Living Trust Form Printable Form 2018

Description

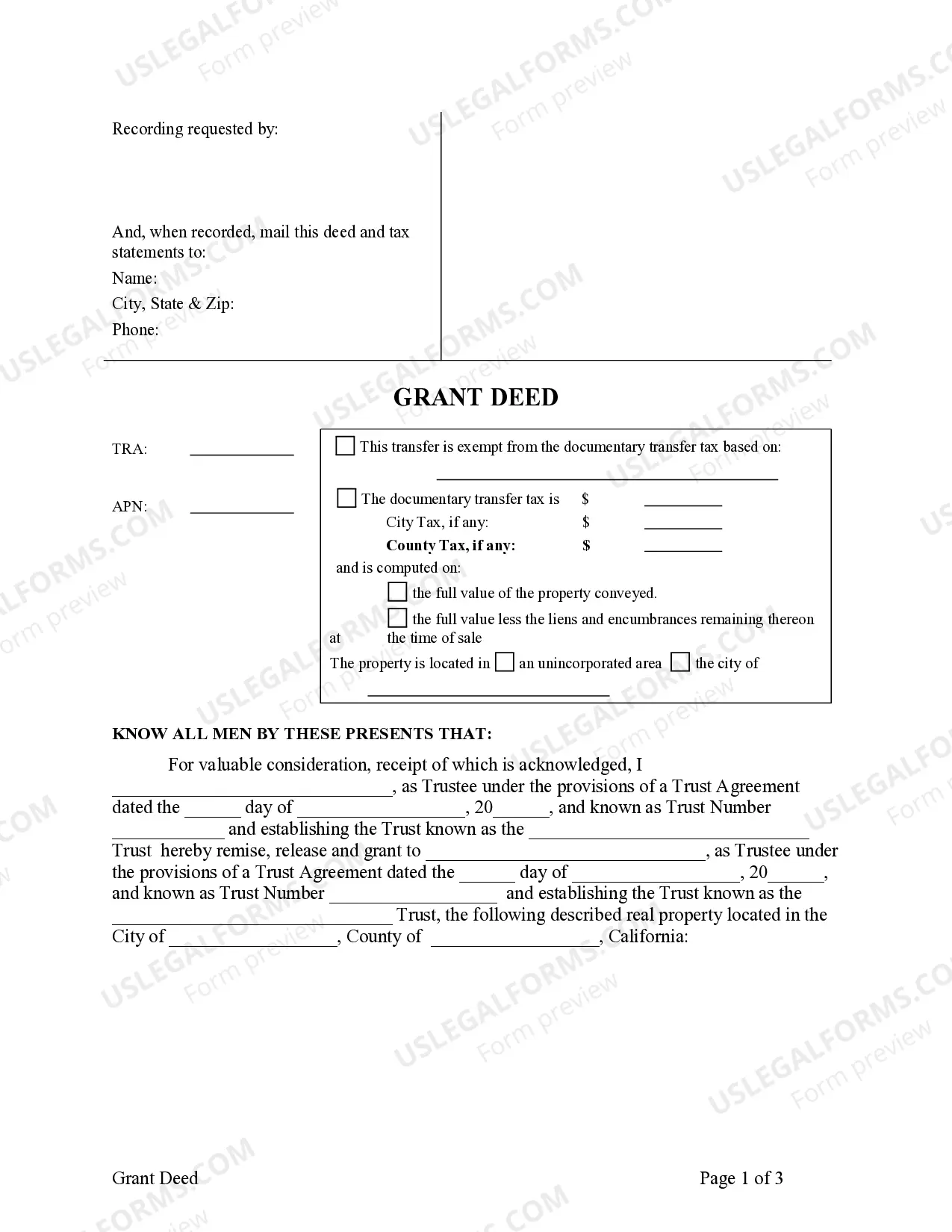

How to fill out California Grant Deed - Living Trust To Living Trust?

Finding a reliable source for accessing the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Living Trust Form Printable Form 2018 solely from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and hinder your current situation. With US Legal Forms, you have minimal concerns.

Once you have the form on your device, you can modify it using the editor or print it and complete it manually. Remove the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog where you can discover legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s details to ensure it meets the criteria of your state and locality.

- Preview the form, if possible, to confirm that it is the template you need.

- Return to the search and find the appropriate template if the Living Trust Form Printable Form 2018 does not fulfill your criteria.

- If you are confident about the form’s applicability, proceed to download it.

- As a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that best fits your requirements.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Living Trust Form Printable Form 2018.

Form popularity

FAQ

How to Fill Out Revocable Living Trust Form Online | PDFRun - YouTube YouTube Start of suggested clip End of suggested clip Click on the fill. Online. Button this will redirect you to pdf runs online editor first enter theMoreClick on the fill. Online. Button this will redirect you to pdf runs online editor first enter the title of your revocable living trust then enter the current date. Next enter both the grantors.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

ALL 4 MUST HAVE DOCS: Will. Revocable Trust. Financial Power of Attorney. Durable Power of Attorney for Healthcare.

Suze Orman, the popular financial guru, goes so far as to say that ?everyone? needs a revocable living trust.

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.