Policy Work Policies With Cash Value

Description

How to fill out California Company Employment Policies And Procedures Package?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft Policy Work Policies With Cash Value without the need of a specialized set of skills. Creating legal documents is a long venture requiring a particular education and skills. So why not leave the creation of the Policy Work Policies With Cash Value to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our website and obtain the form you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

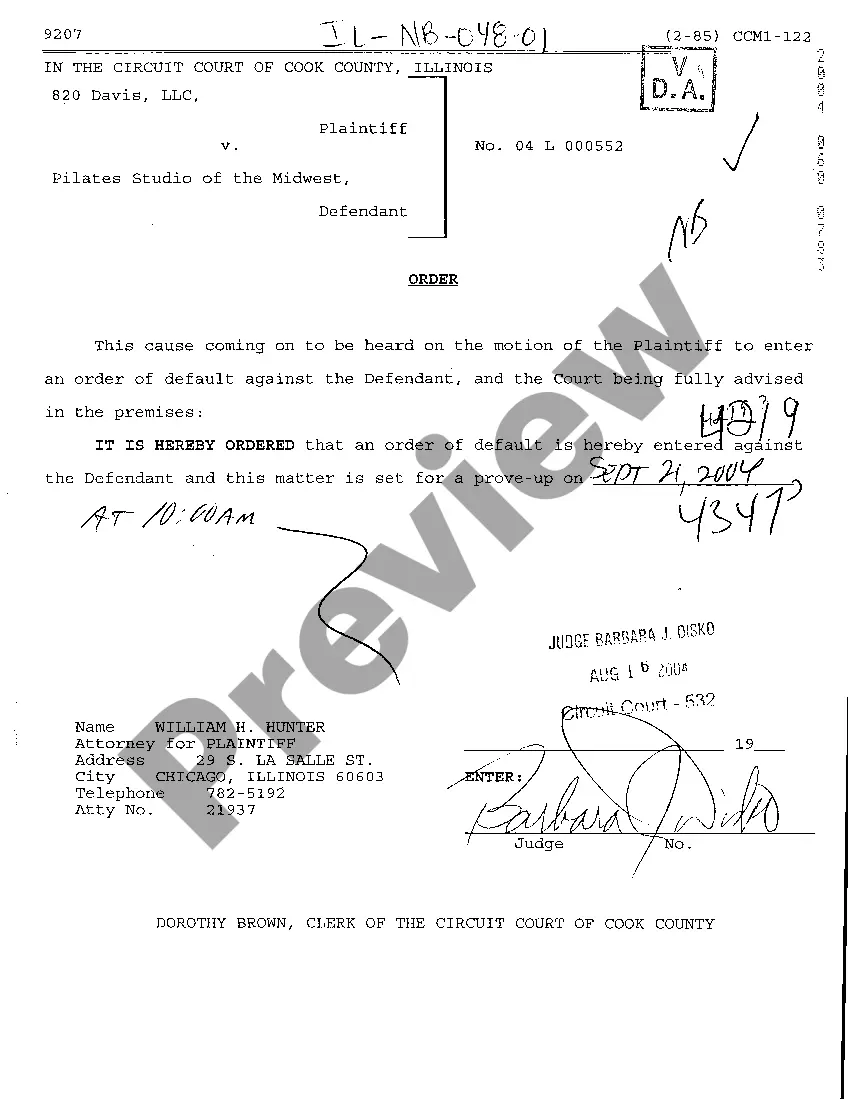

- Preview it (if this option available) and read the supporting description to determine whether Policy Work Policies With Cash Value is what you’re looking for.

- Begin your search over if you need a different template.

- Set up a free account and select a subscription option to purchase the form.

- Pick Buy now. As soon as the payment is through, you can download the Policy Work Policies With Cash Value, complete it, print it, and send or mail it to the necessary people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

A $10,000 term life insurance policy has no cash value. However, a permanent life insurance policy might. Usually, the cash value steadily accumulates over the years, but the cash value of some policies can decrease if an investment performs poorly.

With a cash value life insurance policy, a portion of each premium you pay goes toward insuring your life, while the other portion goes toward building up a cash value. The cash value portion of your policy accrues tax-deferred interest.

The cash surrender value of the life insurance policy is an asset that is recorded on the balance sheet (?B/S?) of the company. The amount recorded varies from year to year as the cash surrender value of the policy increases or decreases.

With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time. As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash.

The cash surrender value of a life insurance policy provides a future economic benefit as it is the amount that can be realized by the company if the policy is surrendered. Therefore, it is the cash surrender value of the life insurance contract that is recorded as an asset on the corporate balance sheet.