Tenancy Common Agreement California With Foreigners

Description

How to fill out California Tenancy In Common Agreement - Single Dwelling - Married Couple?

- Access your US Legal Forms account by logging in. If you’re a new user, create an account to explore the extensive form library.

- Search for the 'Tenancy common agreement' document. Use the preview mode to verify it meets your jurisdiction's requirements.

- If necessary, browse other templates for a better fit. Utilize the Search tab to find any additional forms you might need.

- Select the subscription plan that best suits your needs and proceed to purchase the document. Registration is required for account access.

- Complete your payment using credit card or PayPal for seamless transaction handling.

- Download the tenancy common agreement and save it on your device. You can always revisit it later through the 'My Forms' menu in your profile.

By leveraging US Legal Forms, users can confidently create legally sound documents quickly and efficiently. With an extensive library that outmatches competitors, individuals and legal professionals can find exactly what they need.

Get started today and ensure your tenancy common agreement is accurately drafted to suit your needs. Visit US Legal Forms to simplify your legal journey!

Form popularity

FAQ

Under IRS rules, tenancy in common owners can deduct their share of property taxes and mortgage interest on their personal tax returns. This arrangement allows each co-owner to recognize their portion of income or loss from rental properties. For foreigners investing in California properties, ensuring a proper tenancy common agreement California with foreigners is vital for tax implications. Staying informed about IRS regulations can help you maximize your benefits while remaining compliant.

