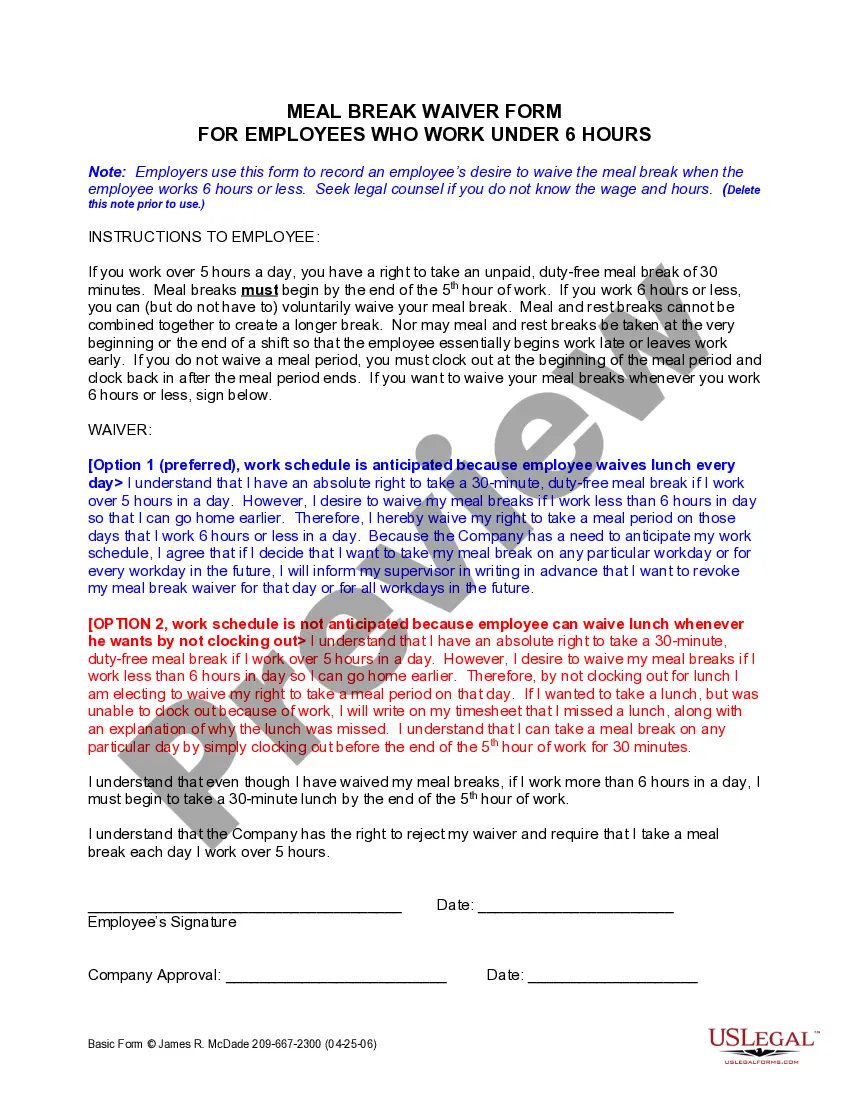

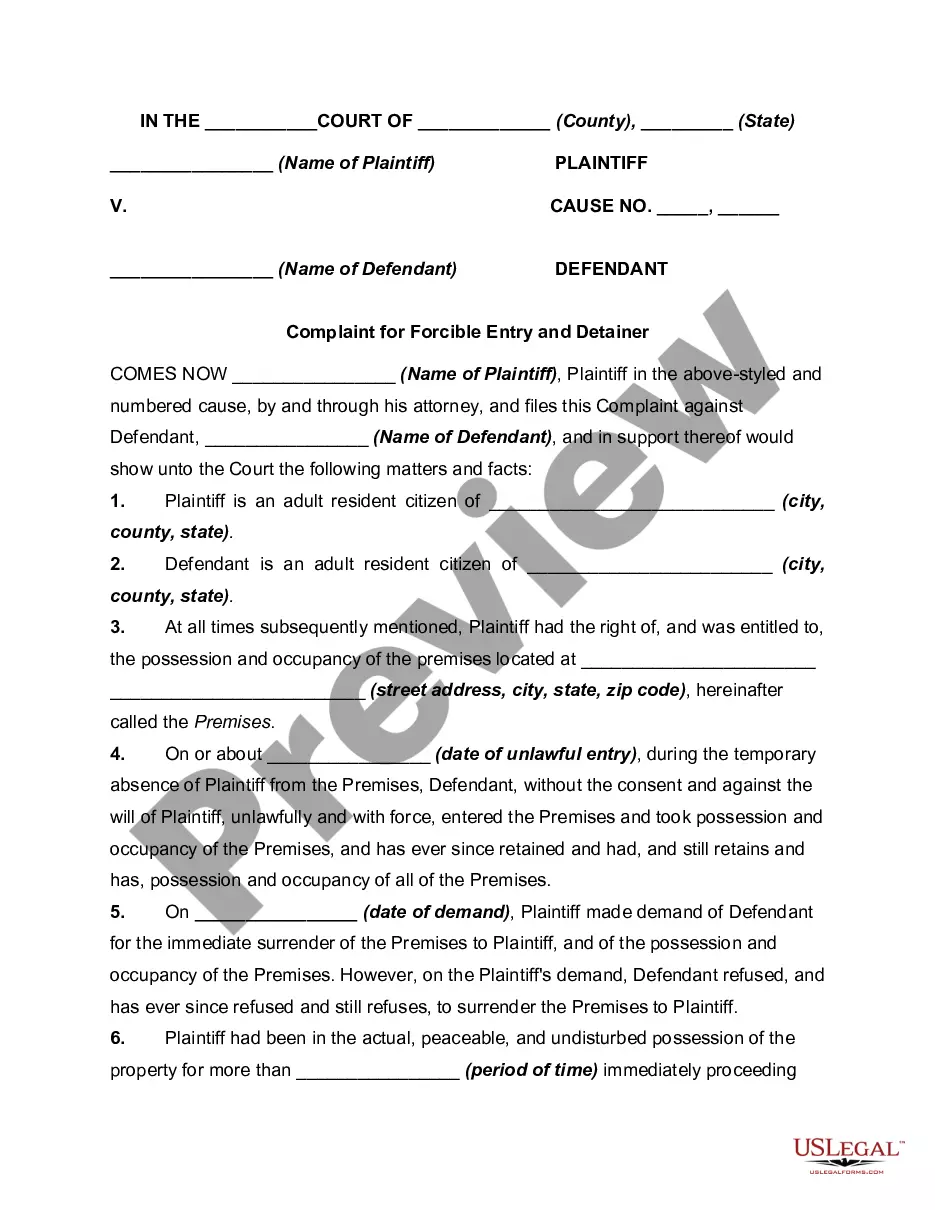

