Common Law Colorado Without Will

Description

How to fill out Colorado Affidavit Of Common Law Marriage?

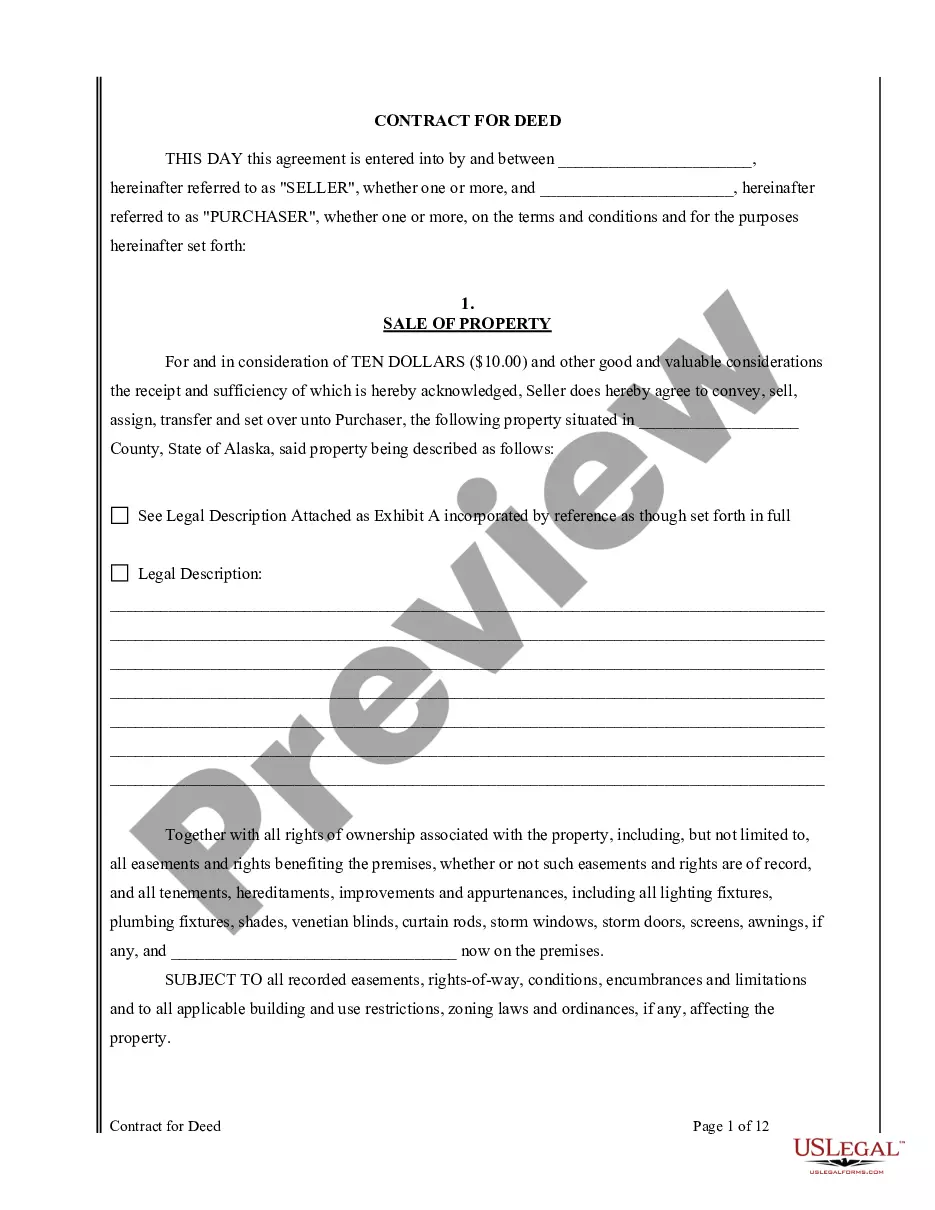

The Common Law Colorado Without Will you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Common Law Colorado Without Will will take you just a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, make use of the search option to get the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Choose the format you want for your Common Law Colorado Without Will (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a eSignature.

- Download your papers again. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

In other words, in Colorado, a common law marriage is exactly the same as a ceremonial marriage and the only way to have it terminated is through a divorce.

You usually must be married to file together. However, if you are non-married but want to file a joint return, it is possible you can use married filing jointly if you're considered married under a common law marriage recognized by either of these: The state where you live. The state where the common-law marriage began.

How long do we have to live together to have a common-law marriage? There is no time requirement for establishing a common law marriage in Colorado. A common law marriage could possibly be valid after one day. Or you could live together with your boyfriend/girlfriend for decades but not be common-law married.

Colorado has recognized common law marriage as legal and binding since 1877 and is 1 of 12 states to do so. A common law marriage is established when the parties mutually consent to be husband and wife. Common law marriage does not require any license, ceremony or documentation to be legal.

Colorado has recognized common law marriage as legal and binding since 1877 and is 1 of 12 states to do so. A common law marriage is established when the parties mutually consent to be husband and wife. Common law marriage does not require any license, ceremony or documentation to be legal.