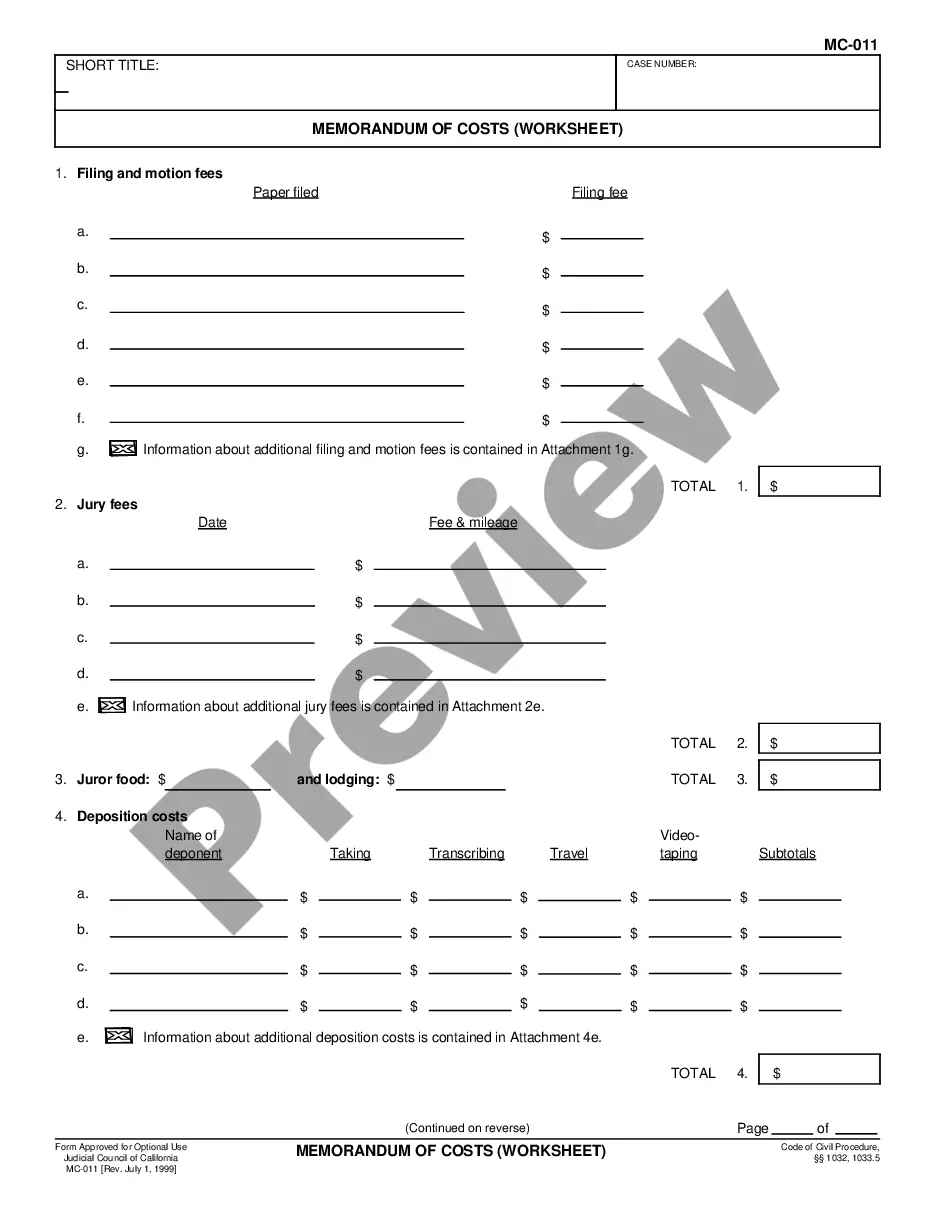

Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest: This Memorandum is simply a list of costs associated with litigation, after the judgment has been rendered. The Declarant signs this Memorandum, stating that he/she declares these costs, including accured interest on the outstanding balance, to be accurate, under penalty of law.

Memo Of Costs After Judgment In India

Description

How to fill out California Memorandum Of Costs After Judgment, Acknowledgment Of Credit, And Declaration Of Accrued Interest?

Creating legal documents from the ground up can occasionally feel somewhat daunting. Specific situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more cost-effective method of preparing the Memo Of Costs After Judgment In India or any other documentation without hassle, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal experts.

Utilize our platform whenever you require a dependable and trustworthy service that allows you to easily locate and download the Memo Of Costs After Judgment In India. If you’re already familiar with our services and have previously set up an account with us, simply Log In to your account, find the template, and download it or re-download it at any time in the My documents section.

US Legal Forms takes pride in its strong reputation and over 25 years of experience. Join us today and transform the process of completing forms into a straightforward and efficient experience!

- Check the document preview and descriptions to ensure you are on the correct form you are seeking.

- Verify that the form you choose complies with the regulations and laws applicable to your state and county.

- Select the most appropriate subscription option to obtain the Memo Of Costs After Judgment In India.

- Download the document. Then complete, certify, and print it out.

Form popularity

FAQ

The most significant difference between a loan and a mortgage is their respective purposes. A loan can be taken out for several reasons, such as to finance a car, consolidate debt, or pay for college tuition. A mortgage, however, can only be used to purchase property or land.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

Your mortgage lender is the financial institution that loaned you the money. Your mortgage servicer is the company that sends you your mortgage statements. Your servicer also handles the day-to-day tasks for managing your loan.

There are two main parts of a loan: The principal -- the money that you borrow. The interest -- this is like paying rent on the money you borrow.

Banks are intermediaries between depositors (who lend money to the bank) and borrowers (to whom the bank lends money). The amount banks pay for deposits and the income they receive on their loans are both called interest.

A lender refers to an individual or financial institution that provides loans to an individual, corporation, or public department in exchange for the principal and interest. A lender could be a bank, an insurance company, or a government agency.