Ca Probate Code Power Of Attorney

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Managing legal documents and tasks can be a lengthy supplementary activity to your day.

California Probate Code Power Of Attorney and similar forms generally require you to search for them and figure out how to fill them out correctly.

For this reason, whether you are handling financial, legal, or personal issues, having a comprehensive and functional online repository of forms readily available will be very beneficial.

US Legal Forms is the premier online platform for legal templates, offering over 85,000 state-specific documents and a variety of resources to assist you in completing your forms with ease.

Is this your first experience with US Legal Forms? Sign up and create an account in a few minutes to gain access to the form library and California Probate Code Power Of Attorney.

- Browse the collection of relevant documents available with just a click.

- US Legal Forms grants you access to state- and county-specific forms for download anytime.

- Protect your document management processes with a reliable service that enables you to prepare any form in minutes without any additional or hidden fees.

- Simply Log In to your account, find California Probate Code Power Of Attorney, and obtain it directly from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

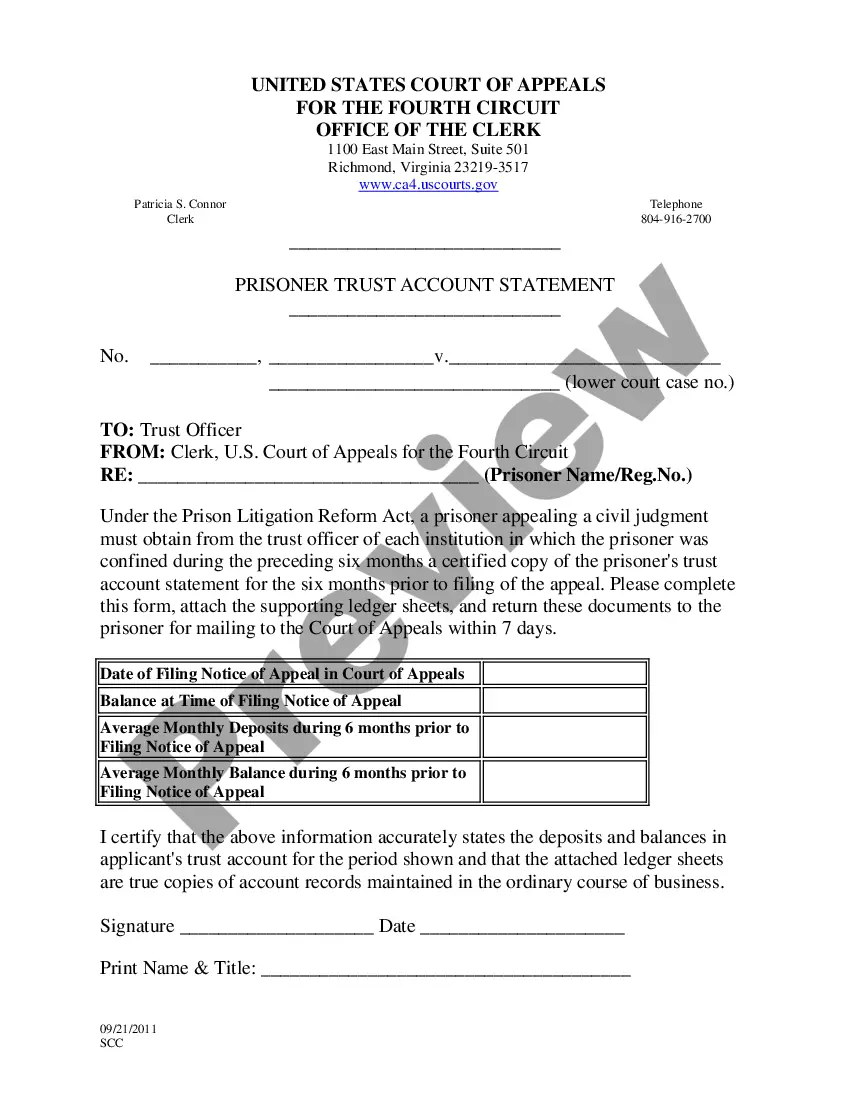

Submitting a CA POA involves sharing the signed document with the relevant institutions or individuals. You do not need to file it with the court, but you should provide copies to banks, healthcare providers, or any other parties who will act under this authority. For a straightforward and legally compliant process, consider using platforms like USLegalForms that offer templates and guidance for navigating the CA probate code power of attorney.

