Living Trust

Description

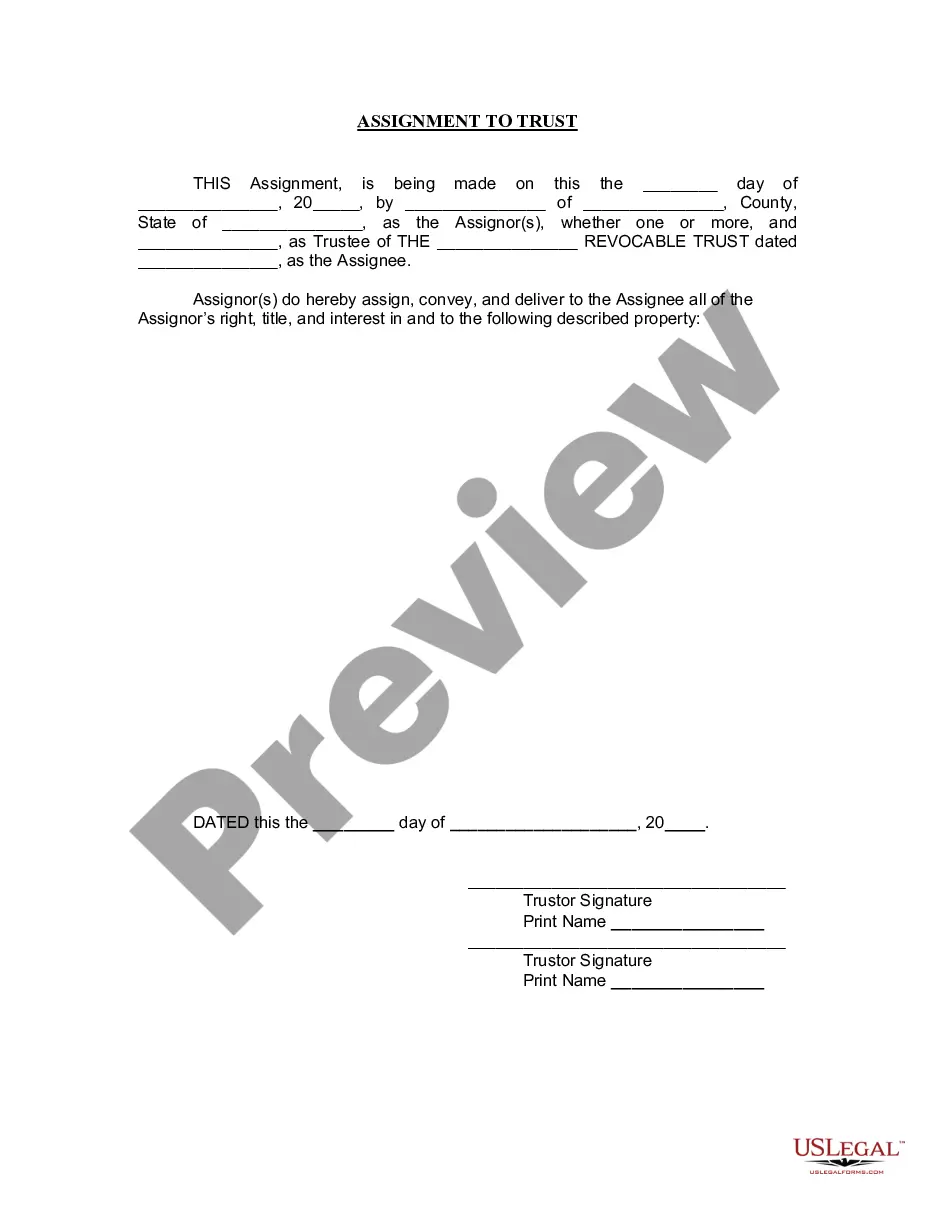

How to fill out California Assignment To Living Trust?

- Visit the US Legal Forms website and sign in to your account. If you're a new user, create an account to get started.

- Search for 'Living Trust' in the library and review the form previews and descriptions to find the one that fits your specific needs.

- If you're not satisfied, use the search functionality to refine your options and locate the most appropriate template.

- Select the living trust form by clicking the 'Buy Now' button and choose the subscription plan that suits you best.

- Complete the purchase by entering your payment details, using either a credit card or PayPal.

- Download the living trust form directly to your device, and access it anytime via the 'My Forms' section.

By following these straightforward steps, you can effortlessly create a living trust that protects your assets and provides peace of mind.

Don't leave your estate planning to chance—visit US Legal Forms today and get started on your living trust!

Form popularity

FAQ

You typically do not need to file your living trust with the court. A living trust is a private document, and it does not require public registration. However, you should keep the trust document in a safe place and inform your successor trustee of its location. Utilizing a platform like US Legal Forms can help you create a well-structured living trust that meets your needs.

Whether your parents should place their assets in a trust depends on their specific financial goals and family situations. A living trust can help manage assets, avoid probate, and streamline the transfer of wealth. Encouraging them to consult with legal experts or explore platforms like US Legal Forms can provide the clarity they need to make informed decisions.

Filling a living trust involves several steps to ensure your assets are properly assigned. First, you need to list the assets you intend to place in the trust, such as real estate, bank accounts, and investments. Next, you complete legal documents, which can be made easier with resources like US Legal Forms, that guide you through the process of naming beneficiaries and trustees.

The downfall of having a trust, including a living trust, may include the ongoing maintenance it requires. You must regularly update and manage the trust to reflect changes in your financial situation or family dynamics. If neglected, the trust may not operate as intended, potentially defeating its purpose in estate planning.

While a living trust can provide numerous benefits, there are downsides to consider. Transferring assets into a trust often requires time and financial resources, which might be burdensome for some individuals. Furthermore, a living trust does not provide protection from creditors, and assets within the trust could still be vulnerable.

A family trust, often a type of living trust, can have certain disadvantages. One notable issue is the potential for confusion among family members regarding the management and distribution of assets. Additionally, if not properly funded or maintained, a living trust may not effectively achieve your estate planning goals, which could lead to complications.

The main purpose of a living trust is to ensure that your assets are distributed according to your wishes after your death, while bypassing the lengthy probate process. A living trust offers flexibility, allowing you to manage your assets during your lifetime and specify how they are handled upon your passing. This can provide peace of mind and simplify the transfer of your estate.

In Texas, a living trust might not provide the same level of tax benefits that some other estate planning tools do. Furthermore, if not properly funded, a living trust may not eliminate the need for probate. Understanding these disadvantages can guide you in making an informed decision about your estate planning needs.

There is no specific minimum amount required to create a living trust. However, establishing a living trust may be more beneficial if you have substantial assets or property you wish to manage and protect. It's wise to evaluate your estate size and determine whether the advantages of a living trust align with your financial goals.

Putting your house in a living trust in Texas can offer advantages, such as avoiding probate and ensuring your property passes directly to your beneficiaries. Additionally, a living trust provides privacy, as it does not become part of public record. It's essential to consider your specific situation, and consulting with an estate planning professional can help clarify your options.