Seller Serves Disclosure For The Balance Sheet

Description

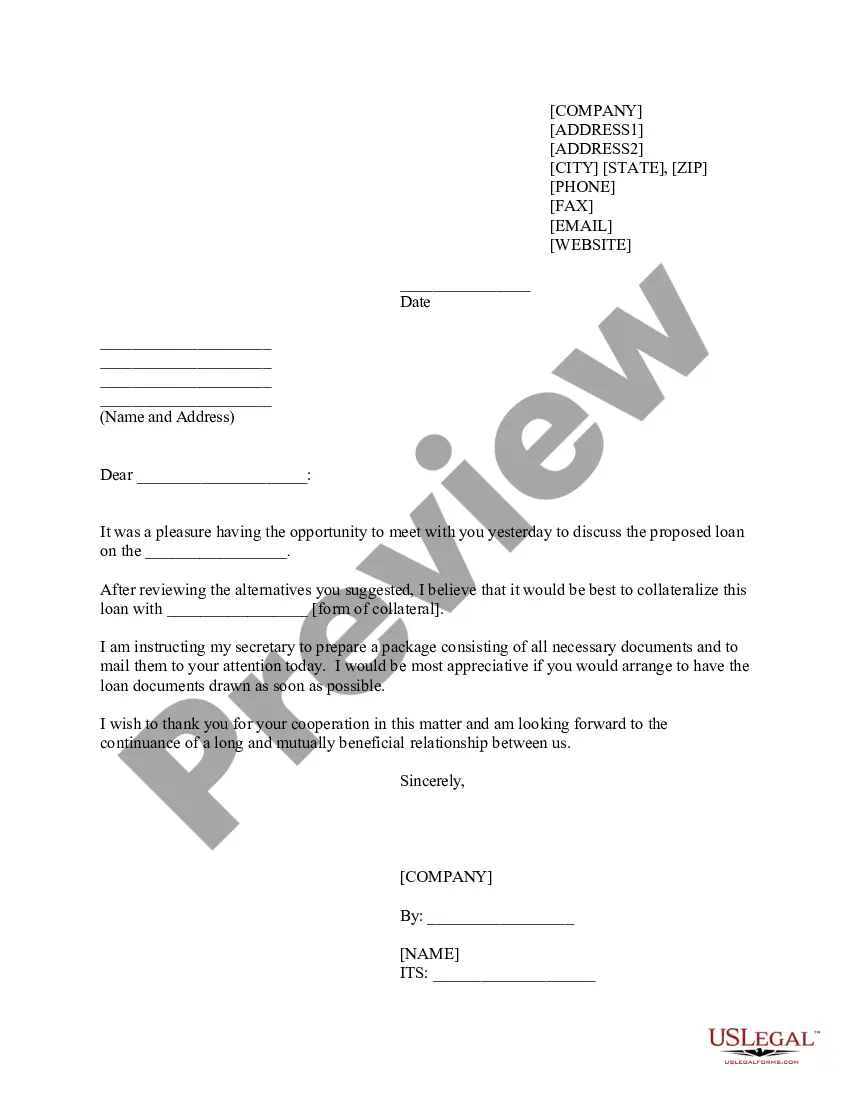

How to fill out California Contract For Deed Package?

- Check the Preview mode for the Seller serves disclosure form to confirm it meets your needs and jurisdiction requirements.

- If the initial template is unsuitable, use the Search tab to find an alternative that aligns with your specifications.

- Select your form and click on the Buy Now button, carefully choosing a subscription plan that best fits your legal needs.

- Create your account by registering, as this will give you access to all library resources.

- Complete your purchase by entering payment details via credit card or PayPal.

- Once payment is processed, download the form to your device and find it later in the My Forms menu of your profile.

Using US Legal Forms not only simplifies the process of creating legal documents but also ensures your forms are precise and legally sound, thanks to access to premium expert assistance.

Start today and empower your legal documents process with US Legal Forms – your one-stop solution for legal forms!

Form popularity

FAQ

A balance sheet typically includes assets, liabilities, and equity. Assets represent what the company owns, liabilities reflect what it owes, and equity shows the ownership interest. Each component provides insight into the company’s financial stability. When creating your balance sheet, ensure that your seller serves disclosure for the balance sheet is accurate and robust, and consider using USLegalForms for easy-to-follow templates.

crafted disclosure statement should include relevant financial data, potential risks, accounting policies, and any significant events that might affect the financial presentation. It must be clear and precise to ensure stakeholders grasp the necessary information. When preparing this statement, remember that seller serves disclosure for the balance sheet is an integral part of maintaining transparency. USLegalForms offers tools that simplify the creation of disclosure statements.

Disclosure in accounting primarily involves four methods: notes to the financial statements, management discussions, accompanying reports, and regulatory filings. These methods ensure that stakeholders understand the financial state of a company. Particularly, the seller serves disclosure for the balance sheet is essential for presenting accurate financial health. Consider utilizing USLegalForms for structured templates that aid in your disclosures.

The disclosure of the balance sheet refers to the detailed information provided about a company's financial status. This disclosure covers aspects such as accounting policies, methodologies, and assumptions underlying the reported figures. It's designed to enhance transparency and provide necessary context for interpreting financial data. Thus, the seller serves disclosure for the balance sheet plays a significant role in financial reporting.

A balance sheet reveals the financial position of a company at a particular moment. It shows whether the business is in a favorable state with sufficient assets to cover its liabilities. Moreover, it helps stakeholders assess the company's liquidity and solvency. This vital insight is part of the seller serves disclosure for the balance sheet.

A balance sheet discloses various essential components, including total assets, total liabilities, and shareholder equity. These elements provide a snapshot of a company's financial standing at a specific point in time. Businesses can use this information to evaluate their performance and operational efficiency. The seller serves disclosure for the balance sheet aids in preparing this critical financial statement.

A seller disclosure provides essential information about a company's financial condition. It ensures transparency between the seller and potential buyers. By outlining any relevant risks or obligations, this disclosure helps buyers make informed decisions. In this way, the seller serves disclosure for the balance sheet facilitates trust and clarity during transactions.

A balance sheet discloses key financial items such as assets, liabilities, and equity. Assets represent what the company owns, while liabilities indicate what it owes. Owner's equity reflects the net worth of the business. Understanding these items is crucial, as the seller serves disclosure for the balance sheet provides valuable insights into a company's financial health.

You can typically find a seller's disclosure through your real estate agent or the seller themselves. Additionally, many online platforms, such as USLegalForms, provide templates and guidelines for obtaining and completing disclosures. It's important to request these documents early in the process, as they contain critical details about the property. Ensuring access to seller serves disclosure for the balance sheet is essential for making informed decisions.

Techniques of disclosure for a balance sheet may include detailed notes explaining asset categorization and valuation methods. You might also see footnotes that clarify liabilities, ownership structures, and significant events that impact finances. These disclosures help users of the balance sheet understand the context behind the figures presented. Utilizing seller serves disclosure for the balance sheet can enhance this clarity and trustworthiness.