Trust Account With Vanguard

Description

Form popularity

FAQ

Yes, you can set up a trust account with Vanguard. They provide various options tailored to meet your financial planning needs. With the right support, you can easily create a trust that aligns with your goals and protects your assets for future generations.

While trust accounts with Vanguard offer many advantages, there are some disadvantages to consider. Establishing a trust can involve legal fees and ongoing management costs. Additionally, it might limit your immediate access to assets, depending on how the trust is structured.

Suze Orman emphasizes the importance of trusts in protecting wealth and ensuring it is passed on to the next generation. In her advice, she often highlights how trust accounts with Vanguard can provide the necessary structure for effective estate planning. Following her guidance, a trust can be a key element of sound financial management.

The best type of bank account for a trust is one specifically designed for trust accounts, such as those offered by Vanguard. These accounts typically offer benefits like interest earnings and ease of management. They help ensure that the trust’s assets are handled according to your specifications.

Finding the right place to open a trust account with Vanguard can depend on your specific needs. Consider reputable financial institutions that offer strong customer service and solid investment options. Vanguard stands out due to its focus on long-term growth and low fees, making it a prime choice.

Trust accounts with Vanguard can help you manage your assets effectively while securing your financial future. They provide a structured way to transfer wealth to beneficiaries. Moreover, they often come with tax benefits, making them a thoughtful financial decision for many individuals.

The best bank for opening a trust account varies depending on your needs. However, Vanguard is highly recommended for its comprehensive investment solutions and user-friendly platform. They provide specialized services for trust accounts, ensuring you can easily manage your funds while enjoying competitive rates and excellent support.

Absolutely, you can open an account for a trust. Many financial institutions offer specific accounts tailored for trusts. By choosing a trust account with Vanguard, you can benefit from a range of investment options and robust account management features, helping you maximize your trust's potential.

