Fmla California Forms Withholding

Description

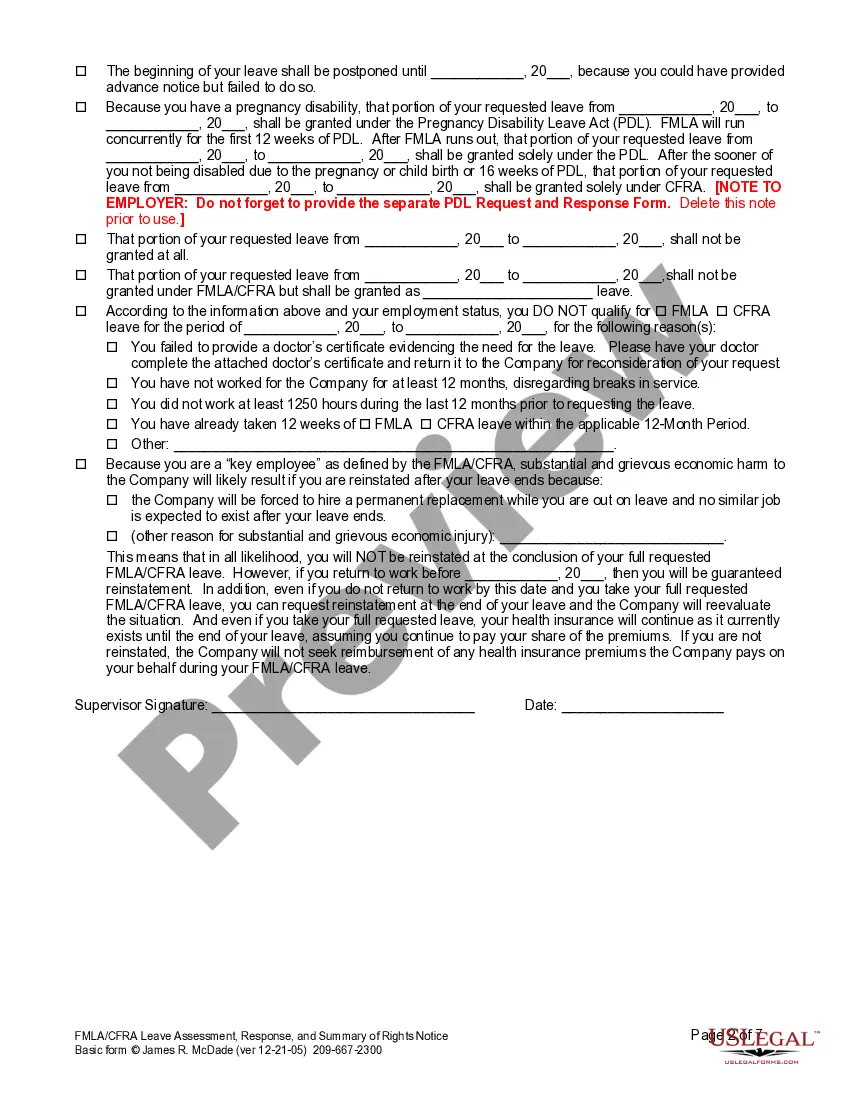

How to fill out California FMLA Request And Summary Of Rights Notice?

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Filling out legal paperwork requires careful attention, beginning from selecting the right form sample. For example, if you select a wrong edition of the Fmla California Forms Withholding, it will be turned down when you submit it. It is therefore important to have a dependable source of legal documents like US Legal Forms.

If you need to get a Fmla California Forms Withholding sample, stick to these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to ensure it matches your case, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong document, go back to the search function to locate the Fmla California Forms Withholding sample you require.

- Download the template if it meets your requirements.

- If you have a US Legal Forms account, just click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the account registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Select the document format you want and download the Fmla California Forms Withholding.

- After it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time looking for the appropriate sample across the internet. Make use of the library’s simple navigation to get the right template for any situation.

