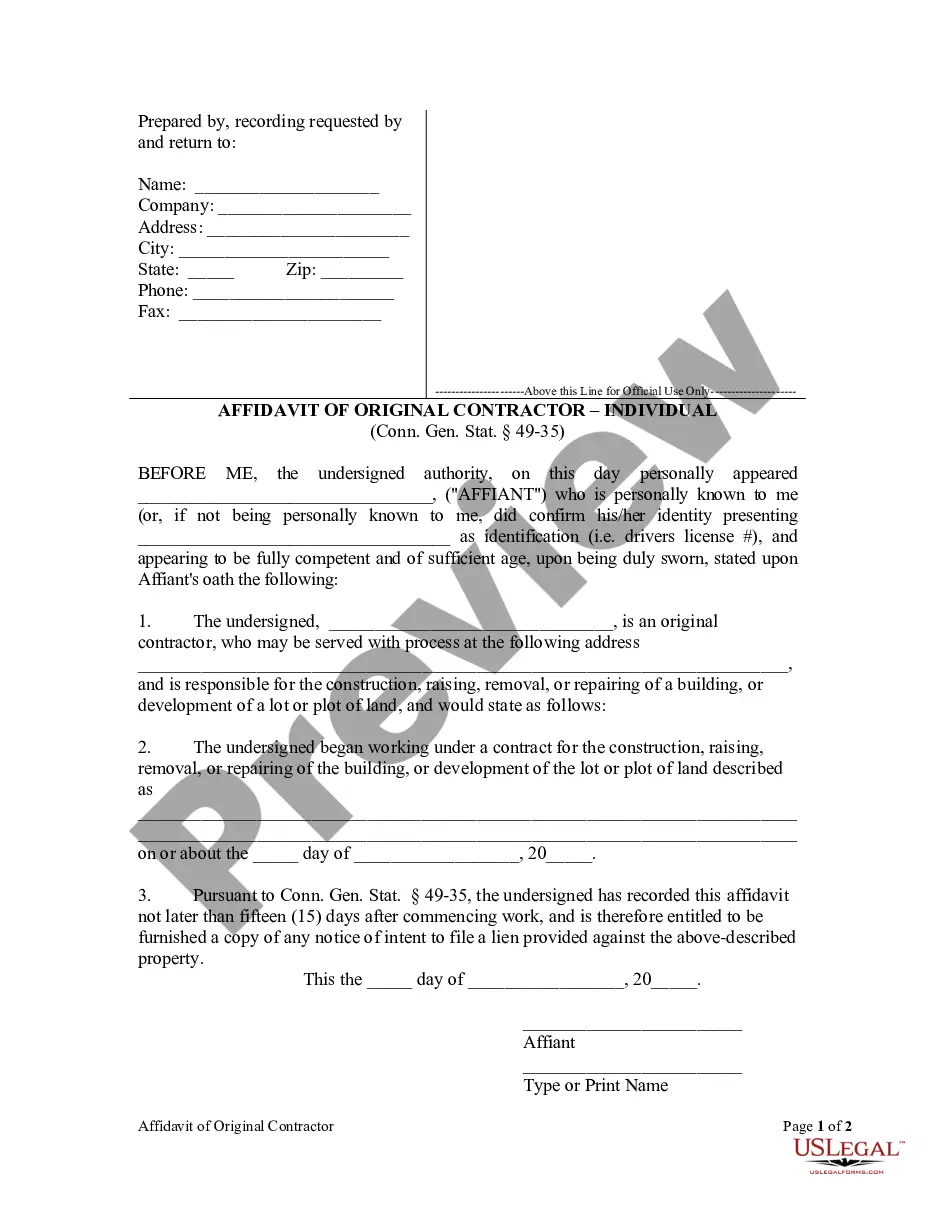

How to fill out Colorado Affidavit Of Service Of Notice Of Intent To File Lien Statement?

- Visit the US Legal Forms website and log in to your account, or create a new one if you haven't registered yet.

- In the search bar, type ‘lien for nonpayment’ to find the relevant form template suited for your state.

- Preview the selected form to ensure it meets your specific needs and complies with local regulations.

- If necessary, explore other templates using the search feature for additional options.

- Select the desired document and click the 'Buy Now' button, then choose your subscription plan.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Once the transaction is confirmed, download your form to your device for easy access and completion.

In summary, filing a lien for nonpayment becomes a straightforward task with US Legal Forms. Whether you're a seasoned user or a first-timer, their user-friendly platform equips you with the necessary resources.

Start protecting your financial rights today by visiting US Legal Forms and accessing thousands of legal templates at your fingertips.

