Professional Corporation In The Philippines

Description

How to fill out Sample Bylaws For A California Professional Corporation?

Whether for commercial reasons or personal issues, everyone must face legal matters at some stage in their life.

Completing legal paperwork requires meticulous care, starting from choosing the correct form template.

With a comprehensive US Legal Forms library available, you don't have to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to discover the appropriate form for any circumstance.

- Obtain the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it suits your situation, state, and locality.

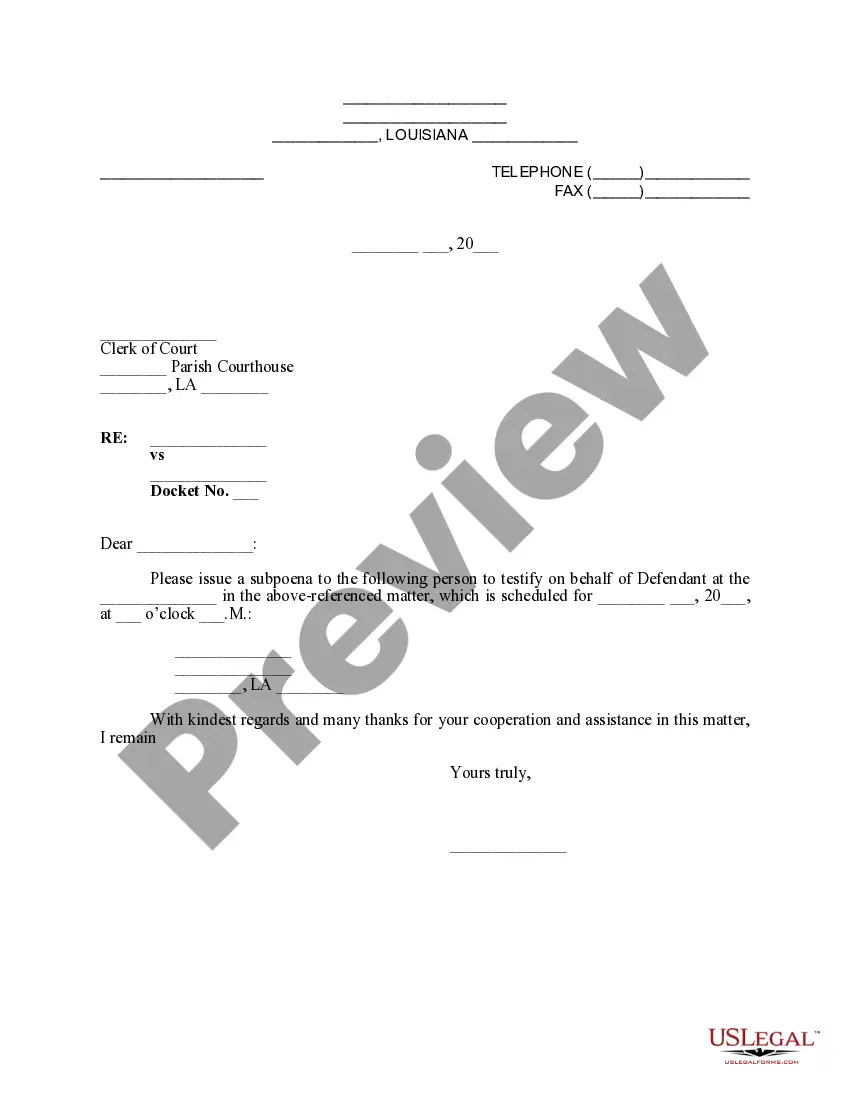

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search tool to find the Professional Corporation In The Philippines template you require.

- Download the file if it satisfies your requirements.

- If you own a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing plan.

- Complete the account registration form.

- Choose your payment option: utilize a credit card or PayPal account.

- Select the file format you prefer and download the Professional Corporation In The Philippines.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Forming a corporation in the Philippines requires several key documents and compliance with specific regulations. These documents typically include the articles of incorporation, by-laws, and a list of incorporators. Additionally, you need to have a minimum capital requirement and secure permits from regulatory agencies. By using US Legal Forms, you can simplify the process of creating a professional corporation in the Philippines and ensure that you meet all legal requirements.

Form ID W-4 ? Employee's Withholding Allowance Certificate to estimate your Idaho withholding. Fill out Form ID W-4 with that information. Give both W-4 forms to your employer.

Form 42 is used to show the total for the unitary group. A schedule must be attached detailing the Idaho apportionment factor computation for each corporation in the group.

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents). You can prepare a current tax year Idaho Tax Amendment on eFile.com, however you cannot submit it electronically.

Use Form 967, Idaho Annual Withholding Report ? to report the total taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid to the Idaho State Tax Commission for the same calendar year.

Part-Year Resident & Nonresident Income Tax Return.

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld Idaho income taxes electronically or with a Form 910, Idaho Withholding Payment Voucher.

The State of Idaho partners with the IRS and certain tax software companies to allow qualifying taxpayers to prepare their federal and Idaho returns for free. They can also e-file both returns for free.