Form popularity

FAQ

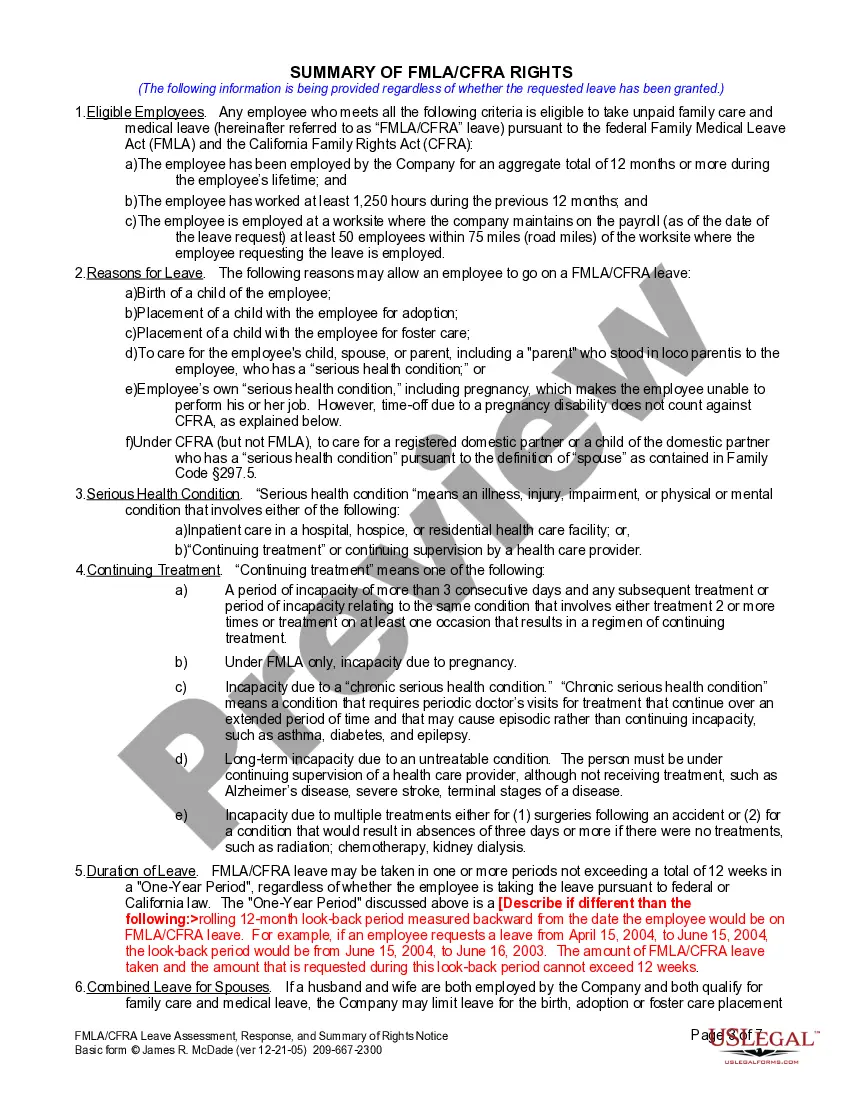

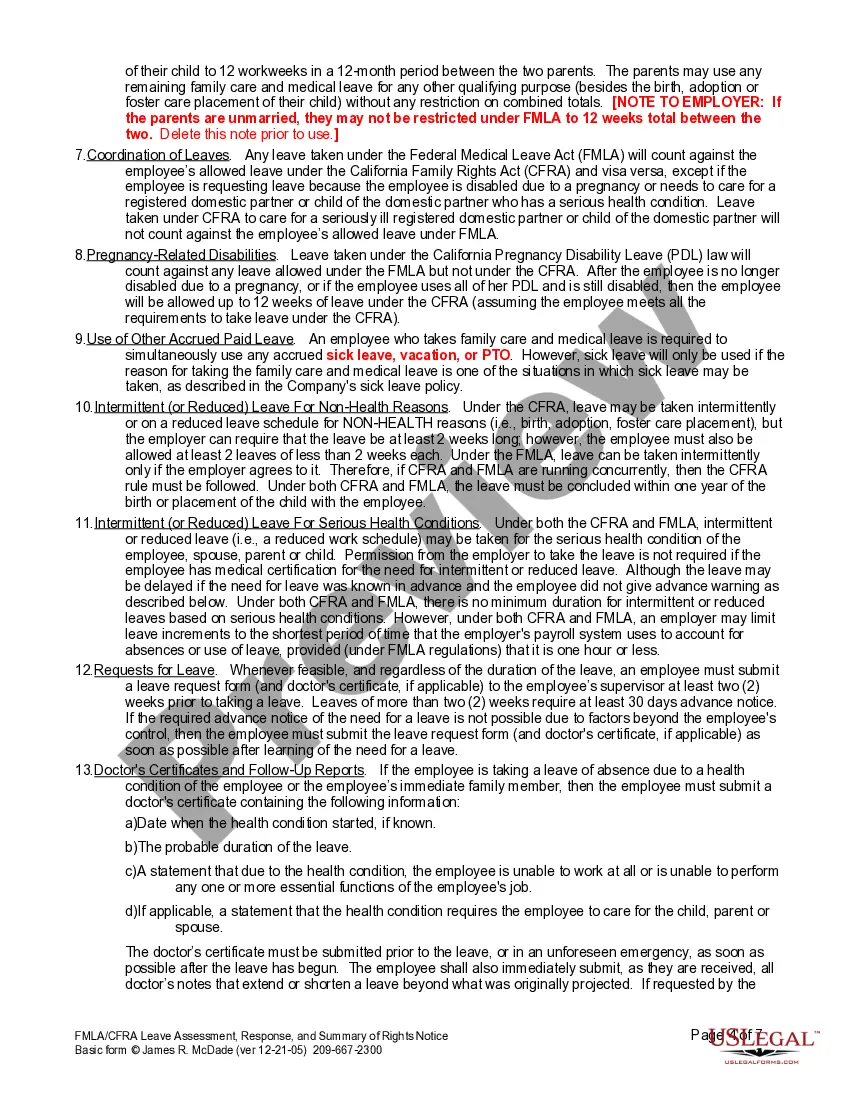

How to Request California FMLA Leave Step 1: Determine if you're eligible. ... Step 2: Give advance notice. ... Step 3: Request the appropriate forms. ... Step 4: Fill out the forms. ... Step 5: Submit the forms. ... Step 6: Follow up. ... Step 7: Understand your rights and responsibilities. ... Step 8: Communicate with your employer.

Among the forms changed were the WH-381, the notice of eligibility and rights and responsibilities; WH-382, designation notice; WH-380-E, medical certification of an employee's serious health condition; and WH-380-F, medical certification of a family member's serious health condition.

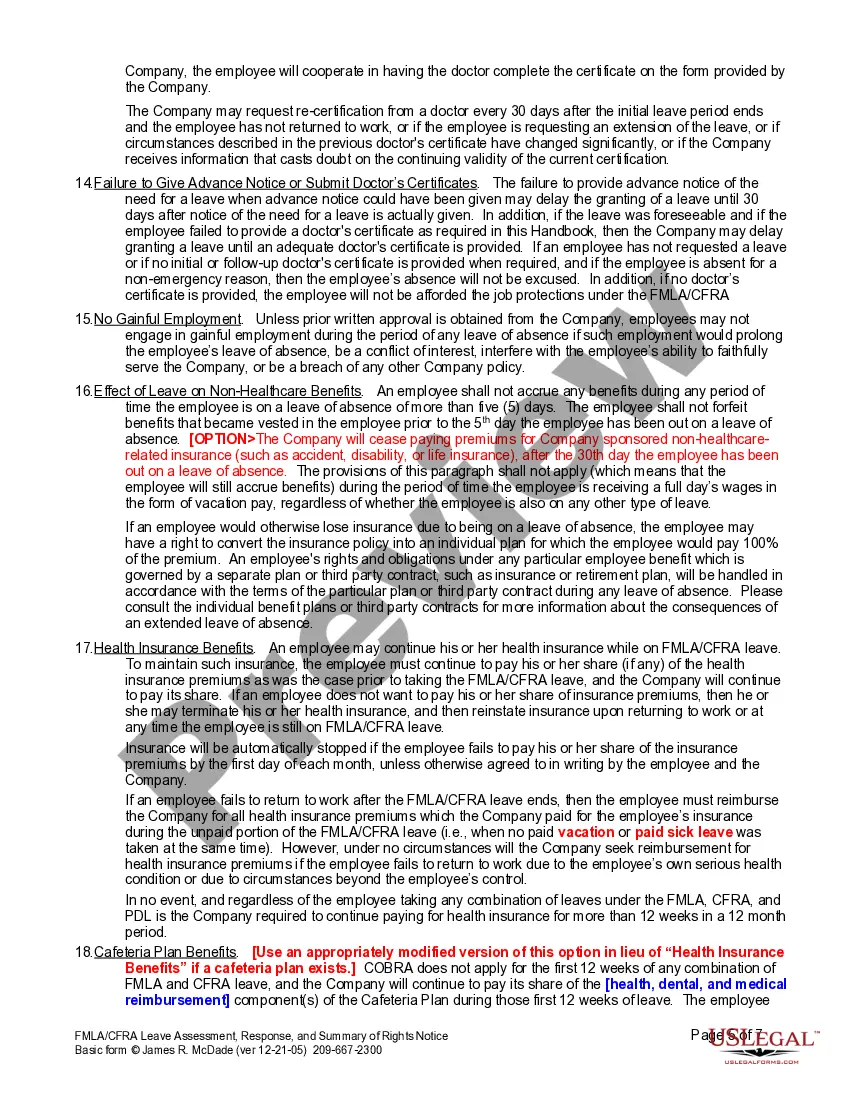

If eligible, you can receive benefit payments for up to eight weeks. Payments are about 60 to 70 percent of your weekly wages earned 5 to 18 months before your claim start date. You will choose your benefit payment option when you file your claim.

You pay into the State Disability Insurance (SDI) program. It is not government assistance. California's Paid Family Leave (PFL) pays eligible employees up to eight weeks of benefits to be there for the moments that matter most.

An employee must have been employed for at least 1,250 hours of service during the 12-month period immediately preceding the commencement of the leave. The hours of service are counted for the 12-month period immediately preceding the leave and generally must be actual hours worked by the employee.