Bonus Per Employee Withholding

Description

How to fill out California Production Bonus Pay Agreement For Construction?

It’s well-known that you cannot become a legal expert instantly, nor can you easily learn how to swiftly prepare Bonus Per Employee Withholding without possessing a specialized background.

Assembling legal documents is a labor-intensive task that demands specific education and expertise.

So why not entrust the preparation of the Bonus Per Employee Withholding to the experts.

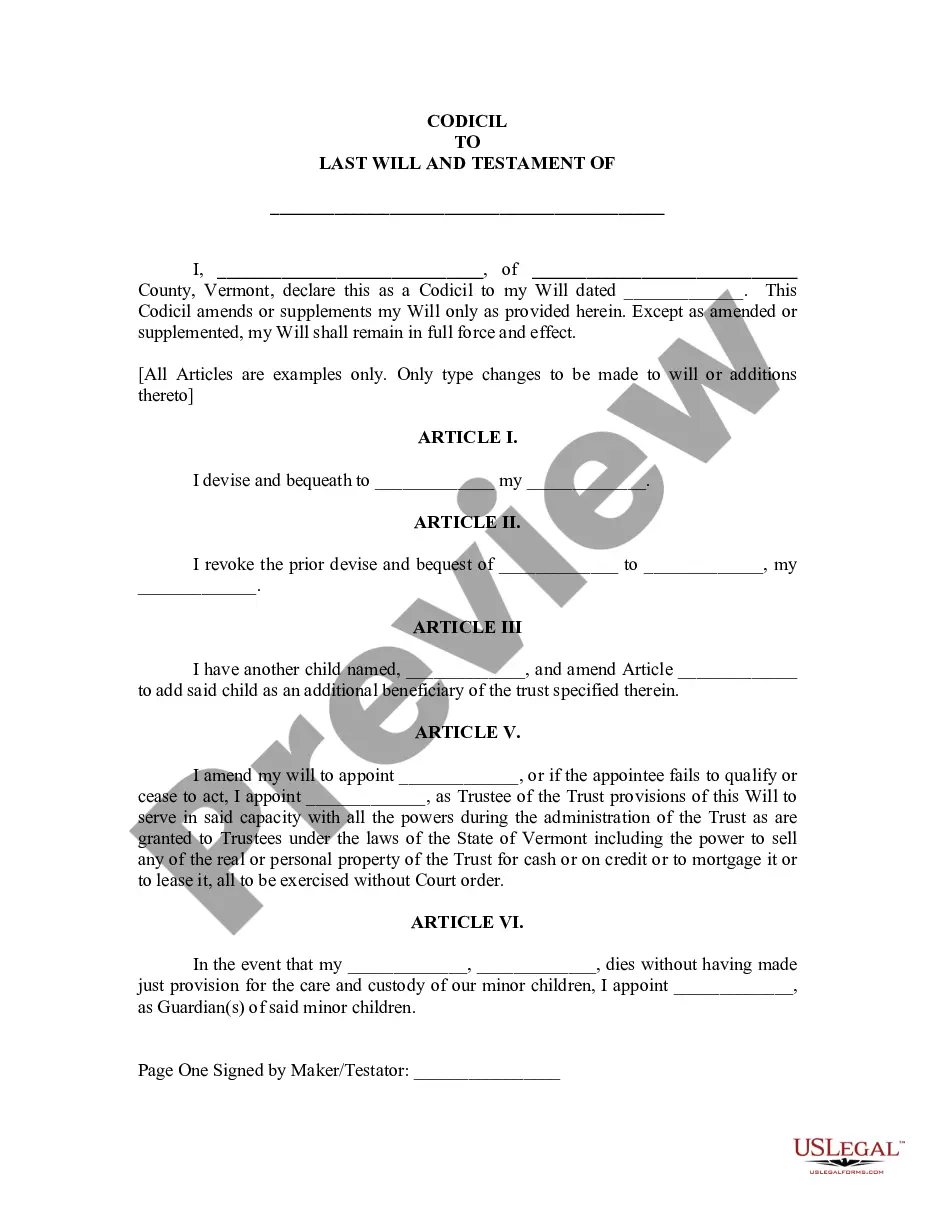

Preview it (if this option is available) and review the accompanying description to ascertain whether Bonus Per Employee Withholding is what you need.

If you require any other form, begin your search anew.

- With US Legal Forms, one of the largest legal template collections, you can find everything from court documents to templates for internal corporate correspondence.

- We recognize how vital compliance and adherence to federal and state laws and regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to start using our platform and obtain the document you need in just minutes.

- Explore the document you require using the search bar at the top of the page.

Form popularity

FAQ

Bonuses are treated as income and thus subject to taxation, but there are ways to manage and reduce the amount of taxes that will be owed. And as is the case with other income from an employer, the employer is required to withhold taxes from a bonus, reducing your take-home pay from the windfall.

Basic Salary x 20% = Bonus p.m. 7000 x 20% = 1400 (16800 p.a.) 7000 x 8.33% = 583 ( 6996 p.a.)

When your employer provides you with a bonus, they will report it on your W-2 in box 1?but it's combined with your normal wages or salary. In the eyes of the Internal Revenue Service, your bonus is no different than the salary you receive.

Calculation of bonus payable If the salary of an employee is less than or equal to Rs. 7000, the bonus calculation is calculated using the formula: Bonus = Salary x 8.33/100. If the salary of an employee is more than Rs. 7000, the bonus calculation is based on Rs. 7000 using the formula: Bonus = Rs. 7,000 x 8.33/100.

Upon the declaration of the bonus by the employer, it is added to your salary. Thereafter, the employer does your tax calculation after including a bonus in your salary. Based on the employer's calculation of your tax liability, the TDS is deducted from your salary.