Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

Pay Deductible With Insurance

Description

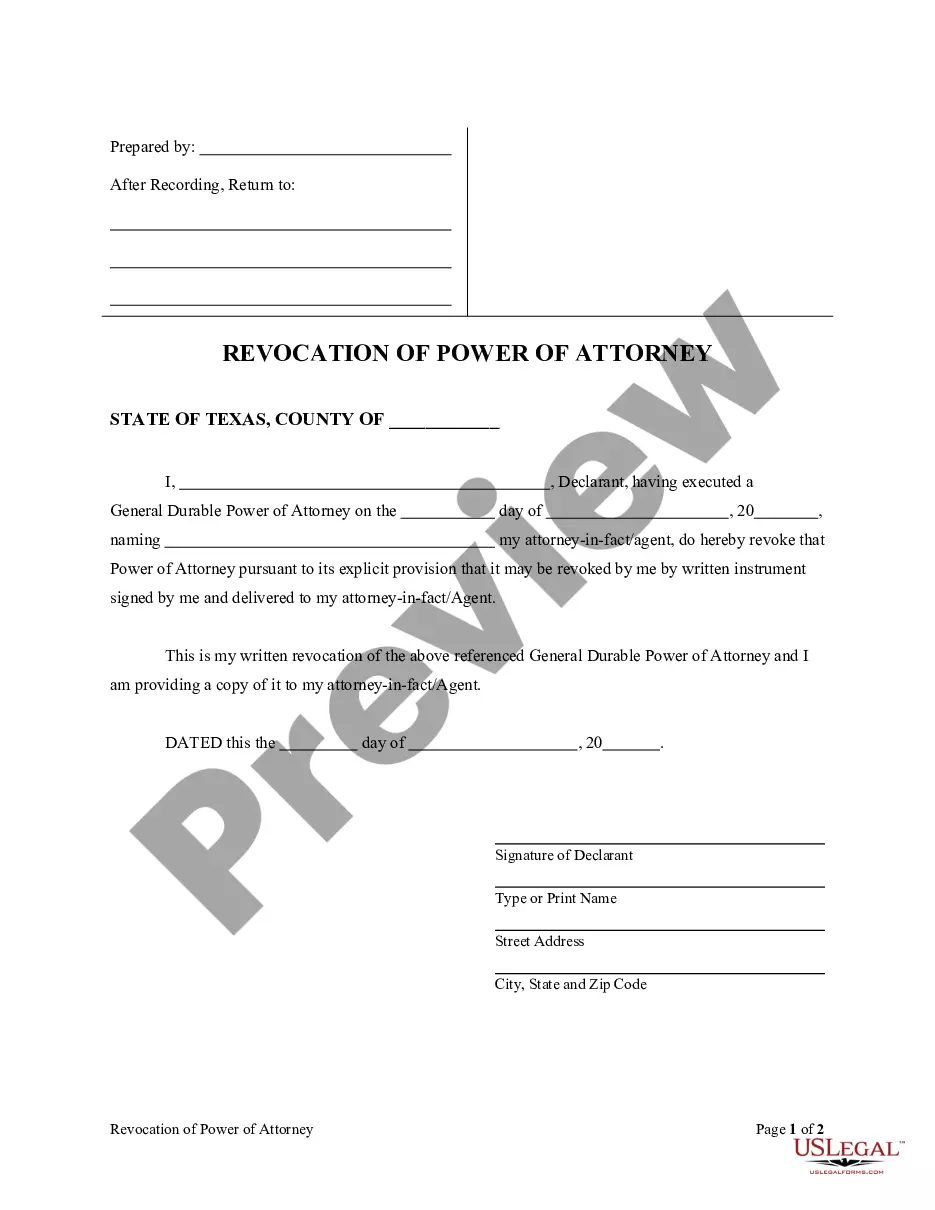

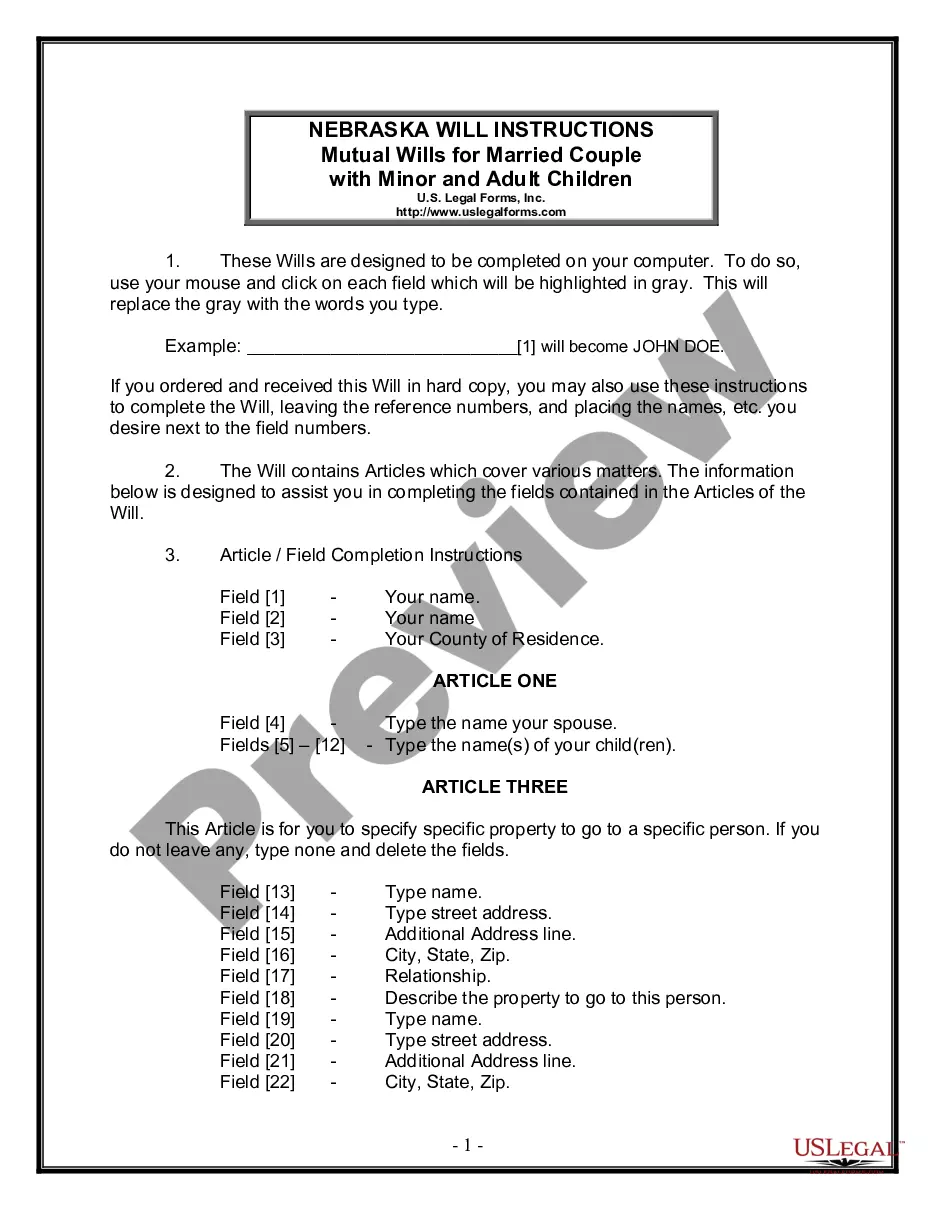

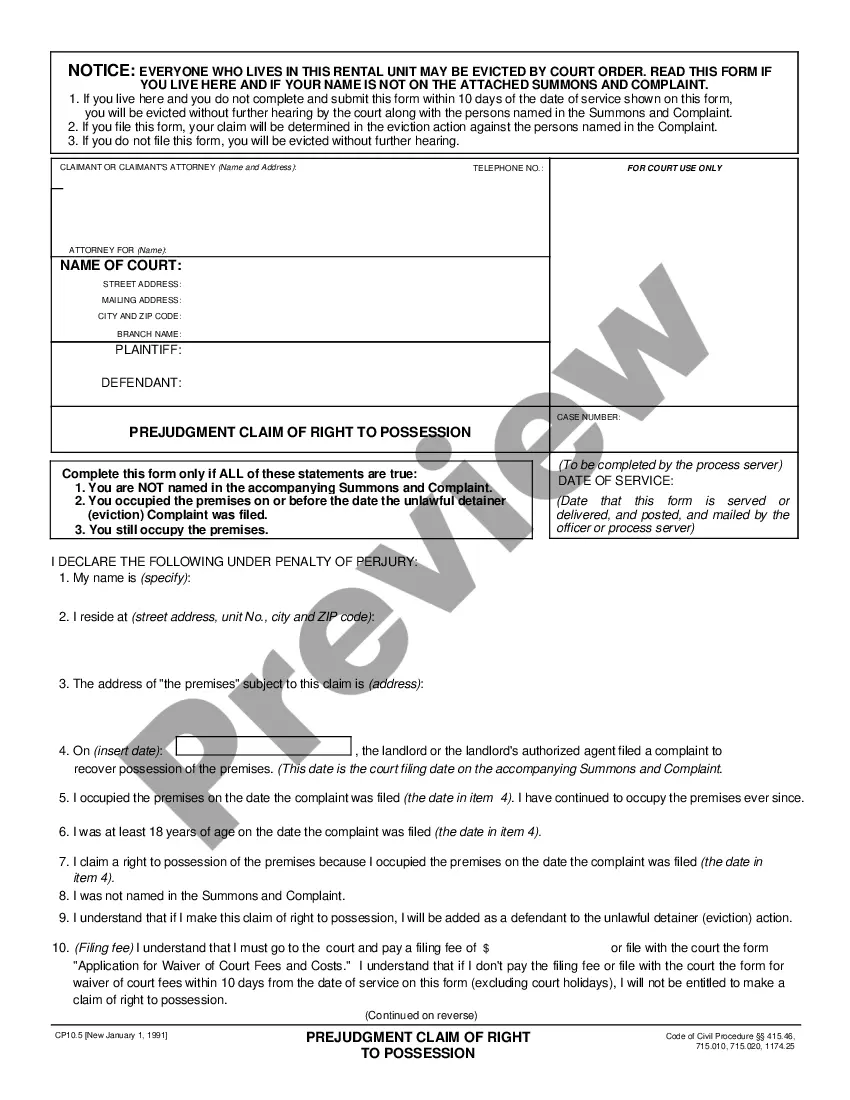

How to fill out California Authorization For Deduction From Pay For A Specific Debt?

Whether for corporate reasons or personal matters, everyone must confront legal circumstances at some point in their lives.

Completing legal documents requires meticulous focus, beginning with selecting the correct form template.

With an extensive collection of US Legal Forms available, you do not need to waste time searching for the correct template online. Use the library’s easy navigation to find the right template for any circumstance.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the details of the form to ensure it is appropriate for your situation, jurisdiction, and area.

