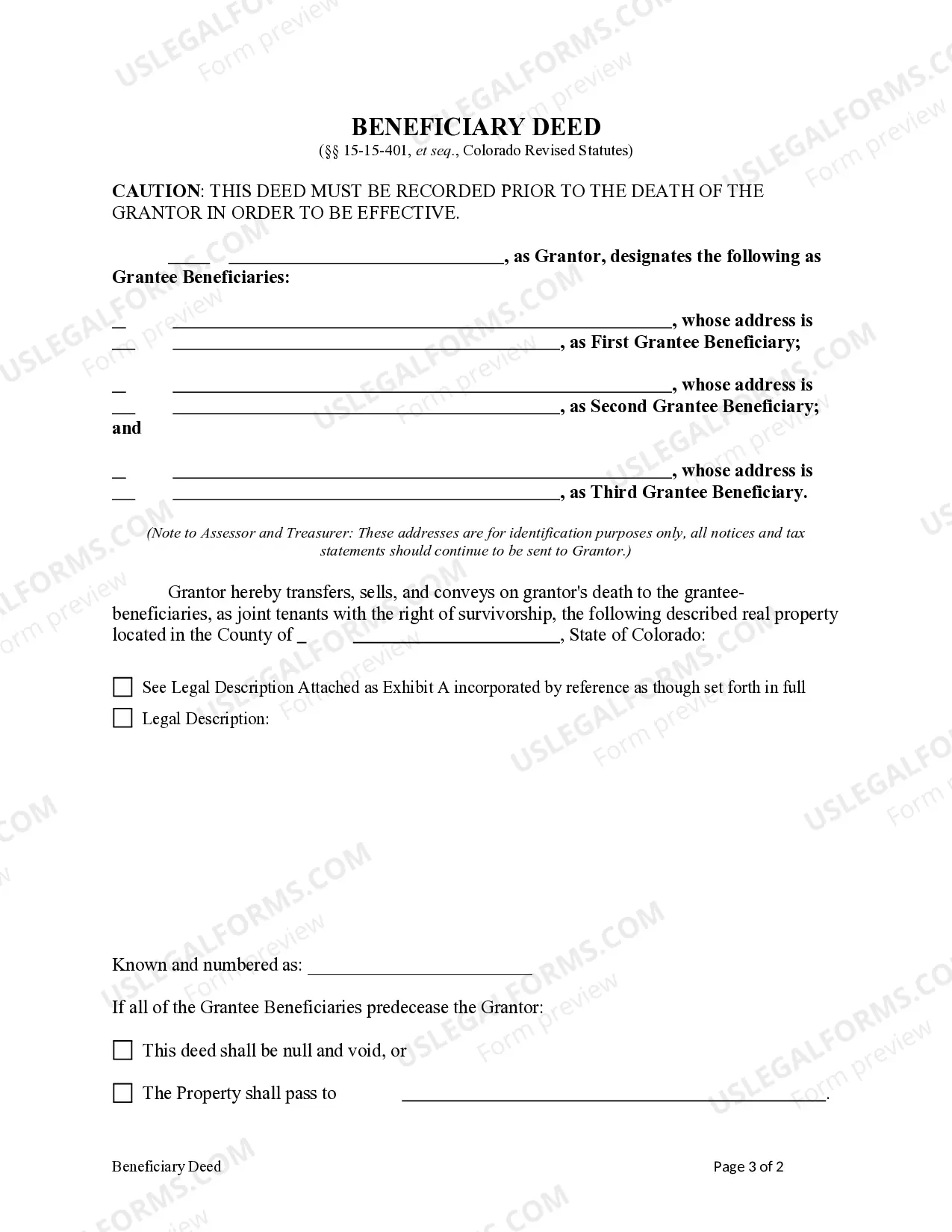

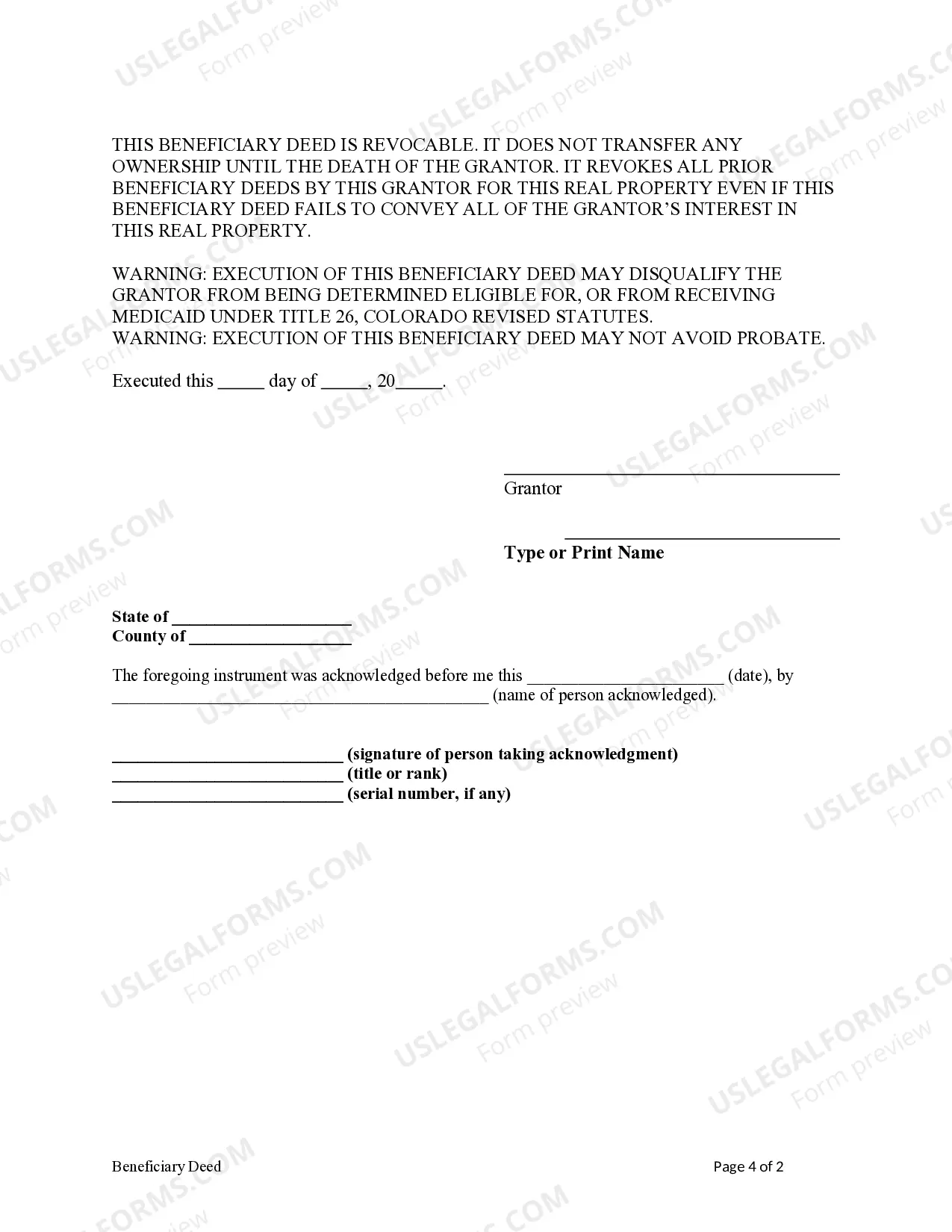

This form is a Beneficiary Deed where the Grantor is an individual and there are three Grantee Beneficiaries. The Grantees take the property as joint tenants with the right of survivorship upon the death of the Grantor. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This deed complies with all state statutory laws.

Transfer On Death Deed With Mortgage

Description

How to fill out Colorado Beneficiary Deed - Individual To Three Individuals?

Managing legal documents can be overwhelming, even for the most seasoned professionals.

When seeking a Transfer On Death Deed With Mortgage and unable to dedicate time to find the right and current version, the tasks can be taxing.

