Employee Meal During With 5 Days

Description

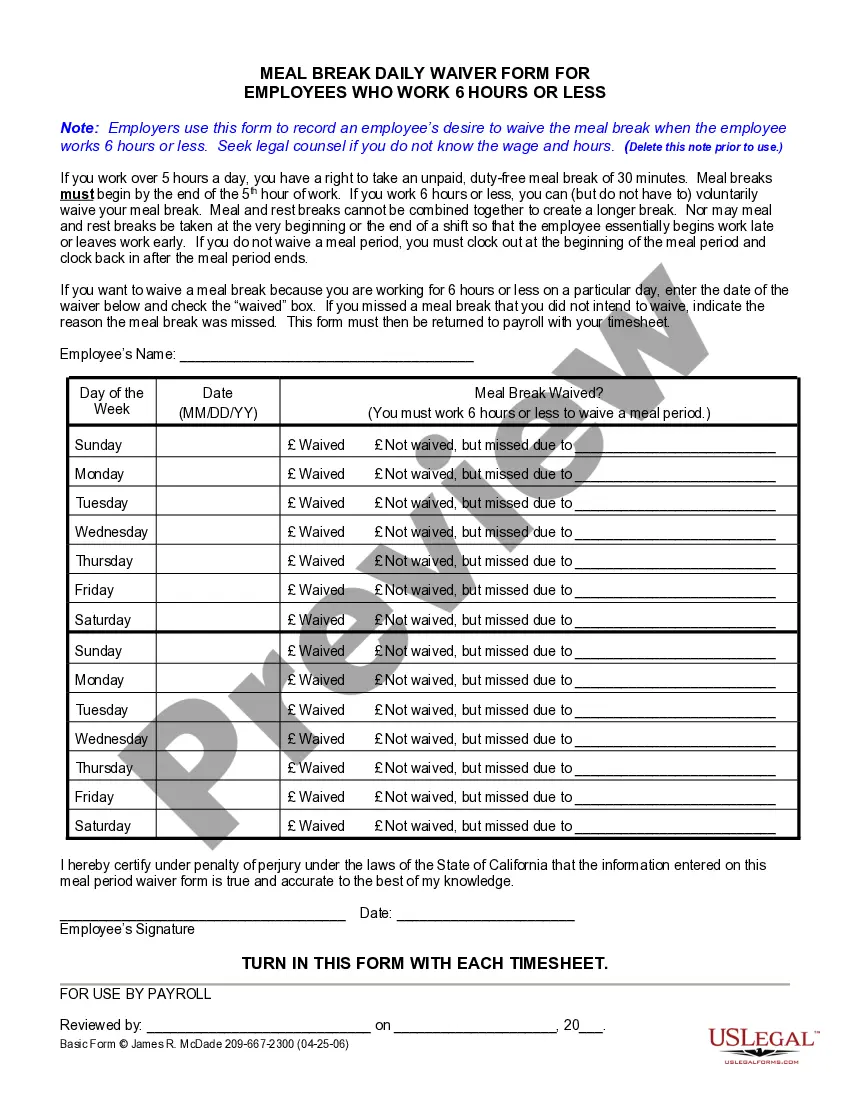

How to fill out California On Duty Meal Period Agreement?

- Begin by logging into your US Legal Forms account. If you don’t have one, create an account to gain full access.

- Once logged in, search for the required form using the Preview mode to verify it meets your specific needs and adheres to your local laws.

- If the initial template doesn't suit your requirements, utilize the Search tab to find alternative options.

- Click the Buy Now button on your chosen document and select a subscription plan that fits your needs.

- Complete the payment process with your credit card or PayPal to finalize your subscription.

- Download the form directly to your device for easy access and completion. Your downloaded templates will also be available in the My Forms section of your profile.

With US Legal Forms, you can obtain a diverse array of documents quickly and efficiently. Their extensive collection ensures you won’t be short on options, helping both individuals and attorneys create legally sound forms.

Ready to tackle your legal documentation with ease? Visit US Legal Forms today and unlock access to thousands of templates tailored to your needs!

