California Living Trust Sample For Arkansas

Description

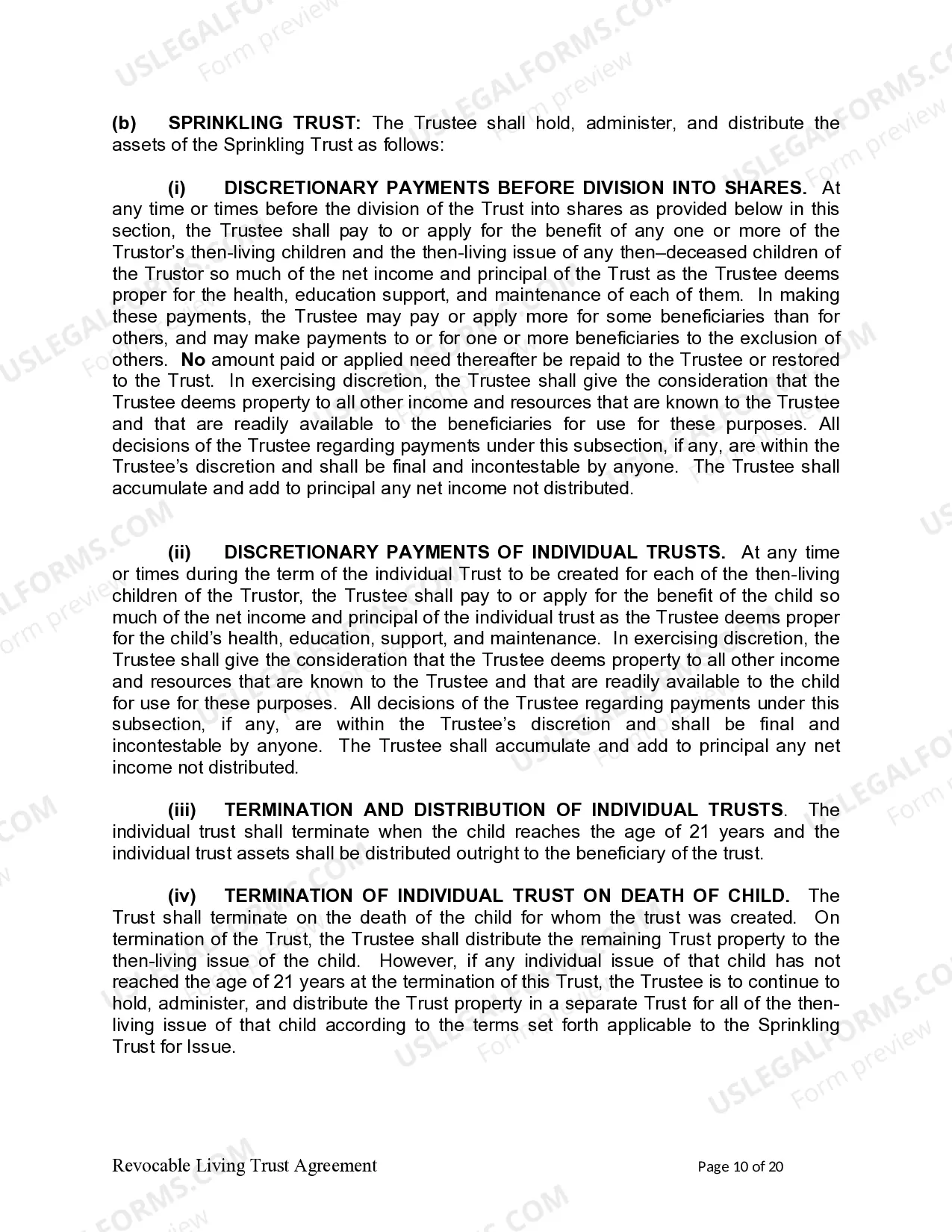

How to fill out California Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and substantial financial investment.

