Irc Revenue Code

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Finding a go-to place to take the most recent and appropriate legal samples is half the struggle of working with bureaucracy. Finding the right legal files needs precision and attention to detail, which is why it is crucial to take samples of Irc Revenue Code only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the details regarding the document’s use and relevance for the situation and in your state or region.

Consider the listed steps to complete your Irc Revenue Code:

- Use the library navigation or search field to find your template.

- Open the form’s information to ascertain if it fits the requirements of your state and region.

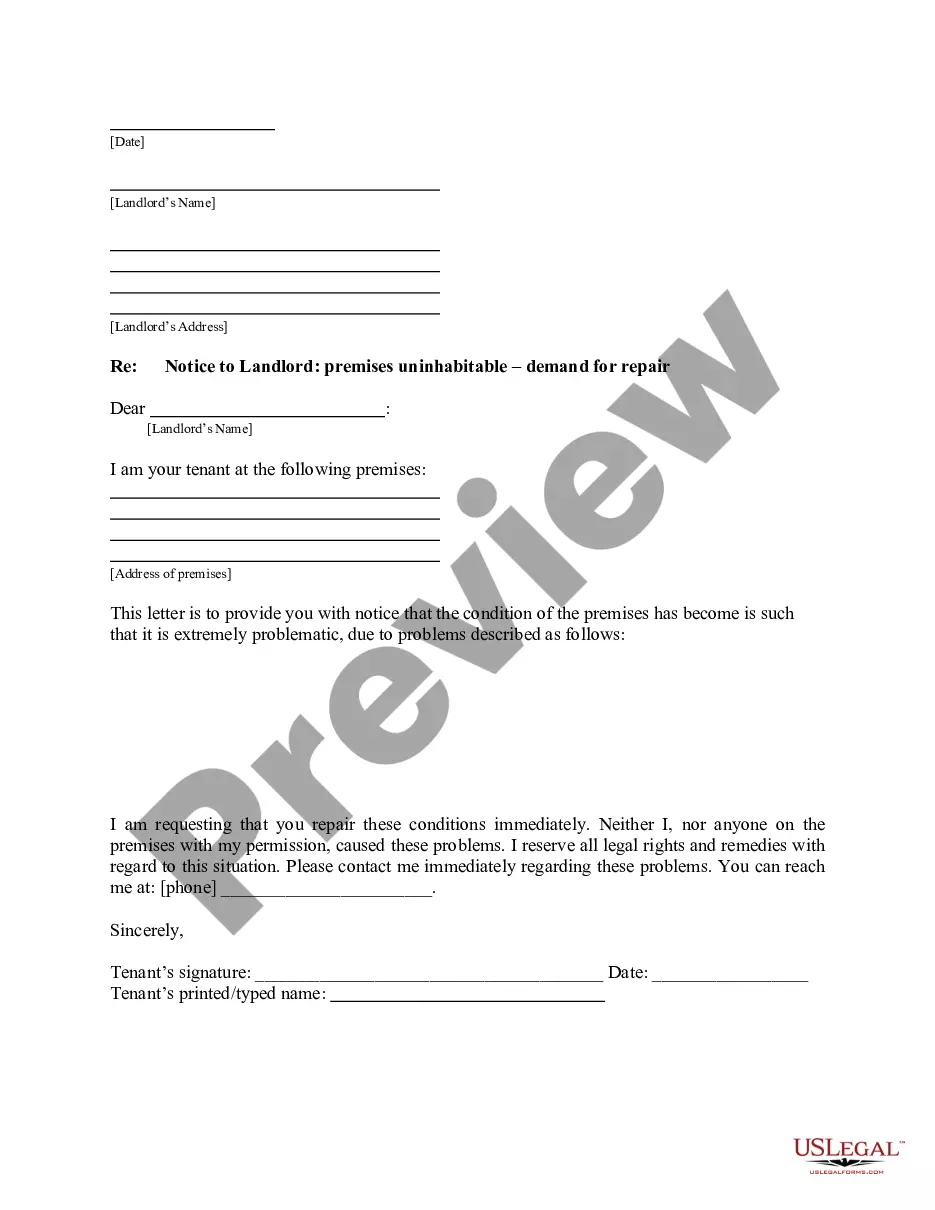