Form popularity

FAQ

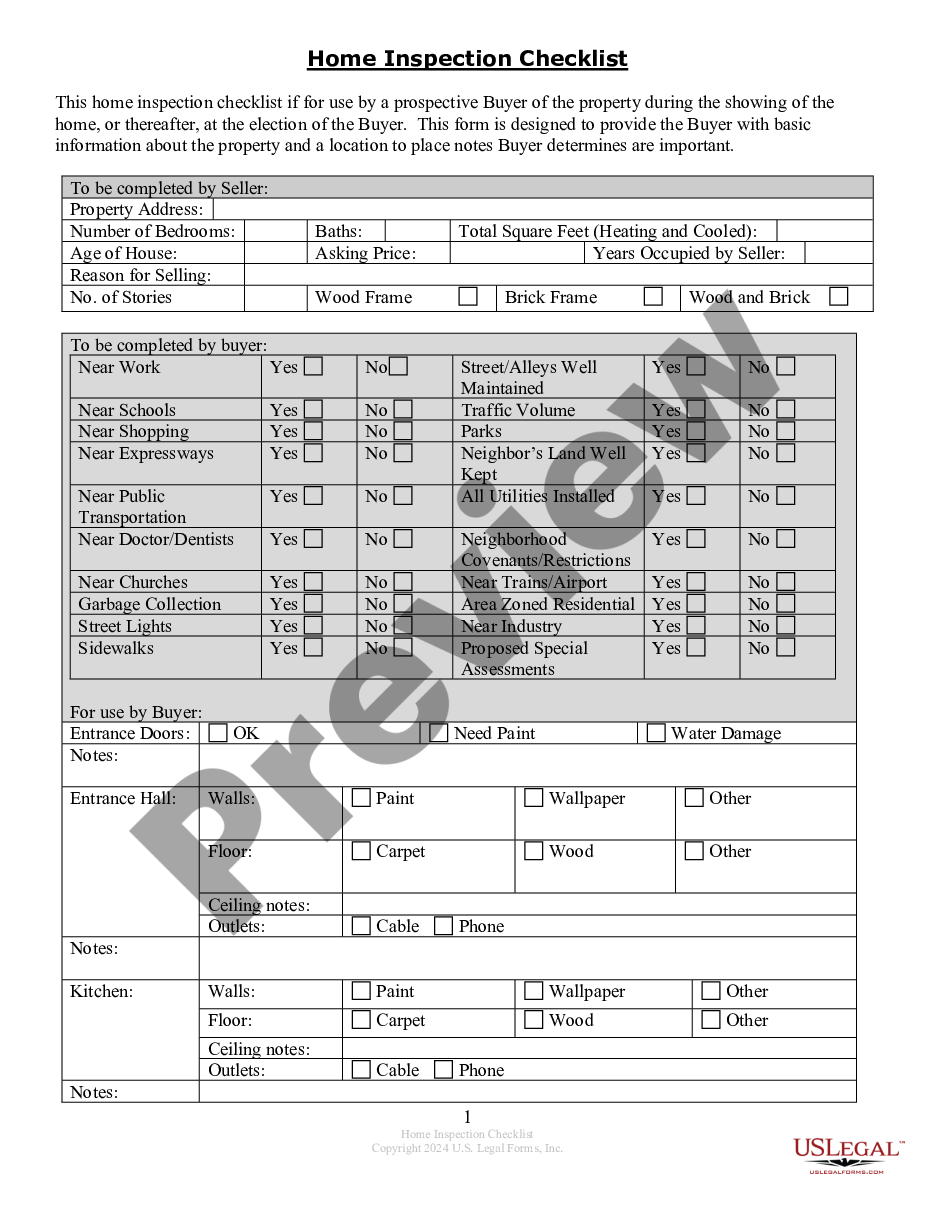

Yes, a lien can potentially be placed on your home without your consent. This often happens in situations involving unpaid debts, like unpaid taxes or contractor services. Such liens can complicate your financial situation and affect your property rights. If you're facing this challenge, it’s advisable to explore your options and consider using uslegalforms to help you file lien for nonpayment, ensuring your rights are protected.

In South Carolina, lien laws provide a framework for filing liens on personal and real property due to unpaid debts. Generally, you must file a lien statement with the South Carolina Secretary of State's Office, and you need to meet specific deadlines for doing so. Understanding these laws is crucial for protecting your interests. If you need assistance navigating these regulations, uslegalforms can help you file lien for nonpayment effectively.

