California Homestead Form With Two Points

Description

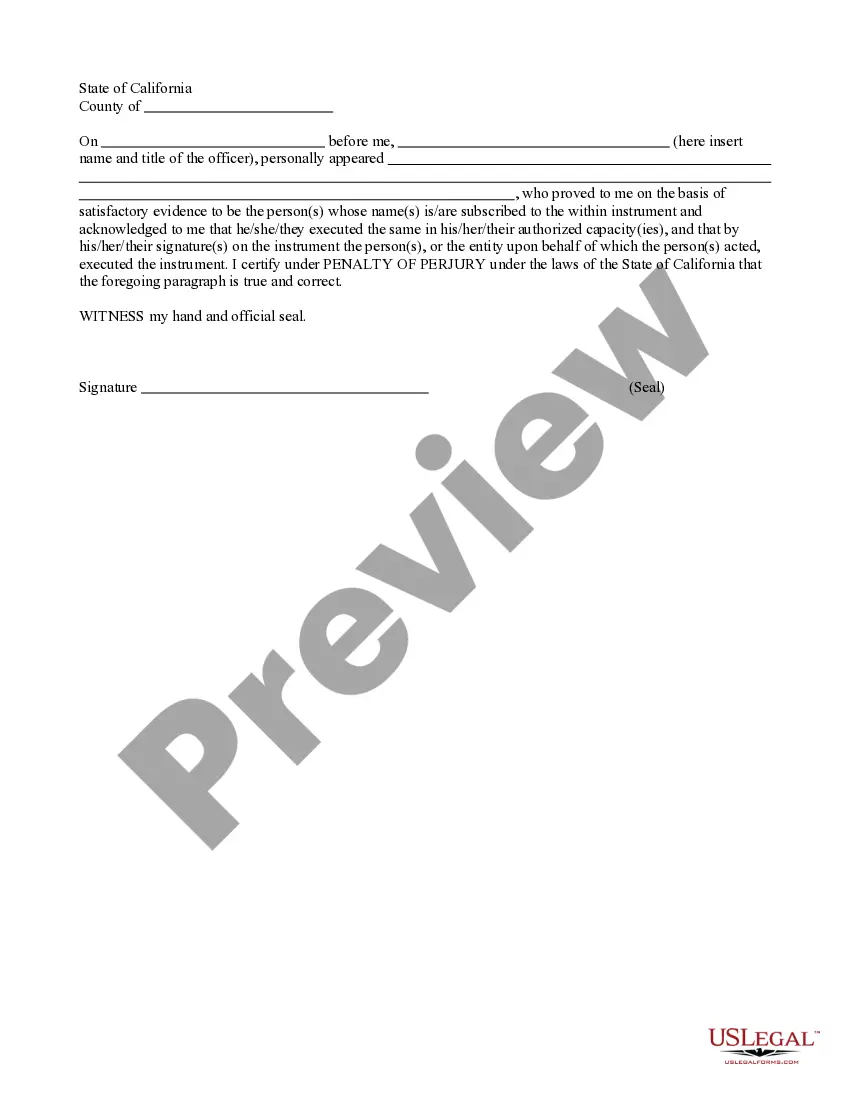

How to fill out California Declaration Of Abandonment Of Homestead Declaration?

Utilizing legal document examples that align with federal and state regulations is essential, and the online world provides numerous choices to select from.

However, what is the benefit of spending time searching for the correct California Homestead Form With Two Points template online when the US Legal Forms digital library already consolidates such documents in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for various professional and personal needs.

- They are easy to navigate with all forms categorized by state and intended use.

- Our experts stay updated with legal updates to ensure your form is current and compliant when acquiring a California Homestead Form With Two Points from our site.

- Acquiring a California Homestead Form With Two Points is swift and straightforward for both existing and new customers.

- If you possess an account with an active subscription, sign in and download the required document sample in the preferred format.

- If you’re a newcomer to our platform, follow these steps.

Form popularity

FAQ

The annual report fee is $85 for domestic business entities, $150 for foreign business entities and $35 for domestic and foreign nonprofit corporations.

Searching for Maine businesses is done through the Maine Informe.org site. Maine Corporations and LLCs are searchable by the following criteria: Search by Name. Search by Charter Number.

Maine LLCs are taxed as pass-through entities by default. That means the LLC itself does not pay taxes, but instead passes its revenues and losses on to its members, who pay the state's graduated personal income tax rate.

You need to file an Annual Report in order to keep your LLC in compliance and in good standing with the state. You can file your LLC's Annual Report by mail or online. We recommend filing online since it's easier and the processing time is quicker. You will find instructions below for filing by mail and filing online.

Over 90% of Maine's businesses are considered small businesses, making it a great place to starting an LLC. We'll cover the basics of LLCs and give you a helpful step-by-step guide to forming an LLC in Maine. Starting an LLC in Maine will include the following steps: #1: Choose a Name for Your LLC in Maine.

The largest Maine LLC cost is the $175 filing fee for the Certificate of Formation. However, foreign LLCs pay much larger fees to do business in Maine than domestic LLCs. For example, a foreign LLC must pay $200 to renew its business name registration.

This keeps your Maine Limited Liability Company in good standing and in compliance with state law so it can continue operating. You simply confirm the information on the Annual Report, file it with the Maine Secretary of State, and pay the Annual Report fee. The Maine LLC Annual Report costs $85 per year.

Online: Go to their website under online services and follow the instructions provided on the interactive corporate services page to search and print a certified copy. A list of all filings for the Maine Corporation is provided. If the document is older it may not be available for online printing.