Homestead California Form Withholding

Description

How to fill out California Homestead Declaration For Single Person?

Finding a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and careful consideration, which is why it is crucial to obtain Homestead California Form Withholding samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can waste your time and stall your current situation. With US Legal Forms, you have minimal worries.

Remove the frustration that comes with legal documentation. Explore the extensive US Legal Forms library where you can find legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to locate your template.

- Review the form’s description to confirm if it aligns with the requirements of your state and locality.

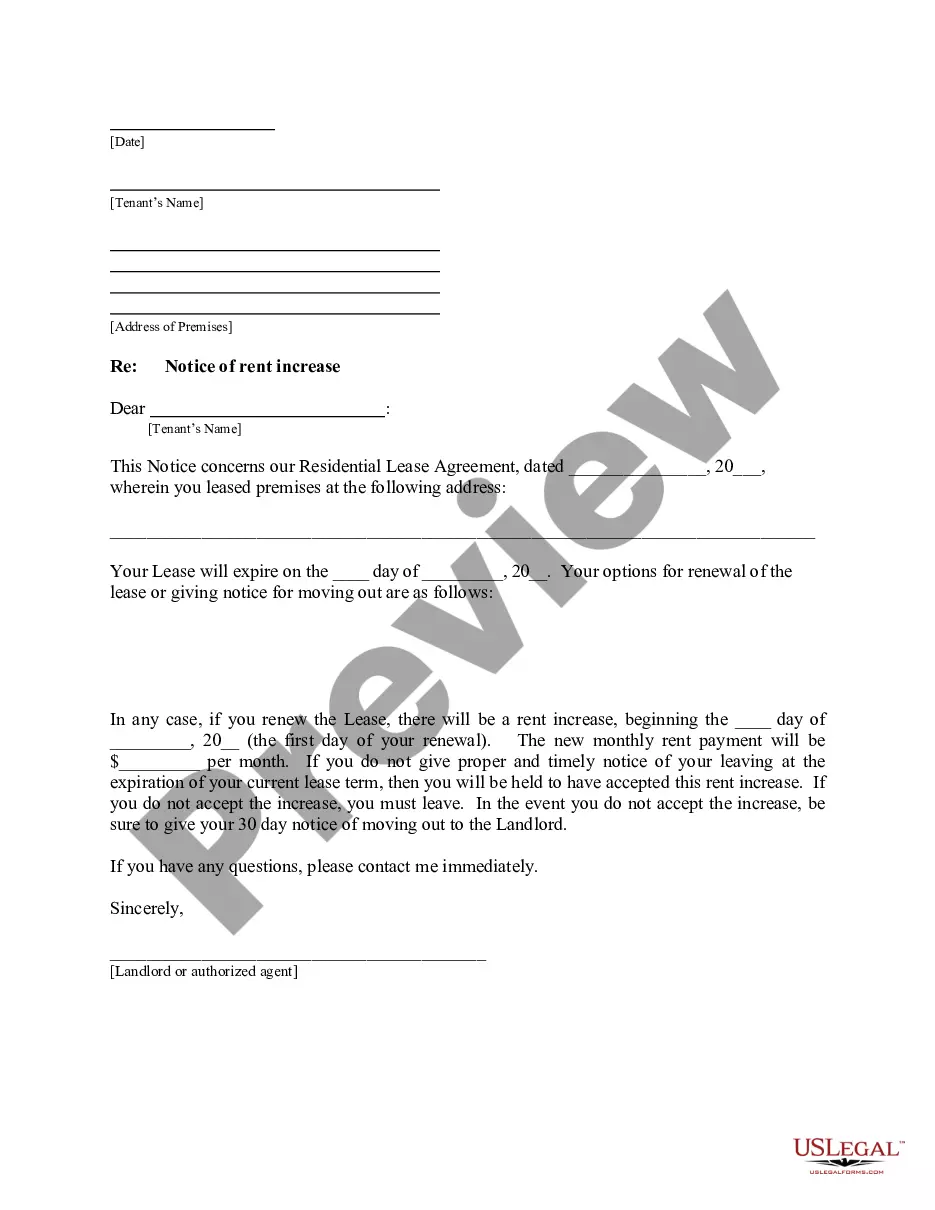

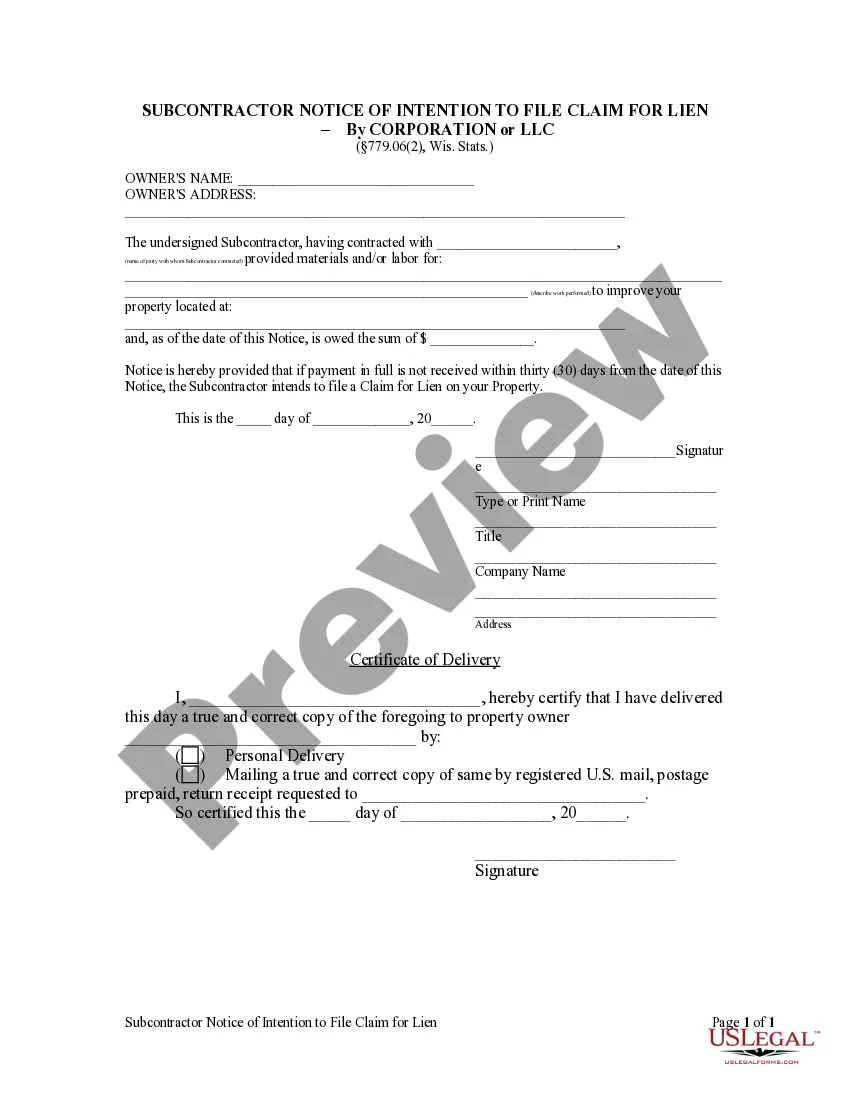

- Access the form preview, if available, to verify it is the document you are looking for.

- Return to the search and look for the correct template if the Homestead California Form Withholding does not meet your requirements.

- If you are confident about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that fits your needs.

- Proceed to register to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Pick the file format for downloading the Homestead California Form Withholding.

- After obtaining the form on your device, you can edit it using the editor or print it out and fill it in by hand.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

In order to claim exemption from state income tax withholding, employees must submit a W-4 (PDF Format, 100KB)*. or DE-4 (PDF Format, 147KB)* certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Completing the Form: Fill in your name, address, Social Security number, and the identification number (if any) of the pension or annuity. ... Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the. ... Enter estimate of total wages for tax year 2023.