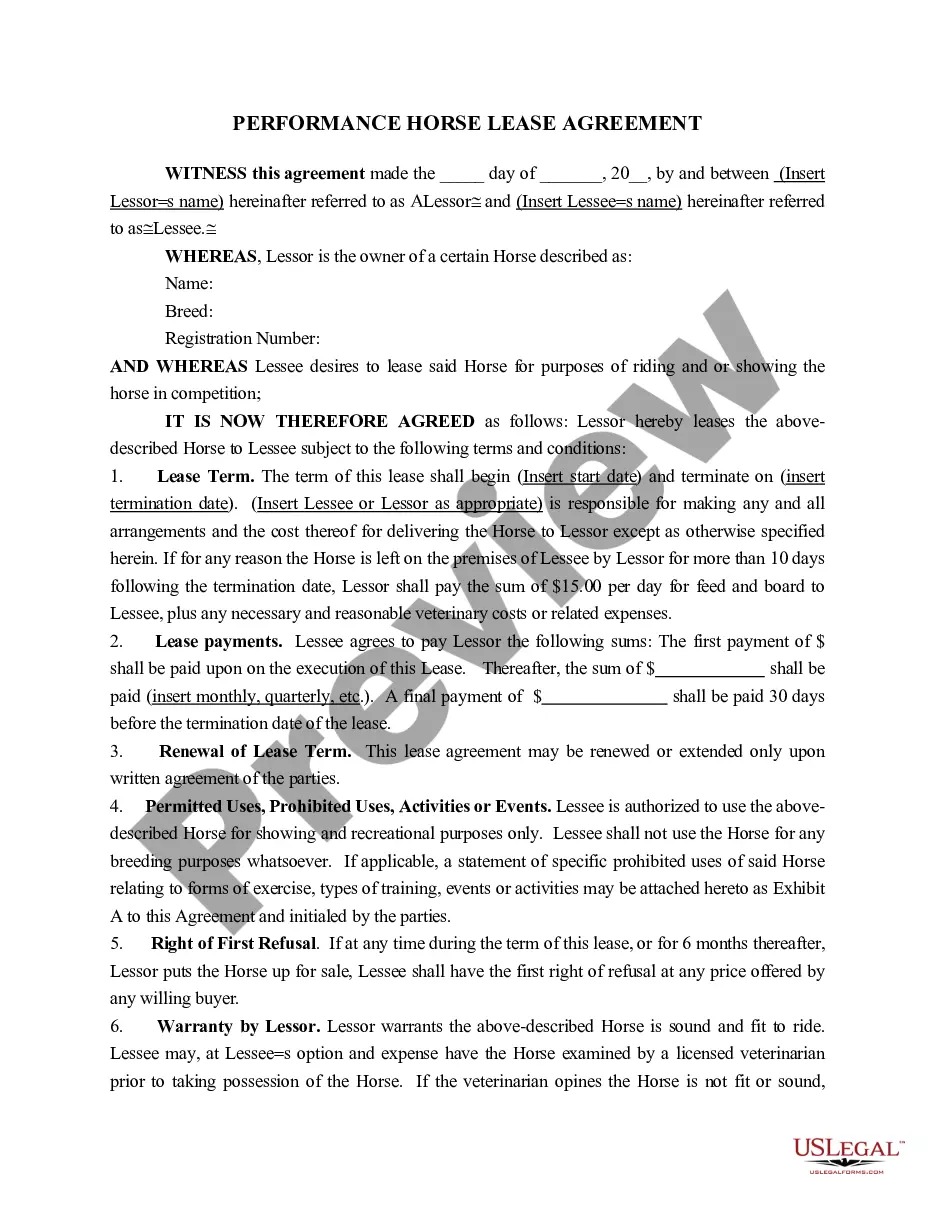

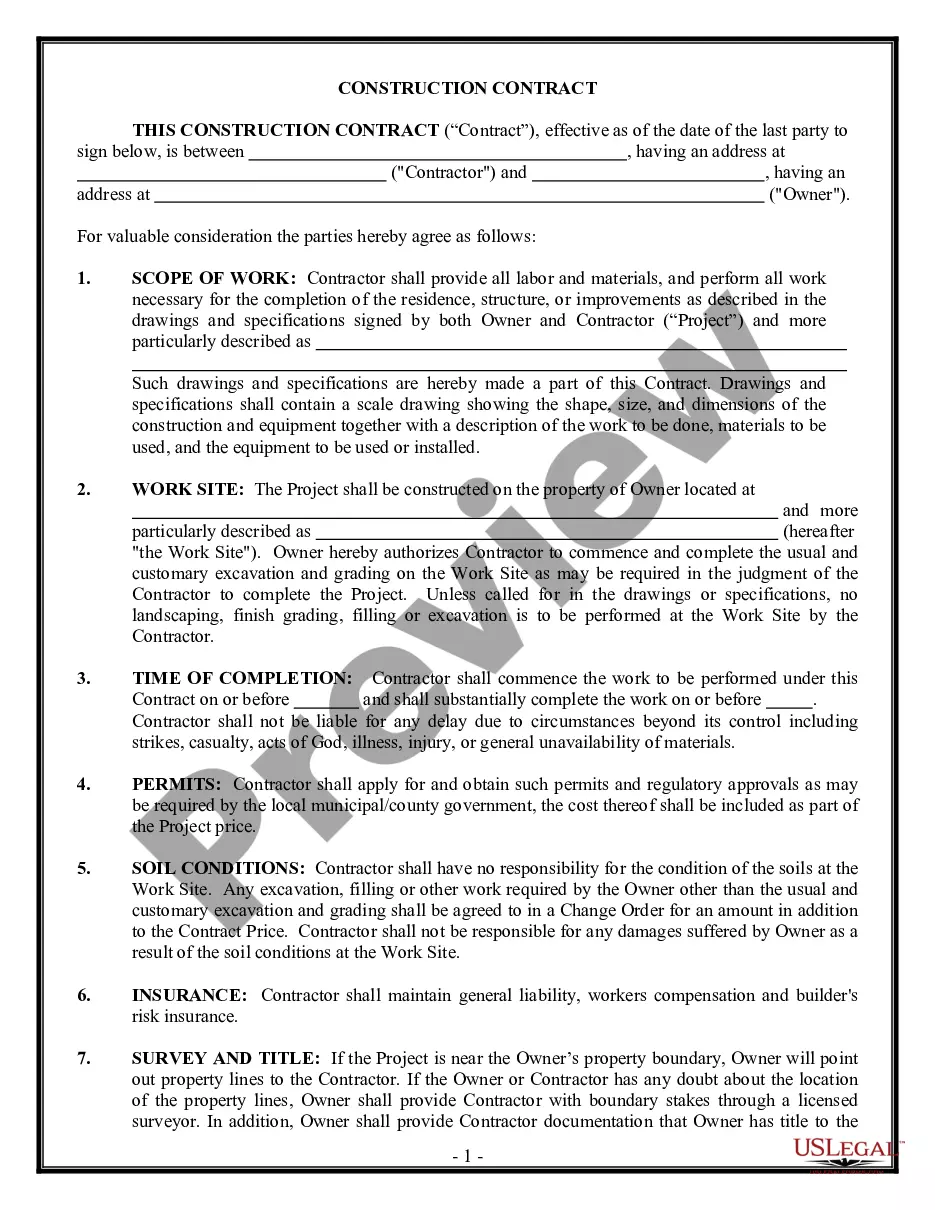

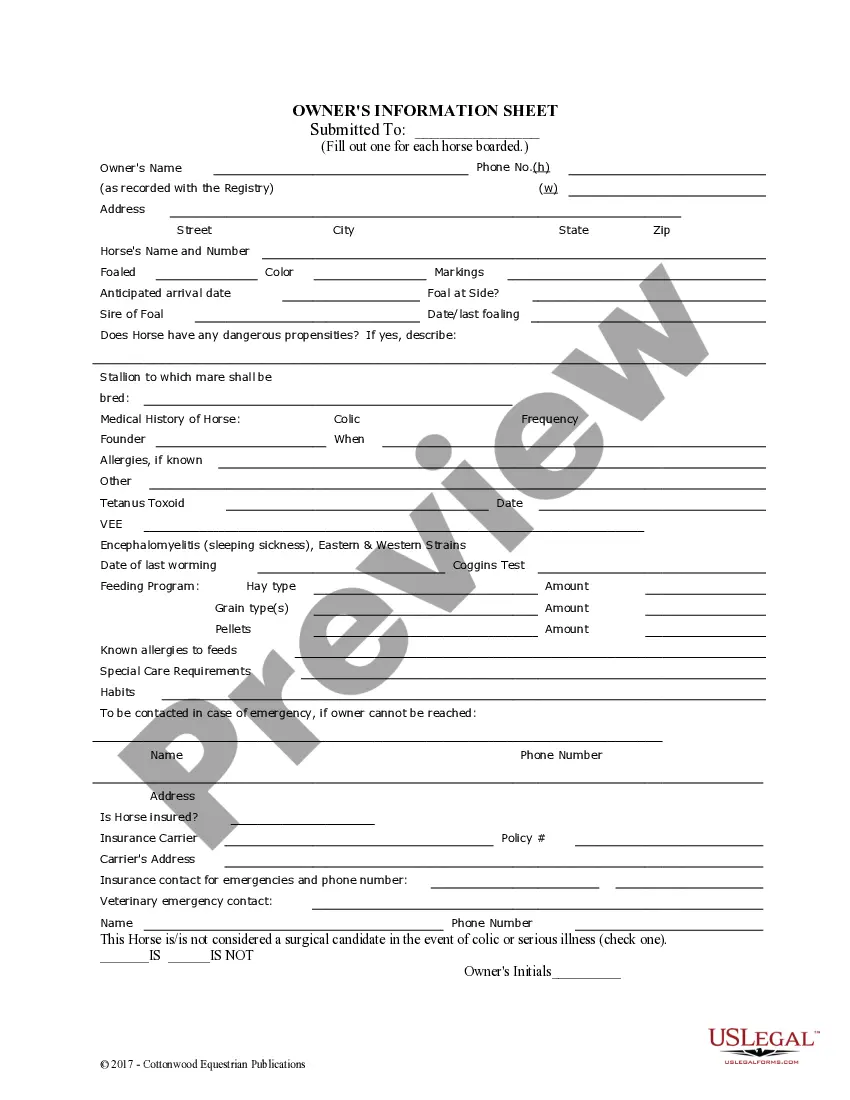

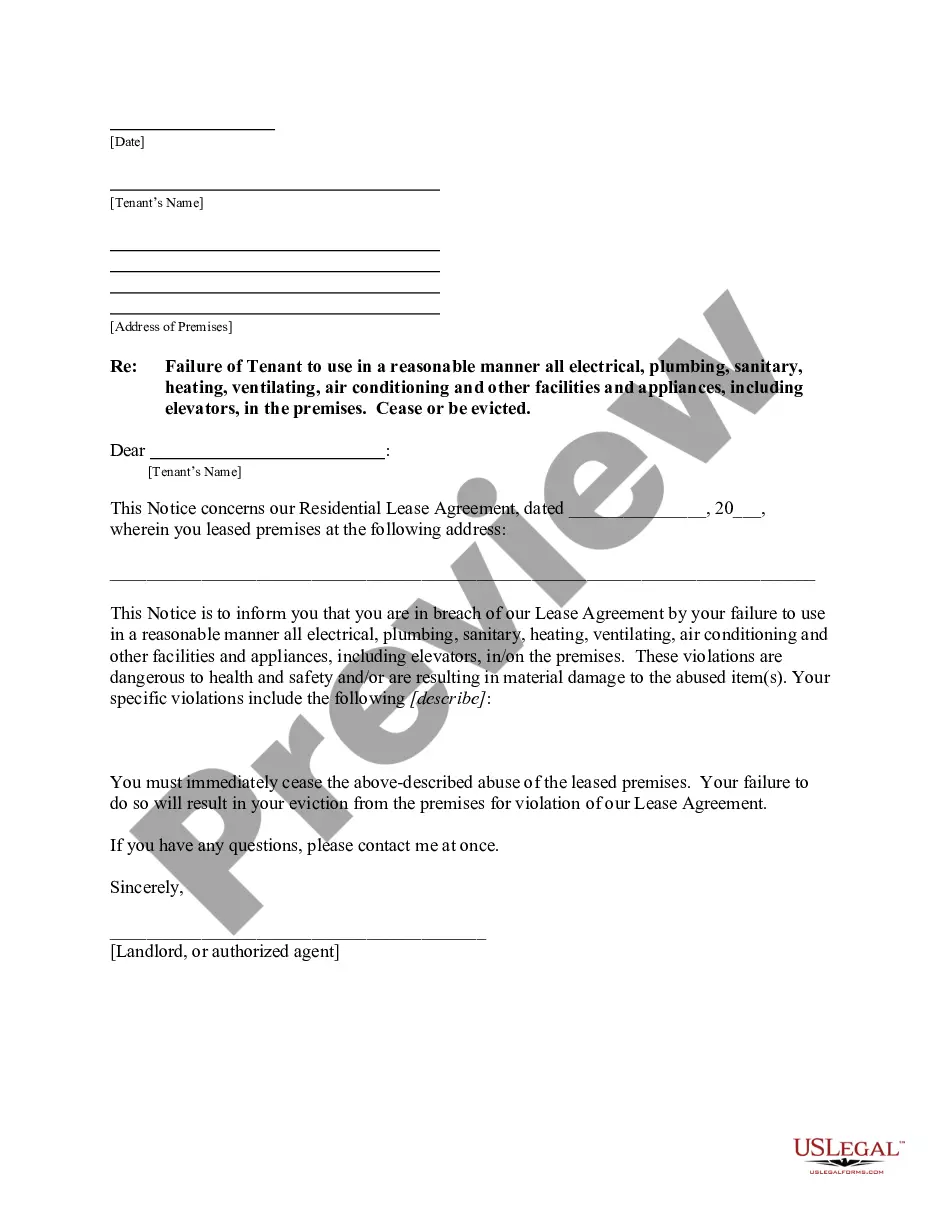

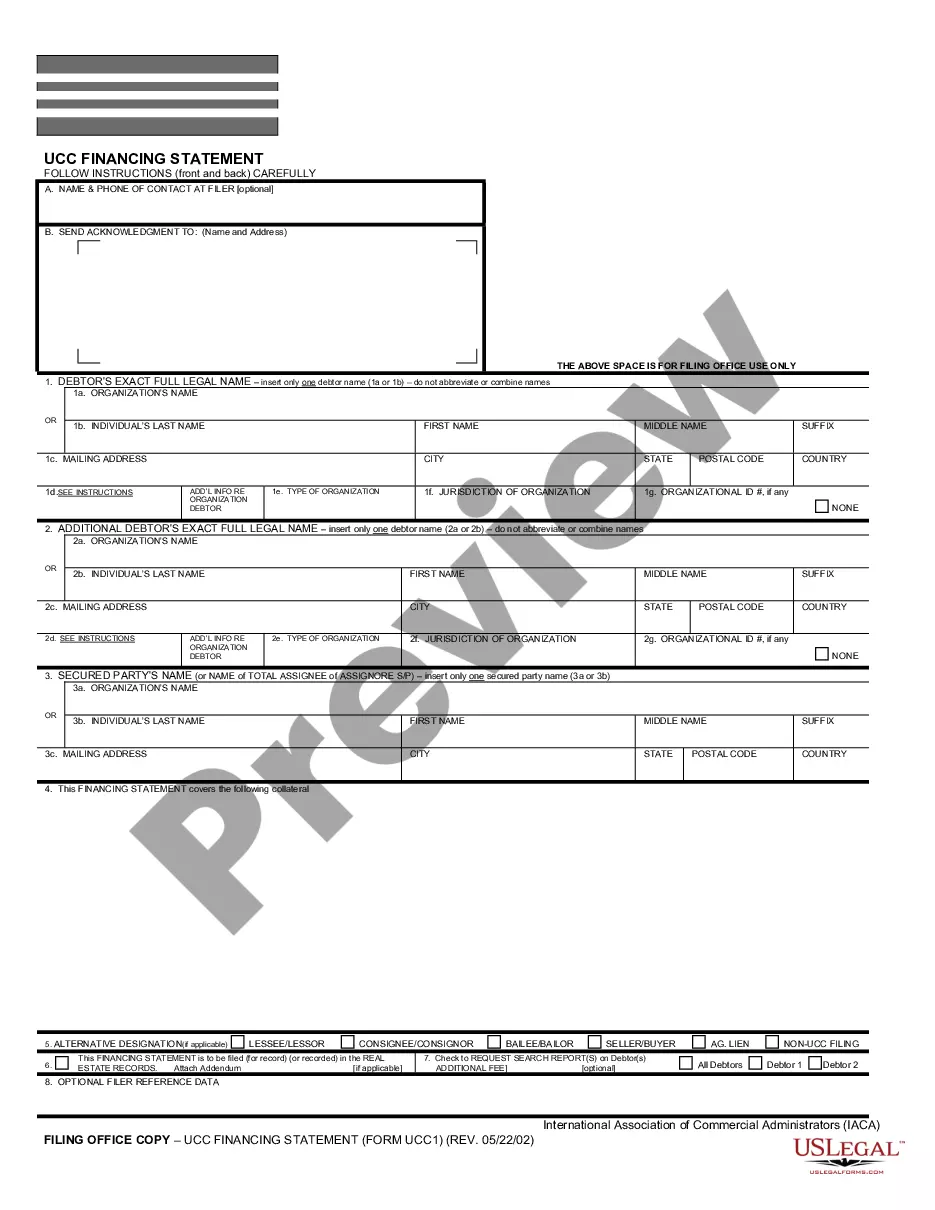

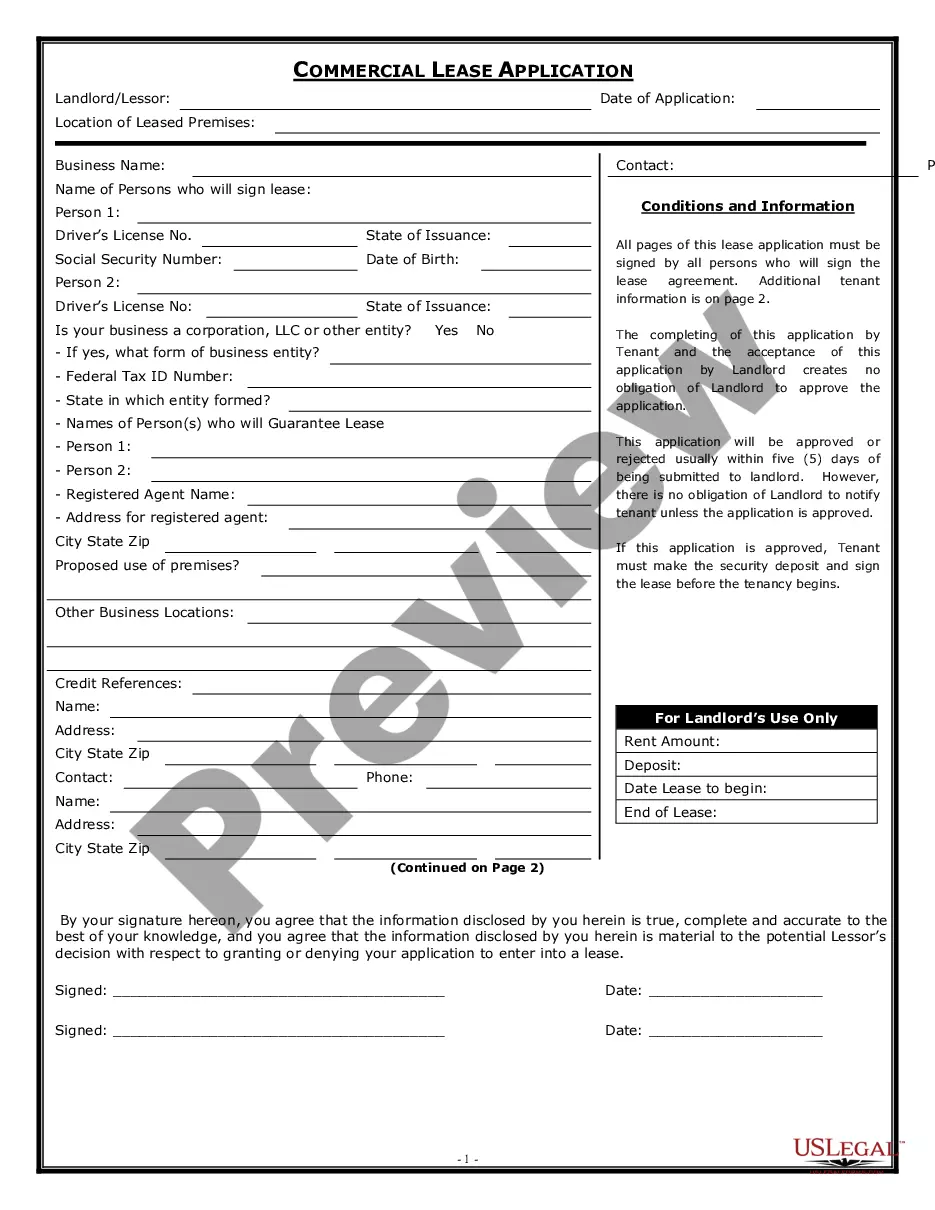

- Open the form preview, if there is one, to make sure the form is the one you are looking for.

