Ca Break With Michelle Wolf

Description

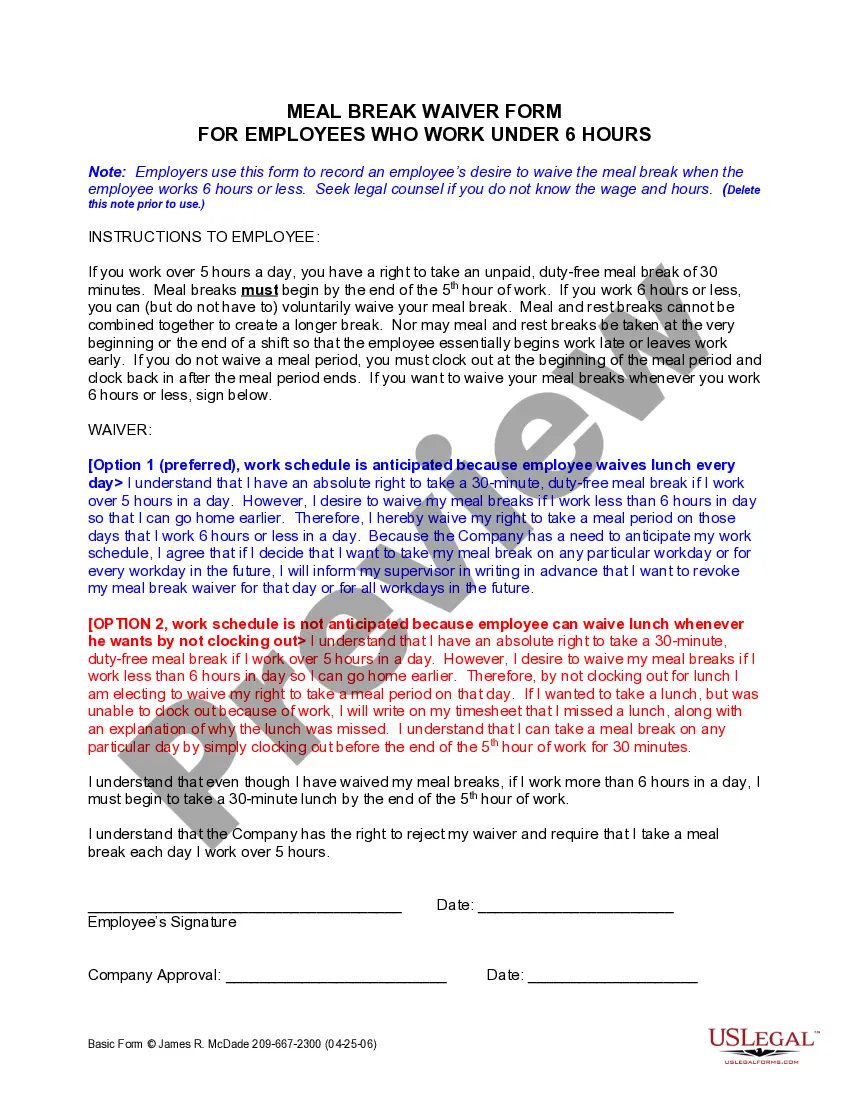

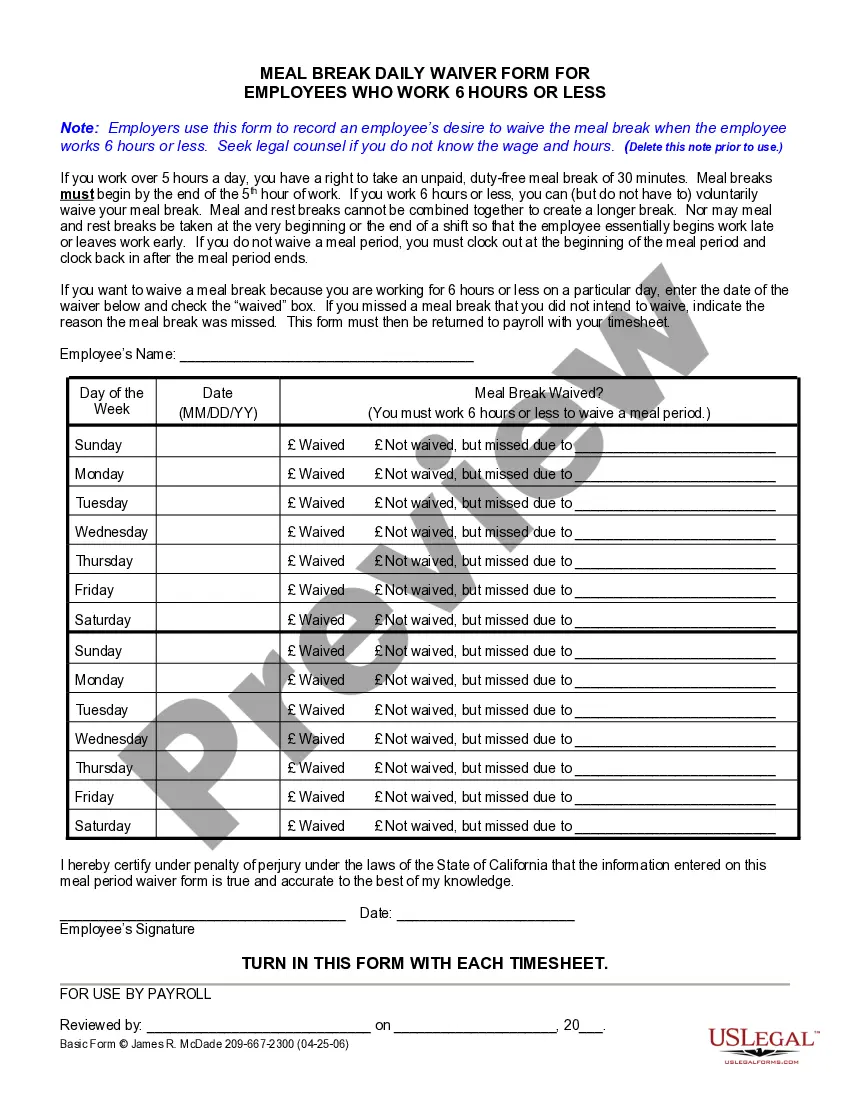

How to fill out California Meal Break Daily Waiver For 6 Hour Employees?

Securing a reliable source for obtaining the most up-to-date and suitable legal templates is a significant part of navigating through bureaucracy.

Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to source samples of Ca Break With Michelle Wolf exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can waste your precious time and prolong the circumstances you are facing.

Remove the stress linked to your legal documentation. Explore the extensive US Legal Forms library to discover legal templates, evaluate their applicability to your situation, and download them immediately.

- Use the library navigation or search feature to locate your document.

- Check the form’s details to confirm it meets the specifications of your jurisdiction and locality.

- Examine the form preview, if available, to verify that the document is indeed what you are looking for.

- Continue searching and discover the appropriate template if the Ca Break With Michelle Wolf does not fulfill your requirements.

- If you are confident about the form’s applicability, proceed to download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the template.

- Choose the pricing plan that best fits your needs.

- Proceed with the registration to complete your order.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Ca Break With Michelle Wolf.

- After acquiring the form on your device, you may either edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

A promissory note must be signed by the borrower to be valid. You may want the borrower to sign in front of a notary to ensure the signature is authentic. The lender keeps the original promissory note and the borrower should receive a copy.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note. But specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Your lender will typically provide you with a copy of the promissory note, along with several other documents, when you close on your home purchase. The lender will keep the original promissory note until the loan is paid off.

You don't need a witness to sign a North Carolina promissory note. Obtaining a witness or signature from a notary public, for example, would strengthen the note's validity if you were to use this document in court.

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

A demand (or due on demand) promissory note is a note that you as the lender, or holder, can collect on at any time. In other words, the loan comes due whenever you decide to ask for the money, whether the borrower is making regular payments or not.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.