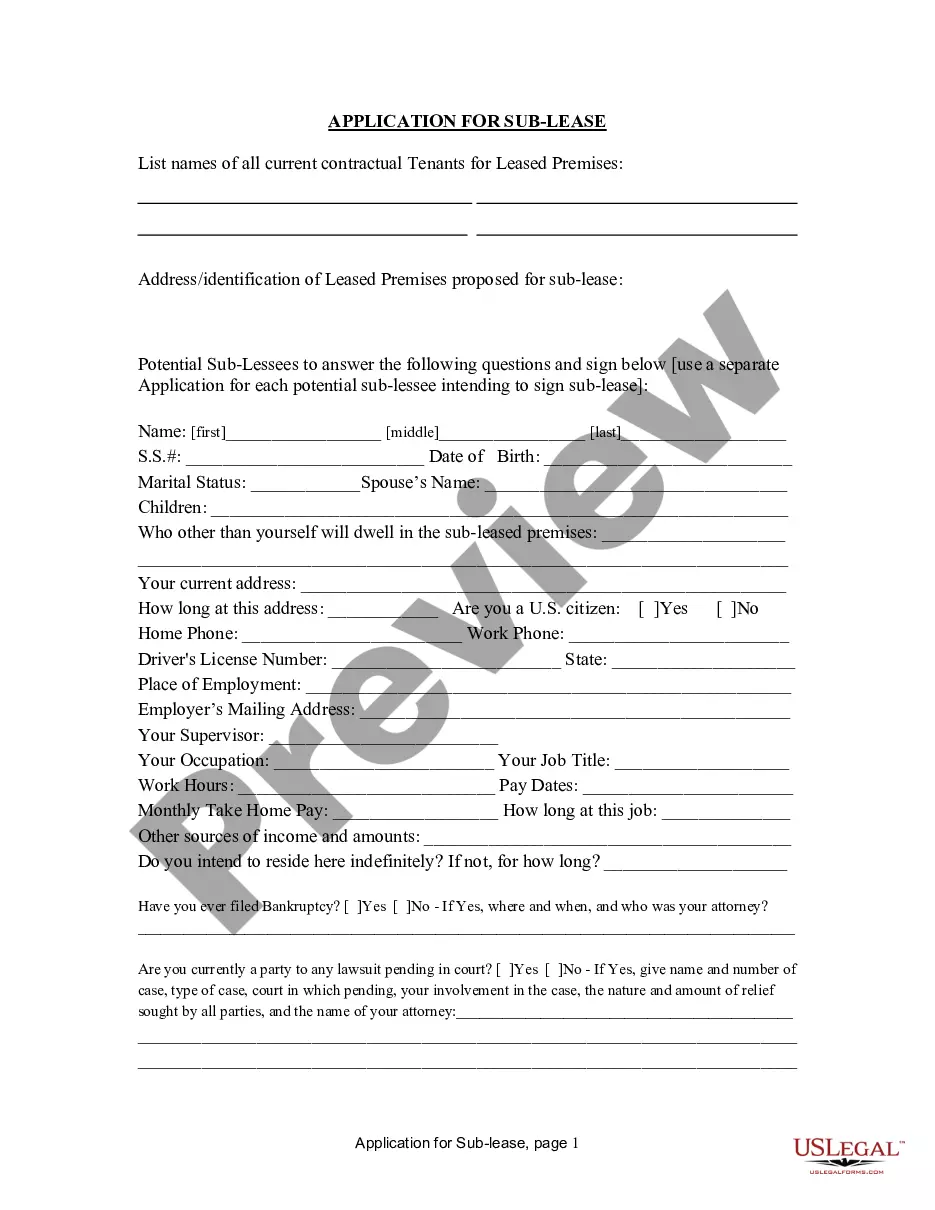

Filling out a California residential lease agreement requires clear identification of all parties, including landlords and tenants, alongside the property details. You must lay out terms such as rent amount, duration of lease, and security deposit information. Using a tenancy common agreement California with foreigners can help ensure all parties understand their rights and obligations, minimizing misunderstandings. Consider utilizing platforms like USLegalForms to guide you through the process effectively.

A Tenancy in Common (TIC) structure can pose risks such as potential disagreements among co-owners, which may lead to disputes over decisions. Particularly in California, foreign owners may find different legal implications challenging to navigate. Another downside is the absence of a management structure unless established through a tenancy common agreement California with foreigners, potentially leading to confusion. Clear communication and established legal frameworks can alleviate these risks.

In California, tenants in common share ownership of a property, where each person holds a distinct share. This arrangement does not require equal ownership percentages, allowing flexibility, especially when foreigners are part of the agreement. As each owner can independently sell or transfer their share, having a detailed tenancy common agreement California with foreigners can help clarify the rules and responsibilities involved. It's advisable to consult legal experts to navigate specific nuances.

Tenancy in common can lead to complications, especially when one party wishes to sell their share. In California, with foreigners involved, this can result in legal complexities regarding ownership rights. Additionally, if there are disagreements about property management or direction, resolving them can become challenging. It's crucial to have a clearly defined tenancy common agreement California with foreigners to minimize potential conflicts.

In California, a landlord cannot evict a tenant without proper legal cause, nor can they retaliate against tenants for exercising their rights. Additionally, landlords must provide safe and habitable living conditions, making it crucial for property owners to understand their obligations. Foreign landlords should use resources like USLegalForms to ensure compliance with state laws regarding tenancy.

One potential disadvantage of a tenancy in common is the possible lack of control over decisions involving the property, as all co-owners must agree on major decisions. Additionally, if one owner decides to sell their share, it may create complications for the remaining tenants. Foreign investors should weigh these factors carefully when entering a tenancy common agreement in California.

In California, a TIC agreement allows multiple individuals, including foreign investors, to jointly own property with defined shares. Each owner has the right to sell, lease, or transfer their share without permission from others, promoting greater flexibility. Understanding these mechanisms can enhance investment strategies for those looking to enter the California real estate market.

California law treats tenants in common as having equal rights to the property, unless an agreement states otherwise. This arrangement allows each co-owner to enjoy the property and benefit from its value without any requirement for equal ownership shares. It's crucial for foreigners to familiarize themselves with these laws under a tenancy common agreement in California.

In California, joint tenancy rules include the right of survivorship, where the share of a deceased owner automatically passes to the surviving co-owners. However, it's important to note that joint tenancy differs from a tenancy in common, where co-owners can sell their shares independently. Foreign investors should fully understand these differences when considering property ownership.