California Probate Code

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Legal managing might be overwhelming, even for experienced specialists. When you are looking for a California Probate Code and do not get the time to commit searching for the correct and up-to-date version, the procedures may be demanding. A strong web form library might be a gamechanger for anyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you might have, from individual to organization papers, in one place.

- Employ advanced resources to finish and manage your California Probate Code

- Access a useful resource base of articles, guides and handbooks and materials related to your situation and requirements

Help save time and effort searching for the papers you will need, and utilize US Legal Forms’ advanced search and Preview tool to discover California Probate Code and download it. For those who have a monthly subscription, log in for your US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to see the papers you previously saved and also to manage your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and have limitless access to all benefits of the platform. Here are the steps for taking after getting the form you need:

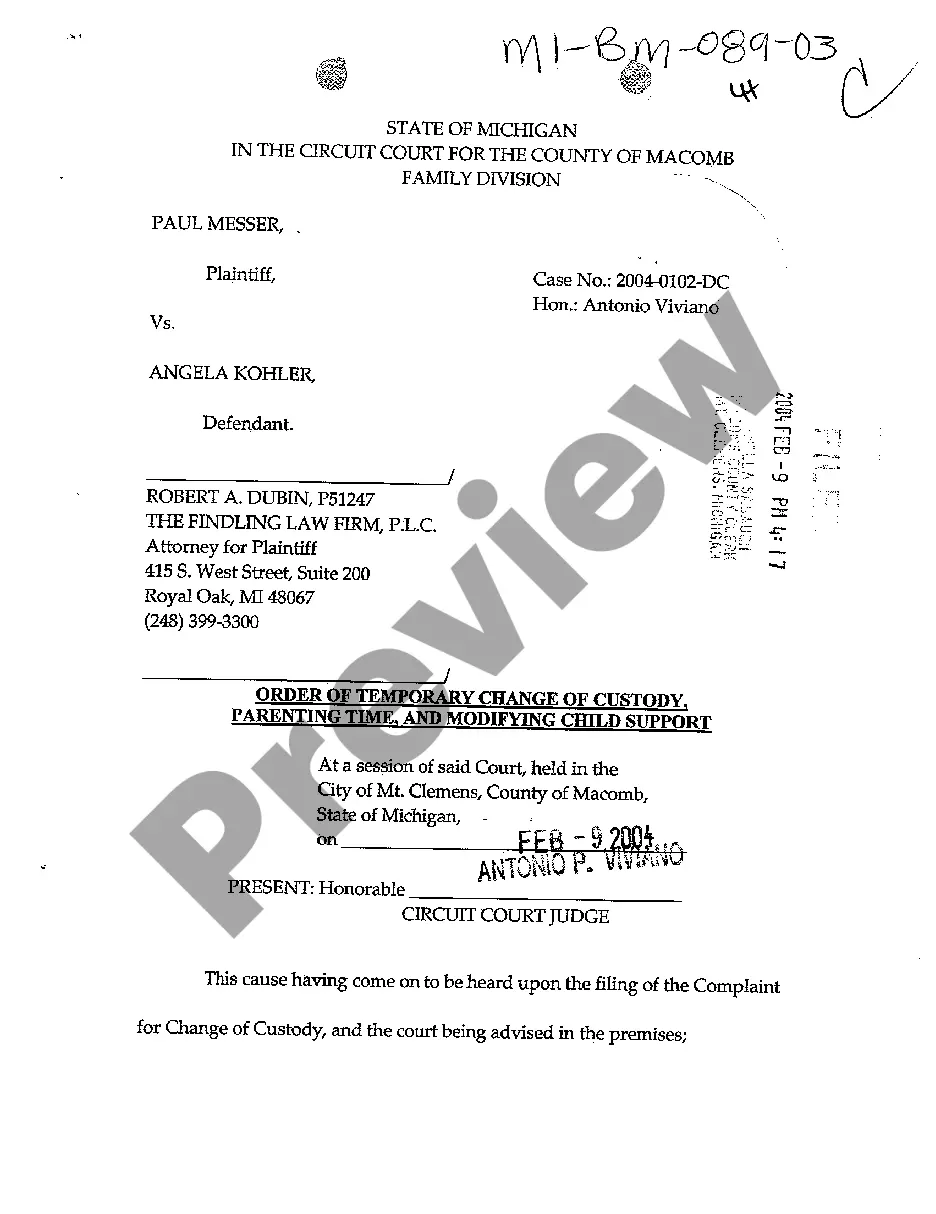

- Verify this is the right form by previewing it and reading its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are all set.

- Choose a subscription plan.

- Pick the file format you need, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Transform your day-to-day document managing into a easy and easy-to-use process right now.

Form popularity

FAQ

Under probate code section 16061.7, when a trust or a portion of a trust becomes irrevocable, the Trustee has a legal obligation to send notice to all legal heirs of the decedent and beneficiaries of a trust within 60 days following the irrevocability of the trust.

Any assets that do not qualify for a simple transfer process will likely have to go through formal probate. And, if the dead person's property is worth more than $166,250, none of the exceptions apply. You must go to court and start a probate case.

16000. On acceptance of the trust, the trustee has a duty to administer the trust ing to the trust instrument and, except to the extent the trust instrument provides otherwise, ing to this division.

California Probate Code is exhaustive; with over 21,000 sections, it covers all details surrounding estate planning, wills, trusts and probate.

Learning about California Probate Code While the term probate typically refers to the process of transferring property and assets from a deceased individual to his or her beneficiaries or heirs, the laws in California known as probate code actually regulate all aspects of estate planning and distribution.