Section 4264 of the California probate code addresses the requirements for executing a Power of Attorney. This section outlines the necessary elements that make a POA valid, including the need for the principal's signature and notarization. Understanding this section is crucial for ensuring that your Power of Attorney complies with the law and serves its intended purpose under the CA probate code power of attorney.

No, a Power of Attorney does not have to be filed with the court in California. The document becomes effective once it is signed and notarized, provided the powers are clearly defined. However, keeping a copy of the CA probate code power of attorney in a safe place and sharing it with involved parties is important for clarity and to avoid any potential disputes.

To submit a CA Power of Attorney (POA), deliver copies of the signed document to the institutions or individuals where the authority will be exercised. For example, if the POA involves financial matters, present it to banks or investment companies. They may have their own procedures for accepting the CA POA, so always check their requirements to ensure smooth acceptance of your document.

Submitting a Power of Attorney in California typically involves filing the document with the relevant parties, such as financial institutions or healthcare providers. While there is no need to file the Power of Attorney with the court, ensure that you provide copies to all parties involved for their records. This way, everyone understands the authority granted under the CA probate code power of attorney.

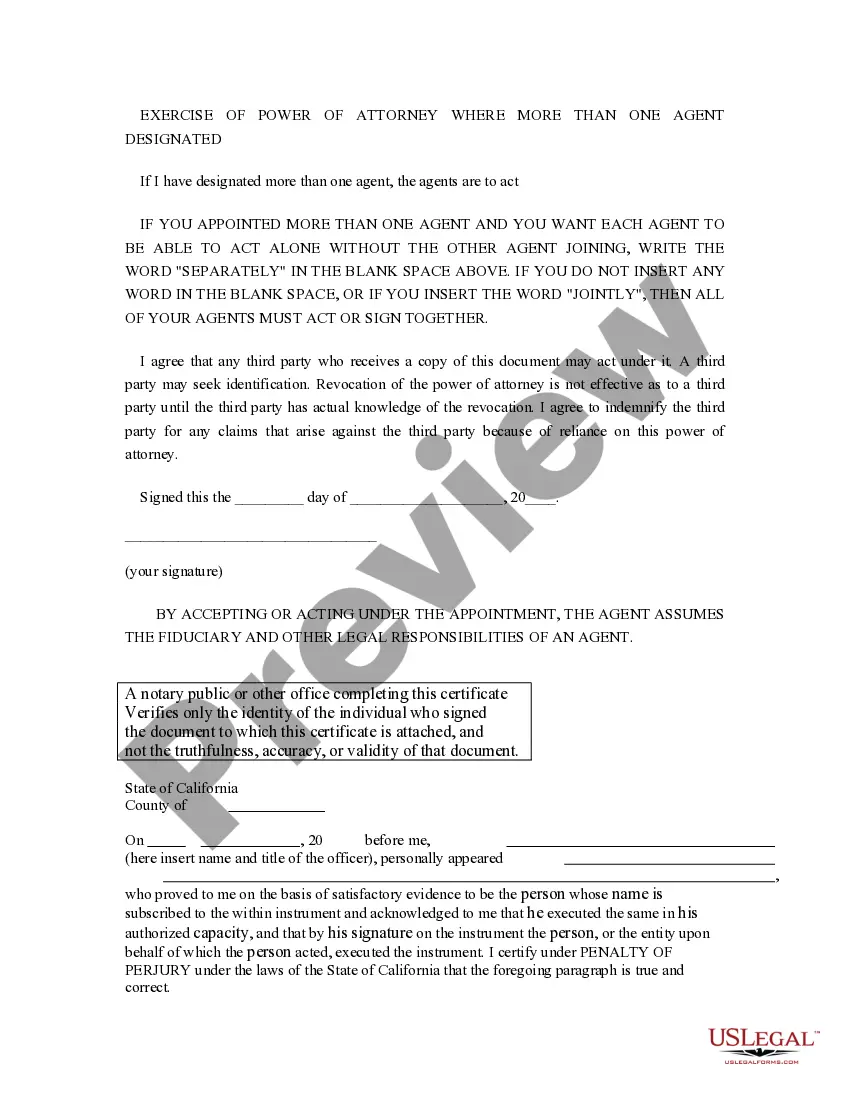

To give someone Power of Attorney in California, you need to complete a Power of Attorney form that complies with the California probate code. You must specify the powers you wish to grant and sign the document in the presence of a notary public. Once completed, provide a copy to the person receiving these powers and keep one for your records. This process ensures that your wishes are clearly communicated and legally binding under the CA probate code power of attorney.

