This form is a Warranty Deed where the grantees hold title to the property as a joint tenants.

Ownership Joint Tenants With Right Of Survivorship

Description

Form popularity

FAQ

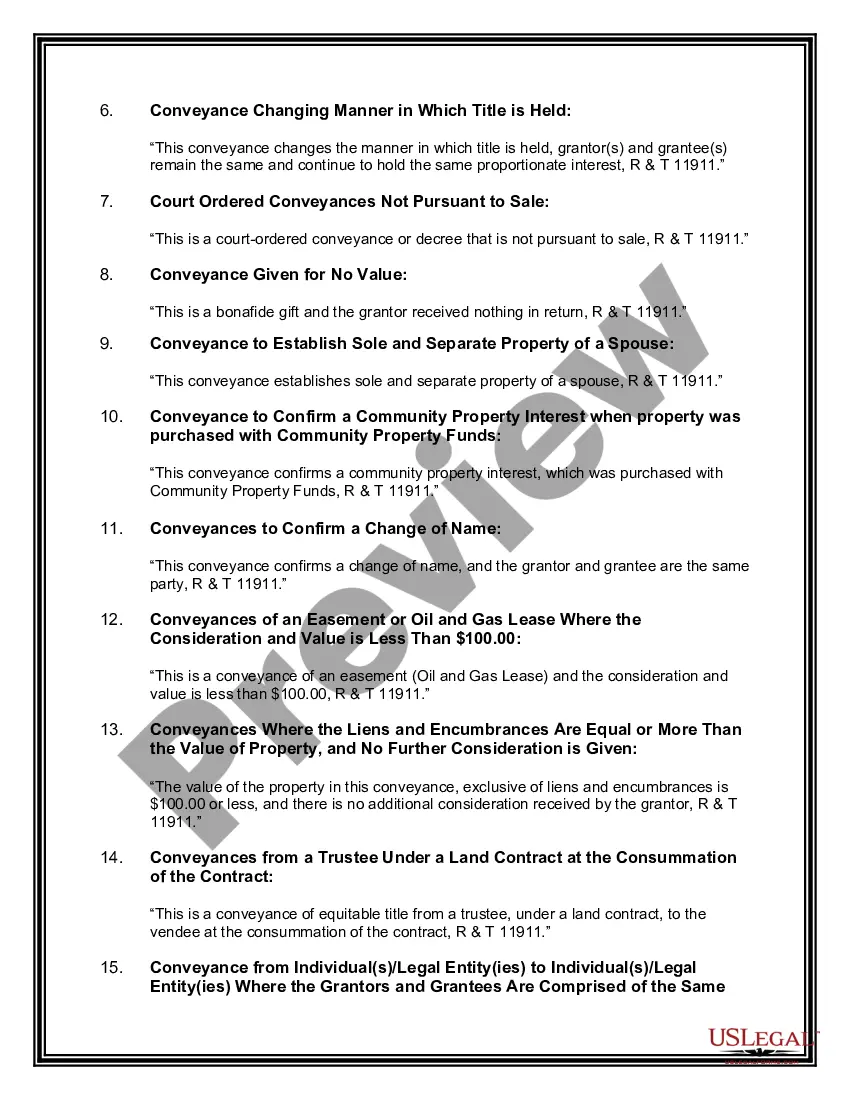

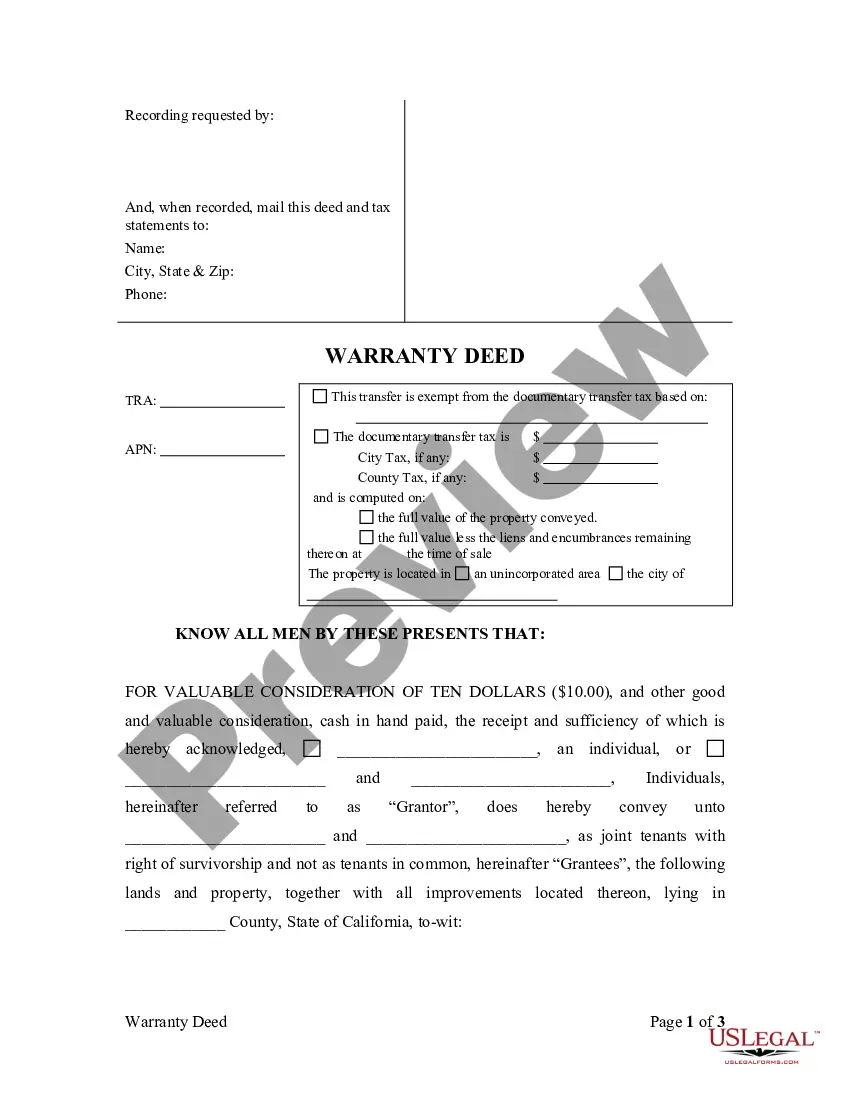

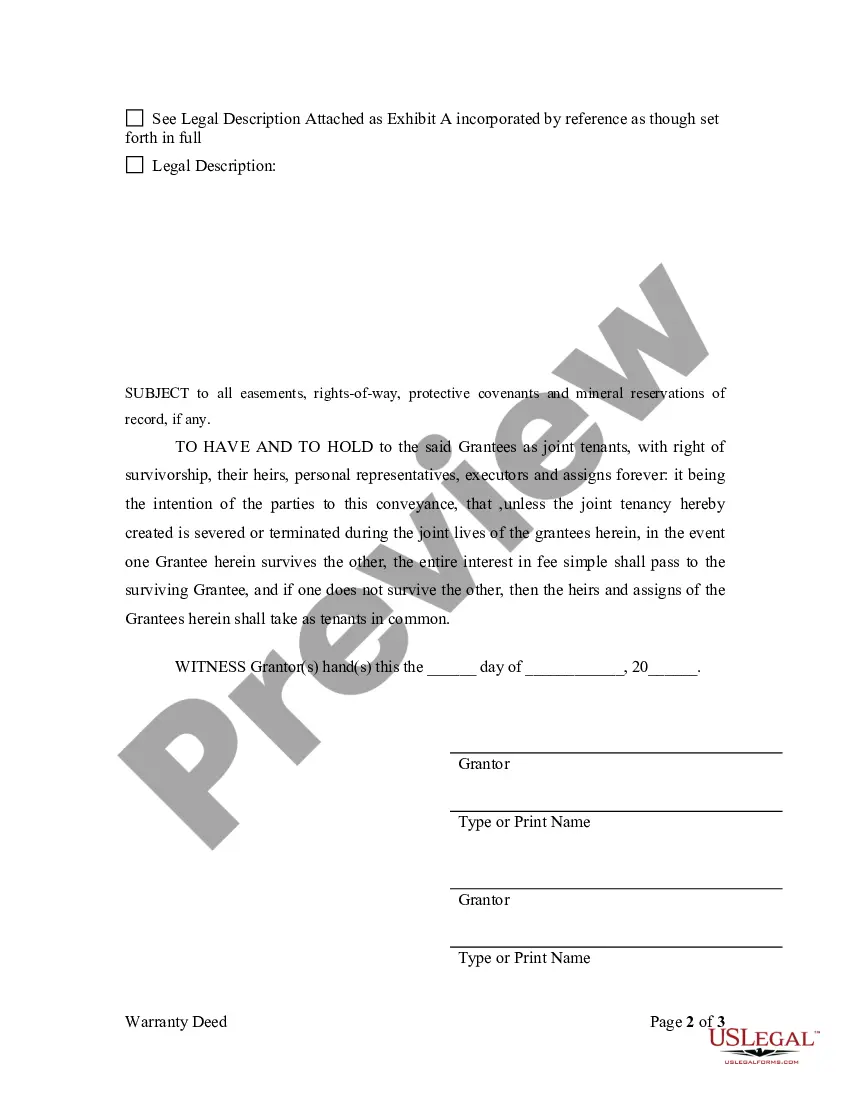

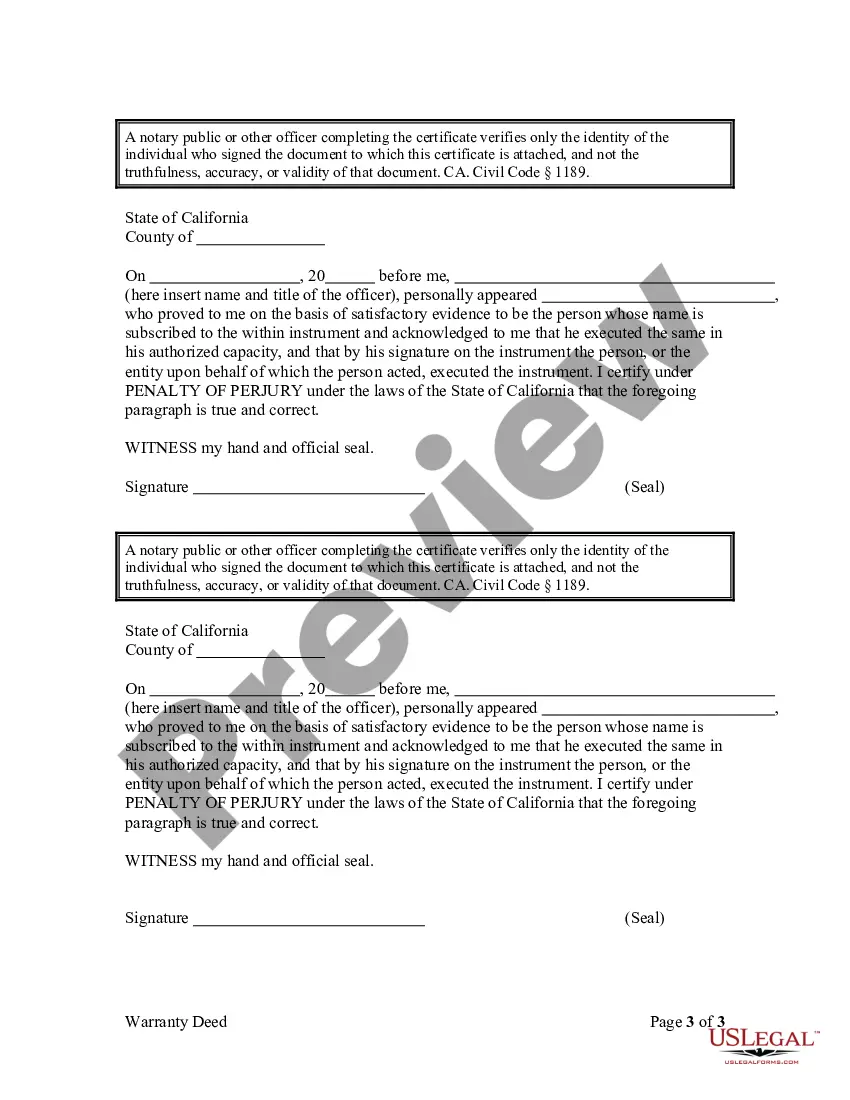

To file joint tenancy with right of survivorship, you must first draft a deed that clearly states this form of ownership. It is essential to include the names of all joint tenants on the deed. Next, you will need to sign the deed and have it notarized. Finally, file the deed with your local county recorder's office to complete the process, ensuring that you establish ownership joint tenants with right of survivorship effectively.

While ownership joint tenants with right of survivorship offers benefits, there are also disadvantages to consider. One potential drawback is that all co-owners must agree to major decisions about the property, which can lead to conflicts. Additionally, if one co-owner incurs debts, creditors may claim their share, affecting the other owners. It’s crucial to weigh these risks and consult professionals to make well-informed decisions.

