Continuing Corporation With Alberta

Description

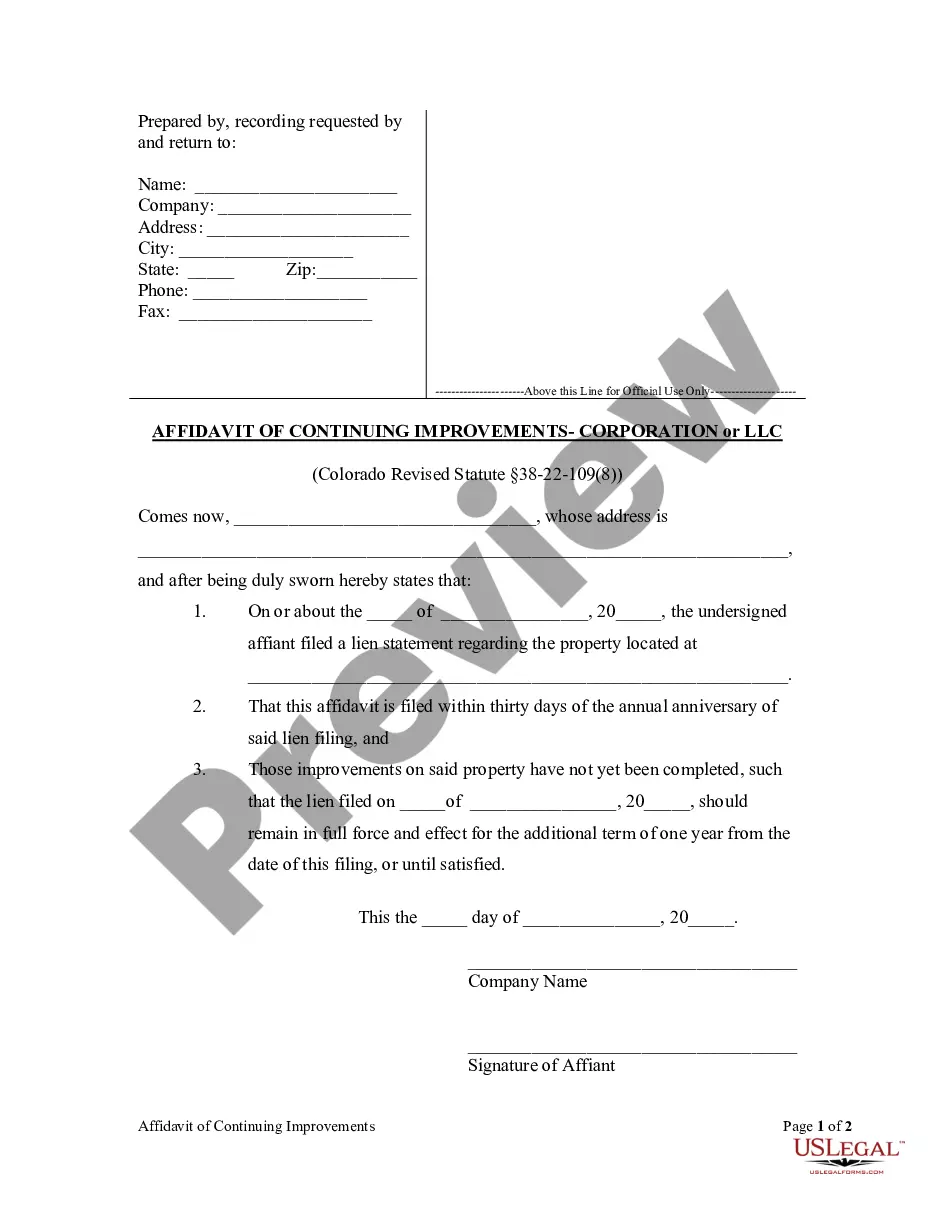

How to fill out Colorado Affidavit Of Continuing Improvements - Corporation?

Individuals commonly link legal documentation with a level of intricacy that only an expert can manage.

In a sense, this is accurate, as preparing Continuing Corporation With Alberta requires a deep comprehension of the subject matter, including state and county regulations.