California power of attorney requirements You (the principal) must have mental capacity, which means you can fully understand your POA and its consequences. Your agent(s) must also be at least 18 years old and have mental capacity. California State Legislature. California Probate Code. Accessed .

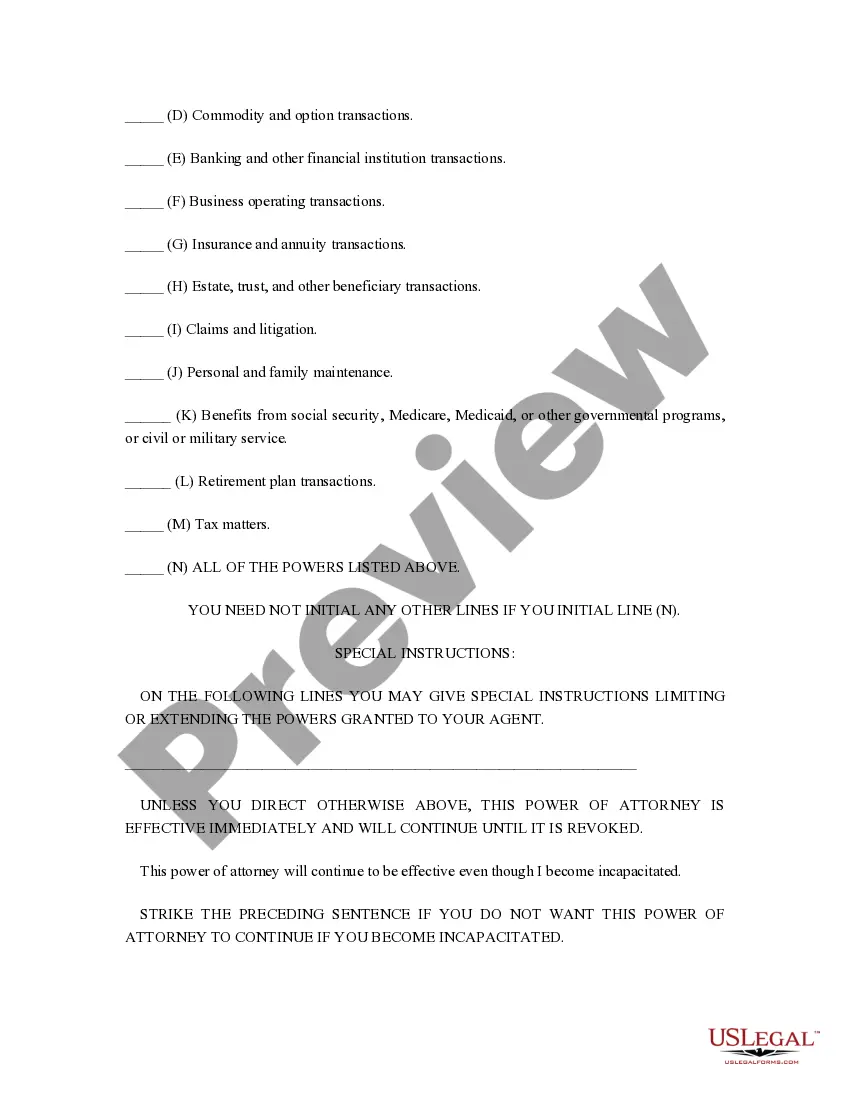

4123. (a) In a power of attorney under this division, a principal may grant authority to an attorney-in-fact to act on the principal's behalf with respect to all lawful subjects and purposes or with respect to one or more express subjects or purposes.

Here are the basic steps to make your California power of attorney: Decide which type of power of attorney you want. ... Decide who you want to be your agent. ... Decide what authority you want to give your agent. ... Get a power of attorney form. ... Complete the form, sign it, and have it notarized or witnessed.

(California Probate Code Section 4401) THIS DOCUMENT DOES NOT AUTHORIZE ANYONE TO MAKE MEDICAL AND OTHER HEALTH-CARE DECISIONS FOR YOU. YOU MAY REVOKE THIS POWER OF ATTORNEY IF YOU LATER WISH TO DO SO.