Small Estate In California

Description

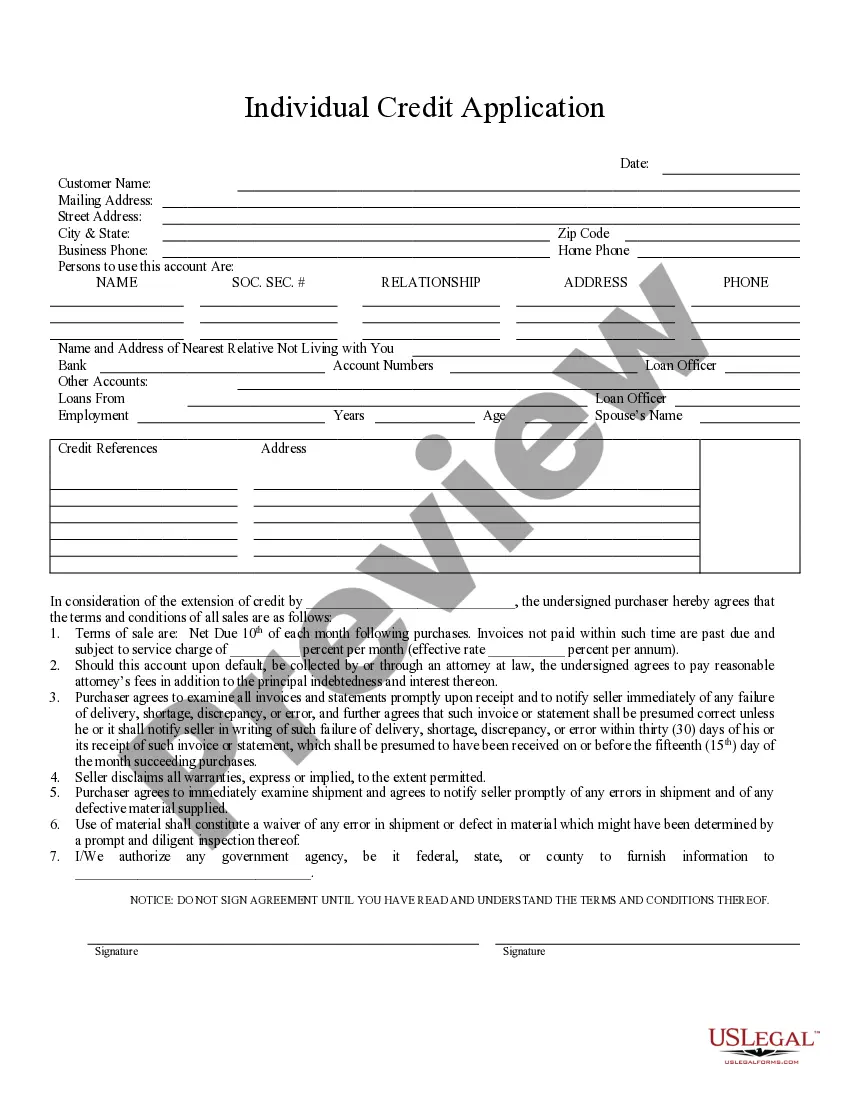

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $208,850?

The Minor Estate In California you observe on this page is a repeatable legal template composed by expert attorneys in alignment with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal practitioners with over 85,000 authenticated, state-specific documents for any commercial and personal circumstance. It’s the quickest, easiest, and most reliable method to procure the forms you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Fill out and sign the documents. Print the template to fill it out manually. Alternatively, employ an online multifunctional PDF editor to quickly and accurately complete and sign your form digitally.

- Look for the document you require and evaluate it.

- Browse through the sample you searched and preview it or examine the form description to confirm it meets your needs. If it doesn’t, utilize the search tool to find the suitable one. Hit Buy Now once you have found the template you require.

- Choose a subscription and sign in.

- Select the payment plan that fits your requirements and create an account. Use PayPal or a credit card to make a fast payment. If you already possess an account, Log In and verify your subscription to move forward.

- Acquire the editable template.

- Pick the format you prefer for your Minor Estate In California (PDF, Word, RTF) and store the sample on your device.

Form popularity

FAQ

The probate threshold in California for 2025 is set at $184,500, which aligns with the small estate limit. If an estate's total value exceeds this amount, it generally requires the full probate process. This threshold is crucial for determining whether heirs can use streamlined methods for asset transfers. Understanding the probate threshold can help you make informed decisions regarding estate management in California.

A small estate in California is defined as one that has a total asset value of $184,500 or less in 2025. This value includes all property, bank accounts, and personal belongings that a deceased person leaves behind. If your estate fits this criterion, you can take advantage of simplified procedures like the small estate affidavit. Knowing the definition of a small estate in California can provide clarity for estate planning.

For 2025, the small estate limit in California remains at $184,500. This limit allows heirs to settle an estate without undergoing probate if the total value of the estate falls under this amount. This legal framework streamlines the transfer of assets, making the process simpler and more accessible for families. Understanding this limit can help you navigate the complexities of managing a small estate in California.