The terms joint tenancy and survivorship are closely related, yet they focus on different legal aspects. Joint tenancy refers to ownership of a property by two or more individuals, while survivorship ensures that upon the death of one owner, their interest in the property automatically transfers to the surviving owners. Understanding these terms helps potential owners decide the best structure for their property rights, especially when considering ownership joint tenants with right of survivorship.

To establish joint ownership with the right to survivorship, you must create a legal document that clearly specifies this arrangement. This often involves drafting a deed that identifies all parties and explicitly states the right of survivorship. You can also use services like USLegalForms to simplify the process and ensure that the documentation meets state requirements, providing peace of mind as you make this important decision.

The step-up basis for joint tenants with right of survivorship is an important aspect of estate planning. When one tenant passes away, their share of the property receives a step-up in tax basis to its fair market value at the time of death. This adjustment helps to reduce capital gains taxes for the surviving tenants if they decide to sell the property in the future. Understanding this can help you make informed decisions about your estate.

Joint tenancy and joint with survivorship are often confused, but they have key differences. Joint tenancy allows two or more individuals to hold equal shares in a property while including a right of survivorship. This means that when one owner passes away, their share automatically transfers to the remaining owners. Thus, those who opt for ownership as joint tenants with right of survivorship can bypass probate, simplifying the transfer process.

Assets that typically pass by survivorship include real estate held as joint tenants with right of survivorship, bank accounts designated with a payable-on-death clause, and certain investment accounts. These assets transfer automatically to the surviving owners, simplifying the process after a death. By clearly structuring ownership, you eliminate the complexities of probate, making it easier for your loved ones.

A clear example of the right of survivorship occurs when one owner of a property passes away, and the surviving owner automatically takes full ownership without involving probate. Imagine a married couple who jointly own their home as joint tenants with right of survivorship. If one spouse dies, the surviving spouse directly inherits the deceased's share, ensuring a smooth transition of ownership.

While joint ownership might seem convenient, it carries certain risks. For instance, if one owner faces legal issues, creditors may target the shared property. Additionally, disagreements about property management can lead to complications. For peace of mind and clearer property rights, you may want to consider alternatives to Ownership joint tenants with right of survivorship.

To file an Ownership joint tenants with right of survivorship, you must first draft a deed that clearly states this arrangement. It's essential to include both names and ensure the language reflects your intention for survivorship. Once the deed is prepared, you should sign it and record it with your local county office. This final step makes your ownership effective and public.