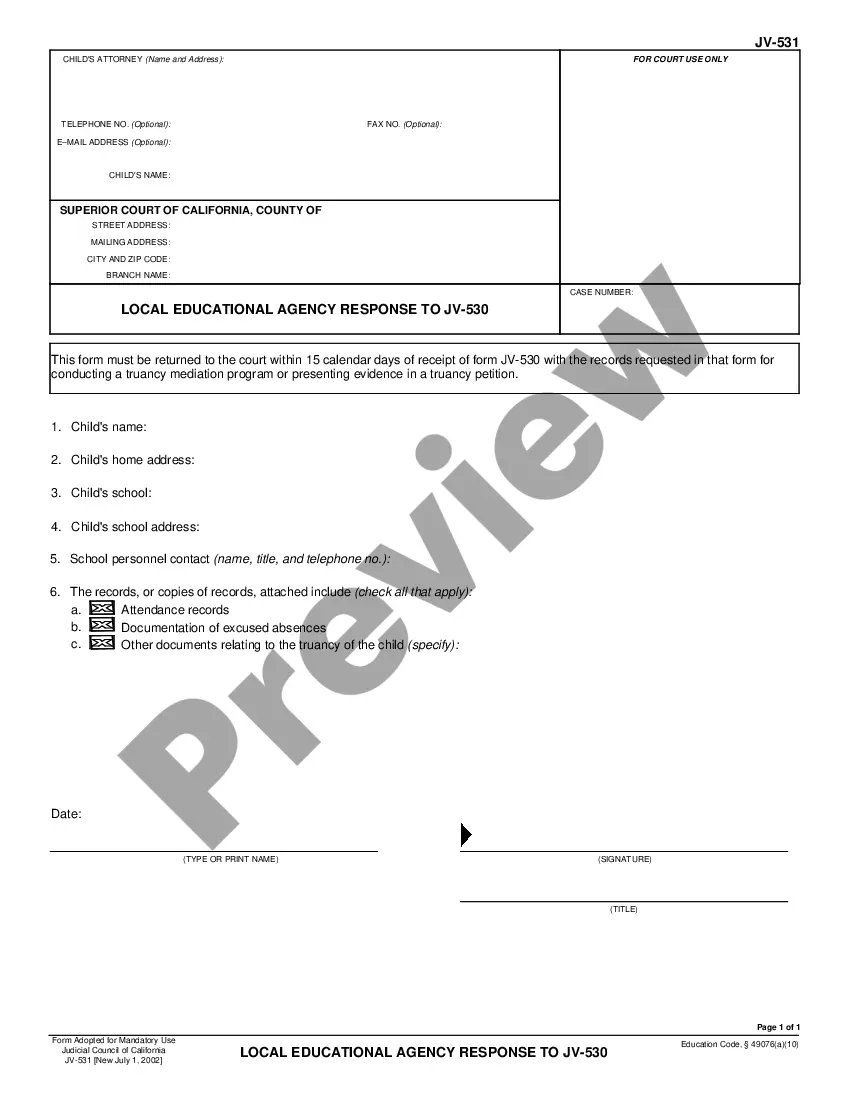

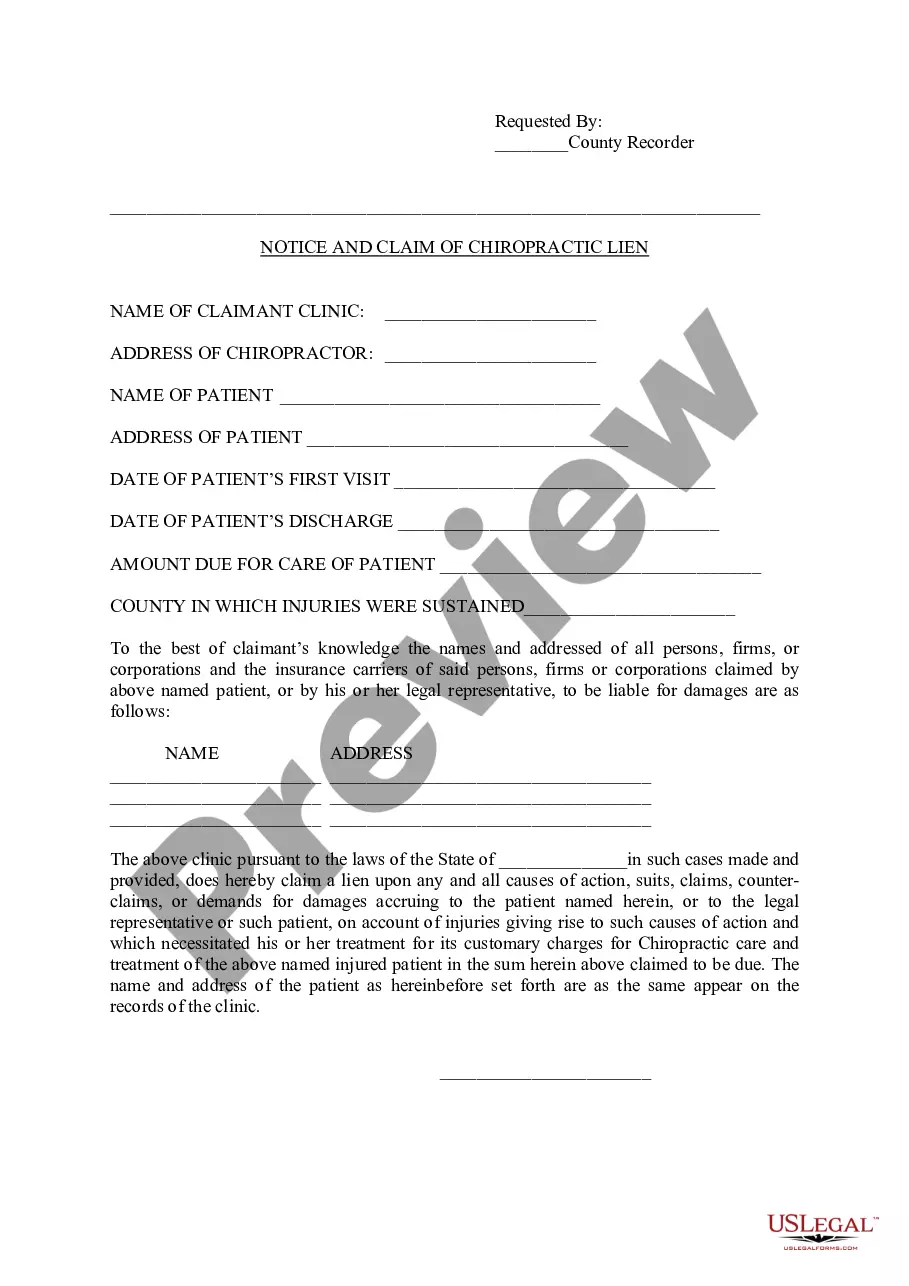

This form is a Personal Representative's Deed of Distribution where the grantor is the Personal Representative of an estate and the grantees are the beneficiaries of the estate. Grantor conveys the described property to the grantees. The Grantor warrants the title only as to events and acts while the property is held by the Personal Representative. This deed complies with all state statutory laws.

