Ca Probate Forms For Texas

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

The Ca Probate Forms For Texas displayed on this page is a reusable formal template created by experienced attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific forms for any corporate and personal circumstance.

Select the format you want for your Ca Probate Forms For Texas (PDF, Word, RTF) and download the sample on your device. Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid. Download your papers one more time. Use the same document once again anytime needed. Open the My documents tab in your profile to redownload any earlier saved forms. Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

- Browse for the document you need and review it.

- Look through the sample you searched and preview it or check the form description to confirm it fits your requirements. If it does not, make use of the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and Log In.

- Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, Log In and check your subscription to continue.

- Obtain the fillable template.

Form popularity

FAQ

While Texas law does not require an attorney to probate a will, having legal assistance can be beneficial. An attorney can help navigate the complexities of the probate process and ensure compliance with state laws. However, if you feel confident managing the process yourself, you can utilize Ca probate forms for Texas from resources like US Legal Forms to assist you in completing the necessary paperwork.

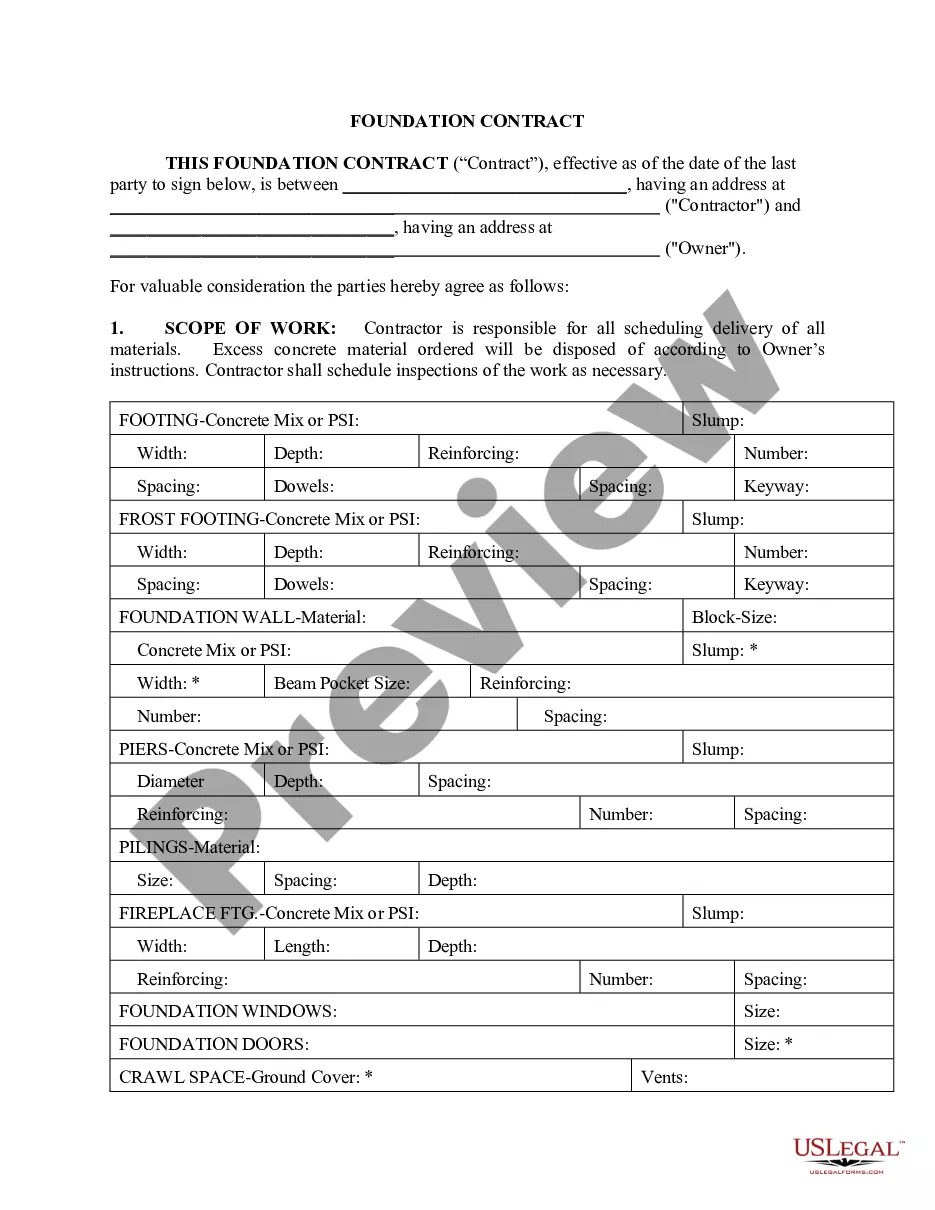

To probate a will in Texas, you will typically need to gather several essential Ca probate forms for Texas. These forms often include the Application for Probate, the Will itself, and a Notice of Application for Probate. Additionally, you may need to complete the Inventory of Estate Assets form. Using platforms like US Legal Forms can simplify this process by providing access to the necessary forms and guidance.

In Texas, if the value of an estate exceeds $75,000, a full probate administration is typically required. This threshold, as stated in the Texas Estates Code, includes the total value of the estate's assets, excluding homestead and exempt property.

Probate, General Forms Agreement as to the Advisability of Independent Administration (DOCX) Complete Small Estate Affidavit (PDF) Motion and Order for Release of Funds from Registry (PDF) Muniment of Title - Additional Requirements (PDF) Order Appointing Attorney Ad Litem (PDF)

To begin the process, you will need to file an application for probate in the county where the decedent lived. Notice period. There is a two-week waiting period after the application is filed. ... Hearing. ... Letters testamentary. ... Inventory. ... Notifying beneficiaries and creditors. ... Distribution of assets. ... Closing the estate.

Step 1 Petition for Probate (Form DE-111, Judicial Council), and all attachments, Original Will (if there is one) Notice of Petition to Administer Estate (Form DE-121, Judicial Council) Duties and Liabilities of Personal Representative (Form DE-147, Judicial Council) Order for Probate (Form DE-140, Judicial Council)

A question we see pop up time and time again is, Can you probate a will in Texas without an attorney? The simple answer is yes, but with some reservations. Robbins Estate Law has created this guide to give you some basic information on how to probate a will without a lawyer.