Homestead California Ca Form 100 Instructions

Description

How to fill out California Homestead Declaration For Single Person?

Regardless of whether it's for commercial reasons or personal issues, everyone must confront legal circumstances at some point in their life.

Completing legal documents requires meticulous attention, starting with selecting the appropriate form template. For example, if you choose an incorrect version of the Homestead California Ca Form 100 Instructions, it will be declined when you submit it. Thus, it is crucial to obtain a reliable source of legal forms like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Use the library’s user-friendly navigation to find the right form for any situation.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your situation, state, and locality.

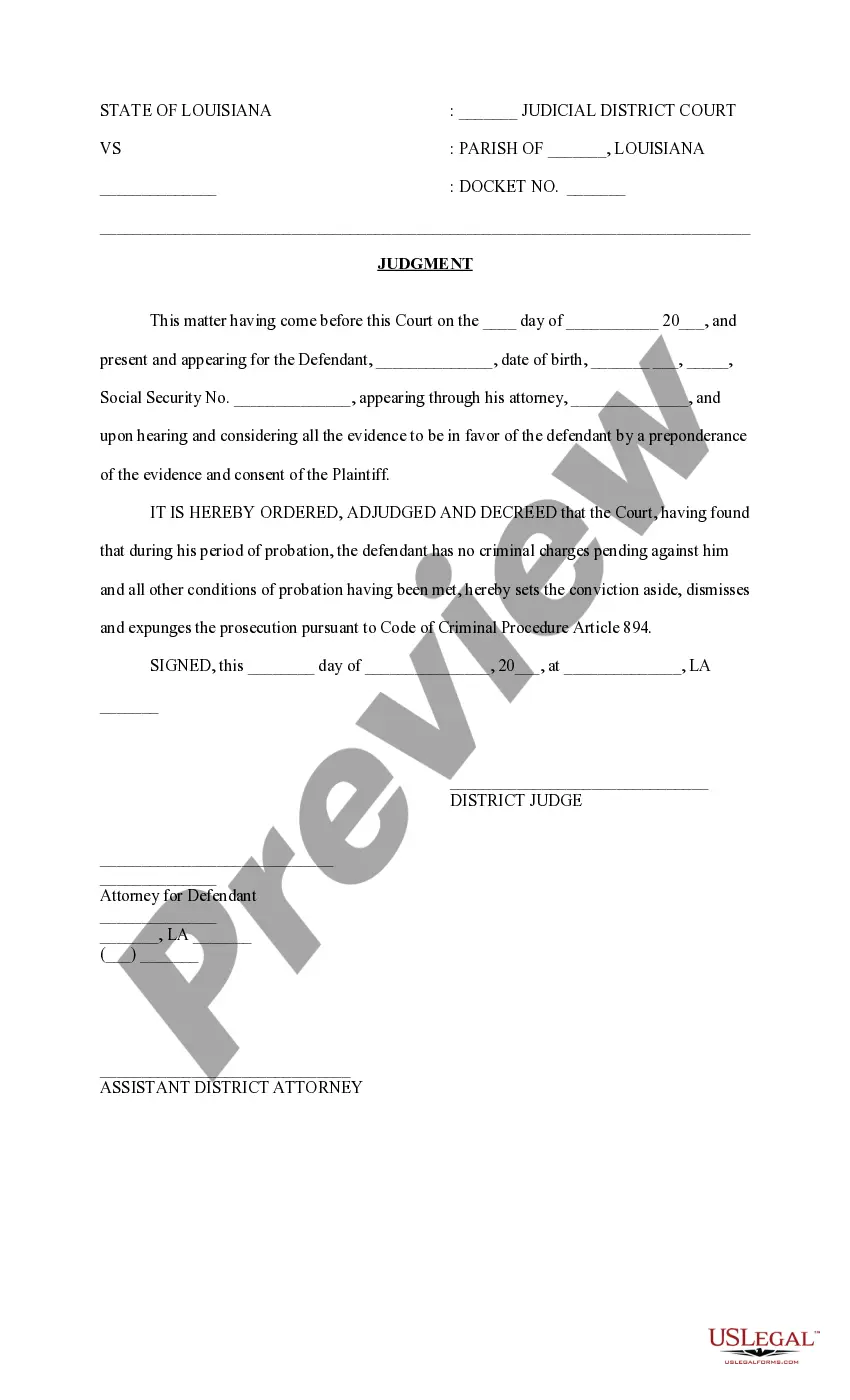

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search feature to find the Homestead California Ca Form 100 Instructions example you need.

- Obtain the file when it fits your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously stored files in My documents.

- If you haven't registered yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Homestead California Ca Form 100 Instructions.

- Once saved, you can fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

Form 100 California Corporation Franchise or Income Tax Return is the regular return for CA corporations. Form 100W California Corporation Franchise or Income Tax Return--Water's-Edge Filers can be filed by combined groups that meet the requirements.

Business FormWithout paymentWith payment100 100S 100W 100X 109 565 568Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501

General Information. C corporations filing on a water's-edge basis are required to use Form 100W to file their California tax returns. In general, water's-edge rules provide for an election out of worldwide combined reporting.

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

Business FormWithout paymentWith payment100 100S 100W 100X 109 565 568Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501