Form popularity

FAQ

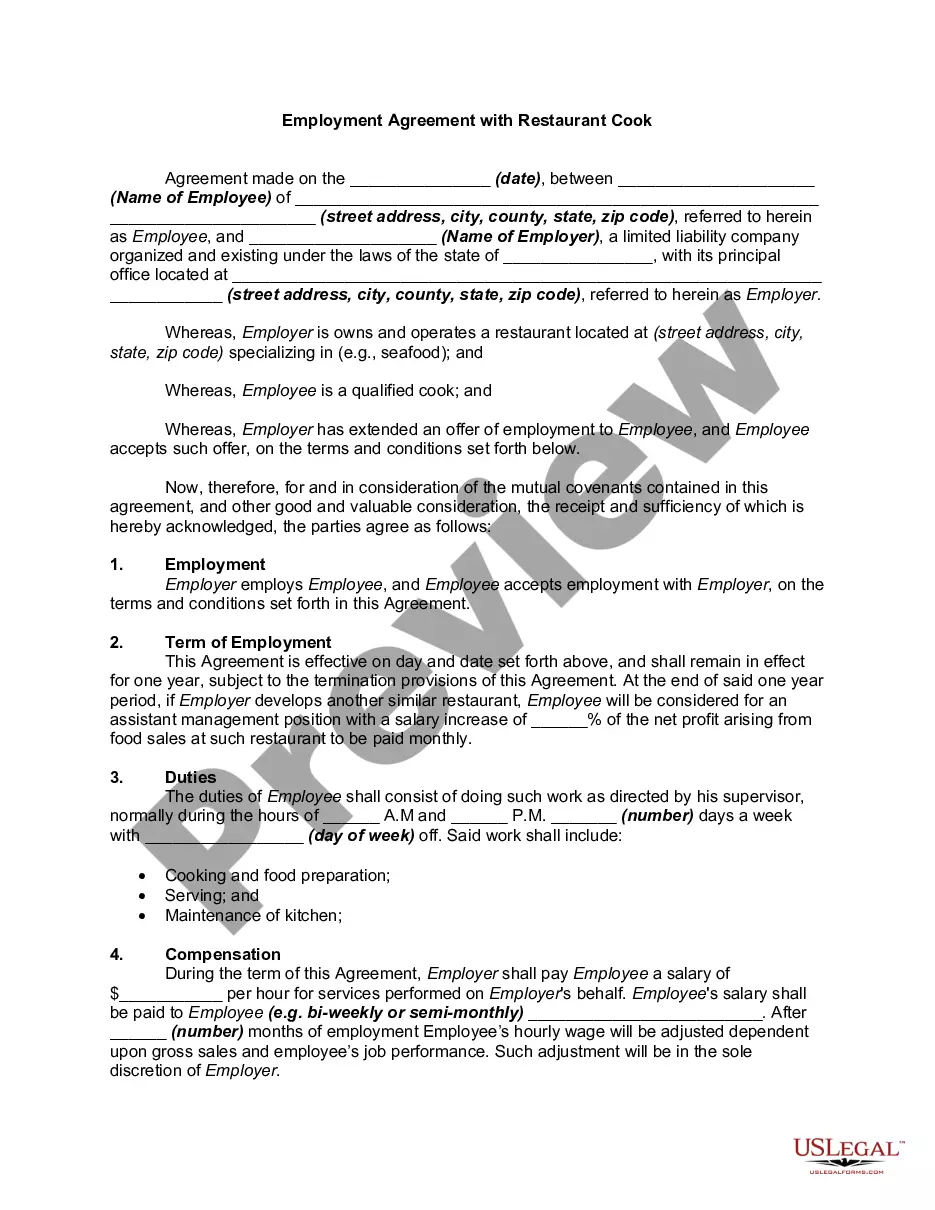

The meal card policy allows employees to conveniently access their meals during a designated timeframe. Typically, each employee receives a meal card that can be used across various locations within your organization. This policy ensures that every employee can enjoy meals without hassle while adhering to budget guidelines. Be sure to review your company’s specific meal card rules to optimize the employee meal during 5 days.

To schedule employee meals during 5 days, you can utilize a dedicated meal planning tool. Start by selecting your preferred meal times and types of meals you want. Afterward, input this information into the scheduling system, which often allows you to customize each day according to dietary needs. Remember, it's important to ensure that your employees' meal preferences are taken into account for a smooth experience.

