Joint Tenancy Vs Tenants By The Entirety

Description

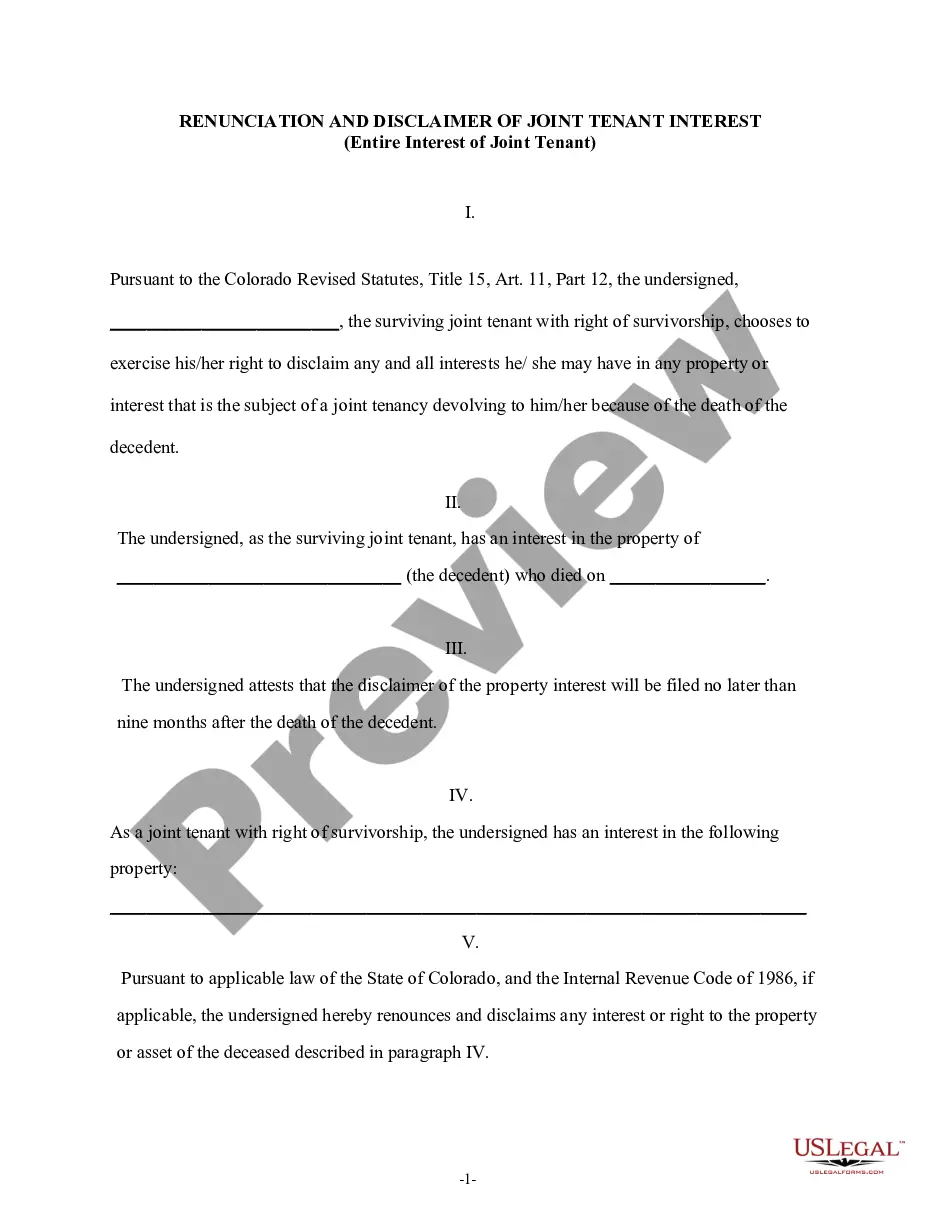

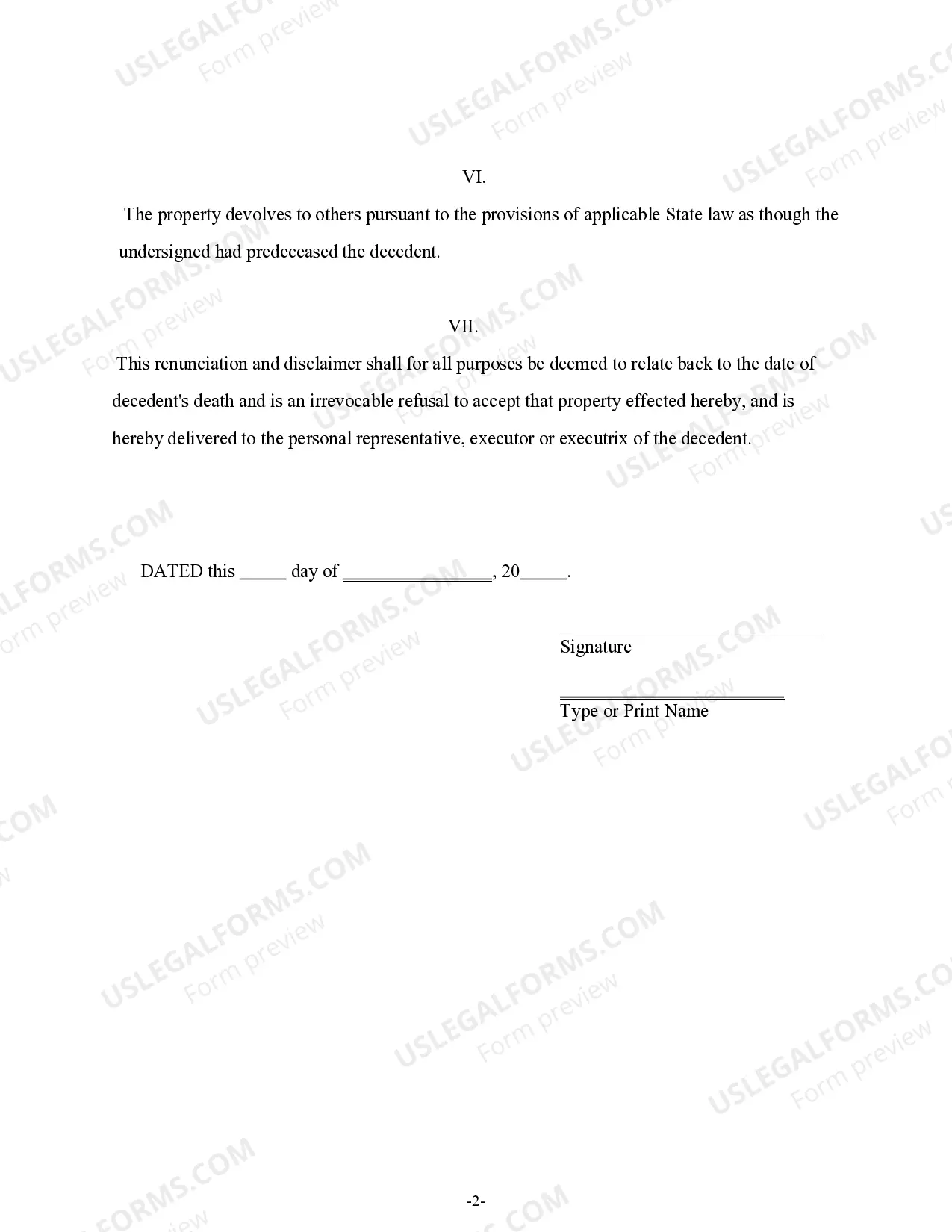

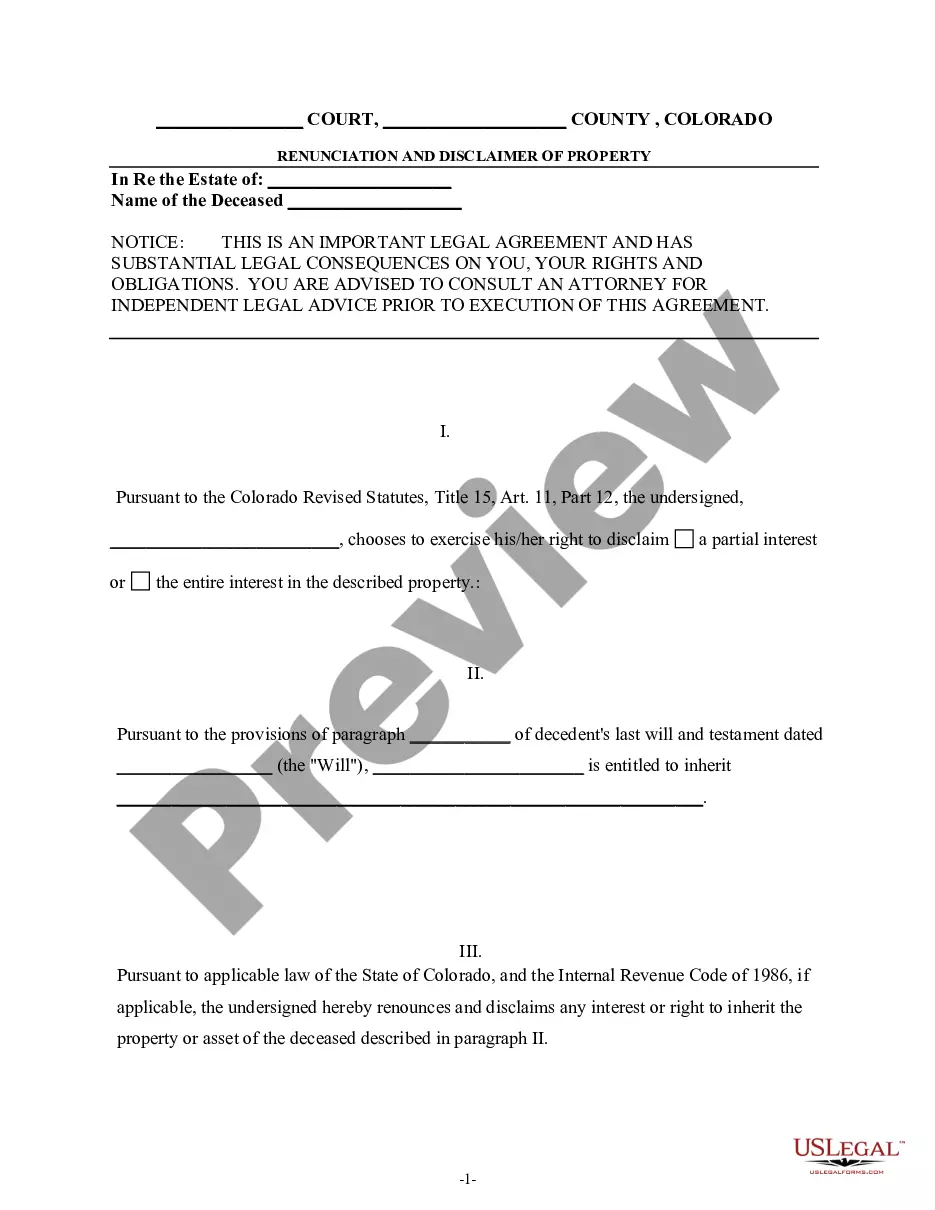

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- If you already have a US Legal Forms account, log in to access your documents. Ensure your subscription is still active; renew if necessary.

- For first-time users, start by examining the Preview mode and form description to find a template that aligns with your needs and complies with local regulations.

