The dissolution of a corporation package contains all forms to dissolve a corporation in California, step by step instructions, addresses, transmittal letters, and other information.

Dissolve Llc California Form

Description

Form popularity

FAQ

One way to avoid the $800 LLC fees in California is to dissolve your LLC properly and timely. Completing the ‘Dissolve LLC California form’ ensures you are no longer liable for standard annual fees. Additionally, staying informed about changes in legislation can offer further opportunities to minimize your costs.

To file a dissolution of an LLC in California, you must complete the necessary paperwork, including the ‘Dissolve LLC California form.’ This form requires information about your LLC and the reason for dissolution. After filling it out, you can submit it to the California Secretary of State and manage any remaining financial matters.

Dissolving an LLC means officially ending the business entity, while terminating may involve closing out financial obligations and notifying stakeholders. When you choose to dissolve your LLC, you are opting out of all future operations and liabilities associated with it. Understanding this difference can guide you in completing the ‘Dissolve LLC California form’ effectively.

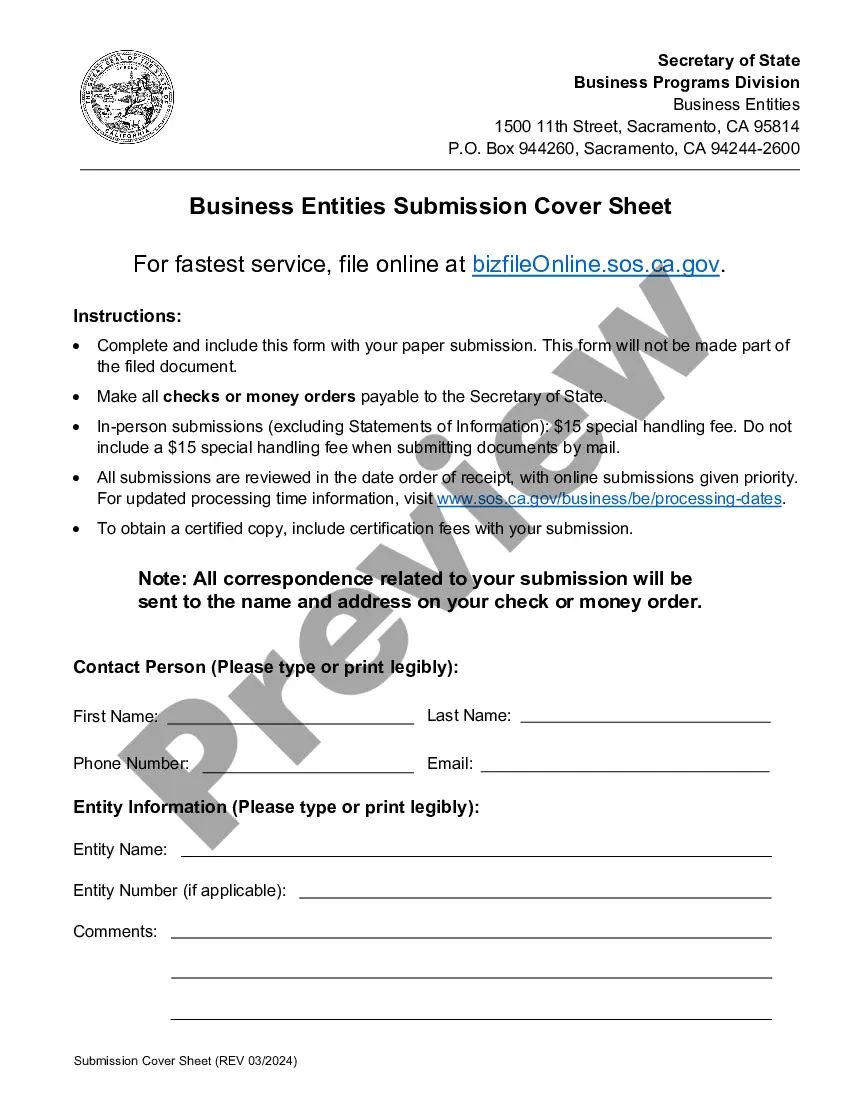

You should mail your CA dissolution forms to the Secretary of State's office at the address specified by their website. This includes sending all completed forms and any associated fees. Be sure to check that you are using the most recent address and guidelines as these can change. Using US Legal Forms can simplify the process by providing accurate mailing addresses and instructions.

The CA Secretary of State form SI 100 is the Statement of Information form required for LLCs in California. It provides important information about your company, such as the address and details of the management. Submitting this form is vital and ensures that your dissolve LLC California form is complete with all required documentation. Make sure to keep track of the deadlines for filing this form to avoid penalties.

You file a statement of information within the California Secretary of State’s office. This can also be done online, making it simpler and quicker to submit your information. If you have recently dissolved your LLC and need to update any information, using the correct California form is crucial. Utilizing the US Legal Forms platform can also help you find the necessary forms easily.

To mail your California dissolution certificate, send it to the Secretary of State's office. The address is located on the form and typically includes the Sacramento office. Ensure you include any necessary additional documents or fees with your mailing. Following these steps accurately helps to ensure a smooth processing of your dissolve LLC California form.

Yes, you can file your dissolve LLC California form online through the California Secretary of State's website. This process allows you to complete and submit your dissolution form conveniently from anywhere. Online filing helps speed up the processing time and ensures that your documents are filed correctly. Remember to have all required information ready before you begin.

To remove yourself from an LLC in California, you typically need to follow the procedures outlined in your operating agreement. This may include obtaining mutual consent from other members and then notifying the Secretary of State through the proper filings. Submitting a dissolve LLC California form can be part of this process if you are dissolving the whole entity. For clarity and compliance, using uslegalforms can simplify these steps for you.

Dissolution and termination of an LLC in California refer to related but distinct processes. Dissolution is the formal process of closing your business, while termination refers to ceasing operations and filing the necessary paperwork. When you dissolve your LLC, you must fill out and submit the dissolve LLC California form. Understanding this difference ensures you follow the correct procedure for your business.