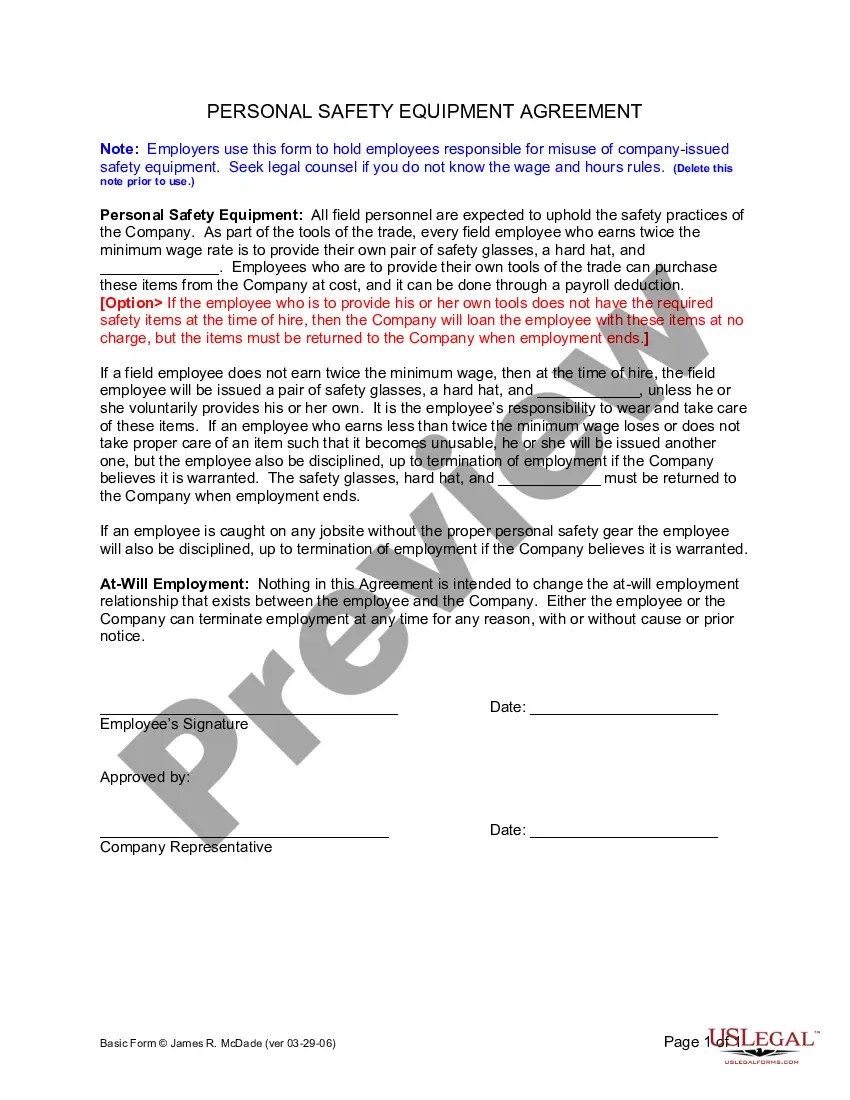

The standard meal allowance method establishes a fixed amount that employees can claim for meals based on predetermined criteria, such as location or duration of travel. This method simplifies the reimbursement process and aids in budgeting and compliance. Establishing a clear standard equips both employees and management with a consistent guideline for meals. Our tools can help implement this method in your organization efficiently.

A meal allowance policy outlines the guidelines for providing meal allowances to employees. This policy typically details the amount employees can claim, eligible circumstances for reimbursement, and any applicable limitations. Clear policies help set expectations for both employees and employers, contributing to a smooth process. With our platform, you can create and manage these policies effortlessly.

A food allowance provides employees with funds to cover meal expenses during work hours. Generally, employers set a specific amount that staff can spend for meals daily, which simplifies budgeting and expense claims. Employees can use this allowance for meals consumed during business activities, ensuring they receive adequate nutrition while they work. Utilizing our platform can help you manage and track these allowances smoothly.

OSHA does not specifically regulate lunch and break periods; however, it is essential for employers to provide reasonable break times. In many industries, allowing employees a meal during with 5 days is necessary for maintaining productivity and workplace safety. Employers must also comply with state laws that may set forth specific requirements for break times. It is prudent to consult the US Legal Forms platform for documents and guidelines that can help you structure compliant break policies.

