Laws For Married Couples

Description

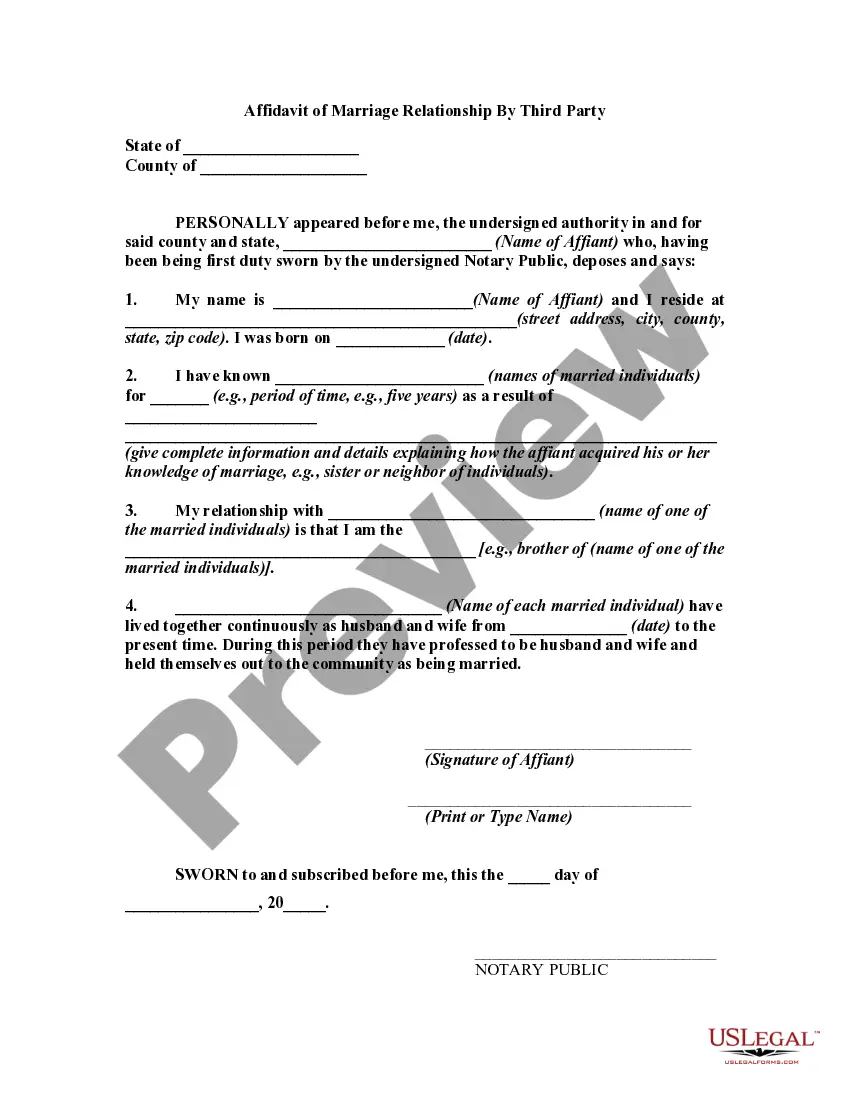

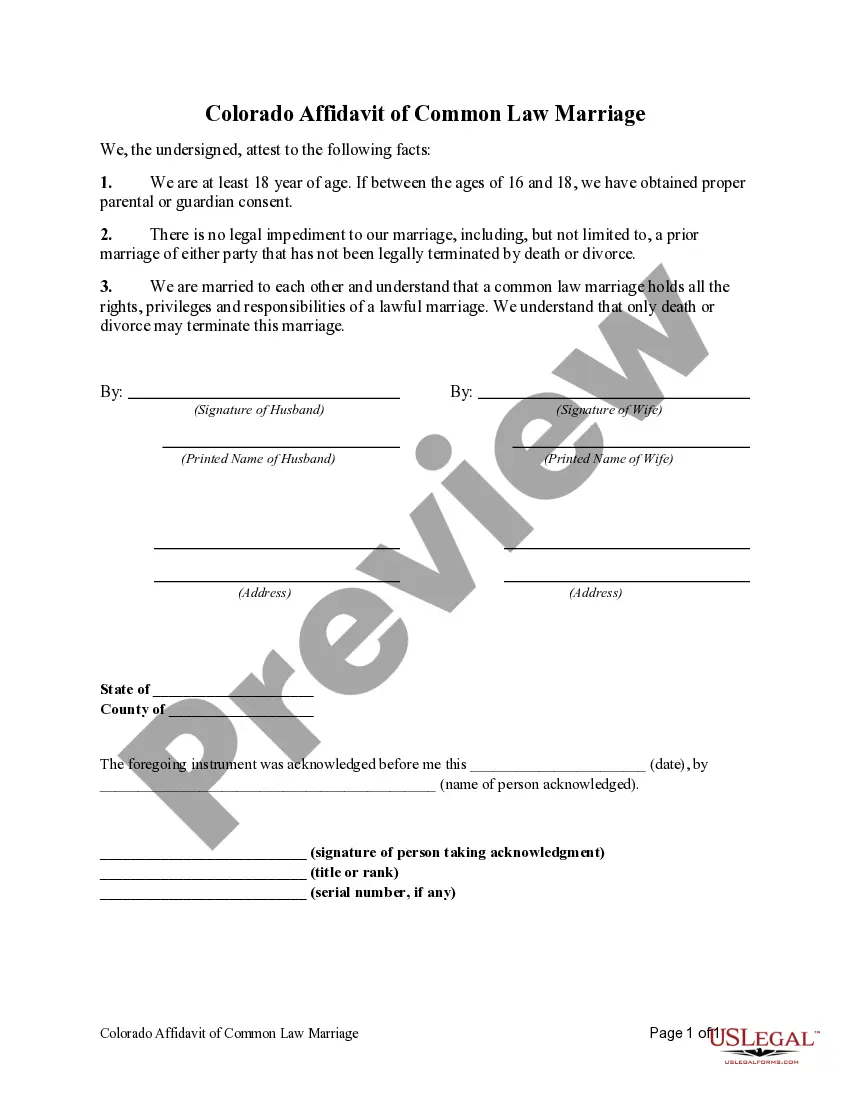

How to fill out Colorado Affidavit Of Common Law Marriage?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more cost-effective way of preparing Laws For Married Couples or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific forms diligently prepared for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Laws For Married Couples. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Laws For Married Couples, follow these recommendations:

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Check if template you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Laws For Married Couples.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

How do I fill out a W4 after marriage? Update personal information. The name on your tax return must match your name on file with the Social Security Administration (SSA). ... Determine your filing status. ... 2: Account for multiple jobs. ... 3: Claim any dependents. ... 4: Change your withholdings (optional)

If you're married, you can claim two allowances ? one for you and one for your spouse. * You can divide your total allowances whichever way you prefer, but you can't claim an allowance that your spouse claims too.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.