- Resume the search and look for the correct document if the Irc Revenue Code does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Select the document format for downloading Irc Revenue Code.

- Once you have the form on your gadget, you may modify it with the editor or print it and finish it manually.

Get rid of the hassle that comes with your legal paperwork. Check out the extensive US Legal Forms collection where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

The Internal Revenue Code (IRC) is the body of law that codifies all federal tax laws, including income, estate, gift, excise, alcohol, tobacco, and employment taxes. U.S. tax laws began to be codified in 1874, but there was no central, comprehensive source for them at that time.

Sections are denoted by numbers (1, 2, etc.), subsections by lowercase letters (a, b, etc.), paragraphs by numbers (1, 2, etc.), subparagraphs by capital letters (A, B, etc.) and clauses by lowercase roman numerals (i, ii, etc.). Parentheses are used for each division after the section number.

Internal Revenue Code, 2023 ed. is designed to be used with Title 26 of the United States Code Annotated® for historical notes and notes of decisions construing the Code. The book contains the complete text of the Internal Revenue Code, as amended through Public Law 117-362 of the 117th Congress.

Internal Revenue Code Citations: If you are citing ot the current edition of the Code, use the abbreviations "I.R.C." and provide only the section number, using regular Bluebook rules for numbering. Example: I.R.C. § 61.