In California, the small estate affidavit limit for 2025 is set at $184,500. This means that if the estate's total value falls below this threshold, the heirs can avoid the lengthy probate process. By utilizing a small estate affidavit, individuals can claim assets more efficiently, saving time and resources. It's an excellent solution for those looking to manage a small estate in California.

To qualify as a small estate in California, the total value of all assets must not exceed $166,250, and certain kinds of property are exempt from this calculation. You can transfer these assets without court involvement using specific forms and guidelines. Additionally, all debts of the deceased must be settled before distribution of the assets. Using platforms like US Legal Forms can guide you through the rules of small estates, ensuring compliance and ease in the process.

Not all estates in California must go through probate. Estates that qualify as a small estate in California can avoid probate altogether, allowing for simpler and faster asset distribution. However, estates exceeding the limit typically require probate unless assets are held in certain types of trusts. This knowledge helps ensure your wishes are honored efficiently.

A small estate in California is one that falls under the $166,250 value limit and can avoid probate. In contrast, a probate estate includes any assets exceeding this value that must go through the court’s probate process. The distinction is crucial for estate planning, as probate can be time-consuming and costly. Understanding these differences helps you make informed decisions about your estate.

In California, the small estate exemption allows for assets valued up to $166,250 to bypass the probate process. This amount includes all assets in your estate, but some property, like joint tenancy properties and some trusts, do not count towards this limit. By knowing what qualifies as a small estate in California, you can plan effectively and ensure smoother transitions for your loved ones.

In California, a small estate is defined as having a value of $166,250 or less in total assets. If your estate falls below this threshold, you may be able to use a simplified process to avoid probate. This means your heirs can inherit assets more quickly and with lower costs. It's beneficial to understand these limits when planning your estate.

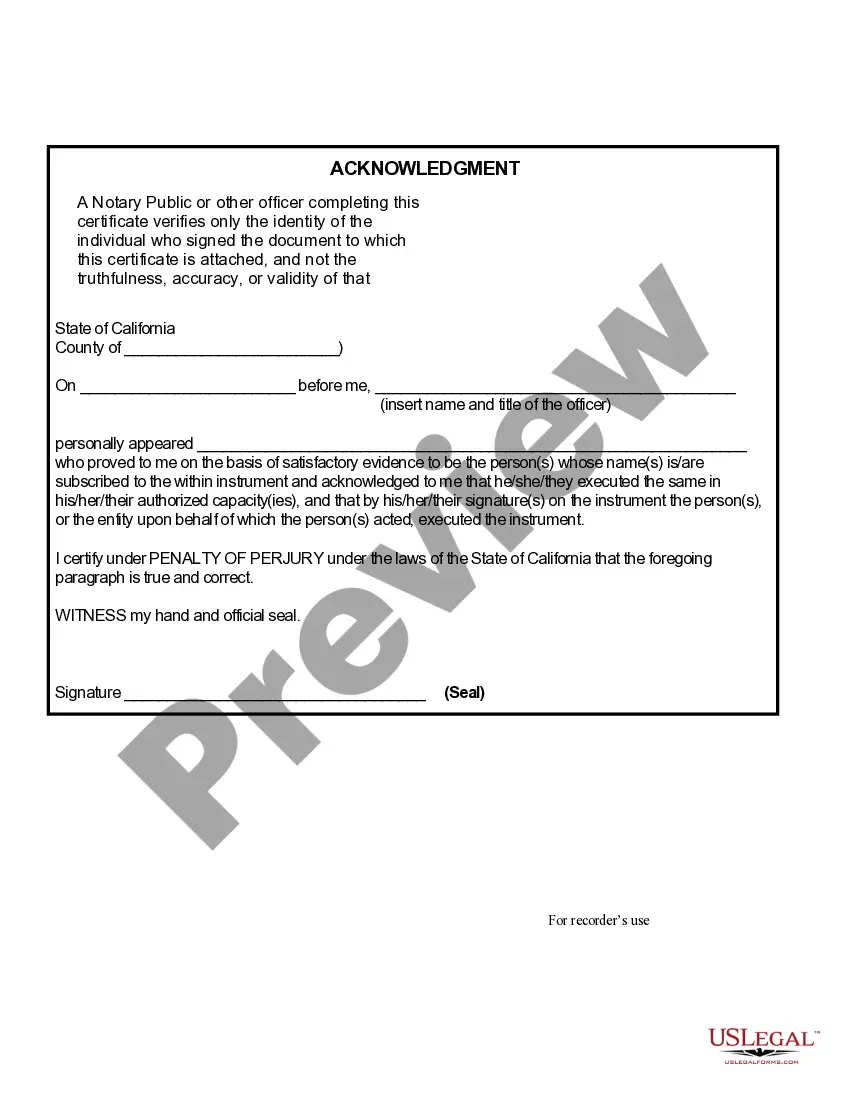

Filing a small estate affidavit in California starts with completing the appropriate form, which you can find on platforms like US Legal Forms. After gathering relevant information about the deceased and their assets, you will submit the completed affidavit to the local court. Once filed, the court will review your application, enabling you to transfer the assets without going through the lengthy probate process. Thus, navigating your responsibilities related to a small estate in California becomes much easier.