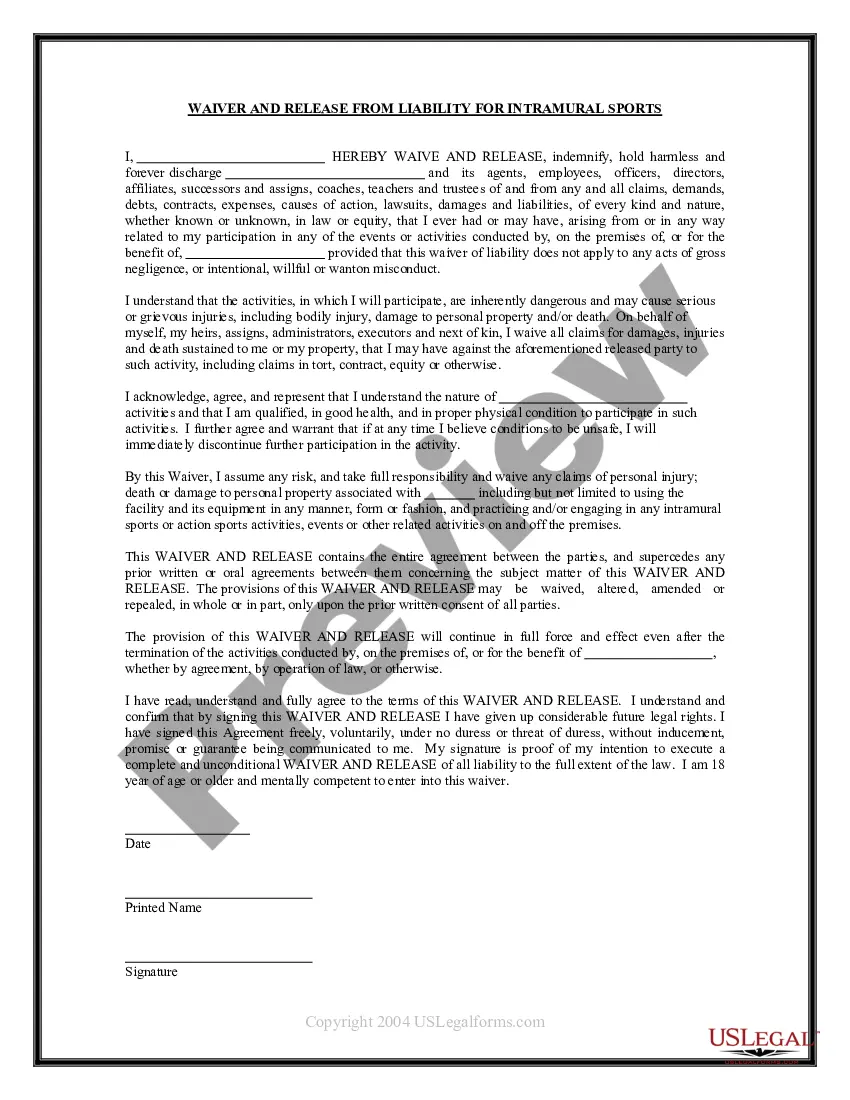

The IRS allows reimbursement for employee meals during business functions, but certain rules apply. Meals must generally be directly related to business purposes and documented with receipts. Furthermore, only 50% of the expense may be deductible when calculating taxes. Using US Legal Forms can help clarify the relevant rules and ensure compliance with IRS regulations.

You can deduct meals while traveling for work, provided they meet IRS guidelines. Employee meals during trips are eligible for deduction, especially if they are necessary for conducting business. It's important to keep all receipts and document the purpose of each meal to support your deduction claims. Utilizing a platform like US Legal Forms can guide you through the necessary documentation.

Yes, you can write off employee meals during a work week under certain circumstances. The IRS allows deductions for meals provided directly to employees as part of business operations. This includes meals offered during meetings or business-related travel. Keeping proper records of these expenses is crucial for maximizing your deductions.

To account for employee meals during a work week, it's essential to track costs accurately. Ensure you maintain detailed receipts and documentation of the meals provided for employees. Doing so helps you properly categorize these expenses in your records. Additionally, using a structured tool, like US Legal Forms, can simplify this accounting process.