Factura De Venta De Carro Formato Excel

Description

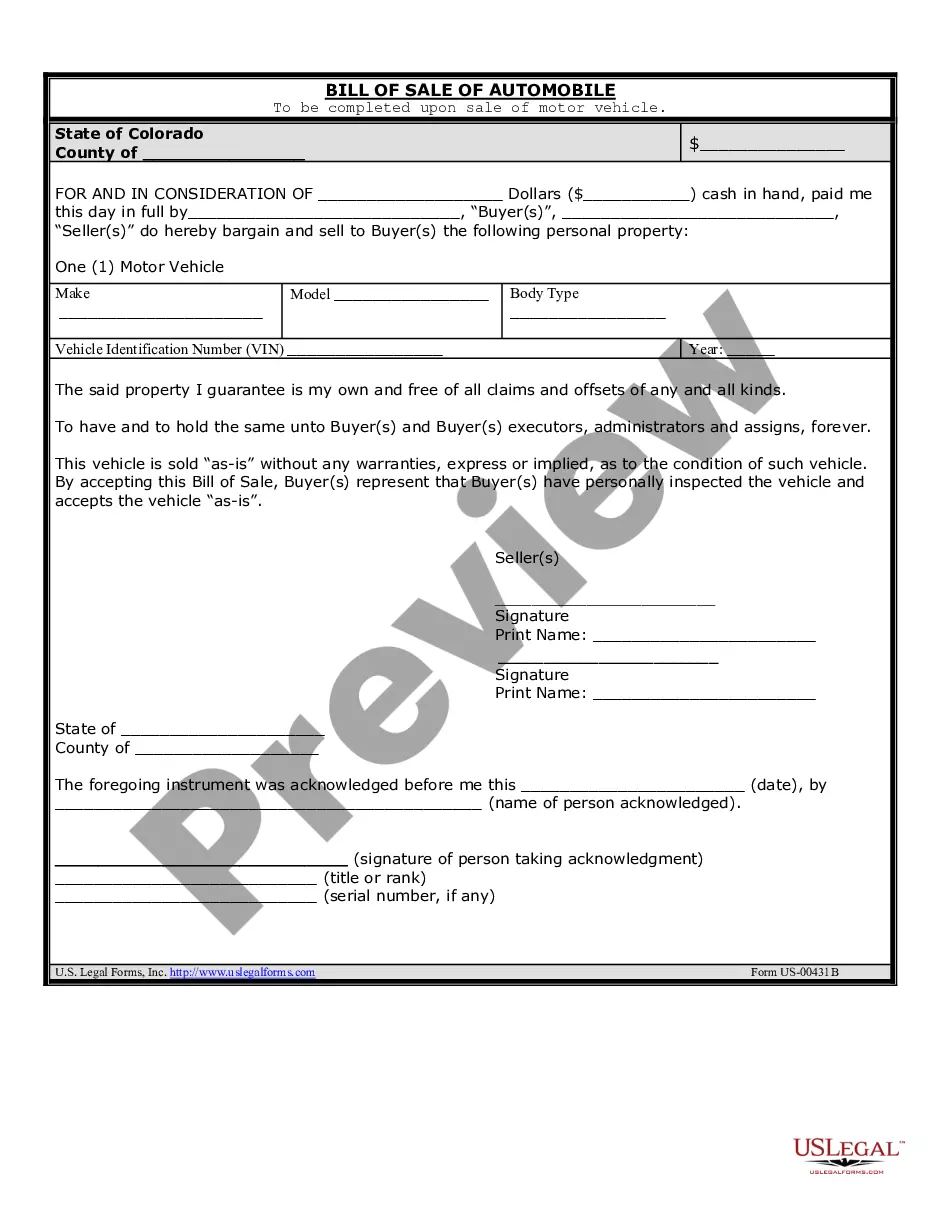

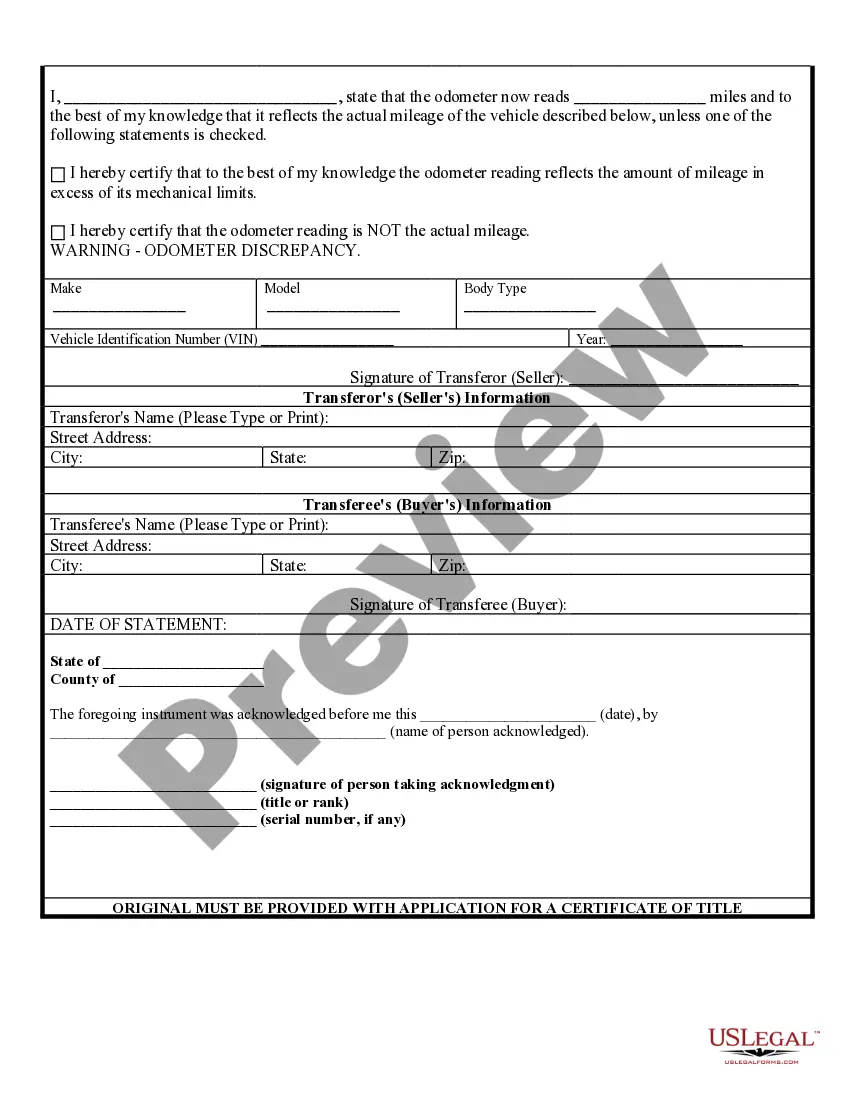

How to fill out Colorado Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Finding a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the correct legal documents requires accuracy and attention to detail, which is why it's essential to obtain samples of Factura De Venta De Carro Formato Excel exclusively from reputable providers, such as US Legal Forms. An incorrect template can waste your time and complicate your situation.

Eliminate the stress associated with your legal documents. Explore the extensive US Legal Forms library, where you can discover legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Review the form’s details to ensure it meets your state and local requirements.

- If available, preview the form to confirm it is the one you need.

- If the Factura De Venta De Carro Formato Excel doesn’t meet your needs, continue searching for the appropriate document.

- Once you are certain of the form’s relevance, proceed to download it.

- If you are an existing customer, click Log in to verify your identity and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to obtain the template.

- Select the pricing option that best fits your requirements.

- Complete the registration process to finalize your order.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Factura De Venta De Carro Formato Excel.

- Once the form is on your device, you can edit it using the editor or print it out and complete it by hand.

Form popularity

FAQ

After doing so, you'll want to research any local requirements, those enforced by the county or city where you're doing business. Good news, North Carolina doesn't require a ?general? business license at the state-level for Sole Proprietors. So there's nothing to do for this step.

There are also no fees involved with forming or maintaining this business type. If you want to operate a North Carolina sole proprietorship, all you need to do is start working. However, just because it's so easy to get started doesn't mean there aren't some additional steps you should take along the way.