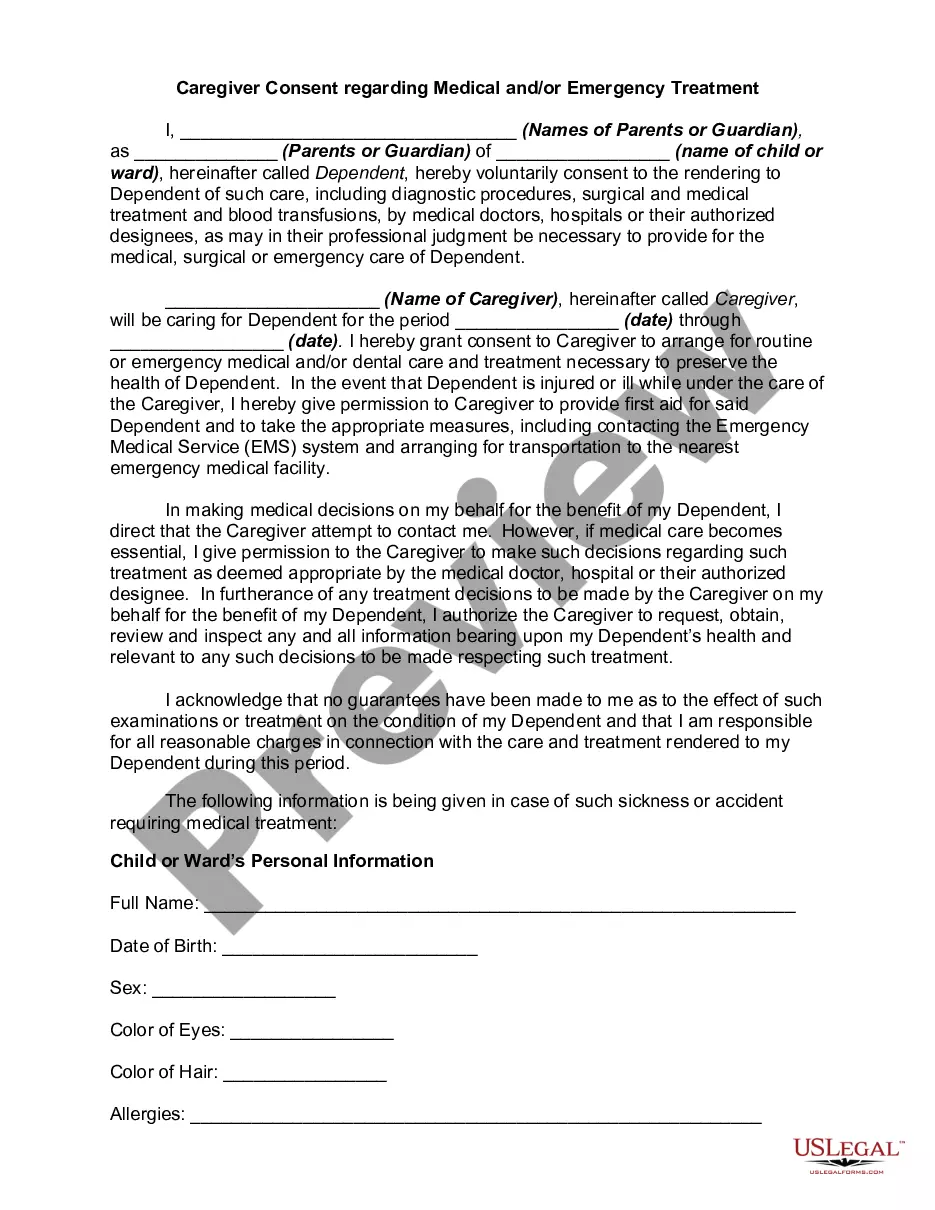

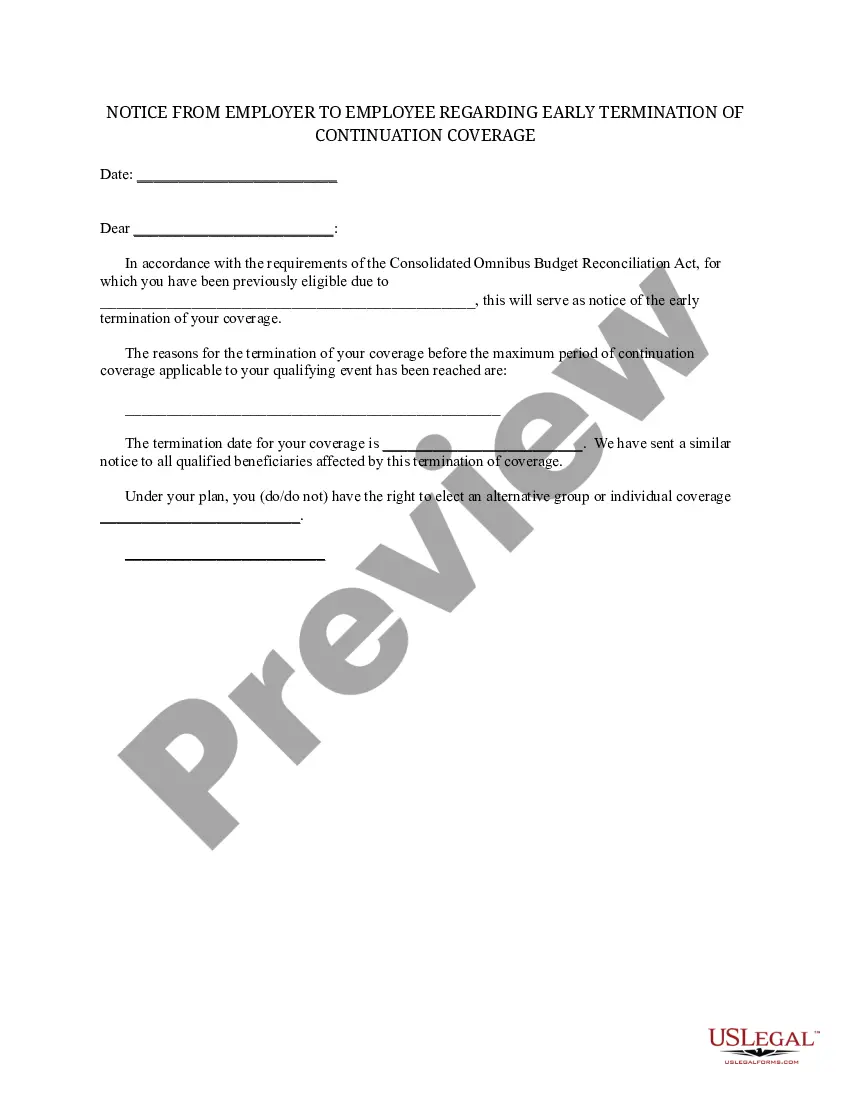

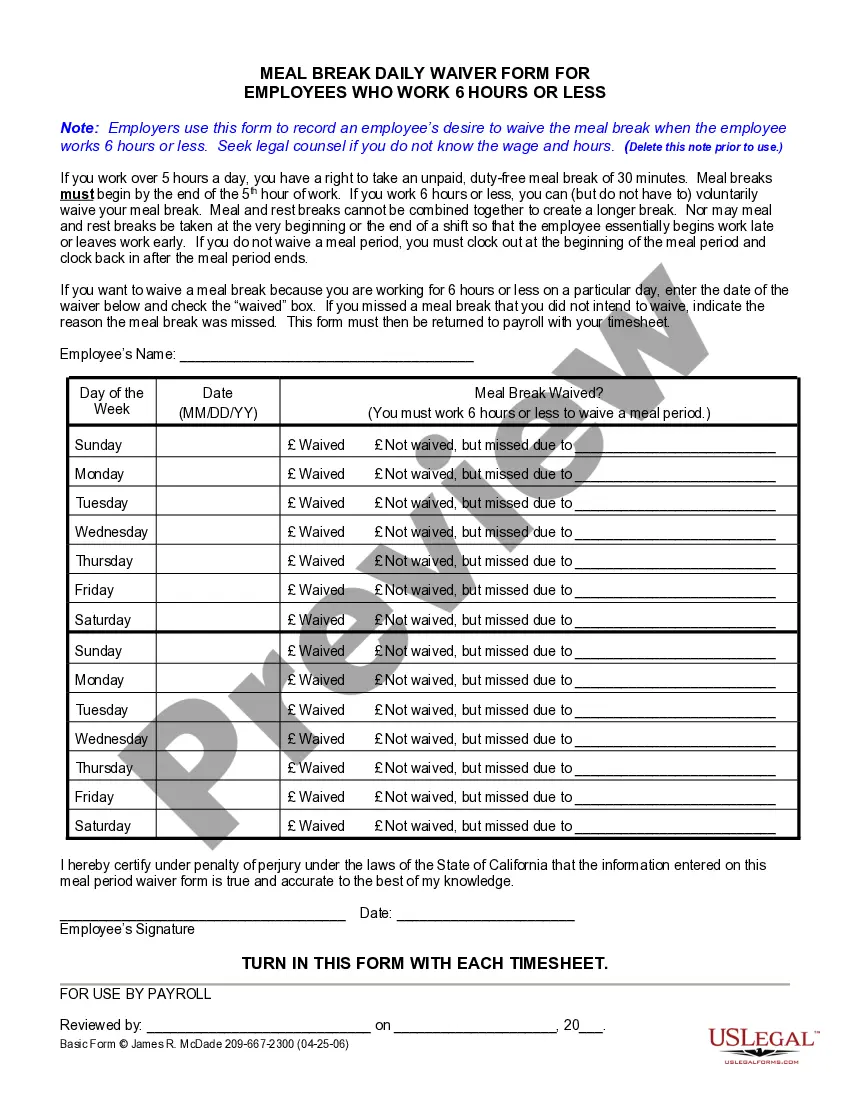

