California Commercial Lease With Personal Guarantee

Description

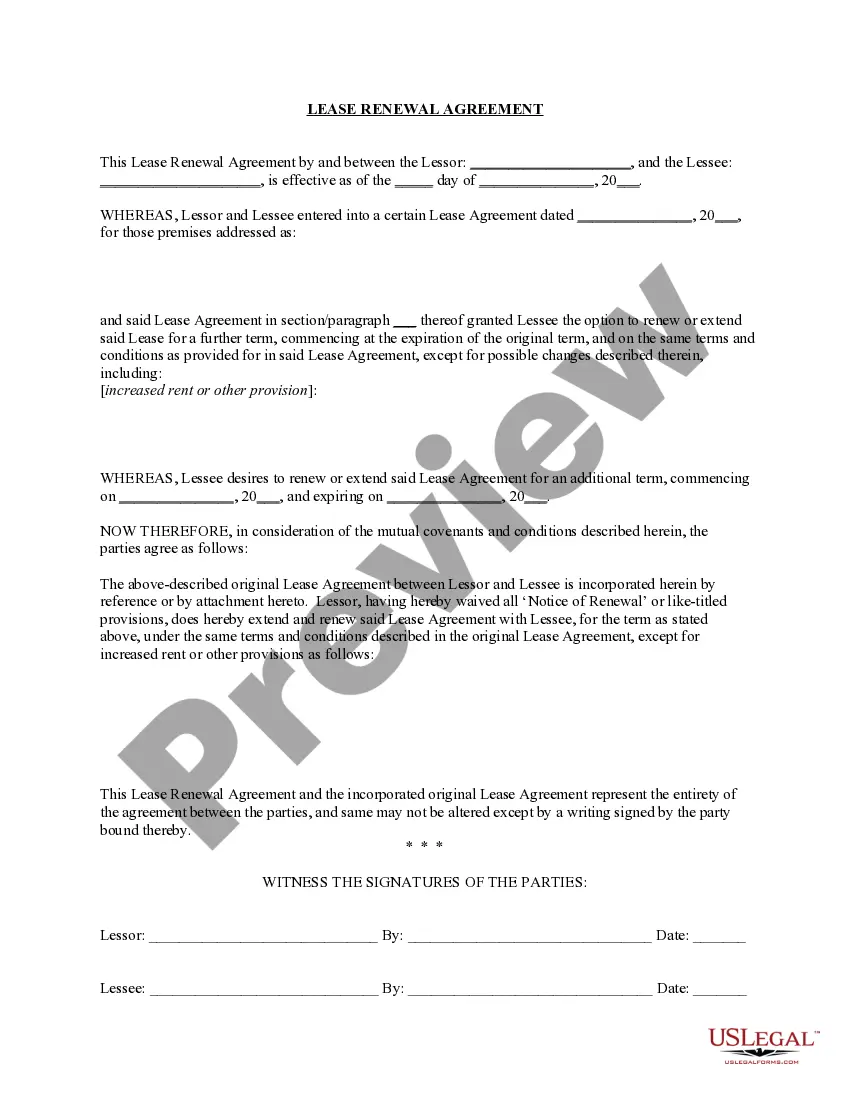

How to fill out California Commercial Building Or Space Lease?

The California Commercial Lease With Personal Guarantee displayed on this page is a versatile formal template crafted by expert legal professionals in compliance with federal and local laws.

For over 25 years, US Legal Forms has delivered individuals, firms, and lawyers more than 85,000 validated, state-specific documents for every business and personal situation. It’s the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service guarantees the utmost level of data security and malware protection.

Select the format you prefer for your California Commercial Lease With Personal Guarantee (PDF, Word, RTF) and store the template on your device.

- Search for the document you require and review it.

- Browse through the sample you found and either preview it or assess the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to locate the correct one. Click Buy Now once you have identified the template you need.

- Register and Log Into your account.

- Choose the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Exiting a personal guarantee on a California commercial lease with personal guarantee can be challenging but not impossible. One common method is to negotiate with the landlord for a release, especially if the business has demonstrated financial stability. Additionally, you might consider refinancing the lease or finding a new guarantor. Utilizing resources like US Legal Forms can provide you with the necessary documents and guidance to navigate this process effectively.

Filling out a personal guarantee for a California commercial lease with personal guarantee involves several steps. You typically need to provide personal information, including your name, address, and financial details. It’s important to read the document carefully to understand your obligations before signing. If you are uncertain, seeking legal advice can help clarify any complex terms and ensure you complete the guarantee correctly.

Yes, personal guarantees are quite common in California commercial leases with personal guarantee. Many landlords require them to mitigate risk, especially with small businesses or startups. This practice allows landlords to hold individuals accountable if the business defaults on the lease. Understanding this trend can help you prepare for negotiations and lease terms when seeking commercial space.

A guarantor may not always be mandatory for a California commercial lease with personal guarantee, but having one can be beneficial. Landlords often prefer a guarantor, especially if the business is new or lacks a strong credit history. A guarantor provides additional assurance to the landlord that the lease terms will be met. If you consider a guarantor, ensure they understand their responsibilities outlined in the lease.

In many cases, a California commercial lease with personal guarantee includes a requirement for a personal guarantee. This requirement helps landlords feel secure that they will receive payment even if the business faces financial difficulties. Additionally, a personal guarantee can strengthen your lease application, showing the landlord your commitment to fulfilling the lease obligations. However, not all leases require this, so it's essential to review each lease agreement carefully.

Not all California commercial leases require personal guarantees, but many landlords request them, especially from new businesses. A personal guarantee provides landlords with added security, ensuring that they can recover losses if your business defaults. However, the requirement often depends on factors such as your business's creditworthiness and financial history. Understanding your options can help you negotiate lease terms more effectively.

Providing a personal guarantee for a California commercial lease is a common practice, but it carries significant risk. When you sign as a guarantor, you become personally liable for the lease obligations if your business fails to meet them. It is important to carefully consider your financial situation and the viability of your business before agreeing to such terms. Consulting with a legal professional can also help you understand the implications.

One alternative to a personal guarantee on a California commercial lease is to offer a larger security deposit. This deposit can provide the landlord with assurance against potential defaults. Additionally, you might consider providing a corporate guarantee if your business structure allows for it. By exploring these options, you can often negotiate a lease that aligns with your needs without the personal risk.