Security Deposit With Interest

Description

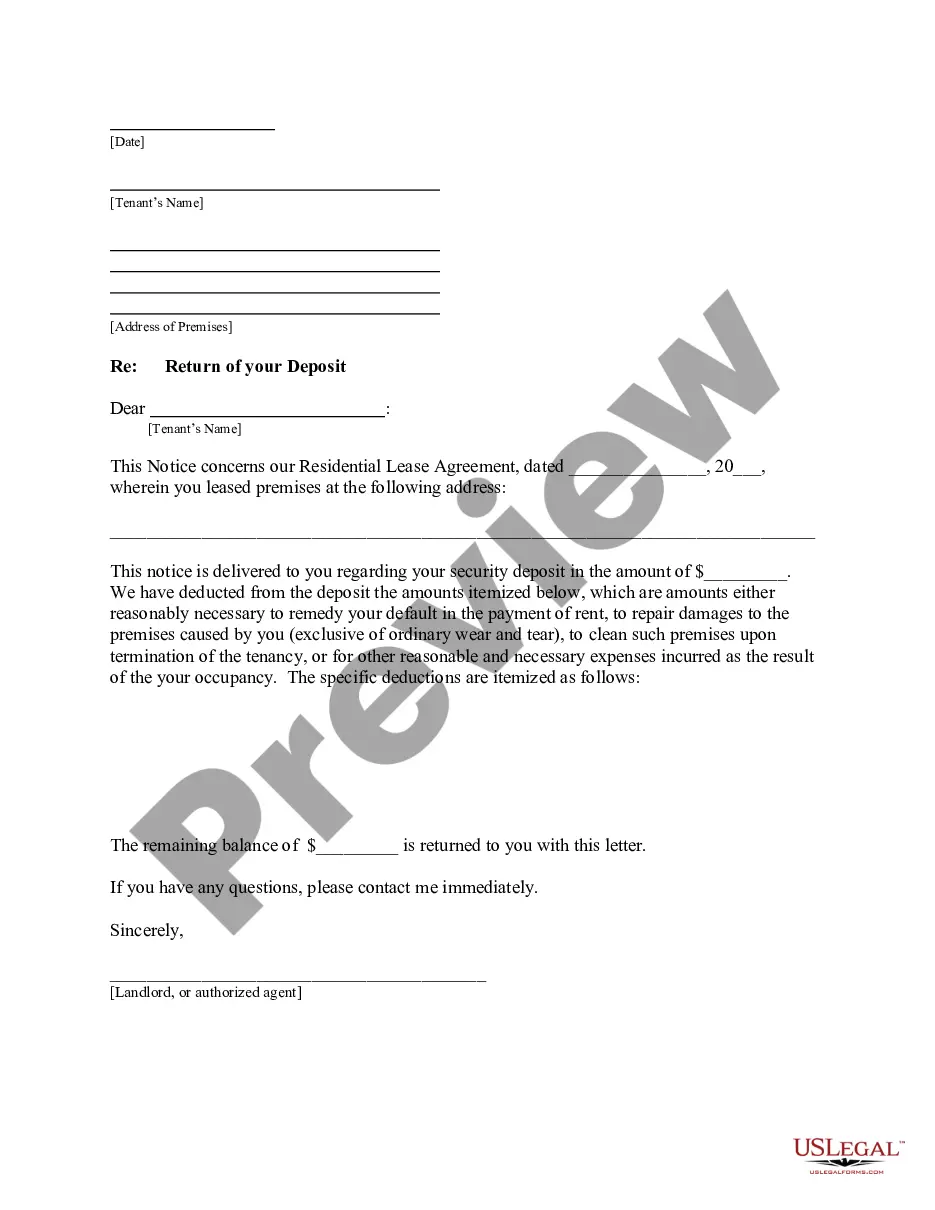

How to fill out Colorado Letter From Landlord To Tenant Returning Security Deposit Less Deductions?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more economical method for generating Security Deposit With Interest or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs.

