Ca Homestead Declaration Form For Montgomery County Texas

Description

How to fill out California Homestead Declaration For Single Person?

Legal management can be frustrating, even for the most skilled experts. When you are searching for a Ca Homestead Declaration Form For Montgomery County Texas and do not get the a chance to commit in search of the right and up-to-date version, the processes could be stress filled. A robust online form catalogue might be a gamechanger for anyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you could have, from individual to business papers, all in one spot.

- Use advanced tools to accomplish and deal with your Ca Homestead Declaration Form For Montgomery County Texas

- Access a resource base of articles, tutorials and handbooks and resources highly relevant to your situation and requirements

Help save time and effort in search of the papers you need, and make use of US Legal Forms’ advanced search and Review tool to locate Ca Homestead Declaration Form For Montgomery County Texas and download it. In case you have a monthly subscription, log in to your US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to see the papers you previously downloaded and to deal with your folders as you see fit.

If it is the first time with US Legal Forms, register an account and have limitless access to all benefits of the library. Here are the steps to take after accessing the form you need:

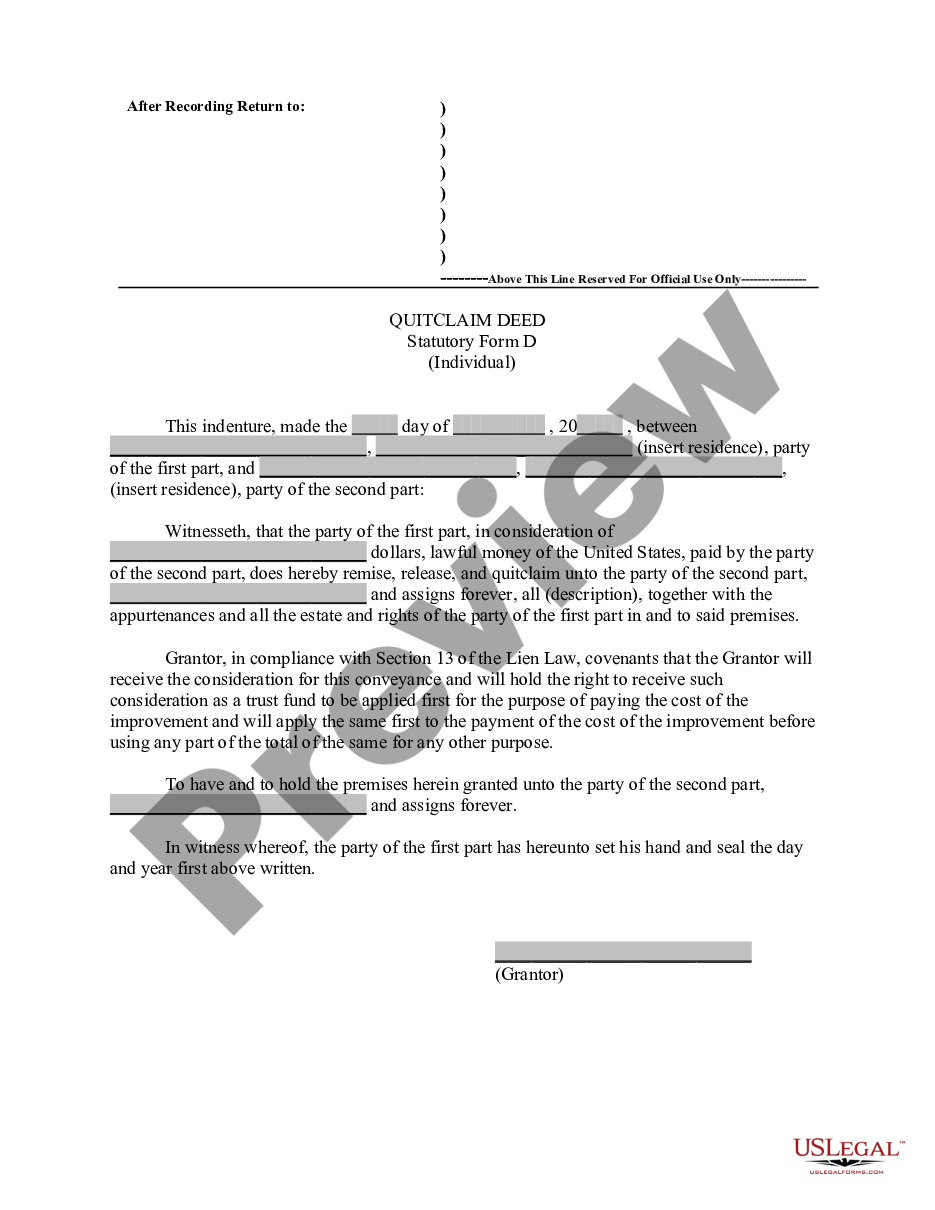

- Verify it is the right form by previewing it and reading its information.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now when you are ready.

- Choose a subscription plan.

- Find the formatting you need, and Download, complete, eSign, print and send your document.

Benefit from the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Transform your daily document managing in to a smooth and intuitive process today.

Form popularity

FAQ

?What you have before you is an analysis of increasing the over [age] 65 [exemption] from $35,000 to $50,000,? Tax Assessor-Collector Tammy McRae said during the item discussion. ?And you can see it's a savings to the taxpayer[s] of approximately $2.7 million. This is based on the 2022 data.?

For information regarding homestead designation under the TEXAS PROPERTY CODE, contact your attorney. Homestead property is protected under Texas law. Recording a ?Designation of Homestead? in the public records is optional.

You must apply with your county appraisal district to get a homestead exemption. Applying is free and only needs to be filed once. You can find forms on your appraisal district website or you can use the Texas Comptroller forms. General Exemption Form 50-114.

Attach a copy of property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

How do I apply for a homestead exemption? You must apply with your county appraisal district to get a homestead exemption. Applying is free and only needs to be filed once. You can find forms on your appraisal district website or you can use the Texas Comptroller forms.