Ca Form Wills For 2022

Description

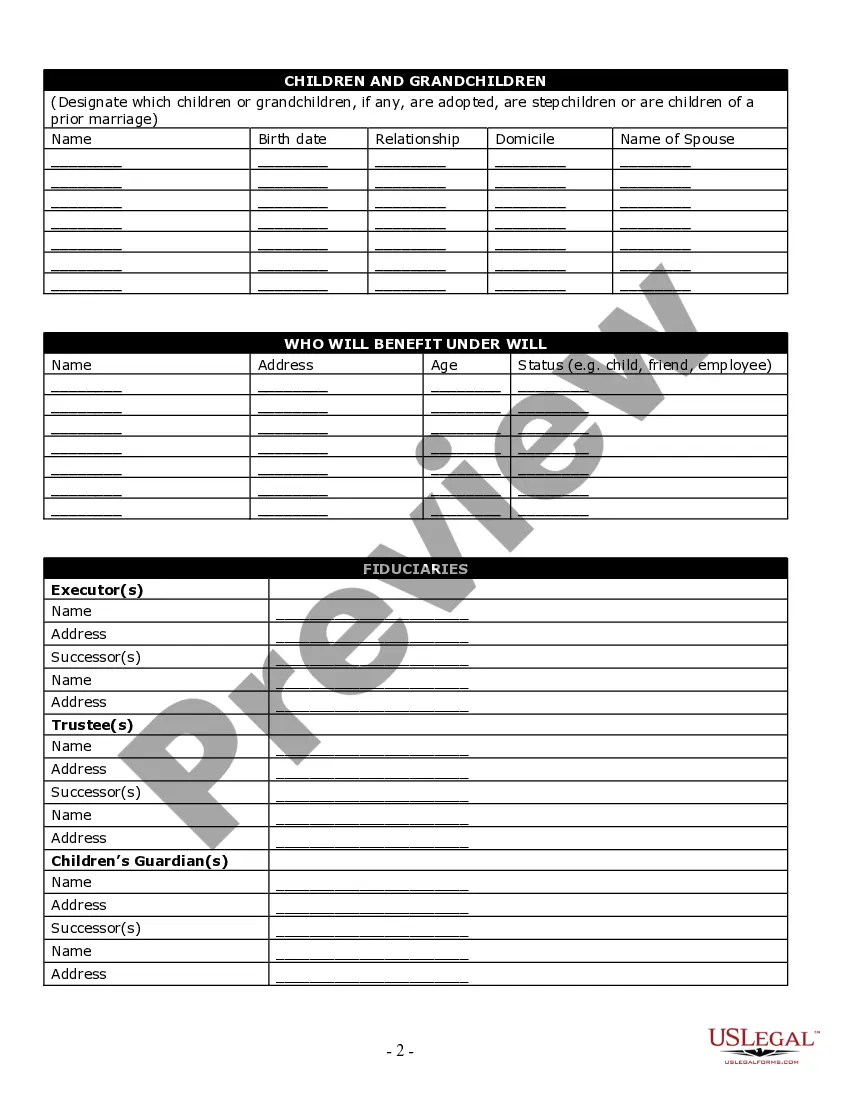

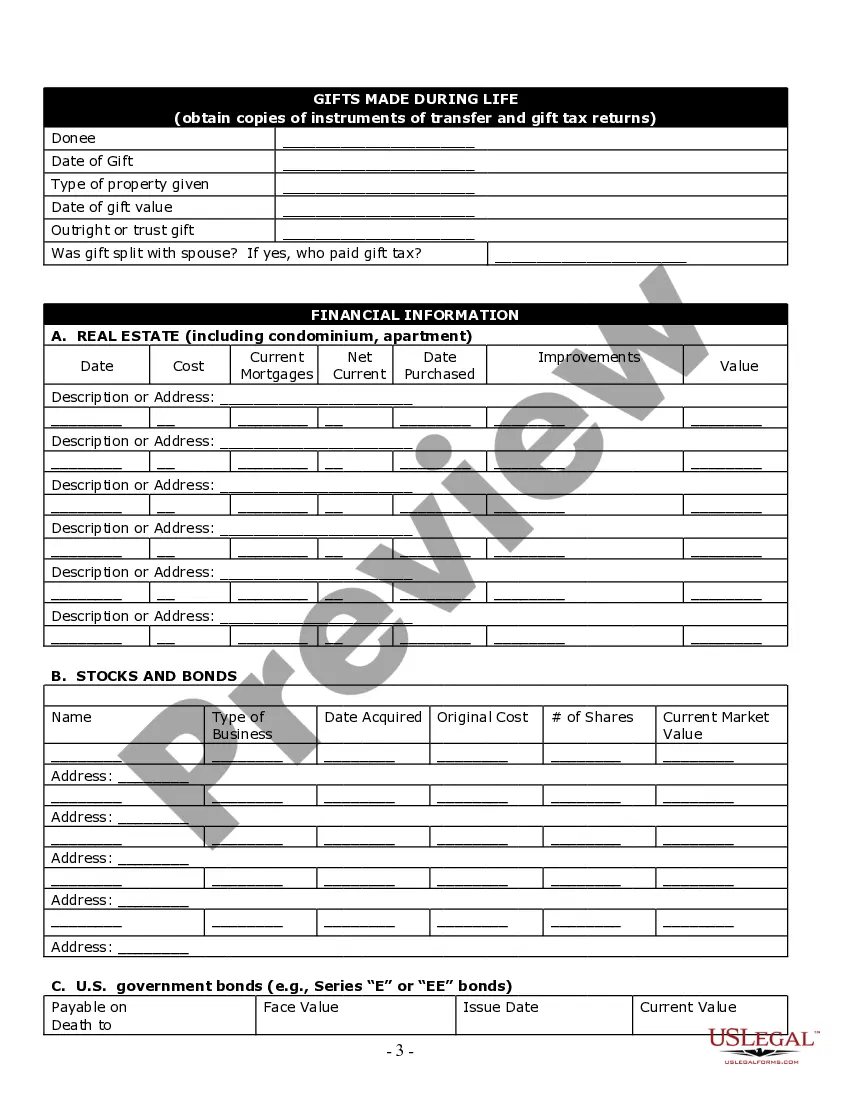

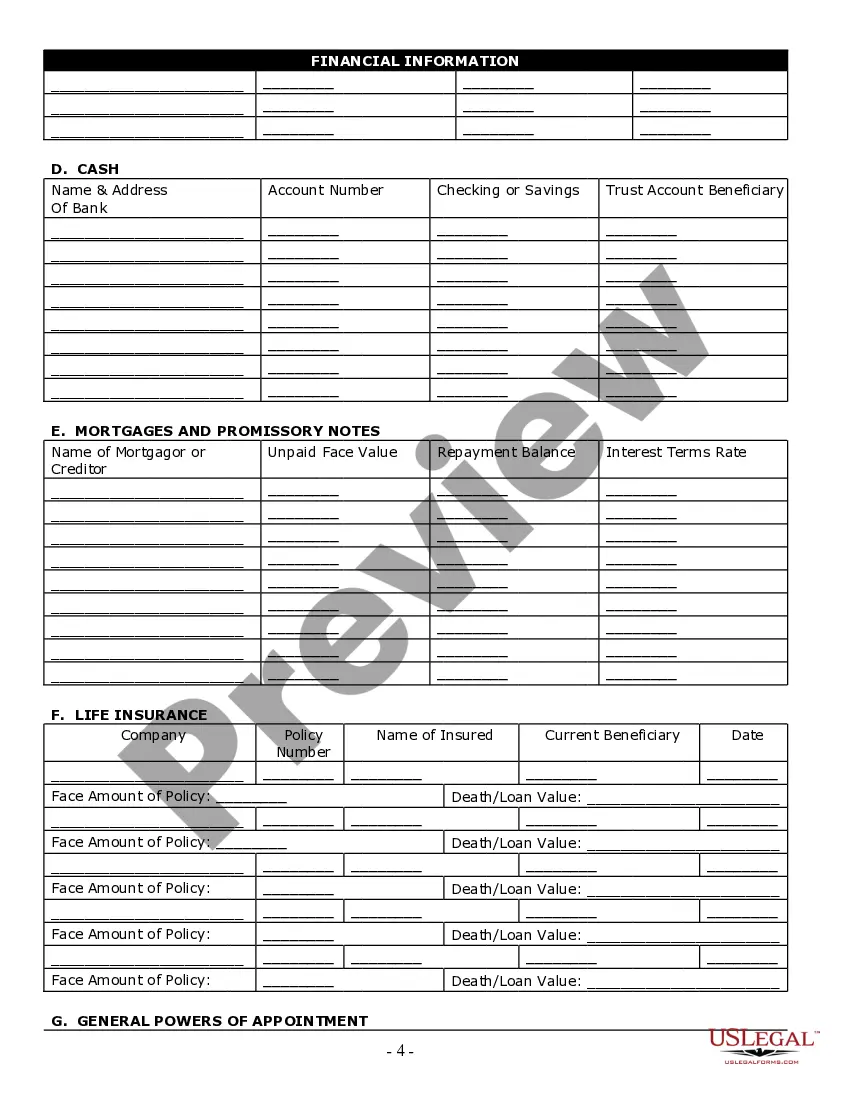

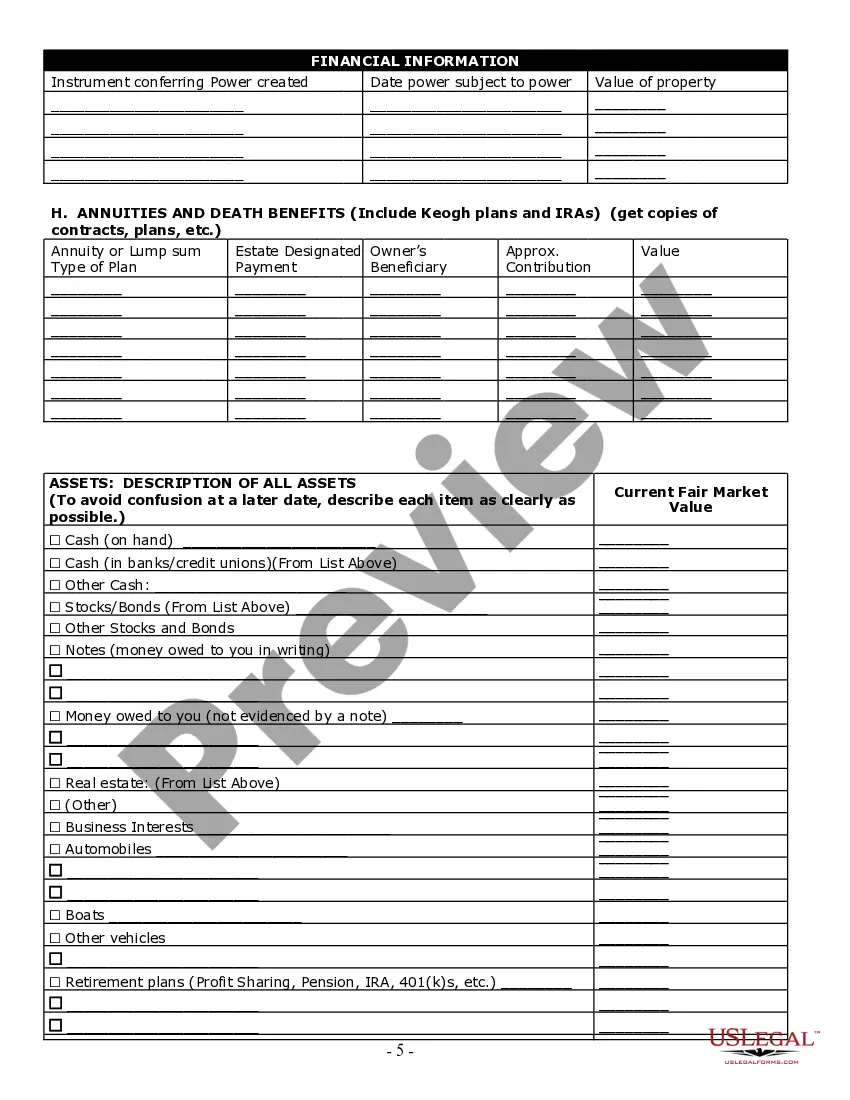

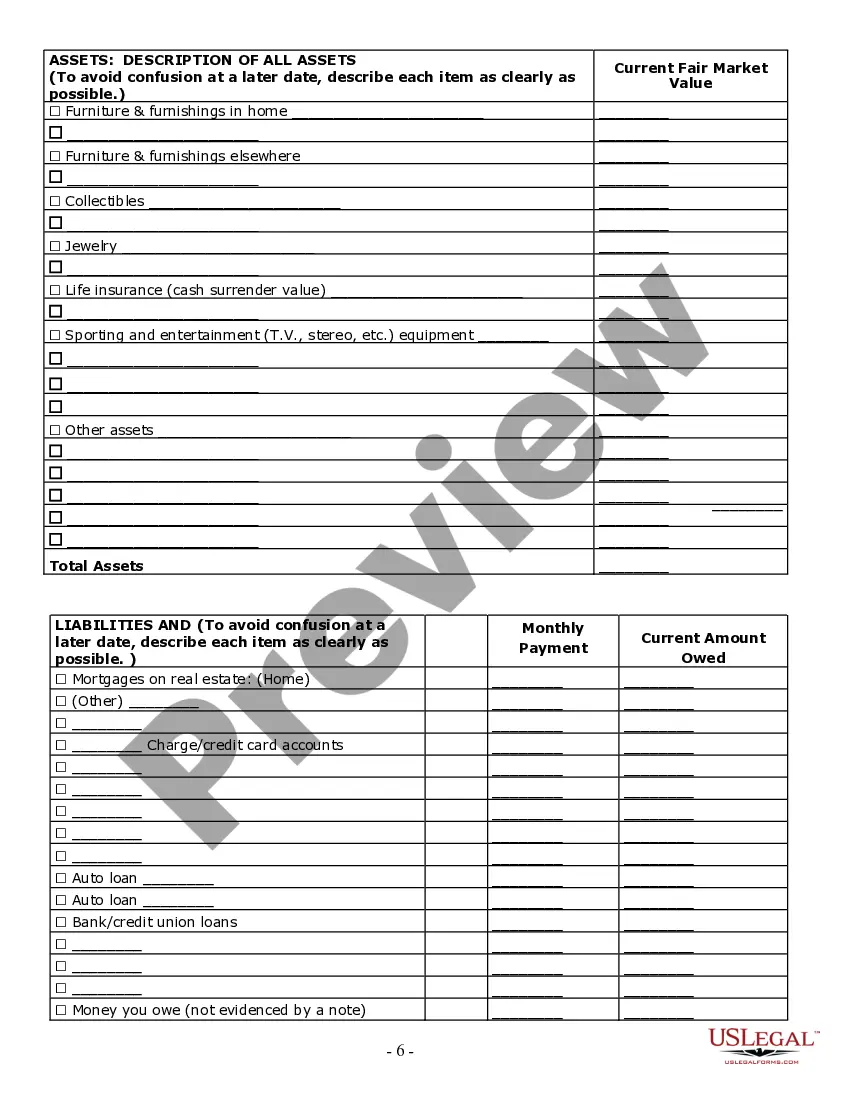

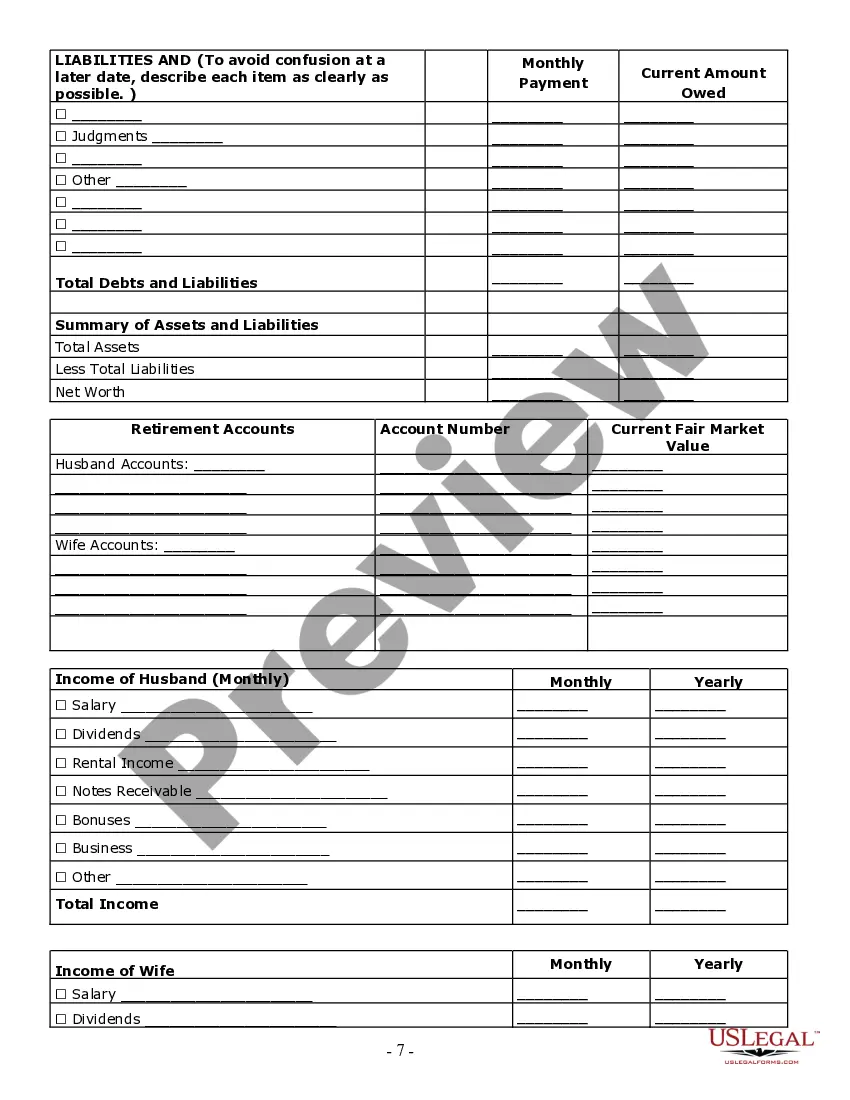

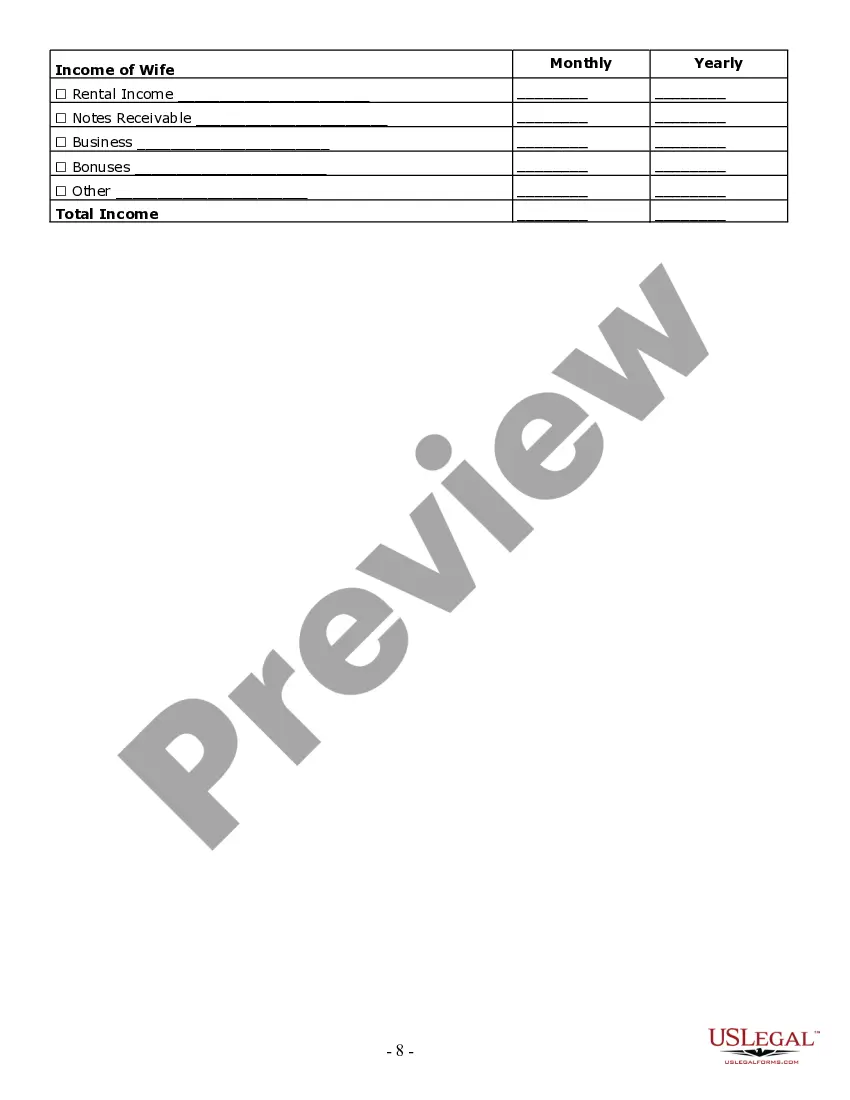

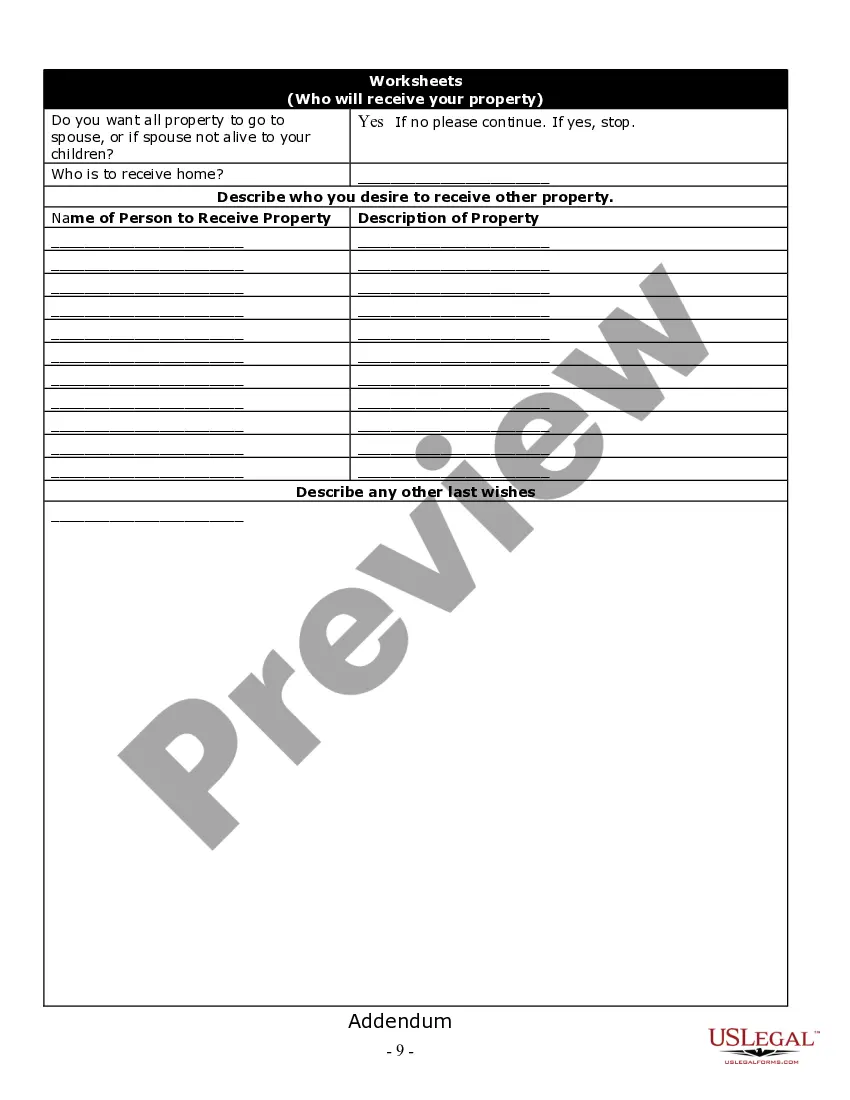

How to fill out California Estate Planning Questionnaire And Worksheets?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal circumstances at some point in their lives. Completing legal documentation necessitates meticulous attention, starting from selecting the correct template. For example, if you choose an incorrect version of the Ca Form Wills For 2022, it will be rejected upon submission. Thus, it is essential to acquire a trustworthy source of legal documents such as US Legal Forms.

If you need to obtain a Ca Form Wills For 2022 template, adhere to these straightforward steps.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the appropriate template online. Utilize the library’s straightforward navigation to find the right form for any circumstance.

- Obtain the template you require by using the search bar or catalog browsing.

- Review the form’s description to verify it aligns with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search function to locate the Ca Form Wills For 2022 template you need.

- Acquire the document if it fulfills your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can purchase the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Ca Form Wills For 2022.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income)

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Personal FormWithout paymentWith payment540 540 2EZ 540NR Schedule XFranchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001540 (Scannable)Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001 24-May-2023

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

The will must be in writing. The will must be signed in front of two witnesses and a legally authorized person (an attorney is fine). A certificate in the exact form of California Probate Code section 6384 must be signed, dated, and attached to the will. The will must be for only one person.