Co Deed Form Withholding

Description

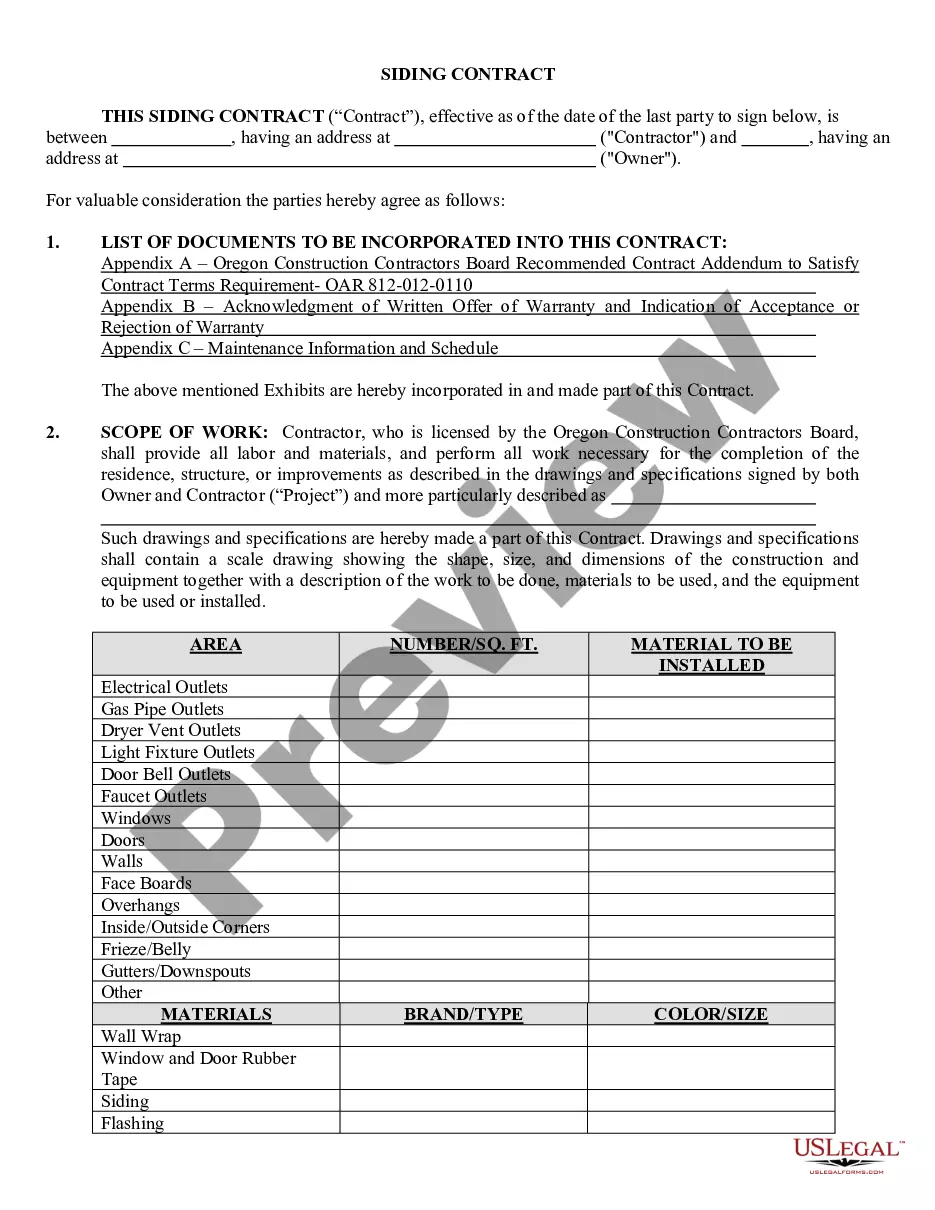

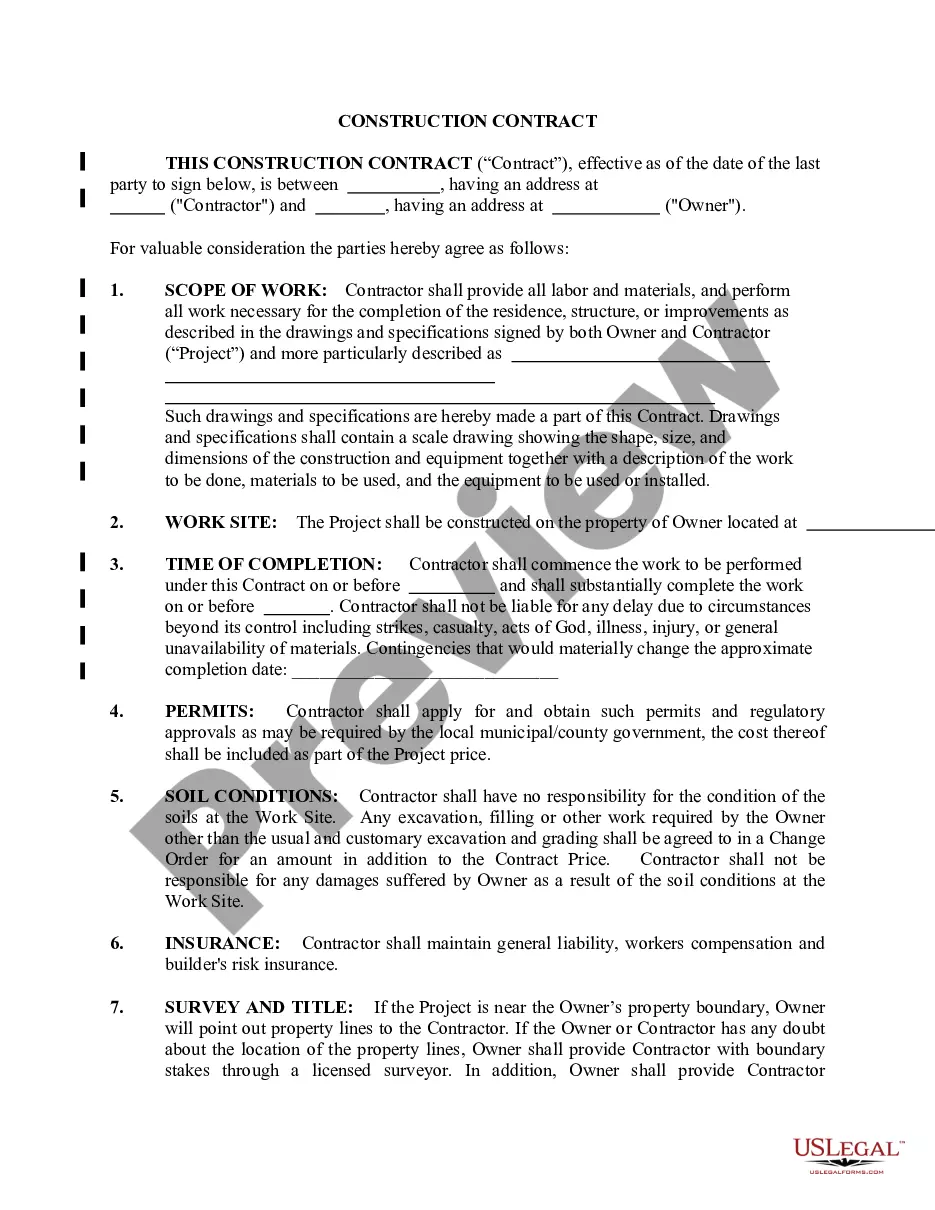

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Managing legal documents can be daunting, even for the most seasoned professionals.

When you're searching for a Co Deed Form Withholding and lack the time to dedicate to finding the appropriate and current version, the process can be challenging.

US Legal Forms fulfills any requirements you may have, from personal to business paperwork, all in one location.

Utilize advanced tools to complete and manage your Co Deed Form Withholding.

Here are the steps to follow after obtaining the form you require: Ensure it is the correct form by previewing it and reviewing its description. Confirm that the template is valid in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you need, and Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Improve your daily document management through a simple and user-friendly process today.

- Access a wealth of articles, guides, and resources related to your situation and requirements.

- Save time and effort searching for the documents you need, and utilize US Legal Forms’ sophisticated search and Review tool to find Co Deed Form Withholding and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents section to view the documents you've previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- A comprehensive online form database can be transformative for anyone aiming to handle these matters effectively.

- US Legal Forms is a leader in the online legal form industry, offering over 85,000 state-specific legal documents available to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