Employers use this form to record an employee’s desire to waive the meal break when the employee works 6 hours or less.

California Break Employee Withholding Allowance Certificate

Description

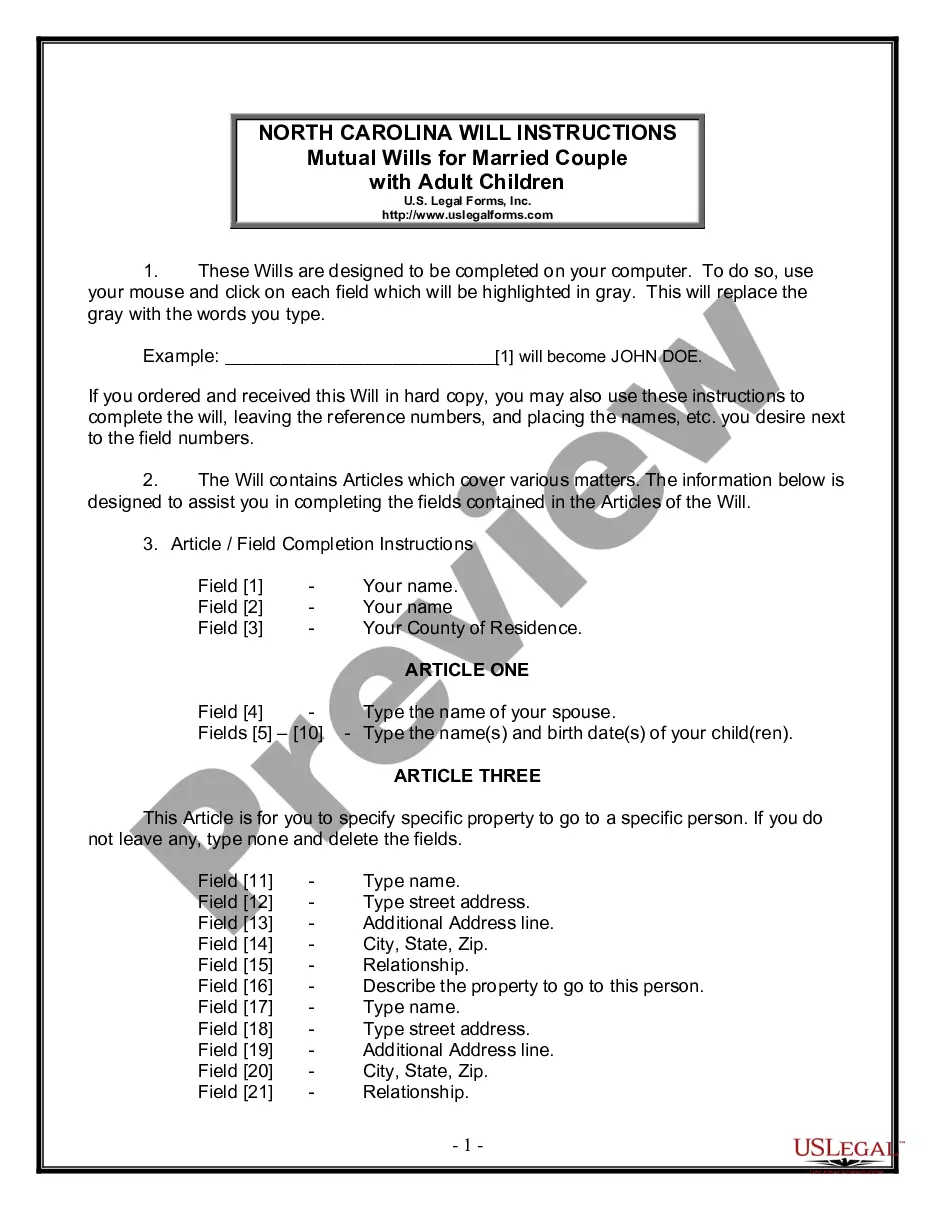

How to fill out California Meal Break Daily Waiver For 6 Hour Employees?

