Ca Professional Corporation California Foreign

Description

How to fill out Sample Bylaws For A California Professional Corporation?

Locating a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Securing the appropriate legal documents demands accuracy and carefulness, which is why it is crucial to obtain samples of Ca Professional Corporation California Foreign exclusively from reputable providers, such as US Legal Forms. An incorrect template can squander your time and hinder your situation.

Once you have the form on your device, you can modify it with the editor or print it out to complete it manually. Remove the stress that comes with your legal documentation. Explore the comprehensive US Legal Forms catalog where you can discover legal templates, verify their relevance to your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your template.

- Examine the form’s details to verify if it aligns with the specifications of your state and county.

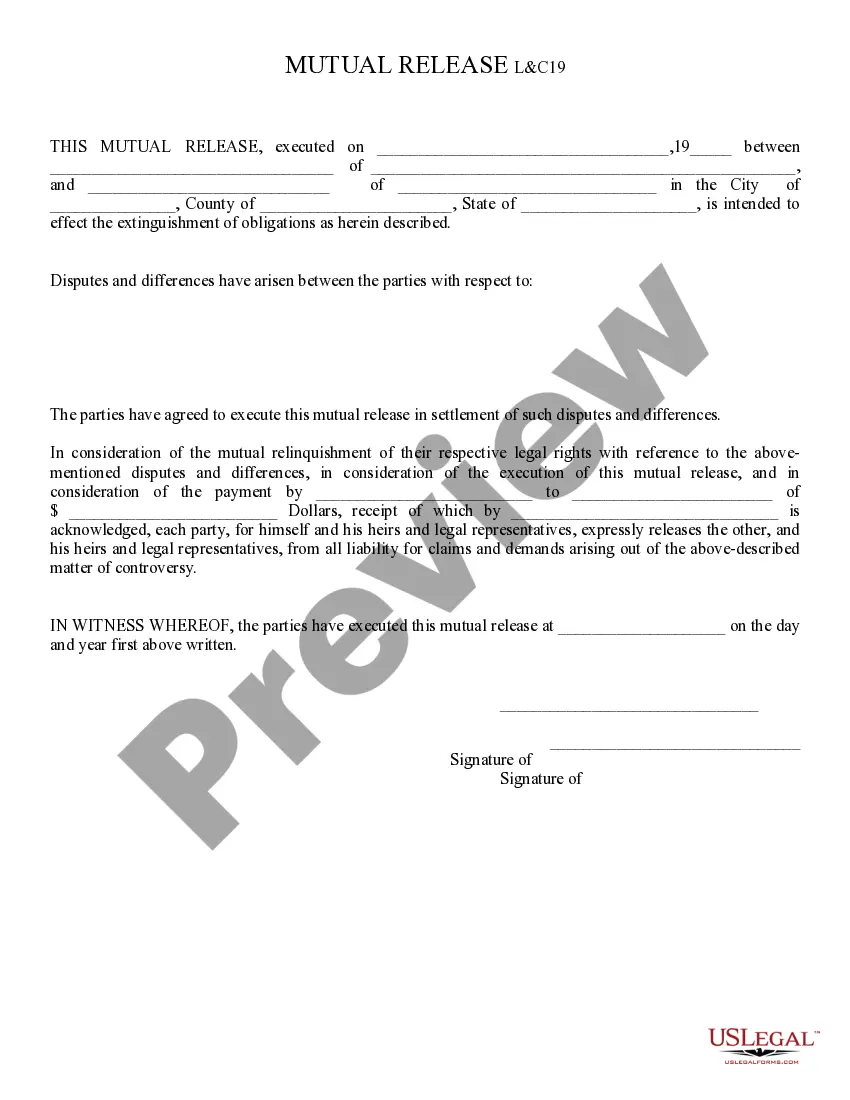

- Check the form preview, if available, to confirm that the form is the one you seek.

- Return to the search if the Ca Professional Corporation California Foreign does not meet your requirements.

- Once you are certain of the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Select the pricing option that fits your needs.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Ca Professional Corporation California Foreign.

Form popularity

FAQ

If you're a foreign corporation, you'll need to file a Statement and Designation by Foreign Corporation. As of 2023, the filing fee is $100. If you're a foreign LLC, you'll need to file an Application to Register. As of 2023, the filing fee is $70.

A foreign corporation is simply a corporation that was formed outside of California but has registered with the California Secretary of State to do business in California. So in this case, foreign simply means ?out-of-state.?

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. The fee is normally $100.

California Foreign LLC Registration. A foreign (out-of-state) LLC can be registered to do business in California by filing an Application to Register a Foreign LLC with the Secretary of State's office, along with a current Certificate of Good Standing, and paying all associated fees.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. The fee is normally $100.