The number of withholding allowances you should claim depends on your personal circumstances, such as your marital status and number of dependents. Generally, more allowances mean less tax withheld, while fewer allowances lead to more tax withholding. It's advisable to use the IRS withholding calculator to determine the optimal number for your situation. A Co deed form withholding can also assist in accurately reporting your allowances and ensuring compliance.

Filling out your withholding form starts with gathering your personal information, such as your name and Social Security number. Next, follow the instructions carefully to report your filing status and any dependents. Be sure to calculate your withholding allowances based on your financial situation. Utilizing a Co deed form withholding can streamline this process and provide clear guidance.

To fill out a withholding exemption, begin by locating the appropriate form for your state. You will typically provide your personal information, including your name, address, and Social Security number. Then, indicate any exemptions you qualify for, which will help determine the correct amount of taxes withheld. Using a Co deed form withholding can simplify this process, ensuring accuracy and compliance.

The amount withheld will be the lesser of two percent of the sales price of the interest in the property or the net proceeds that would otherwise be due to the seller as shown on the closing settlement statement.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

DR 0004. Colorado Employee Withholding Certificate ? This form gives employees the option to adjust their Colorado wage withholding ing to their specific tax situation. If an employee does not submit this form, the employer will calculate their withholding based on their federal withholding certificate, form W-4.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.