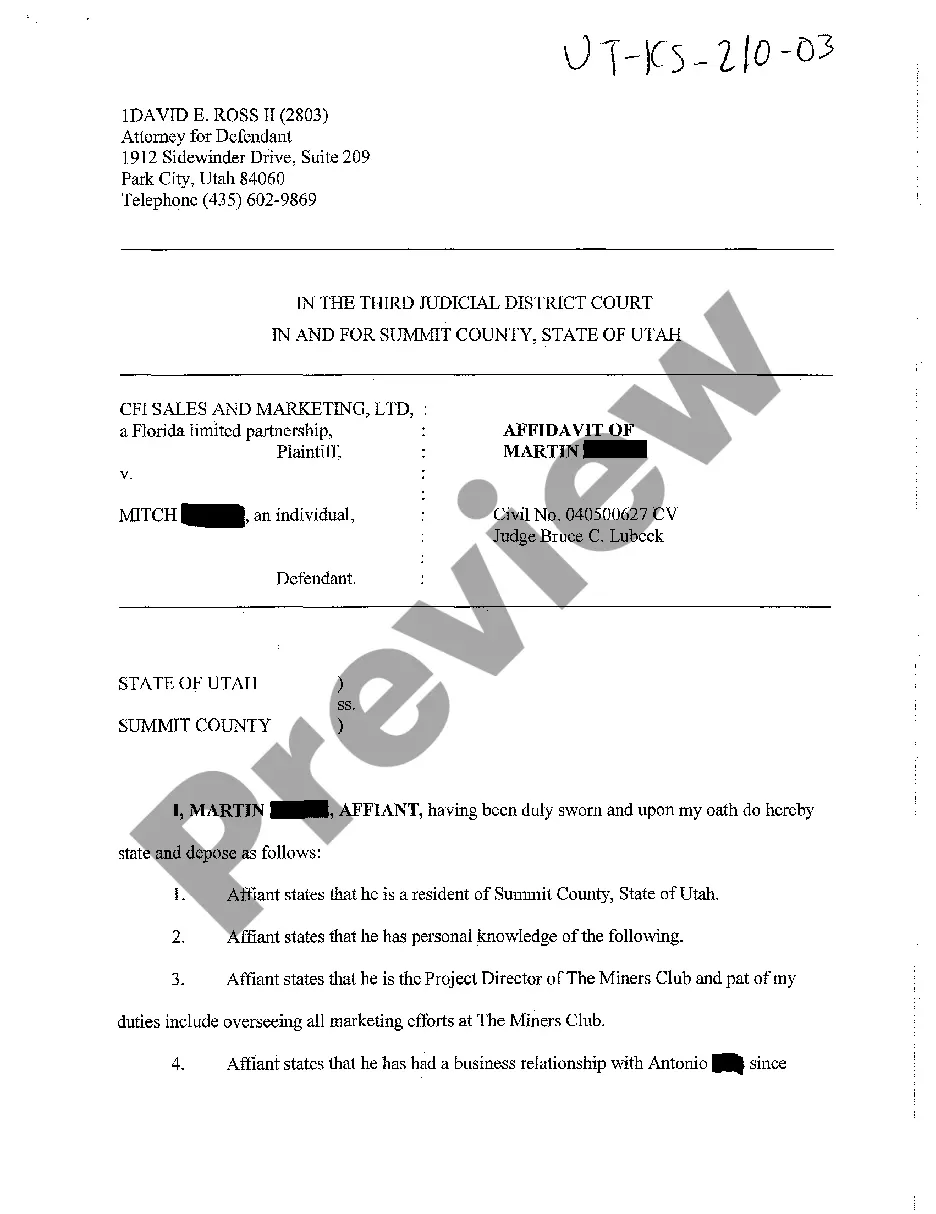

Whether for professional reasons or for personal issues, everyone must confront legal circumstances at some point in their lives.