US Legal Forms accommodates all your needs, from personal to business paperwork, in a single location.

Utilize advanced tools to complete and manage your Transfer On Death Deed With Mortgage.

Here are the steps to follow after acquiring the form you need: Validate that it is the correct document by reviewing it and checking its details.

- Access a valuable resource library of articles, guides, and materials related to your situation and requirements.

- Save time and energy finding the documents you require, and use US Legal Forms’ sophisticated search and Preview tool to locate and download your Transfer On Death Deed With Mortgage.

- If you have a subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Visit the My documents tab to review the documents you’ve previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account to gain unlimited access to all the benefits of the library.

- An extensive web form library can be a significant advantage for individuals looking to successfully manage these circumstances.

- US Legal Forms is a leading provider in online legal forms, offering over 85,000 state-specific legal documents accessible whenever needed.

- With US Legal Forms, you can access state- or county-specific legal and organizational documents.

Form popularity

FAQ

You do not need a lawyer to create a transfer on death deed with mortgage, but having legal support can be helpful. An attorney can assist in clarifying your options and navigating the legal landscape involved in estate planning. Furthermore, using a resource like U.S. Legal Forms equips you with the necessary tools and information to ensure your deed aligns with your wishes and state laws.

One drawback of a transfer on death deed with mortgage is that it does not protect the property from creditors. If the original owner has outstanding debts, those may affect the heirs after the transfer. Additionally, complications may arise if the beneficiary does not wish to assume the mortgage or if there are disagreements among heirs, leading to potential disputes.

While you do not necessarily need an attorney to create a transfer on death deed with mortgage, seeking professional assistance can be beneficial. An attorney can provide valuable guidance on the intricacies of state laws and ensure that your deed complies with all legal requirements. Using a reliable platform like U.S. Legal Forms can also help simplify the process and ensure you have the correct documentation.

In Illinois, to create a valid transfer on death deed with mortgage, you must meet specific requirements. The deed needs to be in writing, signed by the property owner, and recorded with the county recorder's office. Additionally, the deed must clearly state the beneficiary's name and describe the property accurately to ensure the transfer is effective upon the owner's death.

Yes, a mortgage can be transferred upon death, but it’s essential to understand that the transfer on death deed with mortgage may complicate matters. The mortgage typically remains with the property, meaning that the heir must continue to make payments to avoid foreclosure. Additionally, the transfer on death deed allows for a smoother transition of property ownership without going through probate, but it does not eliminate the mortgage obligations.

Using a transfer on death deed with mortgage can help you circumvent inheritance tax on your property in many cases. By designating a benefactor while retaining full control of the property during your lifetime, you can avoid certain tax implications. However, it’s important to ensure that your estate planning aligns with current tax laws. Utilizing resources from UsLegalForms can provide guidance to optimize your property transfer process efficiently.

Typically, a transfer on death deed with mortgage does not trigger immediate taxation for the inheritor. However, any gains realized from the property could be subject to capital gains tax when sold. It’s crucial to understand the tax implications based on your specific situation. Consulting with a tax advisor can help clarify potential liabilities.

The transfer on death deed with mortgage can come with several drawbacks. One major disadvantage is that creditors may still claim against the property, even after your passing. Additionally, if the property owner has outstanding debts, this could complicate the transfer process. It's essential to consult with a legal expert to weigh these factors before using a transfer on death deed.

While it's possible to transfer a deed without an attorney, doing so requires careful attention to detail to avoid legal complications. If you're using a transfer on death deed with mortgage, it's crucial to understand the implications on both the property and any associated debt. Many find that using templates from platforms like US Legal Forms simplifies the process and ensures compliance with state laws. Taking these precautions can save you time and potential issues down the line.

Yes, Florida allows transfer on death deeds, which can be an effective way to transfer property ownership without going through probate. This type of deed enables property owners to designate beneficiaries who will receive the property upon their death. However, it's essential to consider any existing mortgages, as the transfer on death deed with mortgage can impact how debts are handled. Utilizing legal resources like US Legal Forms can help you navigate these details.