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search option to find the Pay Deductible With Insurance template you need.

- Download the file if it meets your needs.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account sign-up form.

- Choose your payment method: bank card or PayPal.

- Select your desired file format and download the Pay Deductible With Insurance.

- After saving it, you can fill out the form using editing software or print it out and complete it manually.

Form popularity

FAQ

Individual deductible In the event you have an individual health insurance plan, your qualifying healthcare payments go directly towards bringing down your deductible. Once you've reached the deductible, you start splitting costs ing to the plan until you reach the out-of-pocket maximum.

You'll pay your deductible payment directly to the medical professional, clinic, or hospital. If you incur a $700 charge at the emergency room and a $300 charge at the dermatologist, you'll pay $700 directly to the hospital and $300 directly to the dermatologist. You don't pay your deductible to your insurance company.

For example, if you have a health insurance policy with a $1,000 deductible and you receive a medical bill for $2,000, you would be responsible for paying the first $1,000 and your insurance would cover the remaining $1,000.

The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself. A fixed amount ($20, for example) you pay for a covered health care service after you've paid your deductible.

A $1,000 deductible is better than a $500 deductible if you can afford the increased out-of-pocket cost in the event of an accident, because a higher deductible means you'll pay lower premiums. Choosing an insurance deductible depends on the size of your emergency fund and how much you can afford for monthly premiums.