Colorado Deed Personal Co Withholding

Description

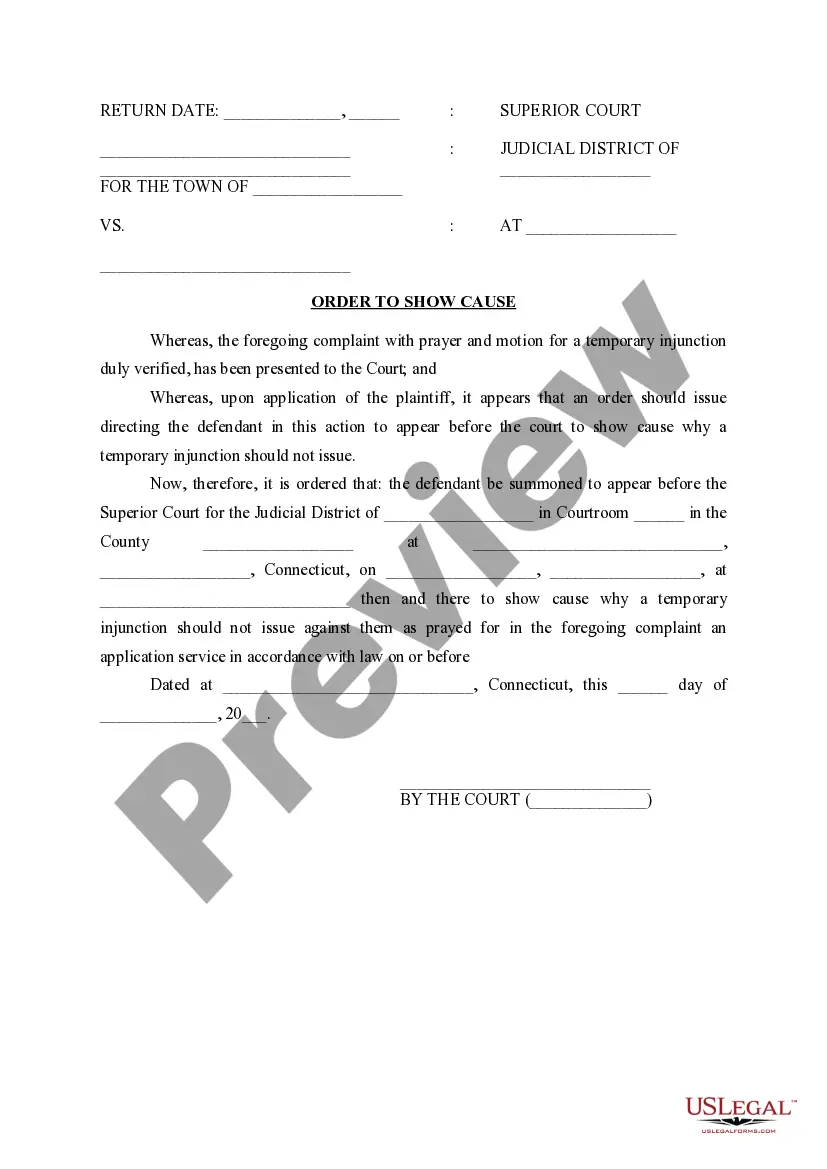

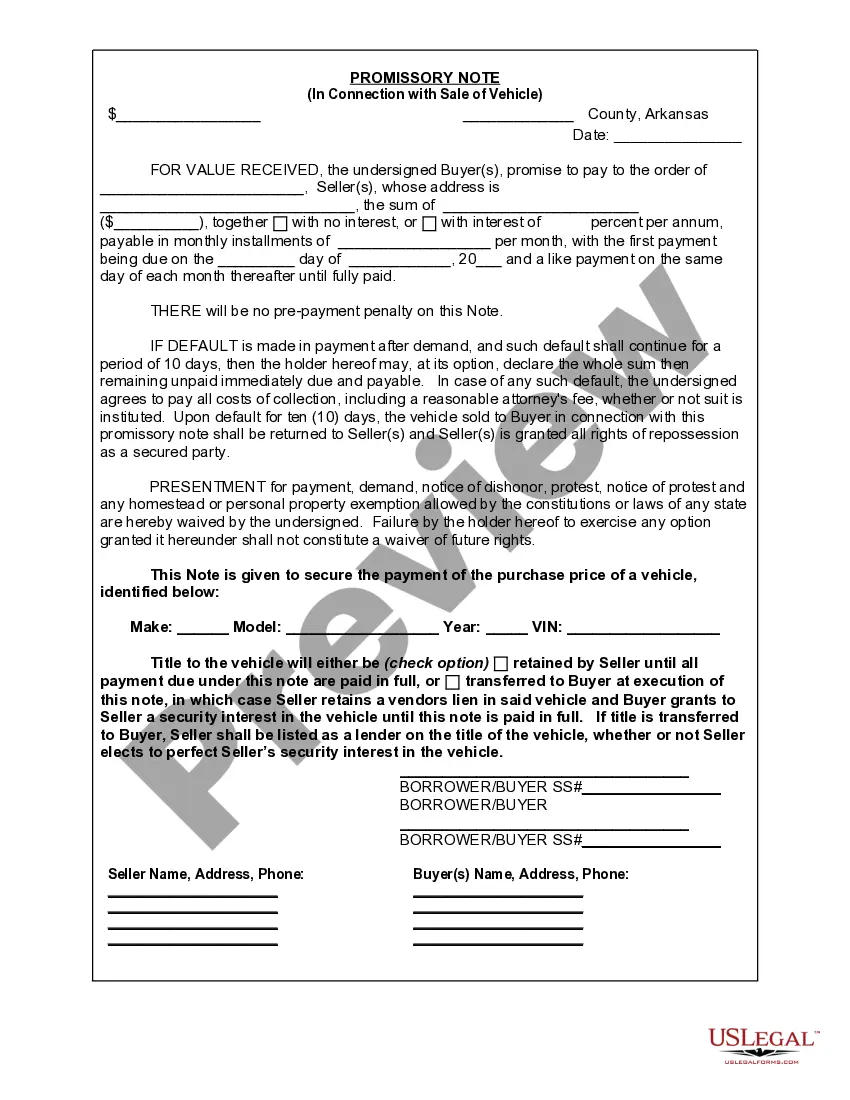

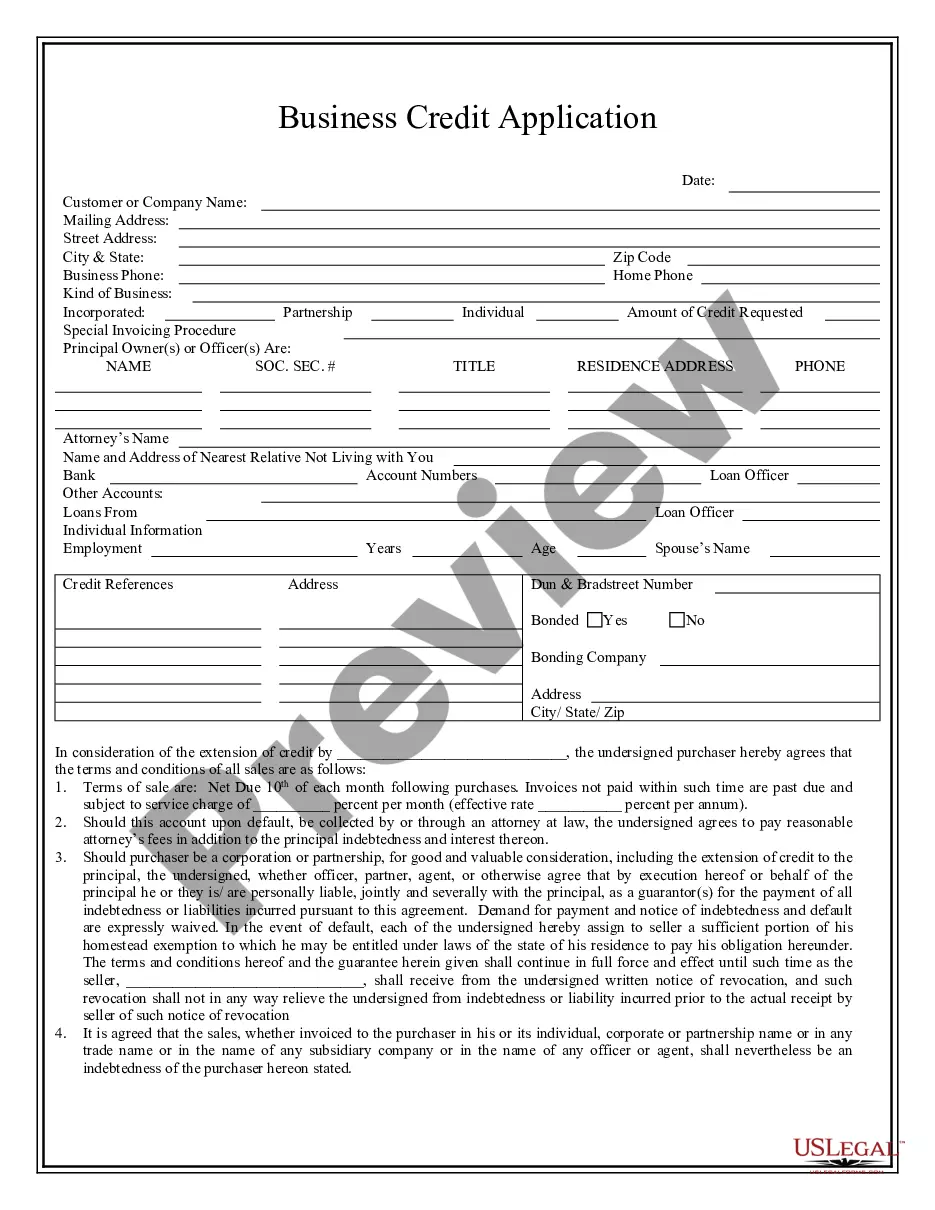

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Working with legal paperwork and operations can be a time-consuming addition to the day. Colorado Deed Personal Co Withholding and forms like it usually need you to search for them and navigate how to complete them appropriately. Therefore, if you are taking care of economic, legal, or personal matters, using a extensive and practical online catalogue of forms close at hand will greatly assist.

US Legal Forms is the best online platform of legal templates, offering more than 85,000 state-specific forms and a number of resources that will help you complete your paperwork effortlessly. Explore the catalogue of relevant documents available with just one click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Safeguard your document administration operations by using a high quality service that allows you to prepare any form within a few minutes with no additional or hidden cost. Just log in to the account, locate Colorado Deed Personal Co Withholding and download it straight away in the My Forms tab. You can also gain access to formerly saved forms.

Would it be the first time using US Legal Forms? Register and set up a free account in a few minutes and you’ll have access to the form catalogue and Colorado Deed Personal Co Withholding. Then, adhere to the steps listed below to complete your form:

- Be sure you have the proper form using the Preview option and reading the form information.

- Pick Buy Now once ready, and choose the subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise assisting users manage their legal paperwork. Obtain the form you want right now and improve any process without breaking a sweat.

Form popularity

FAQ

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

This Certificate is Optional for Employees. If you do not complete this certificate, then your employer will calculate your Colorado withholding based on your IRS Form W-4.

The amount withheld will be the lesser of two percent of the sales price of the interest in the property or the net proceeds that would otherwise be due to the seller as shown on the closing settlement statement.

Colorado 2% Withholding (DR 1083) In general, sales of Colorado real property valued at more than $100,000 and made by non-residents of Colorado, are subject to a withholding tax in anticipation of any Colorado income tax that could be due on the gain of the sale.