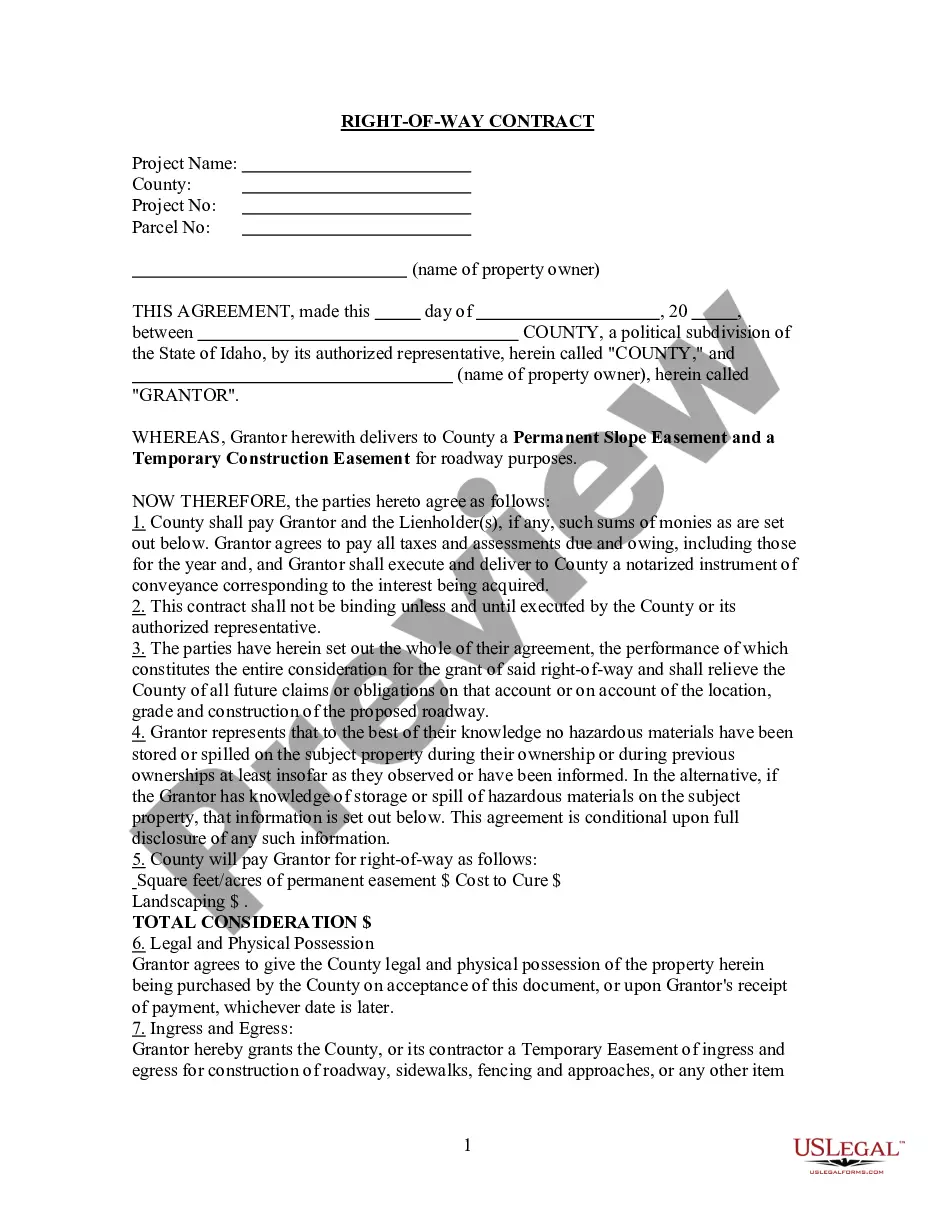

To perfect a lien on personal property, you need to follow specific steps as defined by your state laws. Generally, you should file a notice of lien with the appropriate state or local authority, providing details about the debt and the property involved. Additionally, you must notify the debtor about your intention to file this lien. By completing these steps, you create a legal claim against the property when you file lien for nonpayment.

Yes, you can file a lien for nonpayment online in many jurisdictions, making the process quicker and more convenient. Many platforms, including USLegalForms, provide resources and tools to guide you through the electronic filing process. Just ensure that you have all required documents ready and that you follow the instructions specific to your state. This digital option simplifies the paperwork and helps you secure your financial interests more efficiently.

To file a lien for nonpayment in Missouri, you must provide specific information about the debt and the property involved. This includes details about the parties involved, the amount owed, and the description of the property. Filing the lien properly in the correct jurisdiction is also necessary to ensure its legality. Using USLegalForms can streamline this process, helping you meet all necessary requirements efficiently.

Yes, you can file a lien for nonpayment on an asset you own, such as property or vehicles. This legal claim allows you to secure your interest in the asset until you receive the payment owed. It is important to ensure that you follow the legal procedures applicable in your state to make the lien enforceable. With USLegalForms, you can easily navigate these steps to protect your rights.

In Indiana, you generally have one year from the date of nonpayment to file a lien. This timeline underscores the urgency of addressing unpaid debts quickly. Missing this deadline can result in the loss of your right to file a lien for nonpayment. Utilizing platforms like US Legal Forms can help you navigate the process efficiently and ensure timely filings.

Filing a lien for nonpayment has its disadvantages, particularly for property owners. It can reduce your creditworthiness, complicate future transactions, and even lead to foreclosure if not addressed. Moreover, potential buyers may be deterred by a lien attached to your property. It's essential to resolve any debts promptly to avoid these complications.

To file a lien for nonpayment, specific conditions must be met. Generally, the debt must be valid and documented, and the creditor must follow the required legal procedures for filing. Additionally, filing within a certain timeframe after the debt arises is crucial for the lien to be enforceable. Understanding these conditions can protect you from unexpected liens.

It is possible for someone to file a lien for nonpayment without your immediate awareness. Typically, a creditor can record a lien against your property through a public filing. You might not be informed unless they take further legal action, such as a lawsuit. Staying informed about your financial obligations can help prevent unexpected liens from appearing on your property.