Nevertheless, with US Legal Forms, everything has become simpler: pre-made legal templates for every life and business event tailored to state laws are gathered in one online directory and are now accessible to all.

Print your document or upload it to an online editor for faster completion. All templates in our collection are reusable: once purchased, they remain saved in your profile. You can access them anytime you need through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents organized by state and field of application, so finding Continuing Corporation With Alberta or any other specific form only requires a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users to the platform will need to create an account and subscribe before they can store any files.

- Here is a detailed guideline on how to obtain the Continuing Corporation With Alberta.

- Carefully review the page content to ensure it meets your specifications.

- Examine the form description or confirm it through the Preview feature.

- If the earlier form does not meet your needs, find another example using the Search field above.

- When you identify the appropriate Continuing Corporation With Alberta, click Buy Now.

- Choose a pricing plan that aligns with your needs and financial situation.

- Register for an account or Log In to continue to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Select the format for your document and click Download.

Form popularity

FAQ

Yes, non-residents can incorporate a company in Alberta without needing to live in the province. This process allows for a broad range of opportunities for international business people. By leveraging platforms like US Legal Forms, those looking to set up a continuing corporation with Alberta will find straightforward resources to navigate requirements efficiently and effectively.

When a corporation is dissolved in Alberta, it ceases to exist as a legal entity, meaning it can no longer conduct business or hold assets. The dissolution process may entail liquidating the corporation's assets and settling any outstanding debts. If you wish to resume operations or continue your business activities, you may explore re-establishing a continuing corporation with Alberta, ensuring a fresh start under the appropriate regulations.

Yes, a non-resident can incorporate a business in Alberta. There are specific guidelines that non-residents must follow, including appointing a local representative and ensuring they meet the jurisdiction's requirements. This flexibility makes Alberta an attractive option for international entrepreneurs looking to establish a continuing corporation with Alberta, opening the door to new opportunities and markets.

The articles of continuance for corporations in Canada serve as the official document that allows a corporation to continue its existence under a new jurisdiction or as a different entity type. In the context of a continuing corporation with Alberta, this document outlines key details such as the corporation's name, registered office address, and the nature of its business. It is essential for corporations transitioning to Alberta to ensure compliance with local legislation so that they can operate seamlessly in the province.

When a company is struck in Alberta, it indicates that the corporation has been dissolved or removed from the business registry, often due to non-compliance with filing requirements. This status prevents the corporation from legally operating in the province, affecting contracts and liabilities. If your continuing corporation in Alberta faces this issue, it is vital to address any compliance failures quickly. Services like USLegalForms can help you understand the necessary steps to reinstate your business.

Failing to file an annual return in Alberta can result in your corporation being deemed inactive or dissolved. This inactivity may lead to further legal complications and potential loss of your corporate name. Staying compliant with annual return filings is essential for maintaining good standing; using services like US Legal Forms can assist in ensuring you meet the regulations for continuing a corporation with Alberta.

A letter of continuance out of Alberta is a formal document that allows a corporation to transition from Alberta to another jurisdiction while maintaining its legal existence. This letter outlines the corporation’s information and confirms its compliance with Alberta laws. For corporations looking to relocate, securing this document is crucial for continuing a corporation with Alberta and ensuring a smooth transition.

To continue a corporation into Alberta, you start by obtaining a certificate of continuance from your current jurisdiction. This document must be submitted to the Alberta Corporate Registry alongside your application. As you transition, consider using US Legal Forms to facilitate the process and ensure every step aligns with the requirements for continuing a corporation with Alberta.

Reactivating your corporation in Alberta involves filing necessary documents with the Alberta Corporate Registry. This process may include submitting articles of revival and resolving any outstanding fees or issues that caused the corporation to become inactive. For those pursuing reactivation, US Legal Forms can provide you with the required paperwork and clear guidance on continuing a corporation with Alberta.

To continue a corporation in Alberta, you must obtain a certificate of continuance from your original jurisdiction and file it with the Alberta Registrar of Corporations. This process also includes ensuring compliance with Alberta's regulations and addressing any outstanding issues in your original jurisdiction. If you need detailed support, US Legal Forms offers resources to help you navigate continuing a corporation with Alberta seamlessly.