Ca Death Form For Credit Bureau

Description

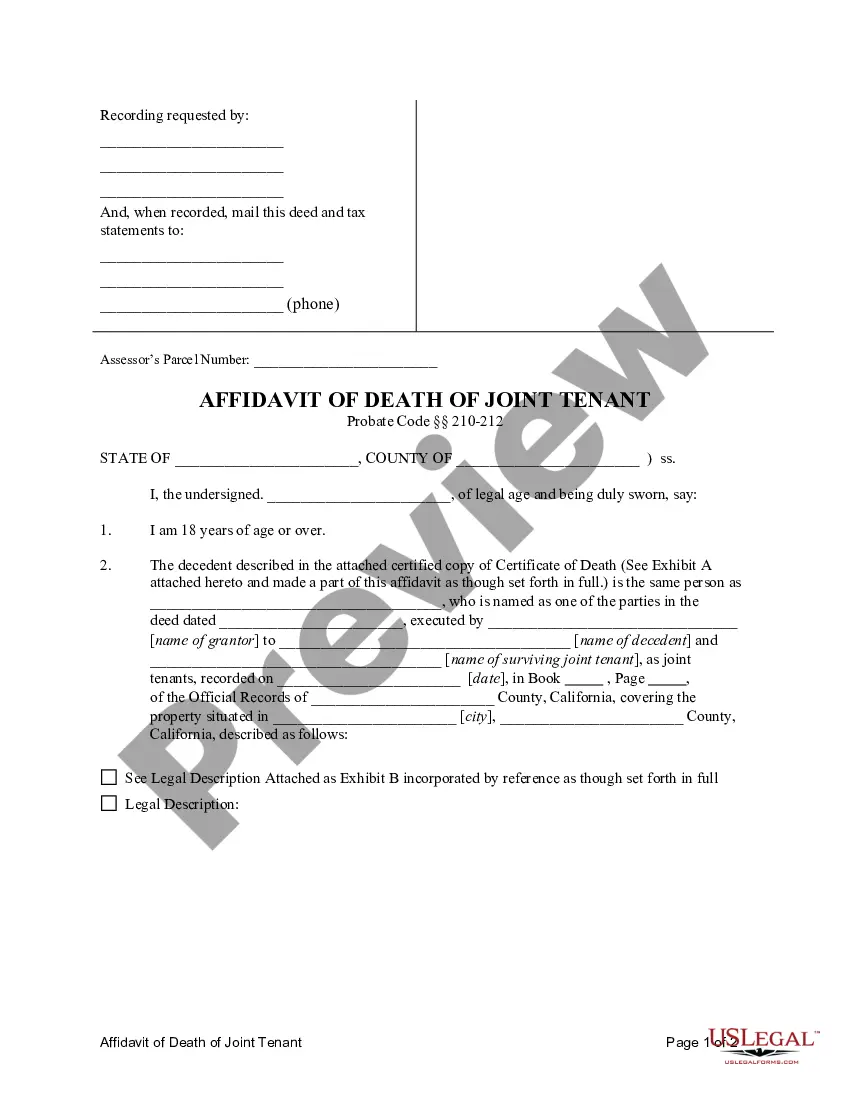

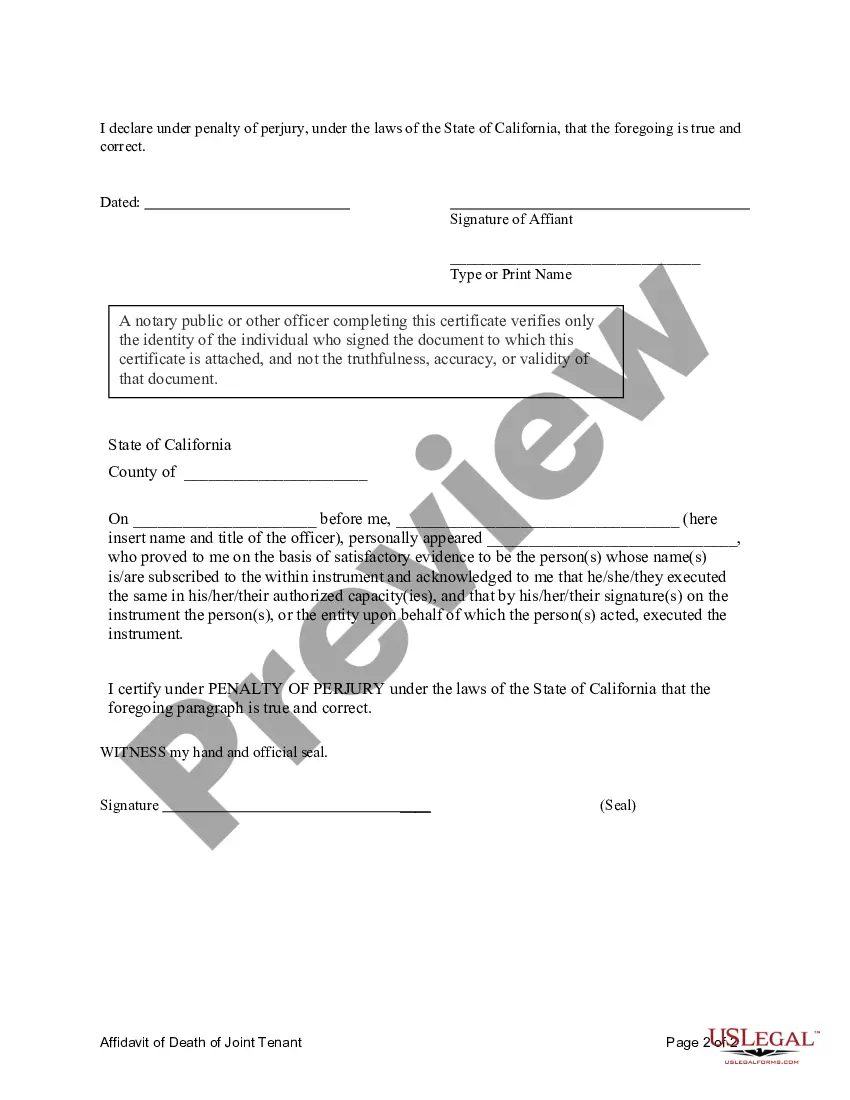

How to fill out California Affidavit Of Death Of Joint Tenant?

Obtaining legal document examples that adhere to federal and state laws is crucial, and the internet provides numerous alternatives to select from.

However, what is the benefit of spending time searching for the accurately prepared Ca Death Form For Credit Bureau template online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates created by attorneys for any business and personal situation.

Review the template using the Preview feature or through the text outline to ensure it fulfills your needs.

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts keep abreast of legislative changes, ensuring your documentation is current and compliant when obtaining a Ca Death Form For Credit Bureau from our site.

- Acquiring a Ca Death Form For Credit Bureau is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in the appropriate format.

- If you are new to our platform, adhere to the instructions below.

Form popularity

FAQ

Generally, a credit report says you are deceased in error because a credit bureau, a credit card company, a bank, or the Social Security Administration made a typo or have a computer glitch. The error gets attached to your social security number on your credit report which does damage to your credit scores.

In order to release personal information on a deceased person, TransUnion requires a copy of the Death certificate or the will/certificate of appointment, stating that this person is the next of kin or executor/executrix.

Account Reported as "Deceased" One or more of your creditors may have reported an account or accounts on your credit report as being associated with a deceased individual. This can happen when someone else who may have been associated with the account, such as a spouse or co-signer, dies.

How to Notify Credit Bureaus of Death Obtain the death certificate. Call the credit agencies and request a credit freeze. Send the death certificate. Request a copy of the credit report. Work with the estate executor to close out credit accounts or pay off any remaining balance.

It's possible to negotiate the credit card debt of a deceased person if you're legally responsible for paying the debt. That means you must be the executor or the administrator of the estate, a cosigner or joint account holder on the credit card, or a surviving spouse in a community property state.