If you're seeking a more straightforward and cost-effective method for preparing a California Living Trust Sample for Arkansas or any other paperwork without unnecessary obstacles, US Legal Forms is perpetually accessible.

Our digital library containing over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted by our legal professionals.

Examine the document preview and descriptions to ensure you are selecting the document you are looking for. Confirm that the form you choose meets the standards of your state and county. Select the most suitable subscription plan to acquire the California Living Trust Sample for Arkansas. Download the file, then complete, certify, and print it. US Legal Forms prides itself on a solid reputation and over 25 years of expertise. Join us today and make the process of filling out forms easy and efficient!

- Utilize our website whenever you need dependable and trustworthy services through which you can easily find and download the California Living Trust Sample for Arkansas.

- If you are already familiar with our website and have set up an account, simply Log In, choose the form, and download it, or re-download it at any moment from the My documents section.

- Not registered yet? No worries. Setting up your account and browsing the catalog only takes a few minutes.

- However, before rushing to download the California Living Trust Sample for Arkansas, consider following these guidelines.

Form popularity

FAQ

No, a living trust does not need to be filed with the court in California. This is one of the key advantages of setting up a California living trust sample for Arkansas. By keeping your trust private, you avoid the probate process, which can be time-consuming and costly. You can maintain control over your assets while ensuring that your wishes are honored without court supervision.

In California, you do not need to file a living trust with the court. A California living trust sample for Arkansas shows that the trust operates outside of the court system, which provides more privacy and flexibility for your assets. The trust remains effective as long as you manage it properly and follow California laws. This feature simplifies the process and allows you to have full control over your estate without court involvement.

Typically, assets like retirement accounts, certain insurance policies, and vehicles should not be placed in a California living trust without careful consideration. These assets may require specific beneficiary designations, which can complicate your estate plan. If you are unsure, a California living trust sample for Arkansas can provide guidance on suitable assets for your trust. Legal professionals can also assist you in making informed decisions about asset placement.

A living trust can become void if certain conditions are not met, such as lack of proper funding or failure to follow state laws. Additionally, changes in ownership of the assets, or legal judgments against the trust, can affect its validity. By using a California living trust sample for Arkansas, you can understand how to properly maintain your trust’s integrity. It's beneficial to stay informed about the requirements and consult with legal experts when needed.

A California living trust can remain valid in another state, but its terms may need adjustments for compliance with local laws. If you move to Arkansas, you should review the trust to ensure it aligns with Arkansas regulations. Additionally, using a California living trust sample for Arkansas can help you identify potential modifications. Consulting with an attorney will ensure your trust functions as intended in your new state.

When creating a trust, it generally needs to comply with the laws of the state where you reside. This means that if you want to use a California living trust sample for Arkansas, you should ensure it meets Arkansas laws. It’s wise to consult a legal expert to tailor the trust according to local requirements. Using a platform like US Legal Forms can help guide you through this process smoothly.

One potential downside to a living trust in California is that it does not provide protection from creditors. This means that if the trust's creator has outstanding debts, creditors can still pursue those assets. When evaluating a California living trust sample for Arkansas, consider these factors, as they influence asset protection strategies.

The 2 year rule for trusts refers to the time limit within which certain tax strategies must be implemented. Specifically, if a trust is created and assets are transferred within two years of a person's death, those assets may still be subject to probate. This is important for individuals considering a California living trust sample for Arkansas, as it can impact estate planning strategies.

Typically, the trustee holds the original copy of the trust document to manage the assets accordingly. It’s vital for the trustee to keep the document secure and accessible upon the trustor's passing or incapacity. If you are creating a California living trust sample for Arkansas, consider best practices for document storage during the setup process.

Setting up a living trust in Arkansas involves drafting the trust document and funding the trust with your assets. It is advisable to consult with a legal professional to ensure compliance with state laws. If you are looking for a California living trust sample for Arkansas, uslegalforms can provide useful templates and guidance for your setup.