Probate Code Section 6401 And 6402

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Locating a reliable source to obtain the latest and pertinent legal examples is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents demands precision and meticulousness, which is why it is crucial to acquire samples of Probate Code Section 6401 And 6402 solely from reputable providers, such as US Legal Forms.

Once you have the form on your device, you can edit it using the editor or print it out and complete it by hand. Eliminate the hassle associated with your legal paperwork. Explore the extensive US Legal Forms catalog to discover legal templates, evaluate their suitability for your situation, and download them right away.

- Utilize the library navigation or search bar to find your template.

- Access the form’s details to ensure it aligns with the stipulations of your state and county.

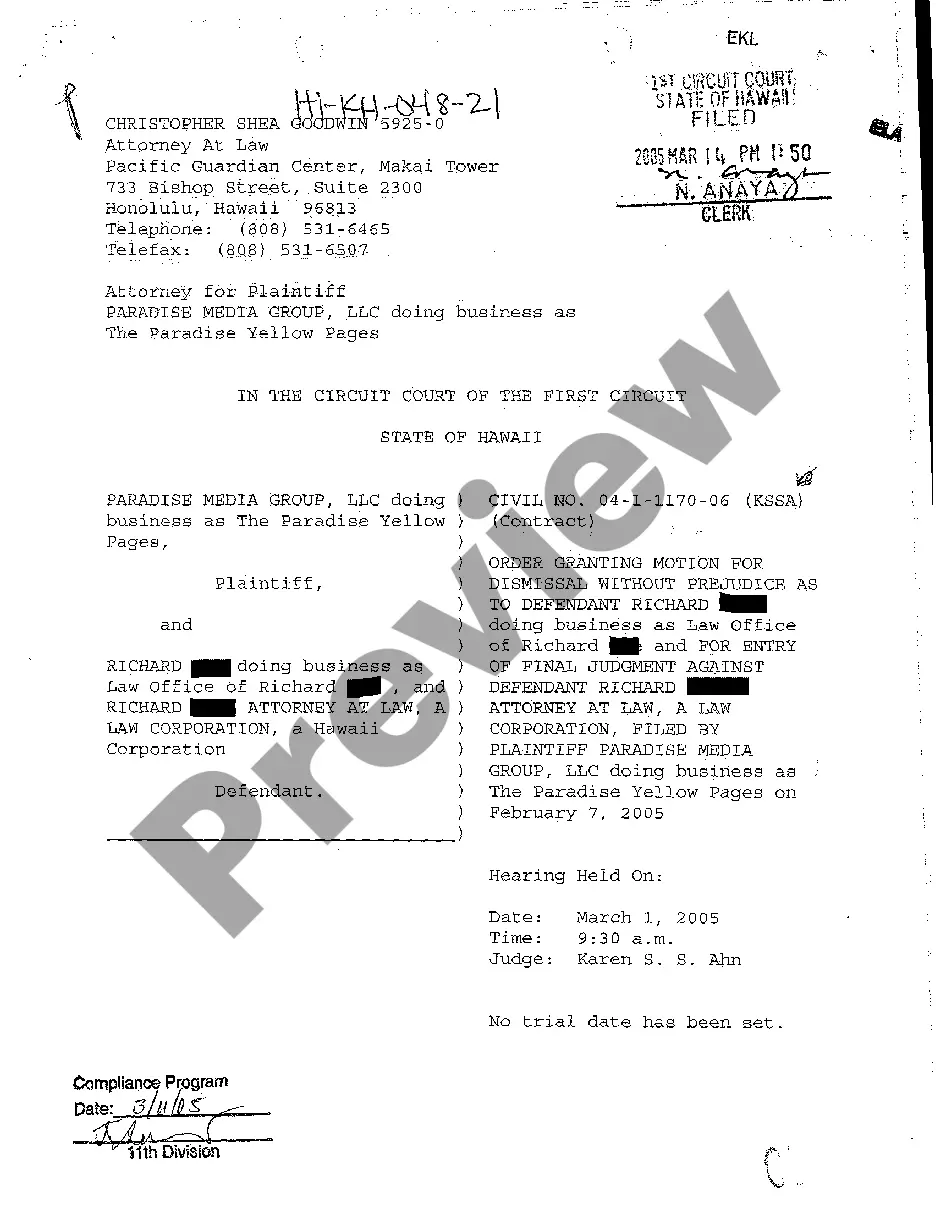

- Review the form's preview, if available, to confirm that it is indeed the document you seek.

- Return to the search and identify the correct document if the Probate Code Section 6401 And 6402 does not meet your specifications.

- If you are confident in the form’s relevance, proceed to download it.

- If you are a registered member, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing option that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Probate Code Section 6401 And 6402.

Form popularity

FAQ

You can learn about filing and paying New York State personal income tax and business tax. You can also request tax forms and get refund information. State tax forms are also available at most public libraries and post offices. Visit the Department of Taxation and Finance website.

About Free File Fillable Forms Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return. Print your return for recordkeeping.

The fastest way to obtain forms and instructions is to download them from our website. Current and prior-year forms are available as standard PDFs, and select forms are available as enhanced fill-in PDFs. For detailed instructions on downloading our forms, see Forms-user instructions.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country.

The fastest way to obtain forms and instructions is to download them from our website. Current and prior-year forms are available as standard PDFs, and select forms are available as enhanced fill-in PDFs. For detailed instructions on downloading our forms, see Forms-user instructions.

A partnership itself does not pay a New York State personal income tax, but the individual partners are taxed on their respective distributive shares of the partnership income, whether or not such shares are actually distributed to them.

If an LLC is treated as a disregarded entity for federal income tax purposes and has any income, gain, loss, or deduction from New York sources, the filing fee is $25. There is no proration of the filing fee if the partnership, LLC, or LLP has a short tax year for federal tax purposes.