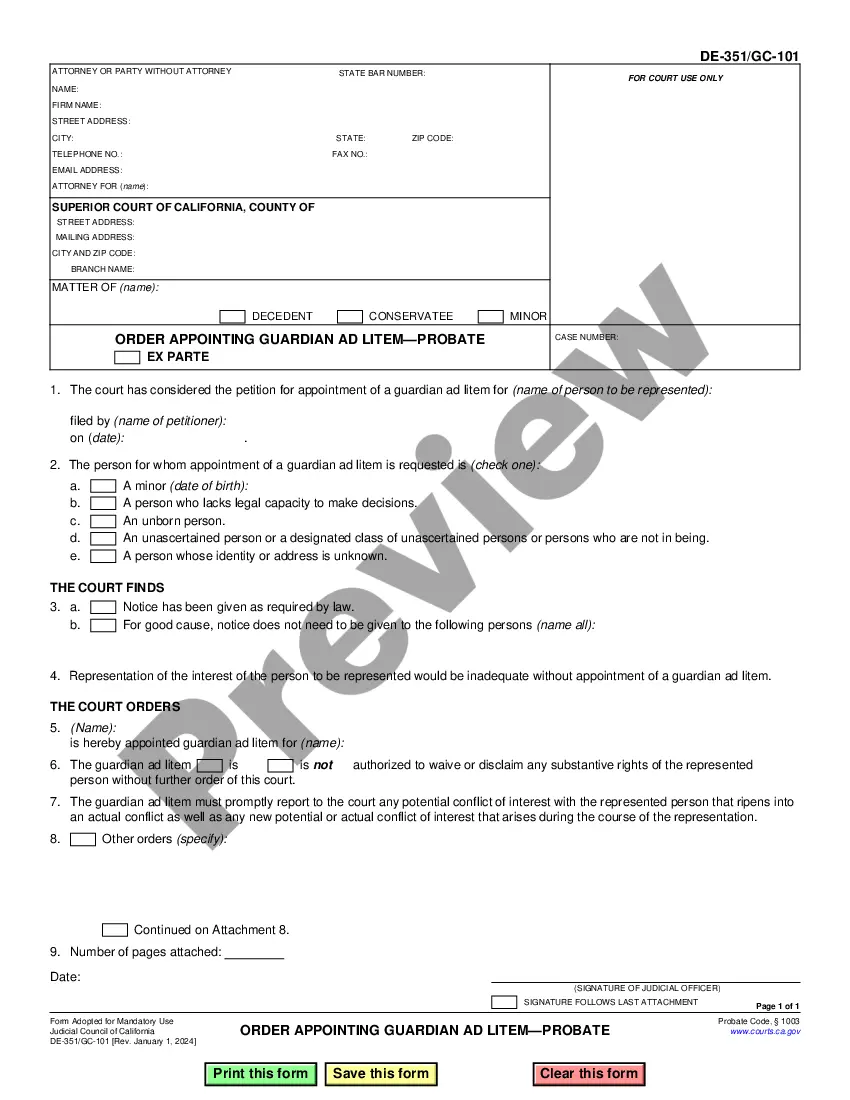

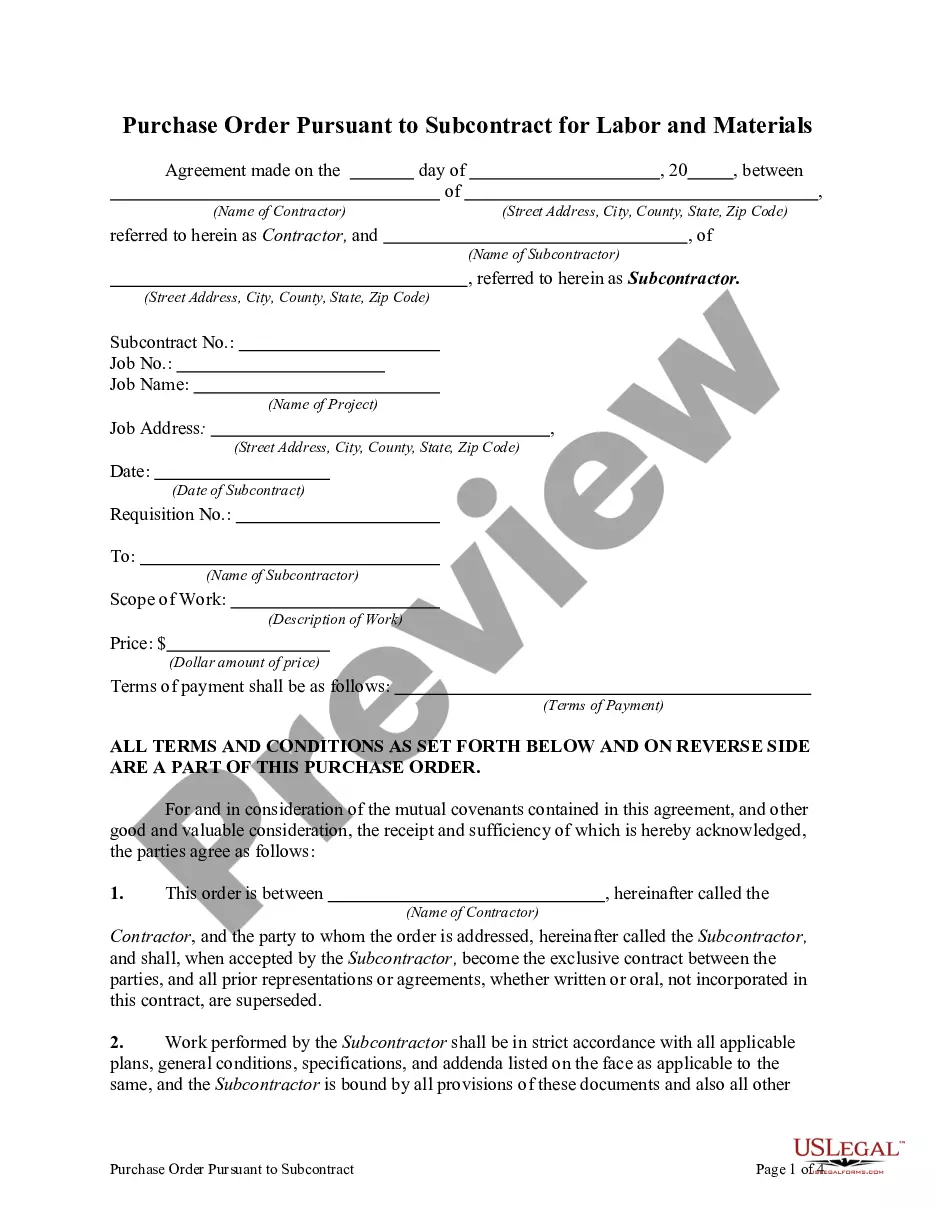

Completing legal documents requires meticulous care, starting with selecting the appropriate form template.

Select the file format you desire and download the California Break Employee Withholding Allowance Certificate. Once saved, you can fill out the form using editing software or print it out and complete it by hand. With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable document online. Utilize the library’s user-friendly navigation to find the right form for any occasion.

- For instance, if you select an incorrect version of a California Break Employee Withholding Allowance Certificate, it will be rejected when submitted.

- Thus, it is imperative to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need to retrieve a California Break Employee Withholding Allowance Certificate template, follow these straightforward steps.

- Acquire the document you require by using the search function or catalog browsing.

- Review the form’s details to ensure it aligns with your circumstances, state, and area.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search feature to locate the California Break Employee Withholding Allowance Certificate template you require.

- Obtain the template if it satisfies your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate price plan.

- Complete the account registration form.

- Choose your payment option: use a credit card or PayPal account.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding. If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages: AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4.