How to start a North Carolina Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.

Checklist required for Sole Proprietorship PAN card of the proprietor. Name and address of the business. Bank account in the name of the business. Registration under the Shop and Establishment Act of the respective state. Registration under GST, if the business turnover exceeds Rs. 20 lakhs.

Naming a sole proprietorship A sole proprietorship has no existence separate from its owner. Therefore, the legal or true name of a sole proprietorship is its owner's full name. But if the business will be operating under a different name, most jurisdictions require that the name be registered.

Does a small company that operates as a sole proprietorship need an employer identification number (EIN)? A sole proprietor without employees and who doesn't file any excise or pension plan tax returns doesn't need an EIN (but can get one).

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File an assumed name with your county register of deeds. Apply for licenses, permits, and zoning clearance. Obtain an employer identification number (EIN).

Differences between LLC and sole proprietorship The most significant difference is whether you have limited liability for the business' debts and obligations, as with an LLC, or whether the business' liabilities and obligations fall to you personally in the event of a lawsuit or debt collection.

How to start a North Carolina Sole Proprietorship Step 1 ? Business Planning Stage. ... Step 2 ? Name your Sole Proprietorship and Obtain a DBA. ... Step 3: Get an EIN from the IRS. ... Step 4 ? Research business license requirements. ... Step 5 ? Maintain your business.

You don't have to register if you're using your legal name. If you plan to create a business name, you'll need to register that with the state. To do so, you need your Social Security Number (SSN), Employer Identification Number (FEIN), and North Carolina Secretary of State Number.