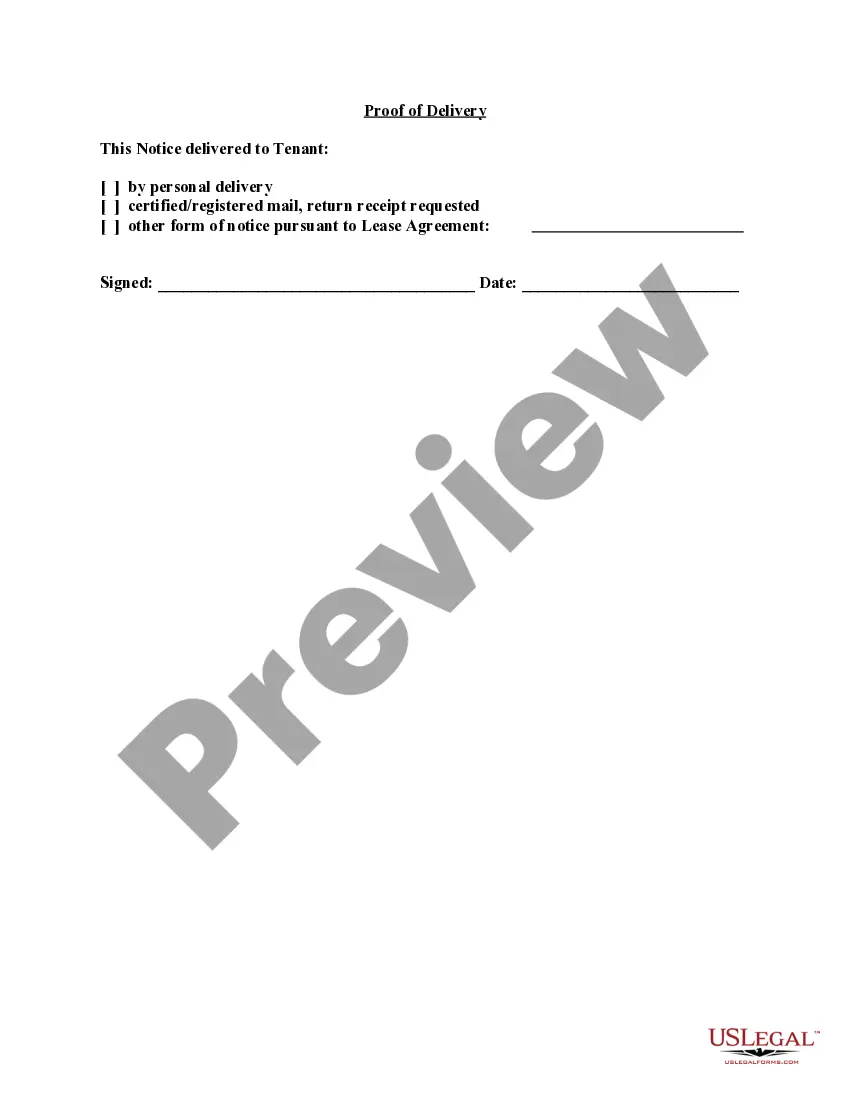

Examine the form preview and descriptions to verify you are looking at the correct form. Ensure the template you choose meets the standards of your state and county. Select the most appropriate subscription option to purchase the Security Deposit With Interest. Download the document, then complete, authenticate, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make form execution a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require trusted and dependable services to swiftly find and download the Security Deposit With Interest.

- If you’re familiar with our website and have created an account previously, simply Log In to your account, choose the form, and download it or re-download it at any time from the My documents section.

- Don’t have an account? No issue. Registration takes just minutes, allowing you to browse the catalog.

- However, before proceeding to download Security Deposit With Interest, consider these suggestions.

Form popularity

FAQ

To calculate simple interest on a deposit, use the formula: Interest = Principal x Rate x Time. This straightforward method helps you determine how much interest your security deposit with interest will earn over a specified period. It's a useful calculation for understanding the potential growth of your funds while renting.

To calculate the interest on your rent deposit, take the total amount of the deposit and multiply it by the applicable interest rate. Make sure to factor in the time your deposit remains in the account, as interest typically accrues over time. A security deposit with interest can provide financial benefits, so it’s worth understanding these calculations.

Calculating interest for a deposit involves multiplying the principal amount by the interest rate and the time period. For a security deposit with interest, ensure you apply the correct compounding method as specified by your lease or local laws. This calculation is essential in understanding how much your security deposit may grow over time.

To calculate your rent deposit, landlords often require a specific amount, typically one month's rent, or a percentage of the total rental amount. Ensure that you understand your lease agreement, as it may specify the exact security deposit with interest that is required. Utilizing platforms like US Legal Forms can help clarify these requirements and provide necessary documentation.

Interest on deposit accounts is typically calculated based on the account balance and the interest rate offered by the bank or financial institution. This calculation can vary by institution, but generally, interest is compounded daily, monthly, or annually. It's important to understand that a security deposit with interest can yield additional earnings over time, which benefits renters and landlords alike.

In Connecticut, landlords must return security deposits within 30 days after the lease ends, along with any interest that has accrued. If any deductions are made for damages, landlords must provide a written notice explaining these charges. This law ensures that tenants receive their rightful deposit back, promoting fairness in rental agreements. For a better understanding of your rights regarding security deposit with interest, resources like US Legal Forms can be very helpful.

In Colorado, landlords have one month to return the security deposit after the tenant leaves the property. If there are any deductions for damages, landlords must provide a detailed list of these charges along with the remaining deposit amount. Knowing this timeframe is crucial for tenants to ensure they receive their security deposit with interest in a timely manner. If you have questions about this process, consider using platforms like US Legal Forms for assistance.

If your landlord fails to return your security deposit within the required 30-day period, you have the right to take action. You can start by contacting your landlord to request the return and remind them of their legal obligation. If they still do not comply, you may consider filing a complaint or pursuing legal action to recover your deposit, including any interest owed. Resources like US Legal Forms can provide necessary documentation and guidance on how to proceed.

Colorado law states that landlords must return the security deposit within one month after the tenant vacates the property. If the landlord withholds any part of the deposit for damages, they must provide an itemized list of those deductions. Importantly, Colorado law also requires landlords to return any interest accrued on the deposit if it exceeds a certain amount. Being aware of these regulations surrounding security deposit with interest can help you secure your rightful funds.

As a tenant, you have the right to receive your security deposit back, along with any interest earned, under the terms of your lease agreement. If you leave the property in good condition and meet the terms outlined in your lease, your landlord must return your deposit promptly. If there are deductions, your landlord must provide an itemized list of any damages. Understanding your rights regarding a security deposit with interest can help you navigate this process smoothly.