- If the current form isn’t what you require, utilize the Search tab at the top to locate alternate templates that better match your criteria.

- Once satisfied, click the Buy Now button, select your preferred subscription plan, and create an account to unlock the document library.

- Proceed to payment by entering your credit card information or using PayPal to finalize your subscription.

- After purchase, download the legal document to your device. You can always access it later through the My Forms section of your profile.

US Legal Forms not only offers a vast collection of legal templates—over 85,000 forms—but also connects users to experts who can help ensure accuracy in filling out these documents. This service significantly outperforms competitors in both quantity and quality.

Take control of your legal documentation today! Visit US Legal Forms to get started on navigating the complexities of joint tenancy vs tenants by the entirety.

Form popularity

FAQ

For husbands and wives, tenancy by the entirety typically represents the best vesting option. This structure not only secures equal ownership but also ensures that each spouse has survivorship rights. Additionally, it offers strong protection against individual debtors, making it a safer choice for married couples. If you’re looking for peace of mind in property ownership, consider this method.

Tenancy by the entirety is widely regarded as the best choice for married couples seeking joint ownership of property. This arrangement protects both parties by ensuring that each spouse has equal rights to the property and provides added safeguards against creditors. While joint tenancy can still work for couples, tenancy by the entirety is often the preferred choice due to its unique benefits. Always consider your specific situation when selecting the best tenancy.

The key difference between joint tenancy and tenancy by the entirety lies in ownership structure and legal protections. Joint tenancy permits two or more individuals to own property equally and includes the right of survivorship. Tenancy by the entirety, on the other hand, is exclusive to married couples and provides added legal protection, particularly against claims from creditors. Understanding these distinctions can help you choose the most suitable option.

Deciding whether joint tenancy or tenancy by the entirety is better relies on your financial situation and goals. Tenancy by the entirety typically offers stronger legal protections for married couples, especially against creditors. However, joint tenancy might be more suitable if you want quieter ownership arrangements with the ability to include additional owners in the future. Review both options carefully to make the best choice.

For married couples, tenancy by the entirety is often considered the best option. This arrangement provides unique advantages, such as survivorship rights and protection from individual creditors. In contrast, joint tenancy offers similar benefits but may not provide as much protection for one spouse against financial claims. Choosing between joint tenancy and tenants by the entirety ultimately depends on your circumstances.

The best deed for a married couple often depends on their specific needs and situation. Joint tenancy and tenancy by the entirety are two common options. Joint tenancy allows for equal ownership, and if one owner passes away, the other automatically inherits their share. Tenancy by the entirety is only available to married couples and offers additional protections against creditors.

Tenancy by the entirety has specific disadvantages that couples should consider when comparing it to joint tenancy vs tenants by the entirety. One key drawback is that this form of ownership is only available to married couples, making it inaccessible for others. Additionally, in the event of divorce, the property can automatically transform into a different ownership structure, complicating asset division. Moreover, if one spouse has significant debt, creditors can potentially target only the debtor's share, leaving the other spouse vulnerable.

Both joint tenancy and tenancy by the entirety feature a right of survivorship, meaning that when one owner passes away, their interest in the property automatically transfers to the surviving owner. This aspect provides security to couples and partners, ensuring that their shared investment remains intact without the need for probate. Understanding the differences and similarities of joint tenancy vs tenants by the entirety can guide you in choosing the most suitable ownership structure. At US Legal Forms, we offer resources and documents to help you navigate these important legal decisions.

One potential downside of tenants by the entirety is the restriction on ownership transfer. Both partners must agree to any sale or transfer, which can complicate matters if one partner wishes to move or sell. Additionally, this form of ownership offers limited options for divisibility; upon the death of one spouse, the property automatically transfers to the surviving spouse, which may not be desirable in all situations. When considering joint tenancy vs tenants by the entirety, it is crucial to evaluate your unique circumstances and goals.