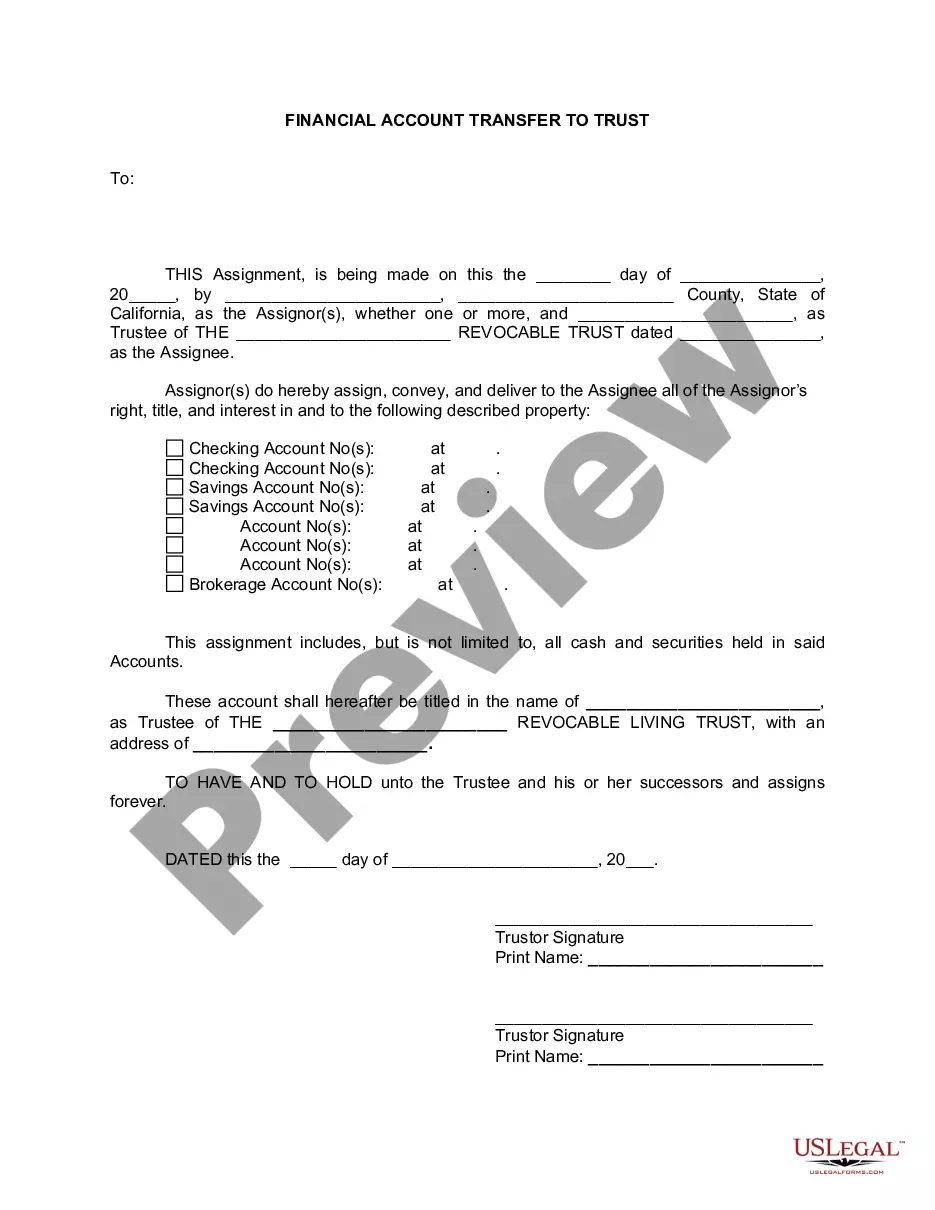

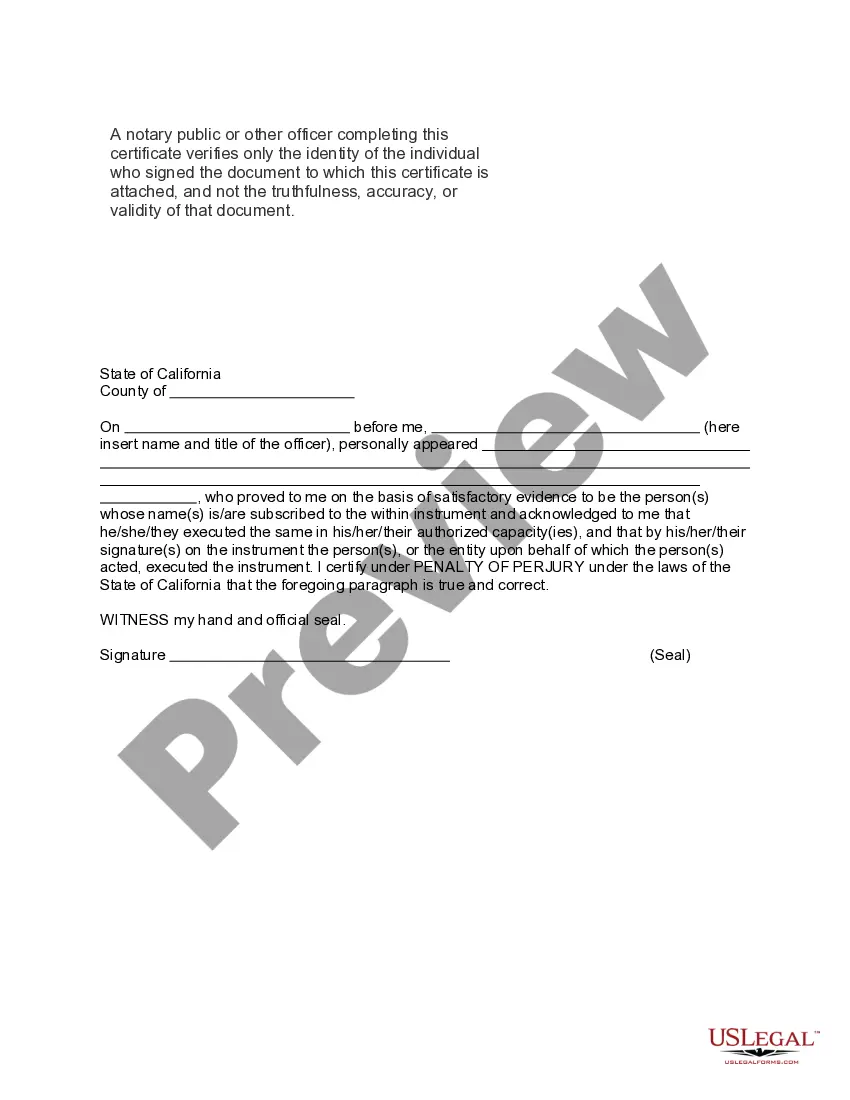

Opening a trust fund account is a straightforward process. First, you need to establish the trust through proper legal documentation. Next, you can visit a financial institution like Vanguard to set up your trust account, ensuring you provide all necessary paperwork. This secure trust account with Vanguard offers excellent management options for your assets.

Yes, you can set up a trust fund by yourself. Many people choose to create a trust independently using online resources or legal forms. However, consider consulting with a legal expert to ensure everything is in order. With a trust account with Vanguard, you can manage your investments effectively and securely.